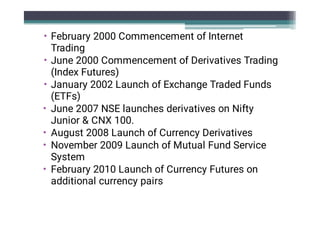

The document summarizes information about the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) in India. It provides details about the board of directors, establishment, purpose, trading schedules, markets, and milestones of NSE. For BSE, it mentions the board of directors, history of establishment in 1875 in Mumbai, and trading hours of operation. It also lists several other stock exchanges in India and the 17 most valuable stock exchanges globally.

![Board of Directors

Mr. Ashok Chawla

Former Secretary, Ministry of Finance

Government of India

Chairman

[Public Interest Director]

Mr. Ravi Narain

Former Managing Director & CEO

National Stock Exchange of India Limited

Vice Chairman

[Shareholder Director]](https://image.slidesharecdn.com/fm-unit-1part2-180105163329/85/Fm-unit-1-part-2-3-320.jpg)