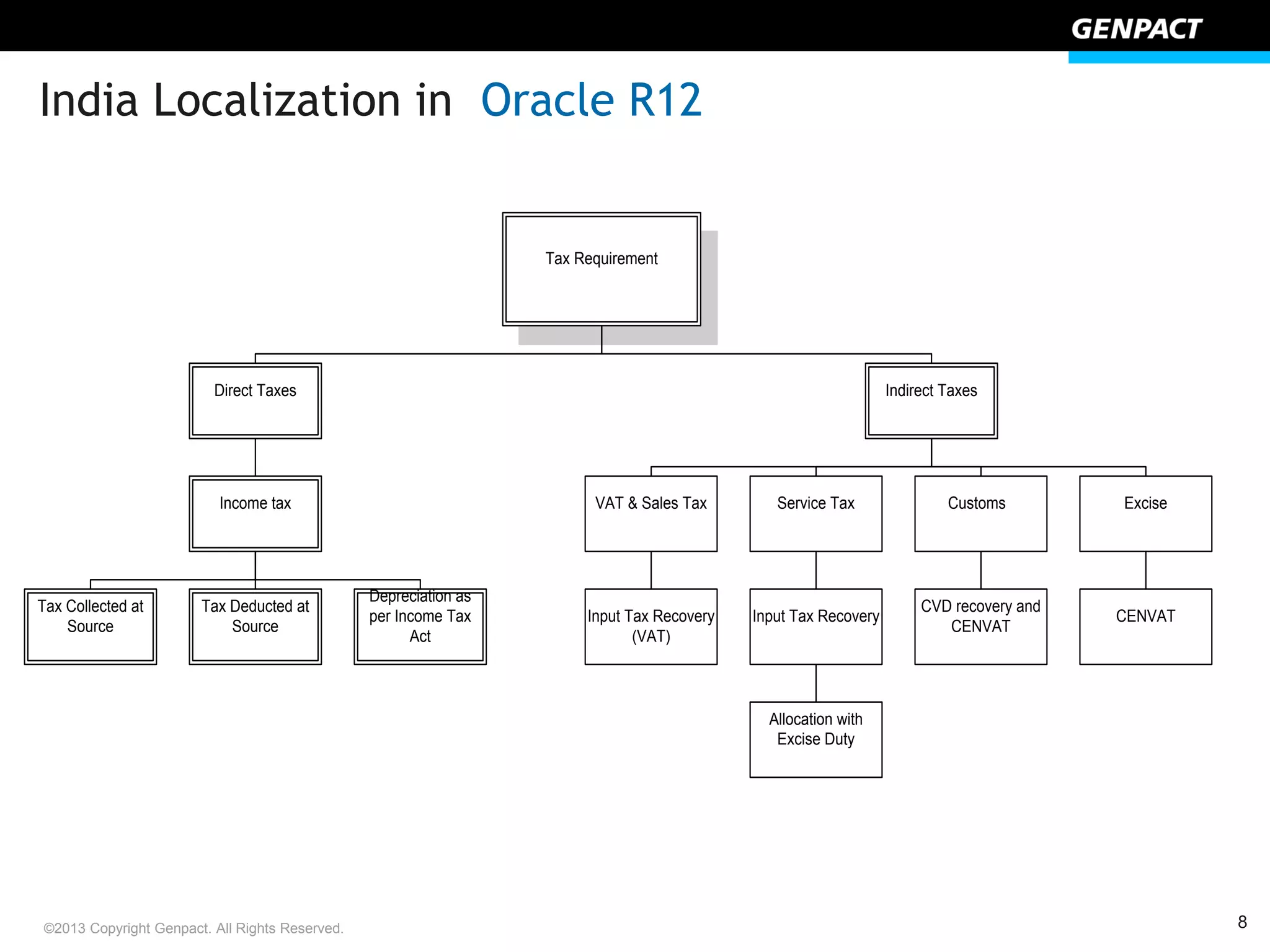

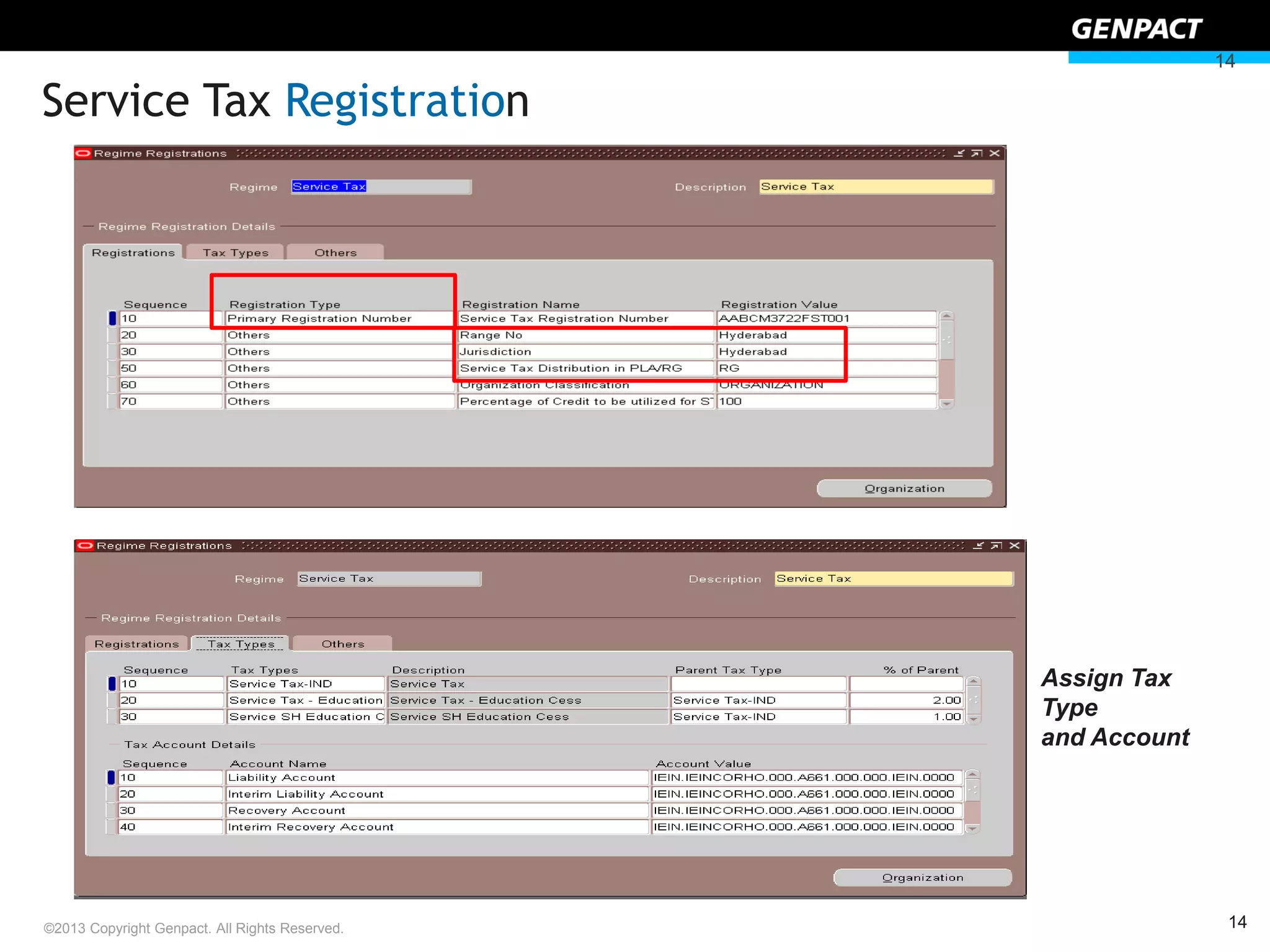

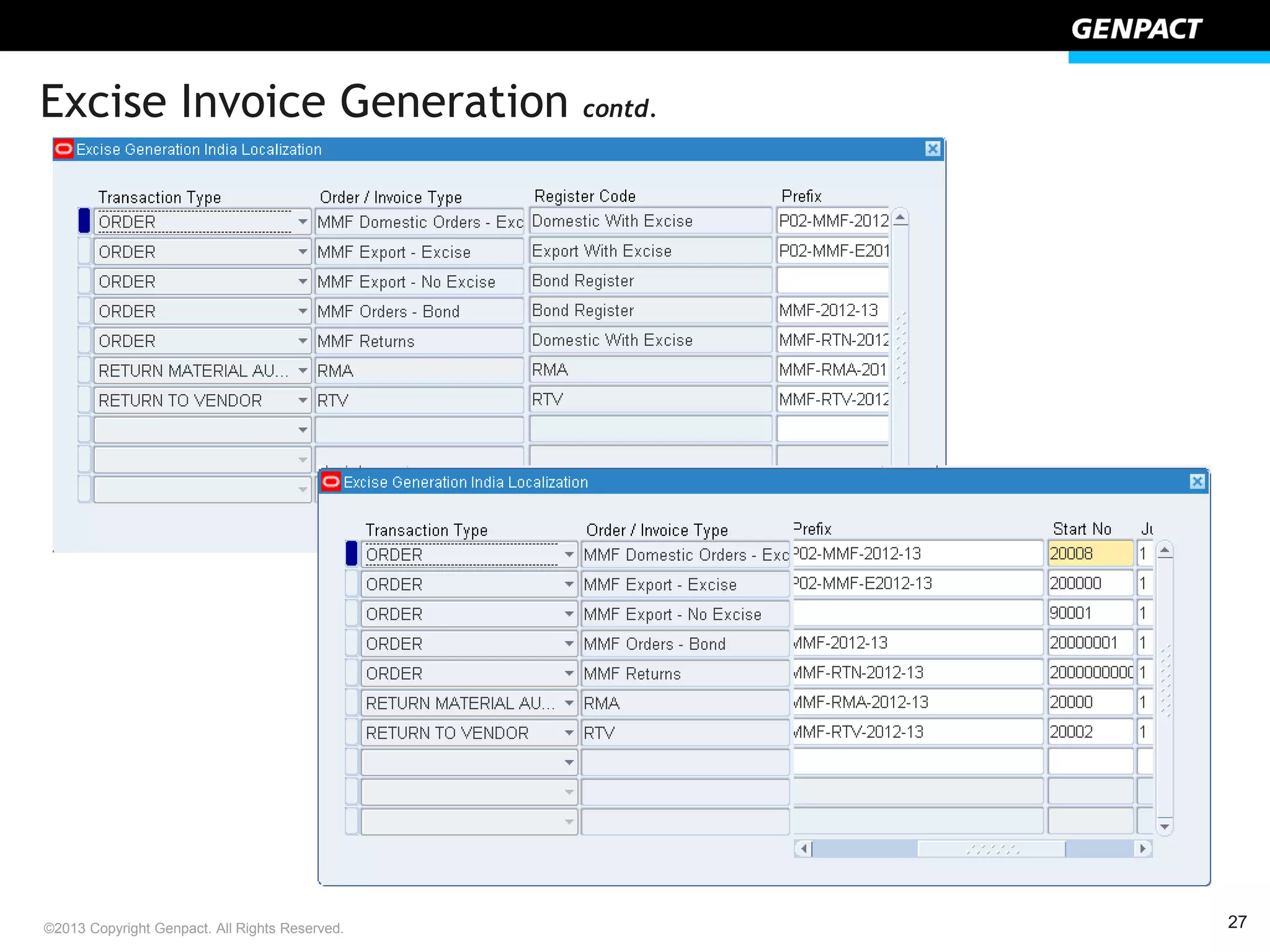

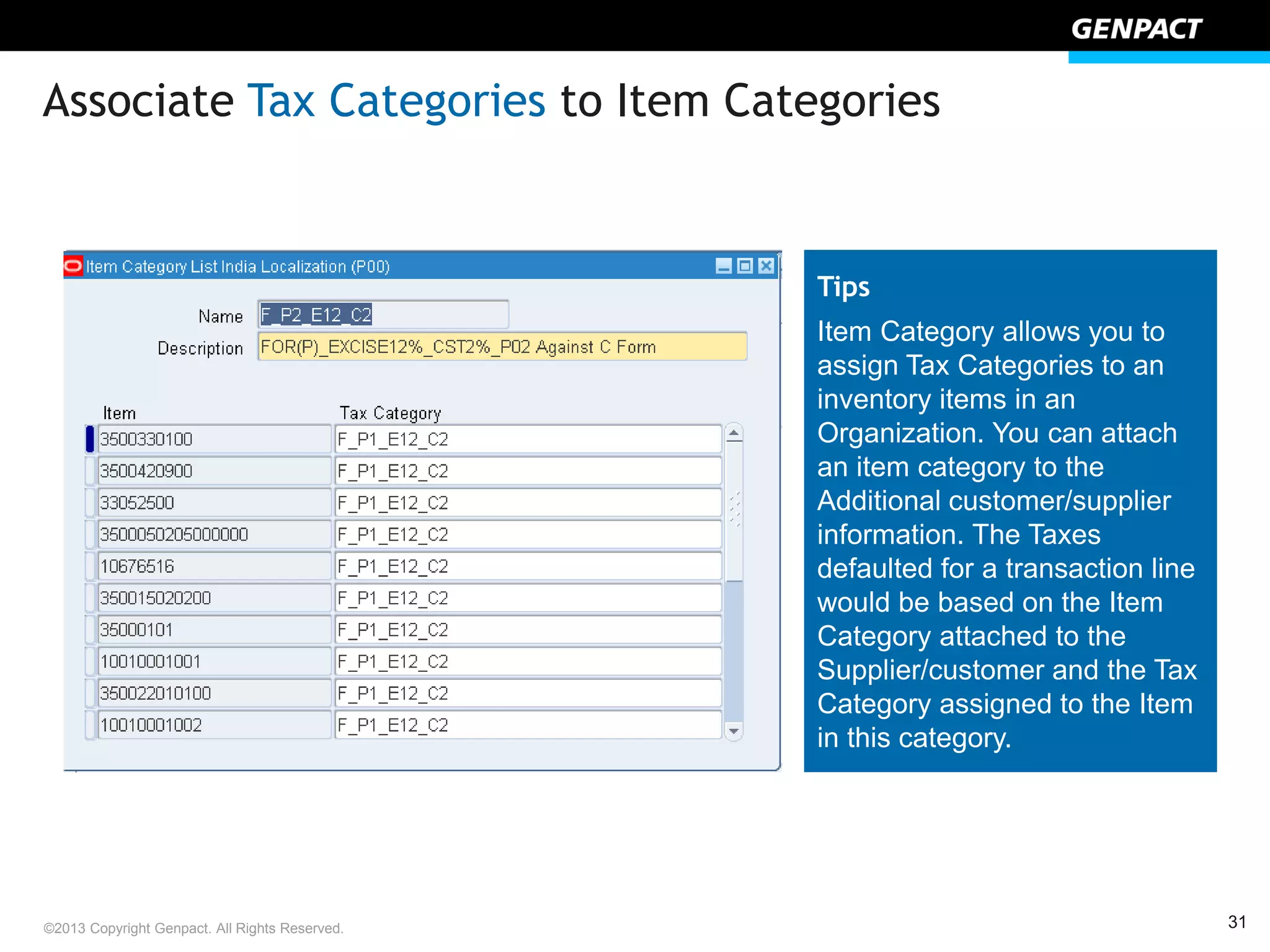

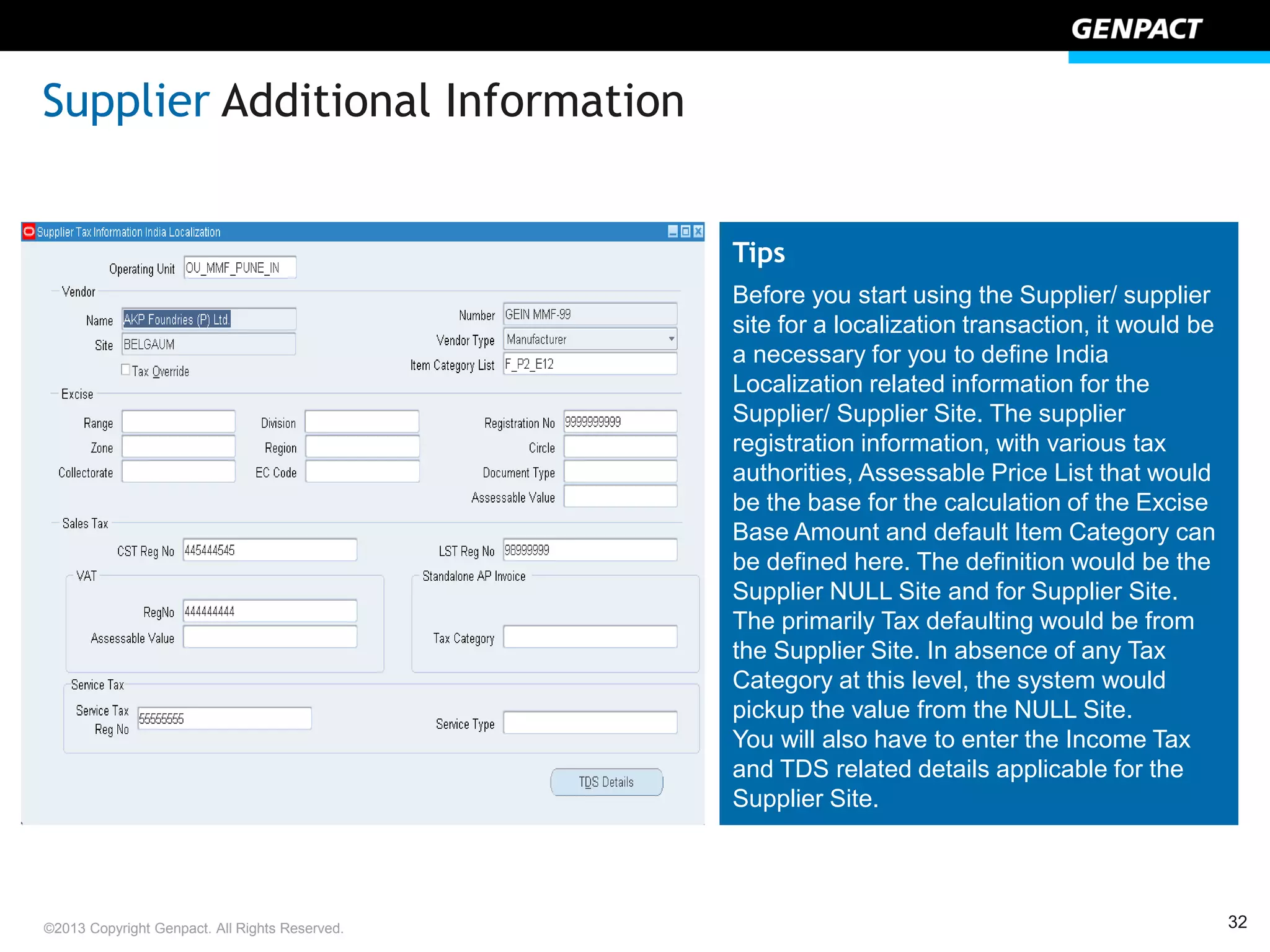

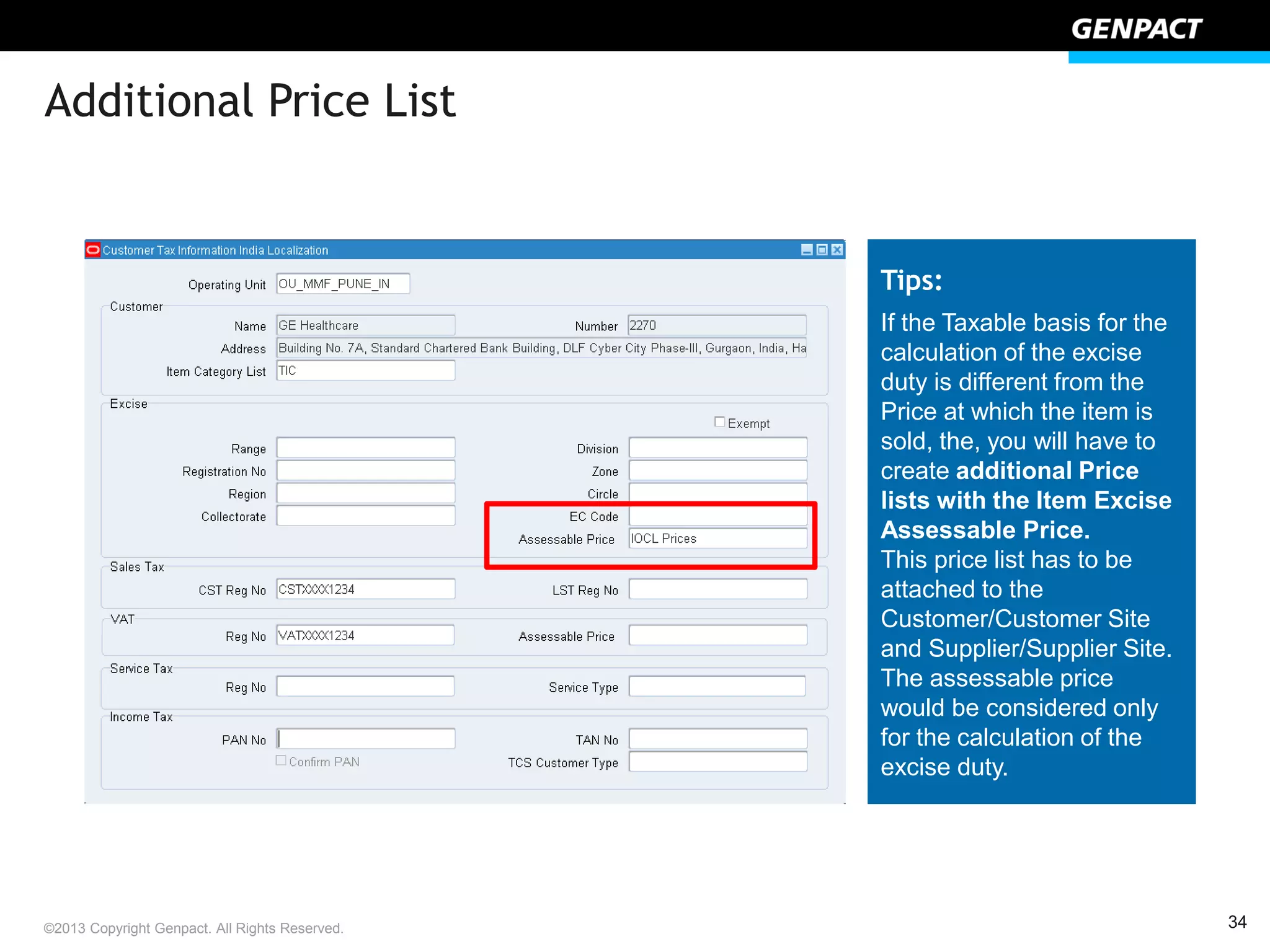

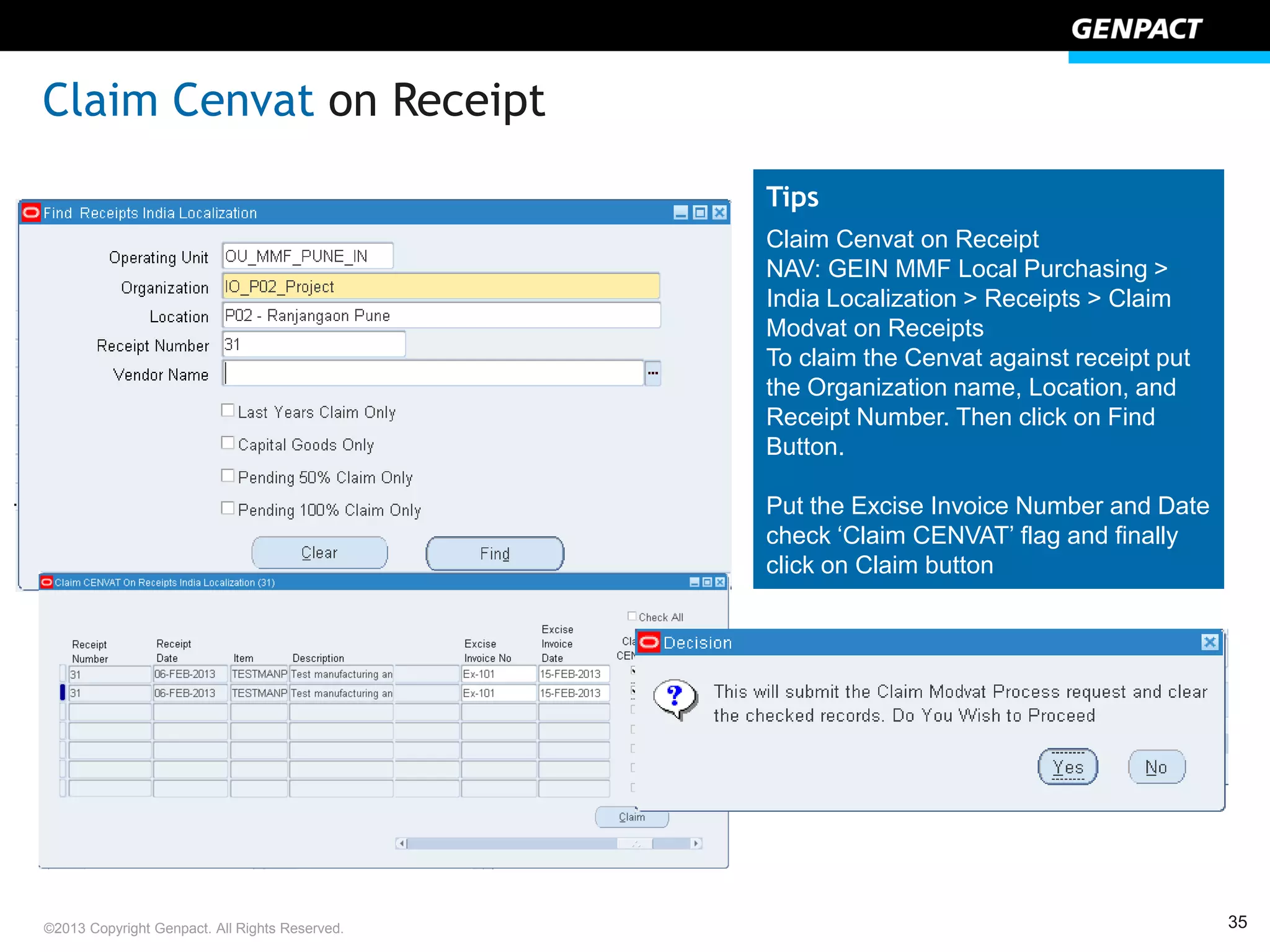

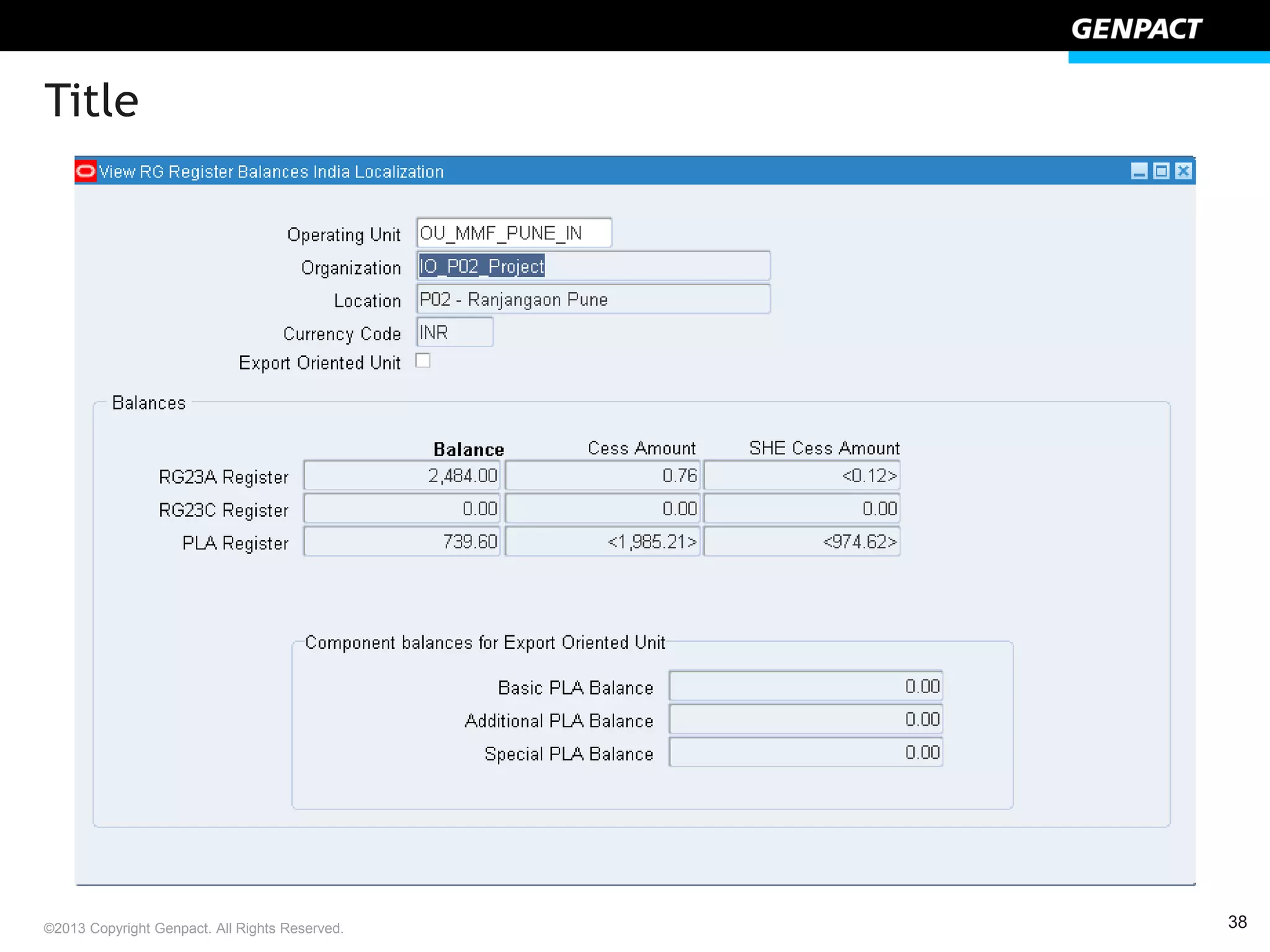

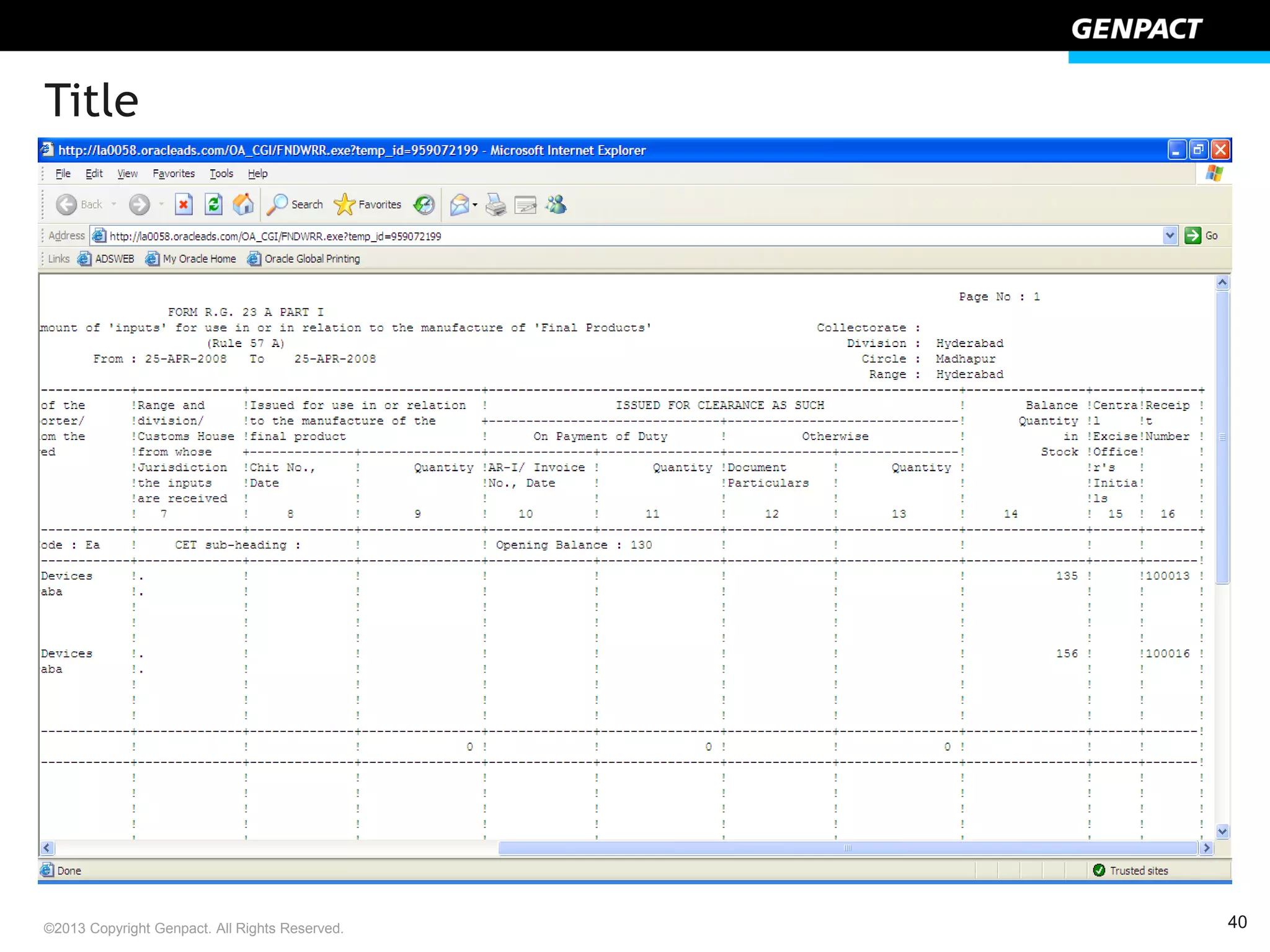

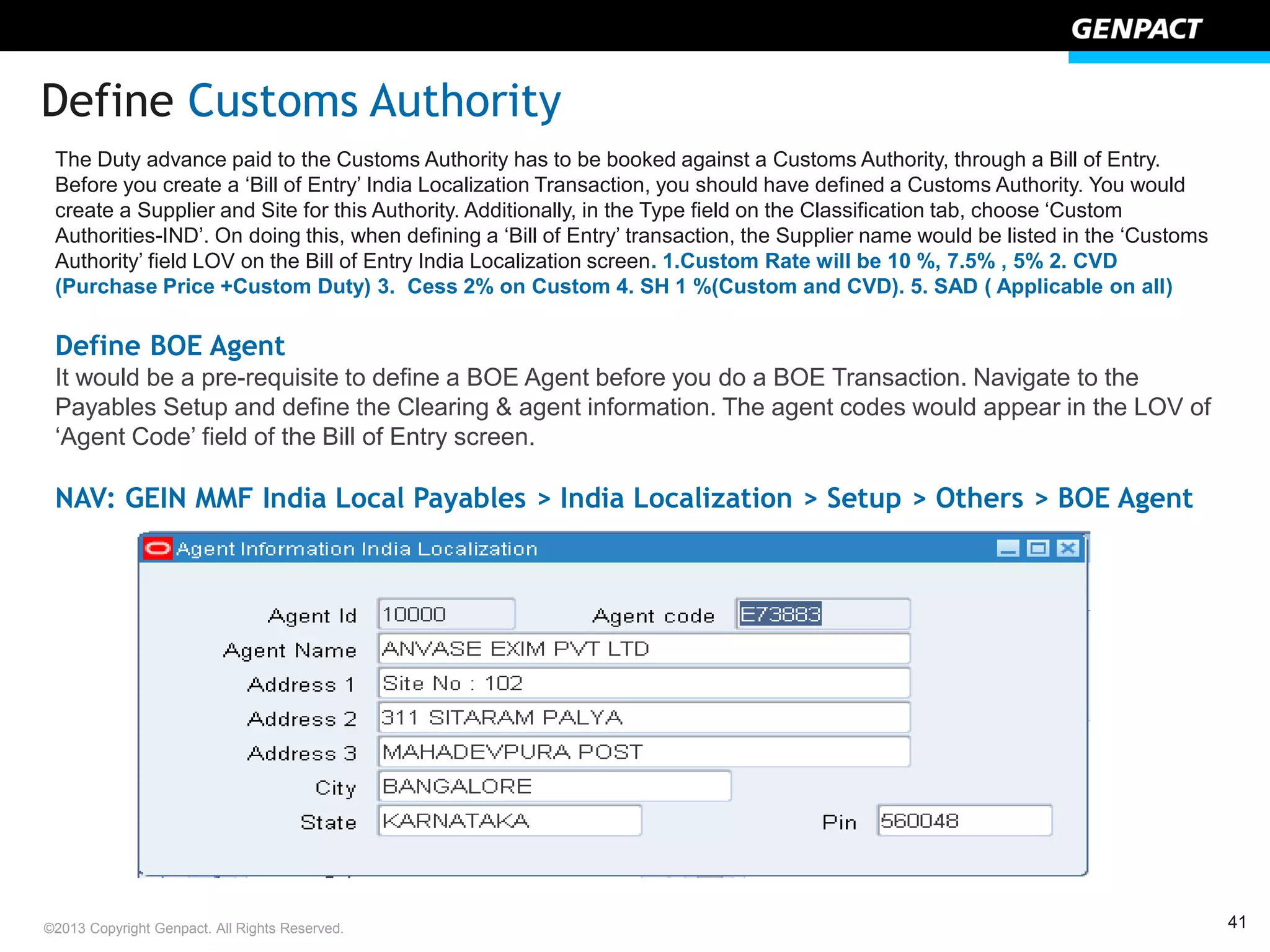

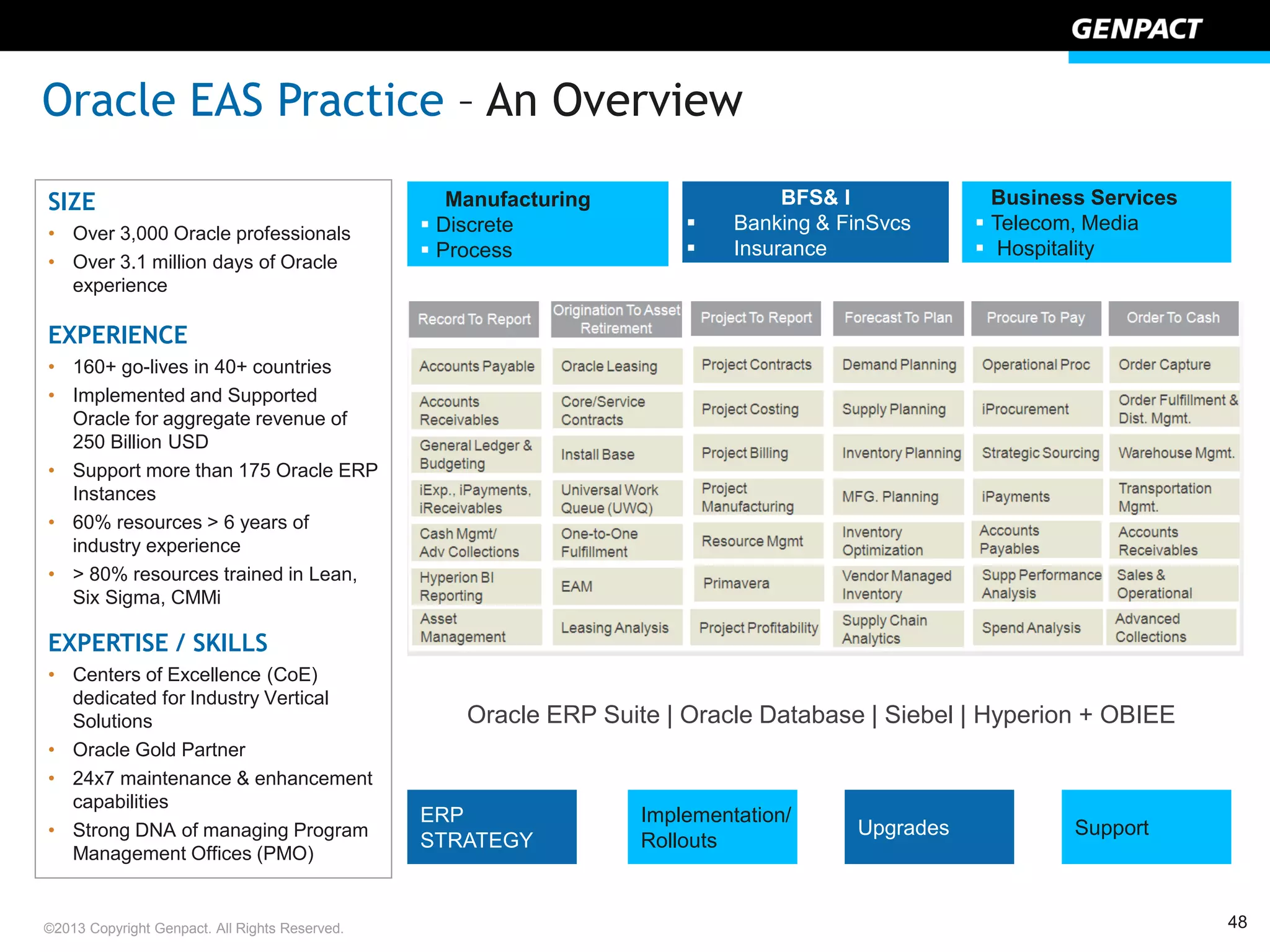

The document discusses India localization in Oracle R12. It provides an overview of the speakers and their qualifications. It then discusses key aspects of implementing tax functionality for India in Oracle R12 such as configuring inventory organizations, item and supplier setup, service tax setup and transactions, excise duty setup including defining registers, bond setup, and transaction impact on registers. It also discusses customs duty implementation including defining a customs authority and bill of entry transactions.