Stock represents partial ownership in a company. There are two main types of stock: common and preferred. Common stockholders own a share of the company and have voting rights, while preferred stockholders have a higher claim on company assets but no voting rights.

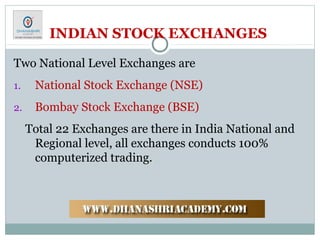

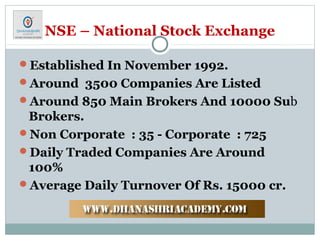

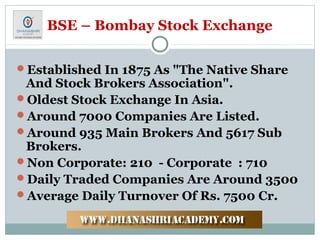

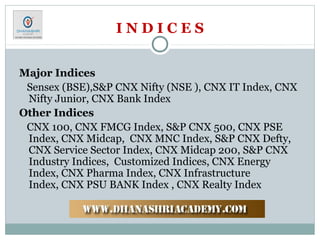

The stock market is a place where publicly traded company stocks are bought and sold. In India, the two major stock exchanges are the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Several indices track the performance of stocks trading on these exchanges.

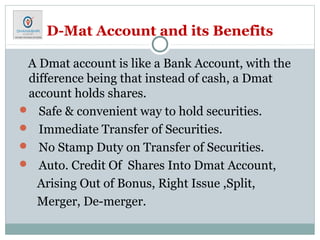

The Securities and Exchange Board of India (SEBI) regulates India's stock markets and protects investors. Basic requirements for investing in stocks include a demat account, trading account, PAN number,