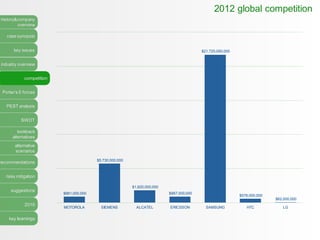

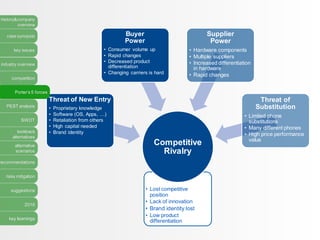

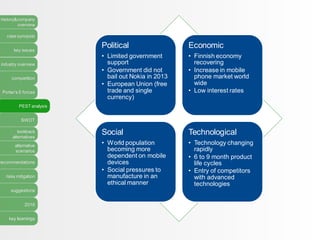

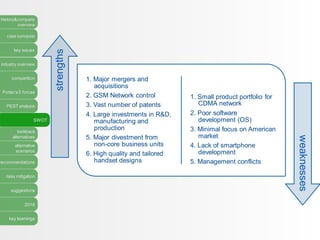

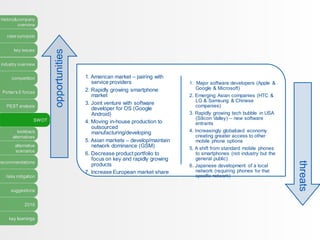

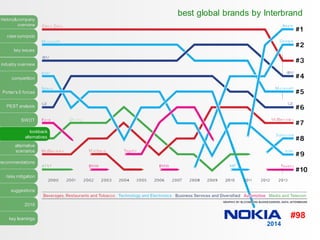

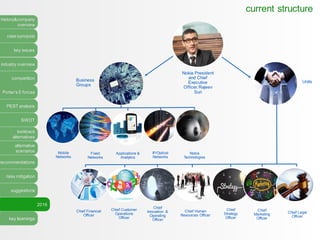

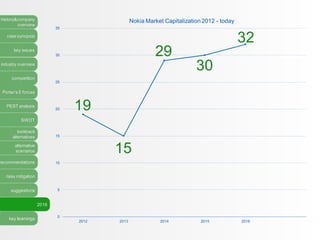

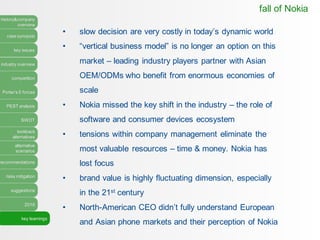

The document discusses the rise and fall of Nokia Corporation over its history from 1865 to 2014. It provides an overview of Nokia's evolution from a timber company to a leading mobile phone producer. The case examines Nokia's successes in product innovation and flexibility, as well as its failures to take advantage of new opportunities like smartphones. Key issues explored include Nokia's management decisions, industry dynamics, competition, and the factors that ultimately led to its decline and acquisition by Microsoft.