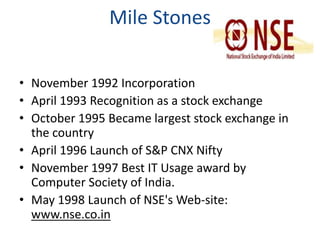

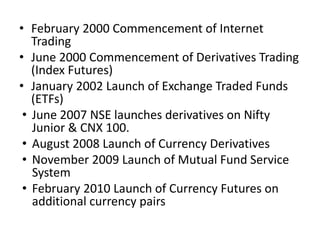

The National Stock Exchange of India (NSE) was established in 1992 as the leading stock exchange in India. It commenced operations in 1994 and is now the third largest stock exchange in the world by trading volume. The NSE operates trading in equity, futures & options, debt, currency derivatives and other financial markets. It uses electronic trading and provides access to investors across India through its nationwide communication network.