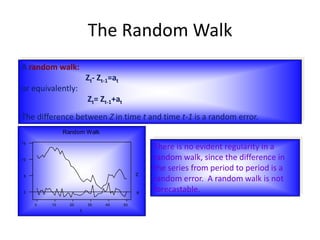

The document provides an overview of time-series forecasting methods, including:

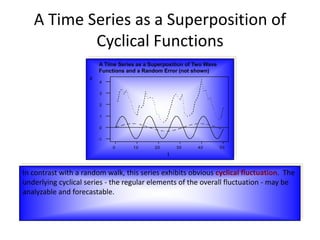

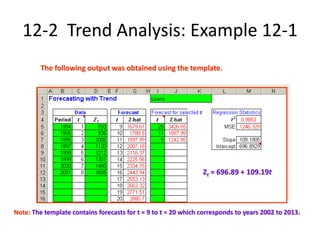

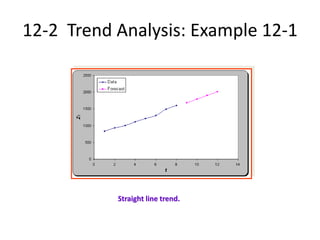

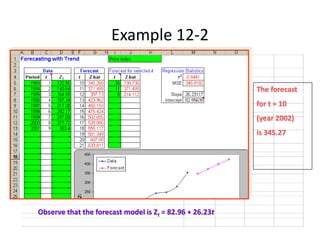

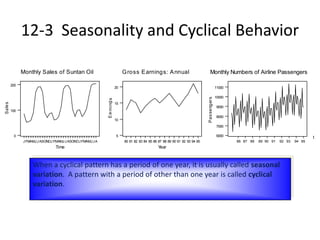

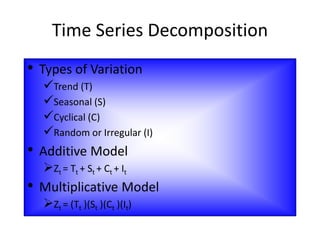

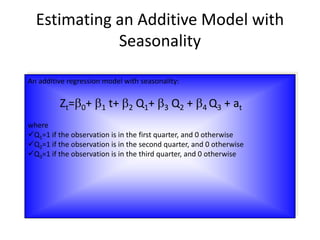

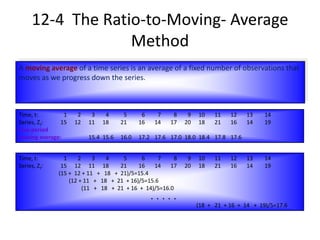

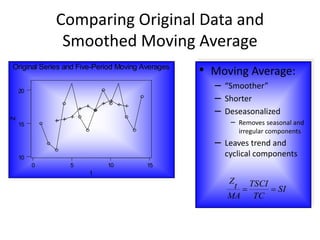

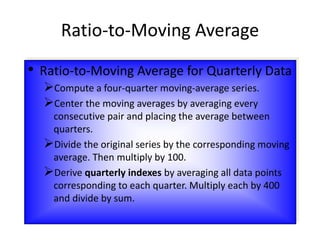

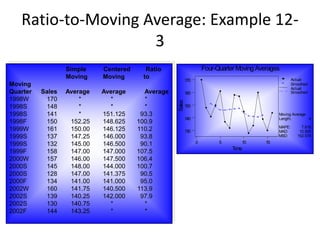

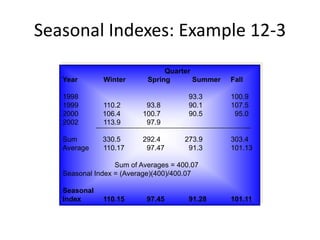

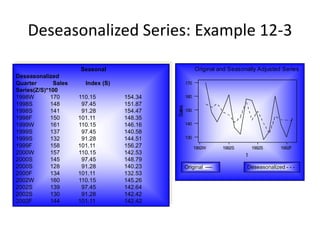

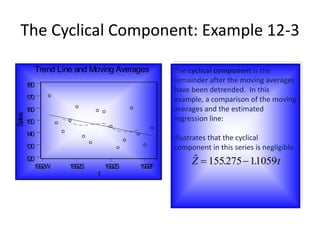

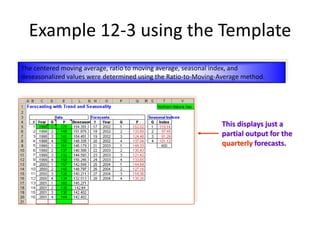

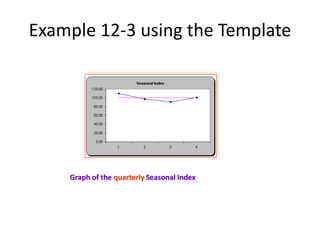

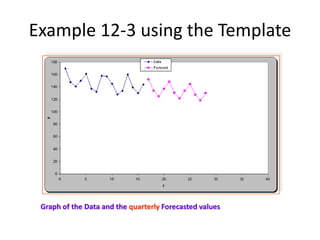

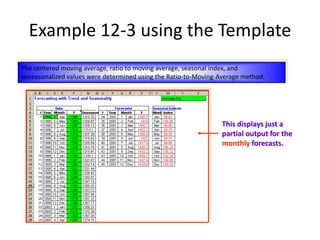

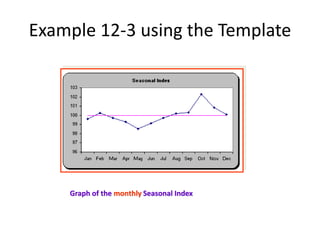

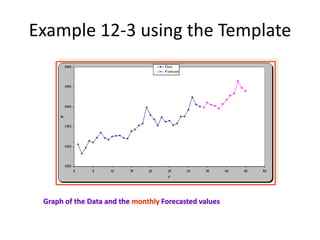

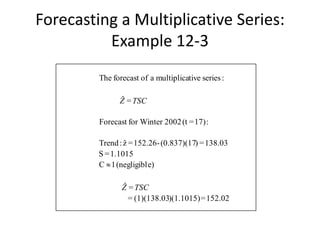

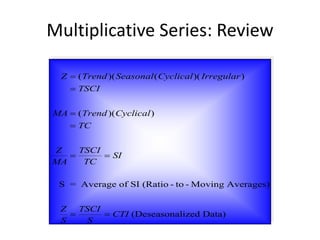

1) It discusses trend analysis, seasonality, cyclical behavior, and various forecasting techniques such as the ratio-to-moving average method and exponential smoothing.

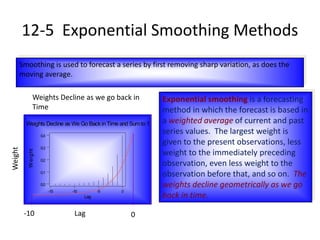

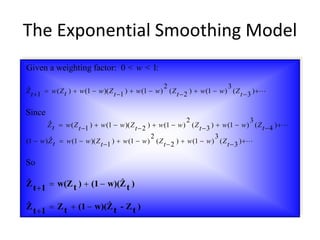

2) Exponential smoothing is described as a forecasting method that gives the largest weight to present observations and smaller, geometrically declining weights to past observations.

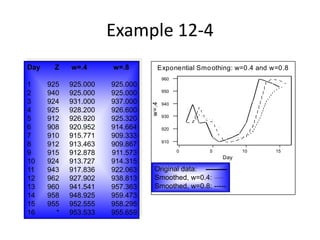

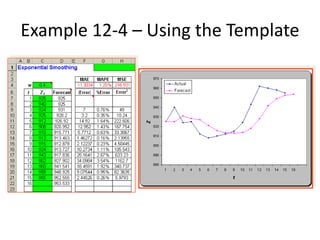

3) An example demonstrates exponential smoothing on a time series using weighting factors of 0.4 and 0.8, showing the smoothed series for each weight.