1) The document discusses Ophthotech's development of new therapies for age-related macular degeneration (AMD), including their lead drug Fovista.

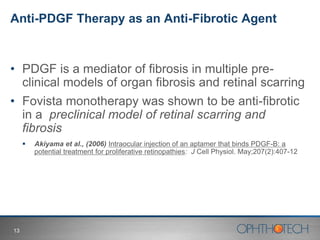

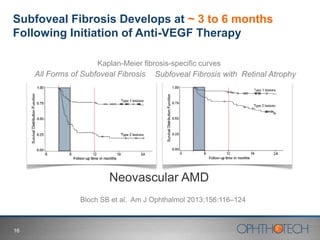

2) Fovista is currently in Phase 3 clinical trials in combination with anti-VEGF drugs to treat wet AMD, with initial data expected in 4Q 2016.

3) Previous Phase 2b results showed Fovista in combination with Lucentis was statistically superior to Lucentis alone and had a favorable safety profile.