The weekly commodity report summarizes the performance of various commodities traded on the National Multi-Commodity Exchange of India (NMCE) from January 4 to 9, 2010. Most commodities saw a decrease in turnover from the previous week. Key highlights include:

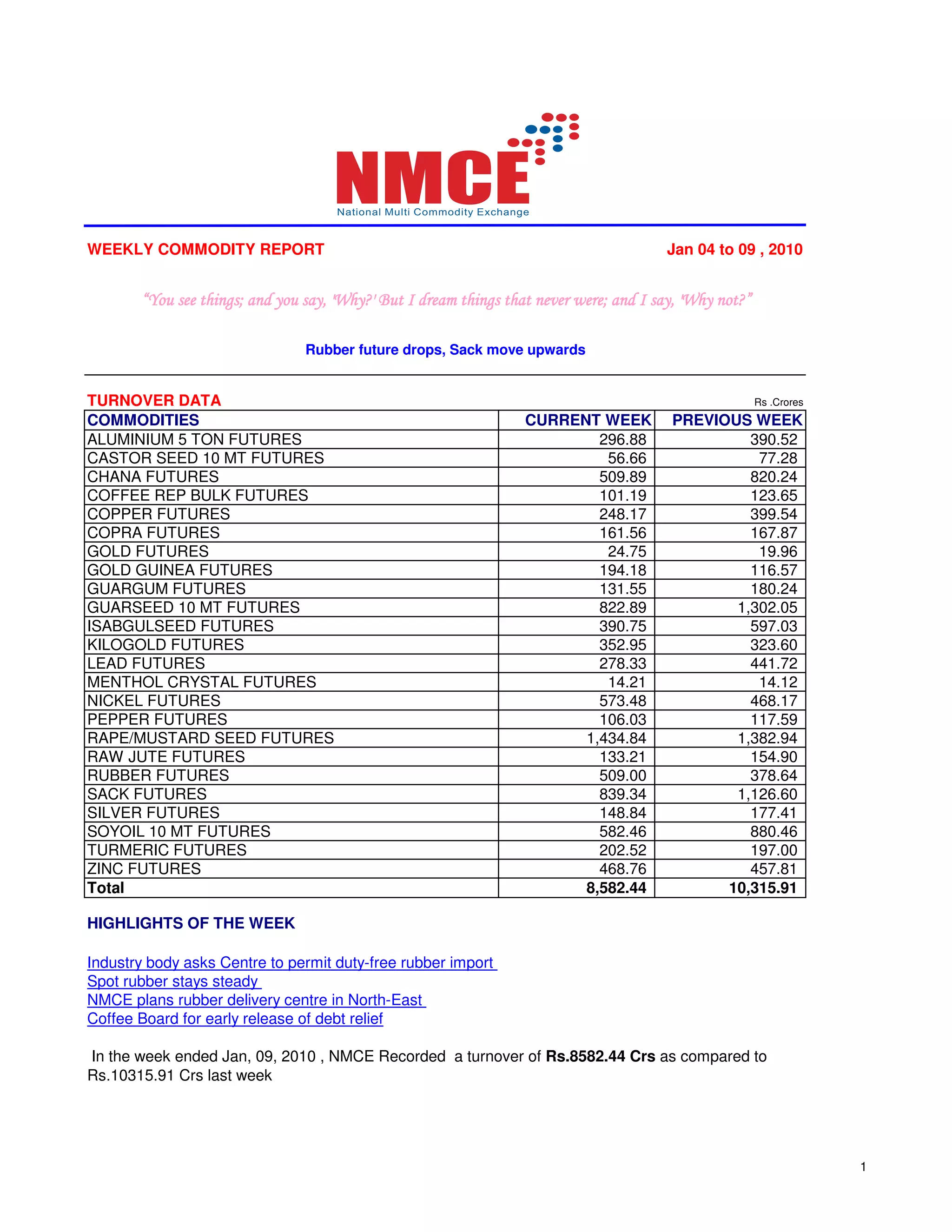

- Castor seed futures for the February series closed lower at Rs. 2,862.3 per 100 kg.

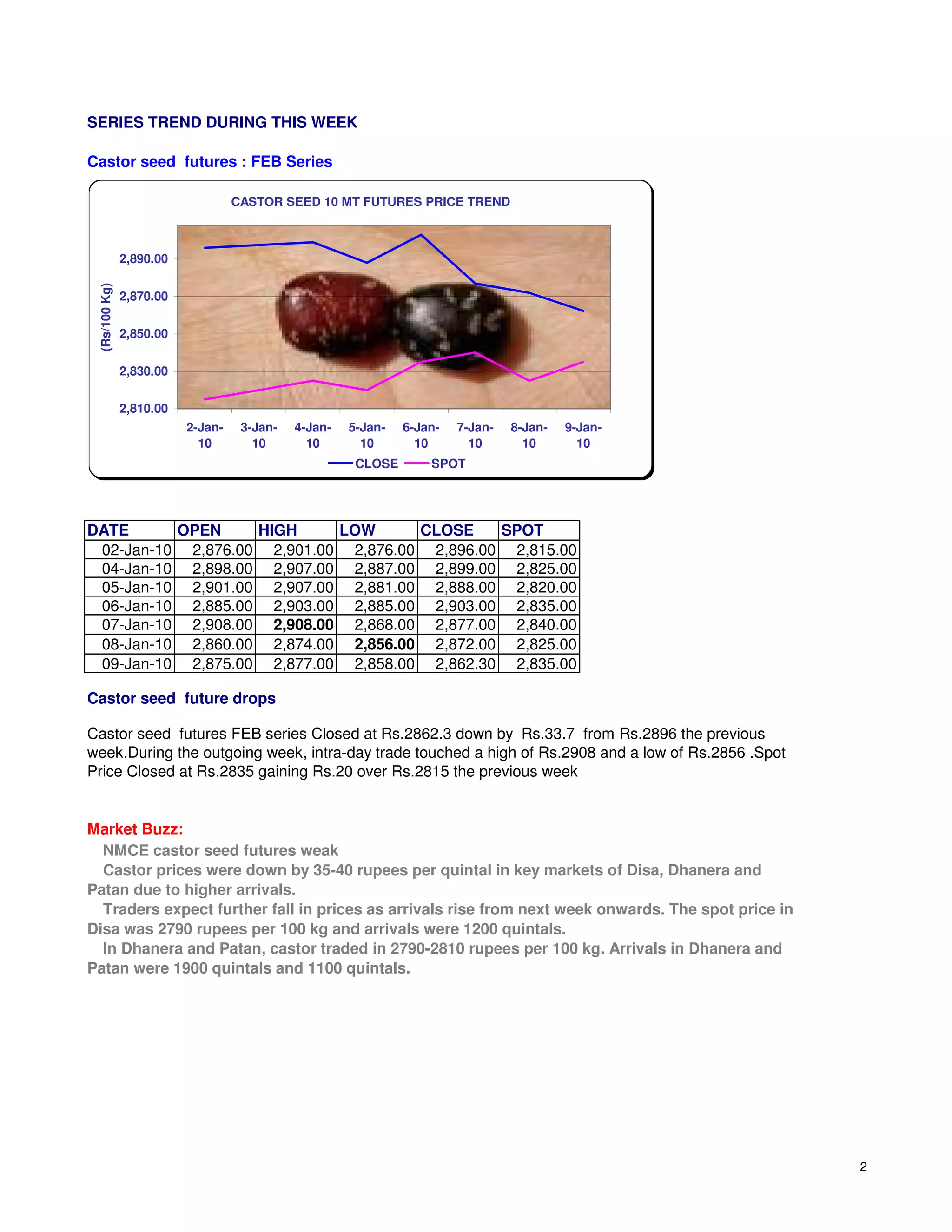

- Chana futures for the January series finished down at Rs. 2,331 per 100 kg.

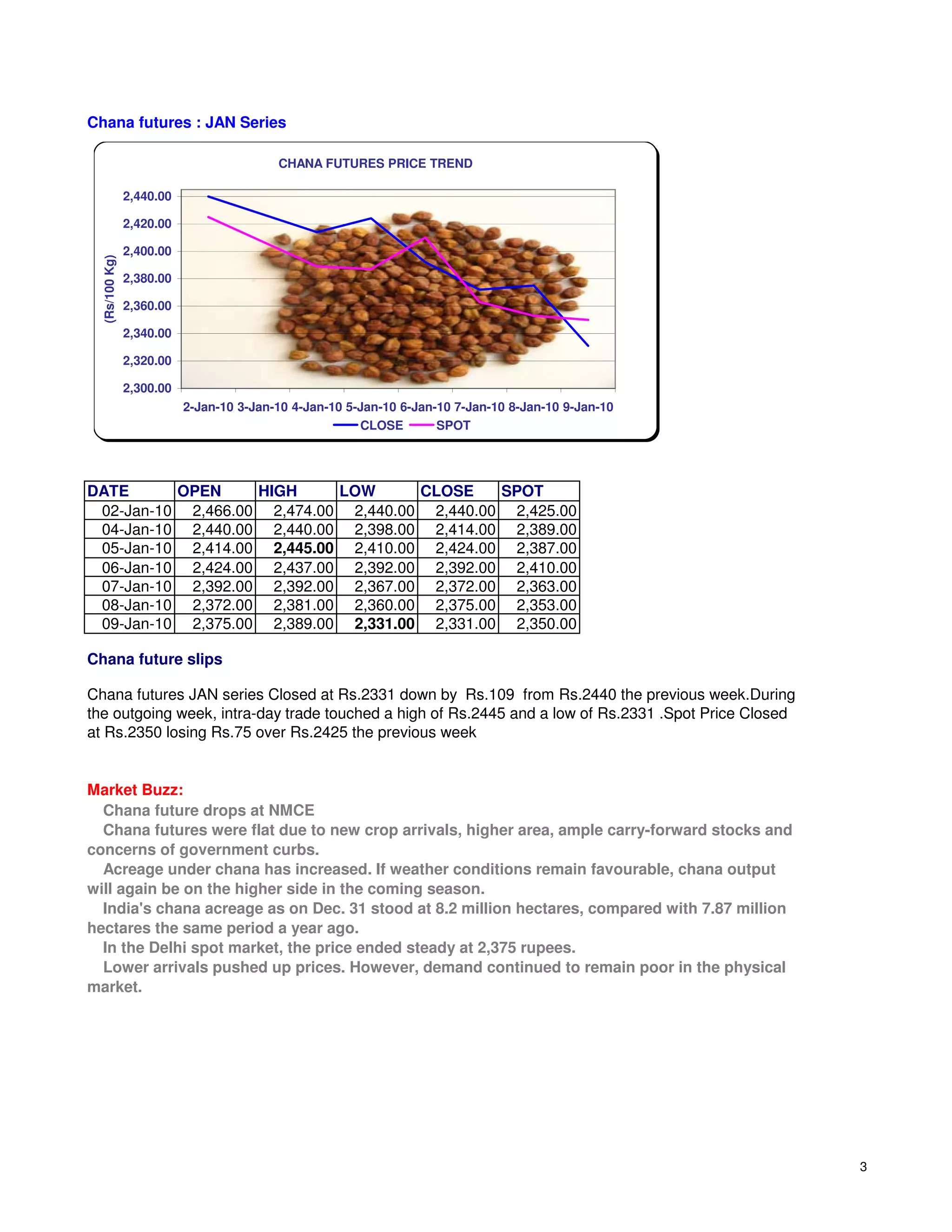

- Coffee futures for the January series closed slightly higher at Rs. 7,765 per 100 kg.

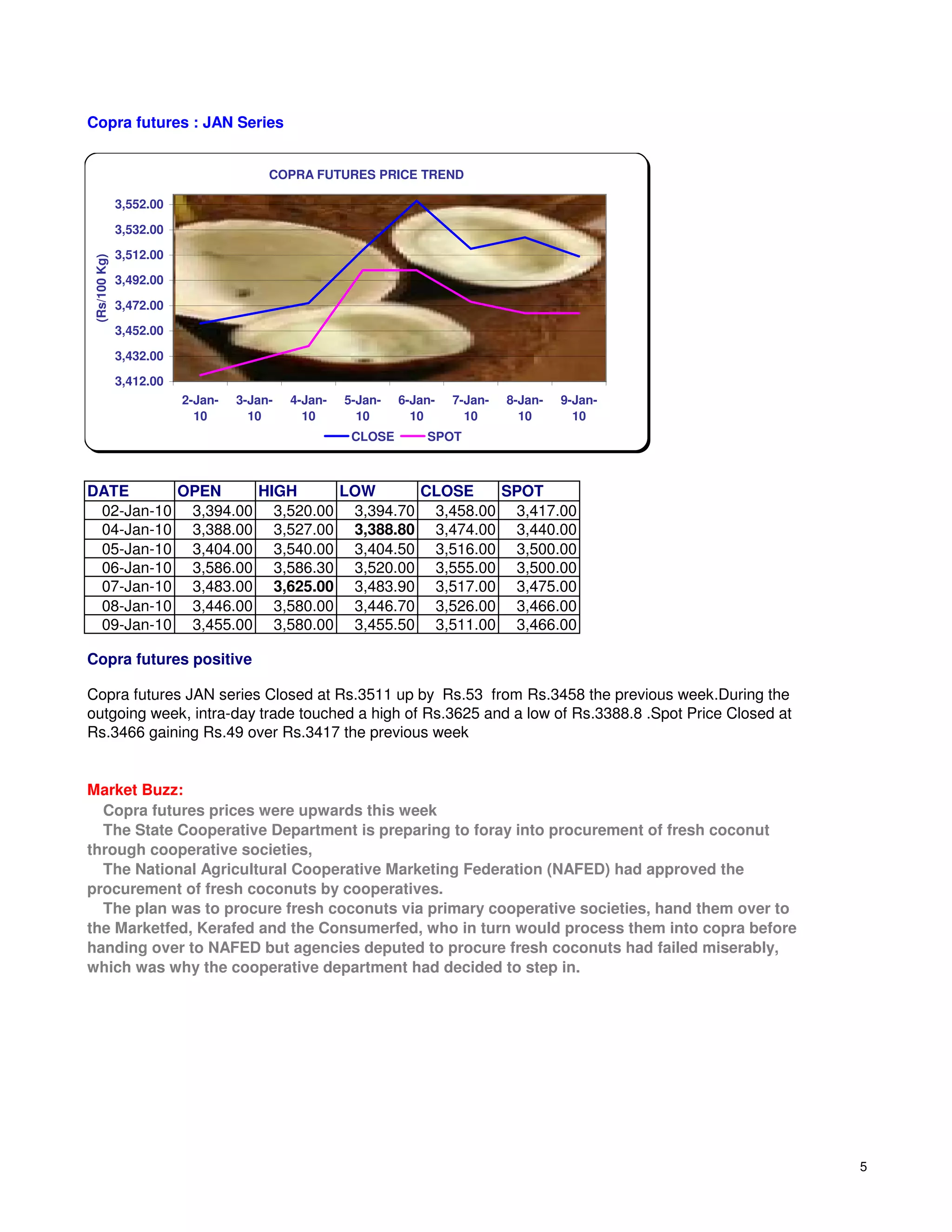

- Copra futures for the January series ended higher at Rs. 3,511 per 100 kg.

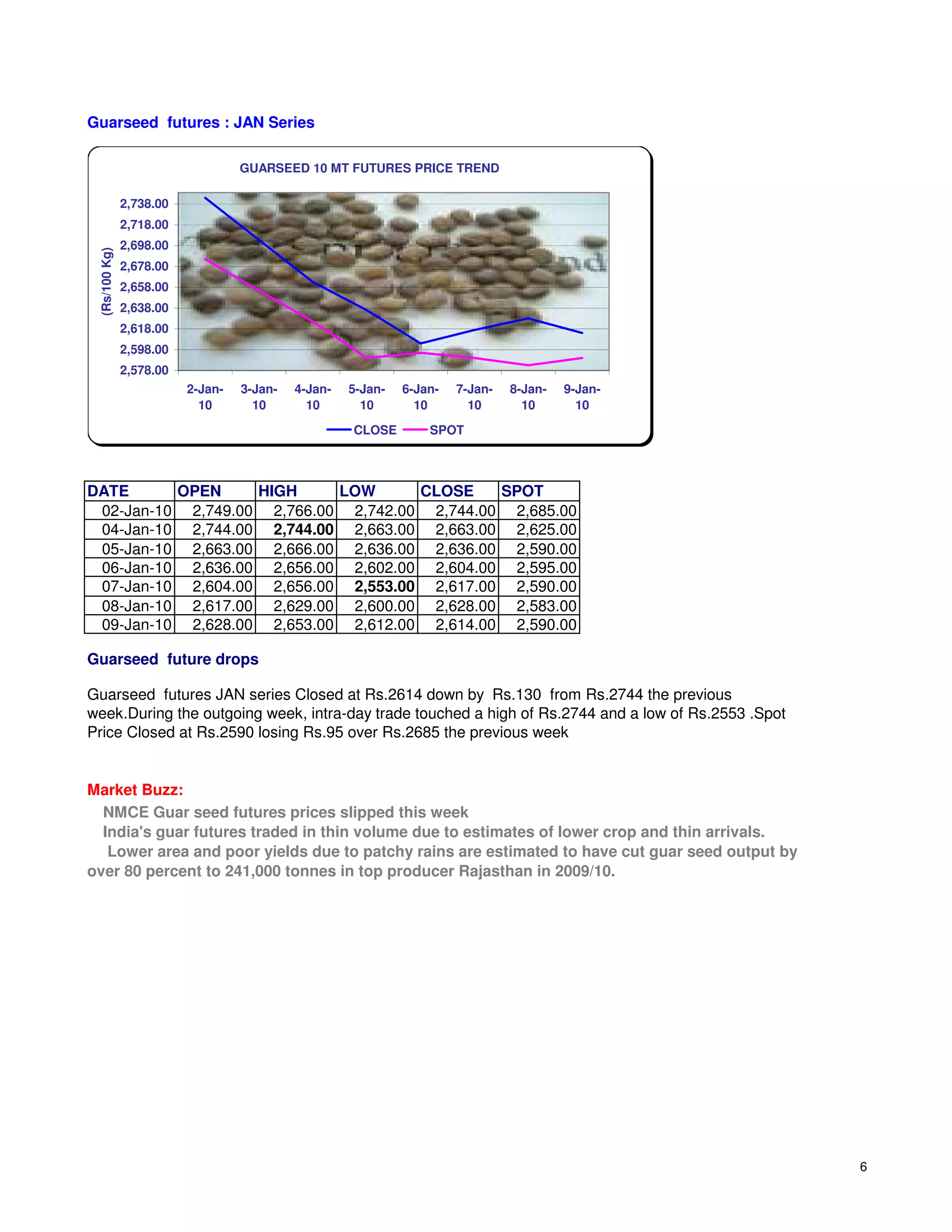

- Guarseed futures