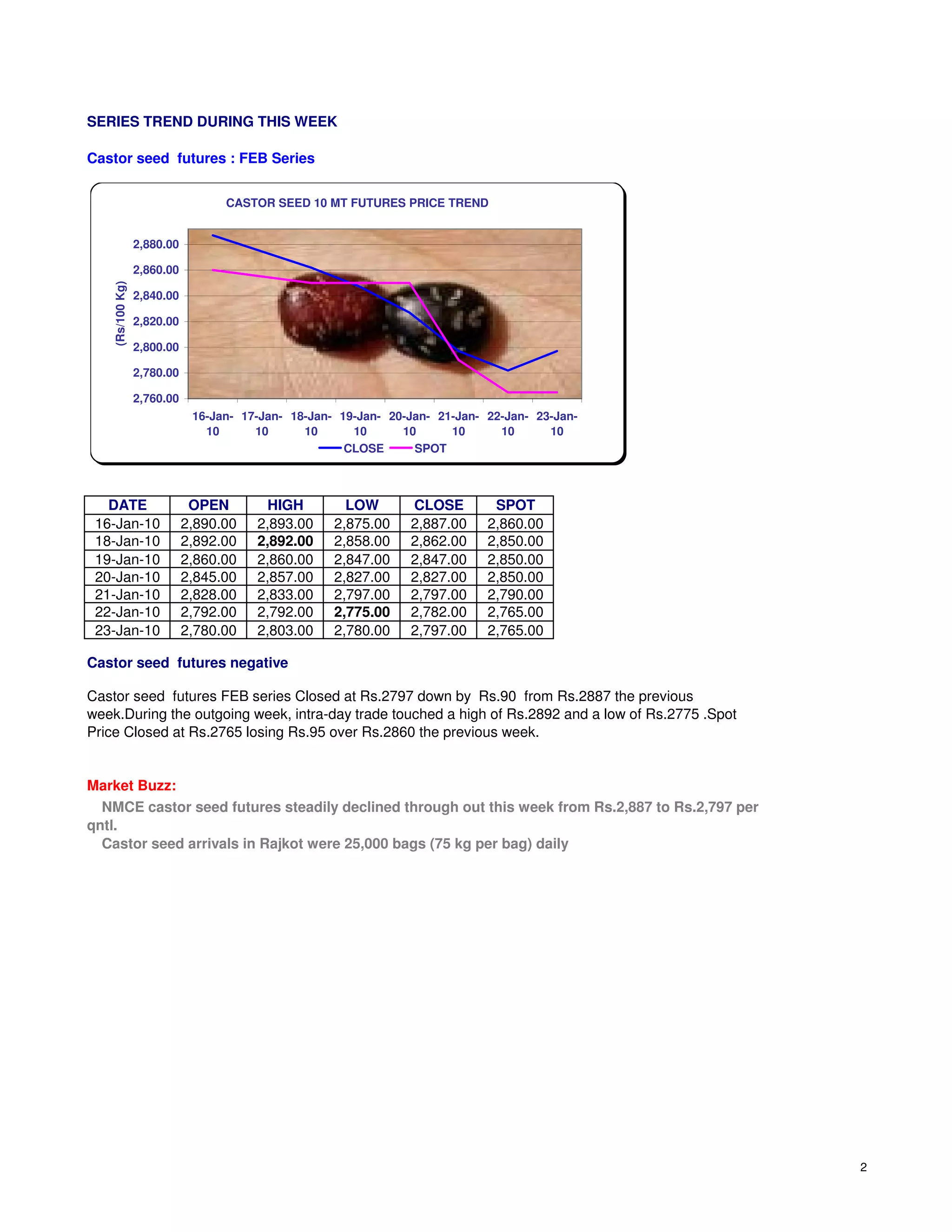

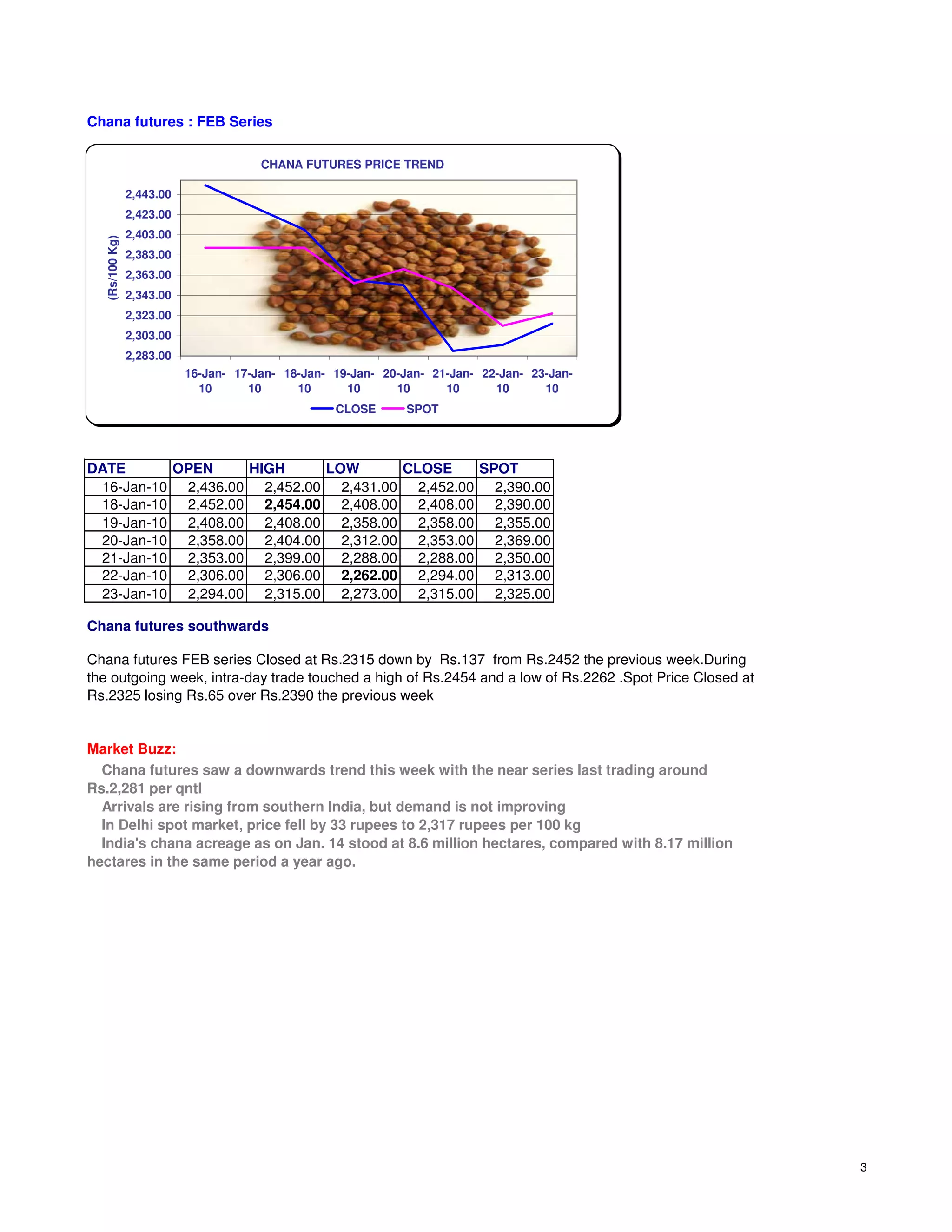

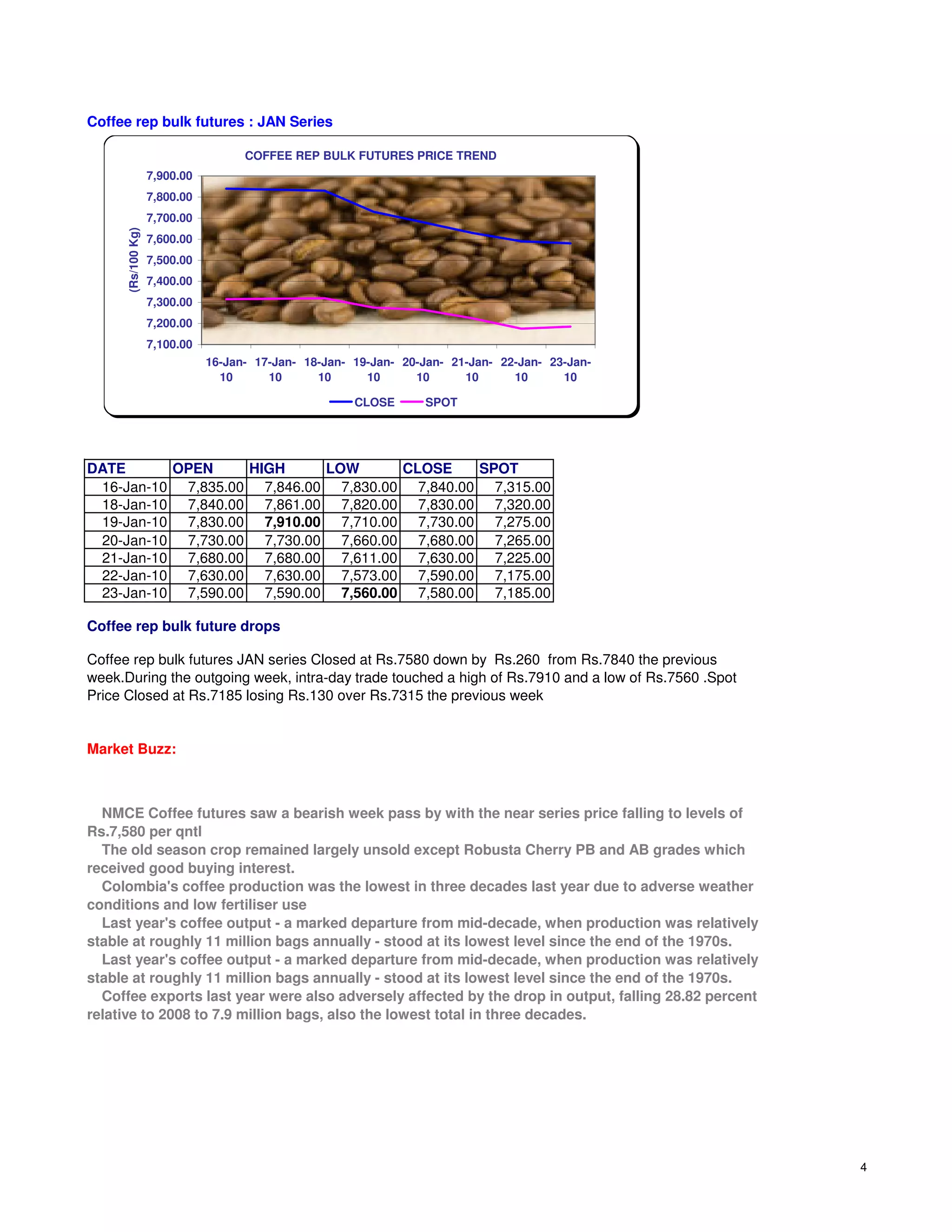

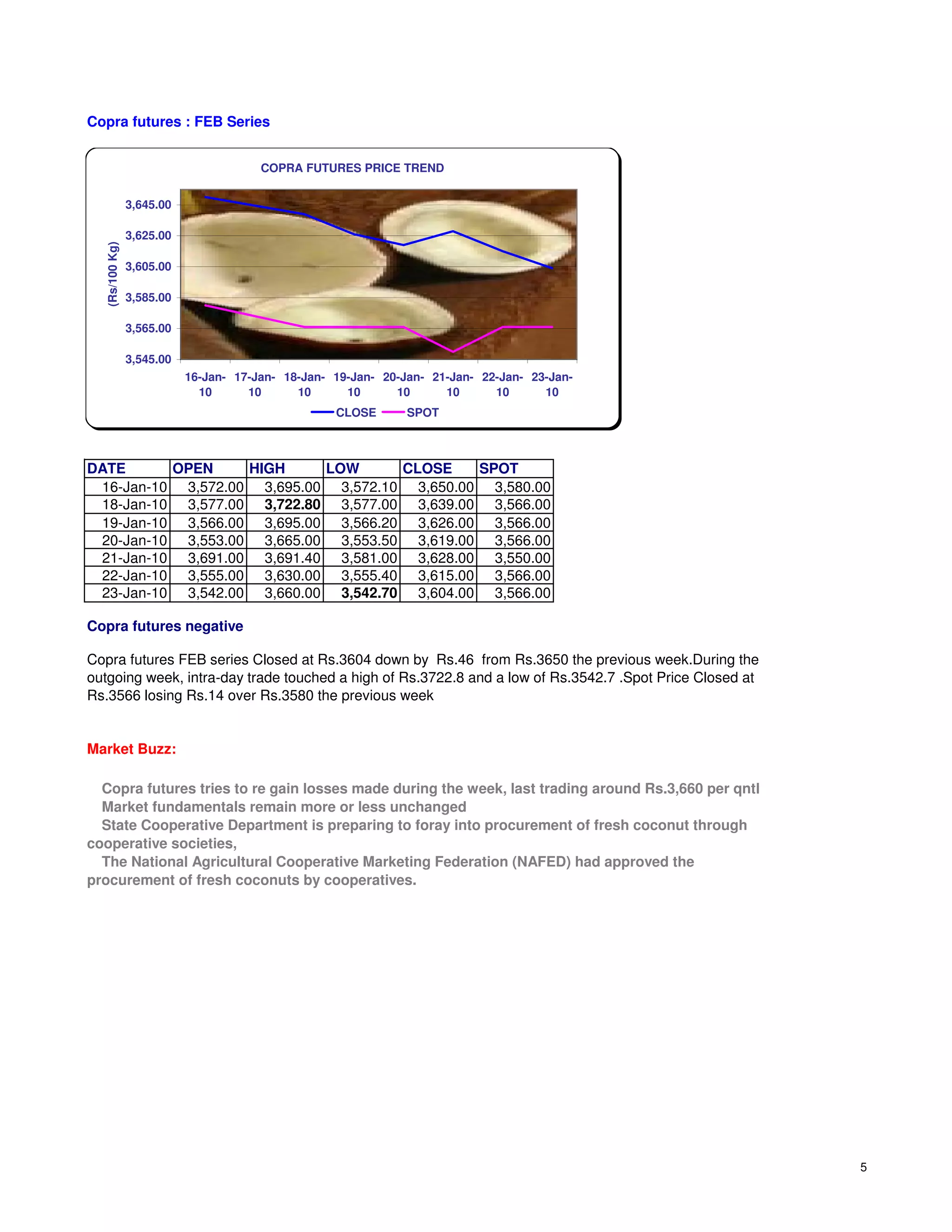

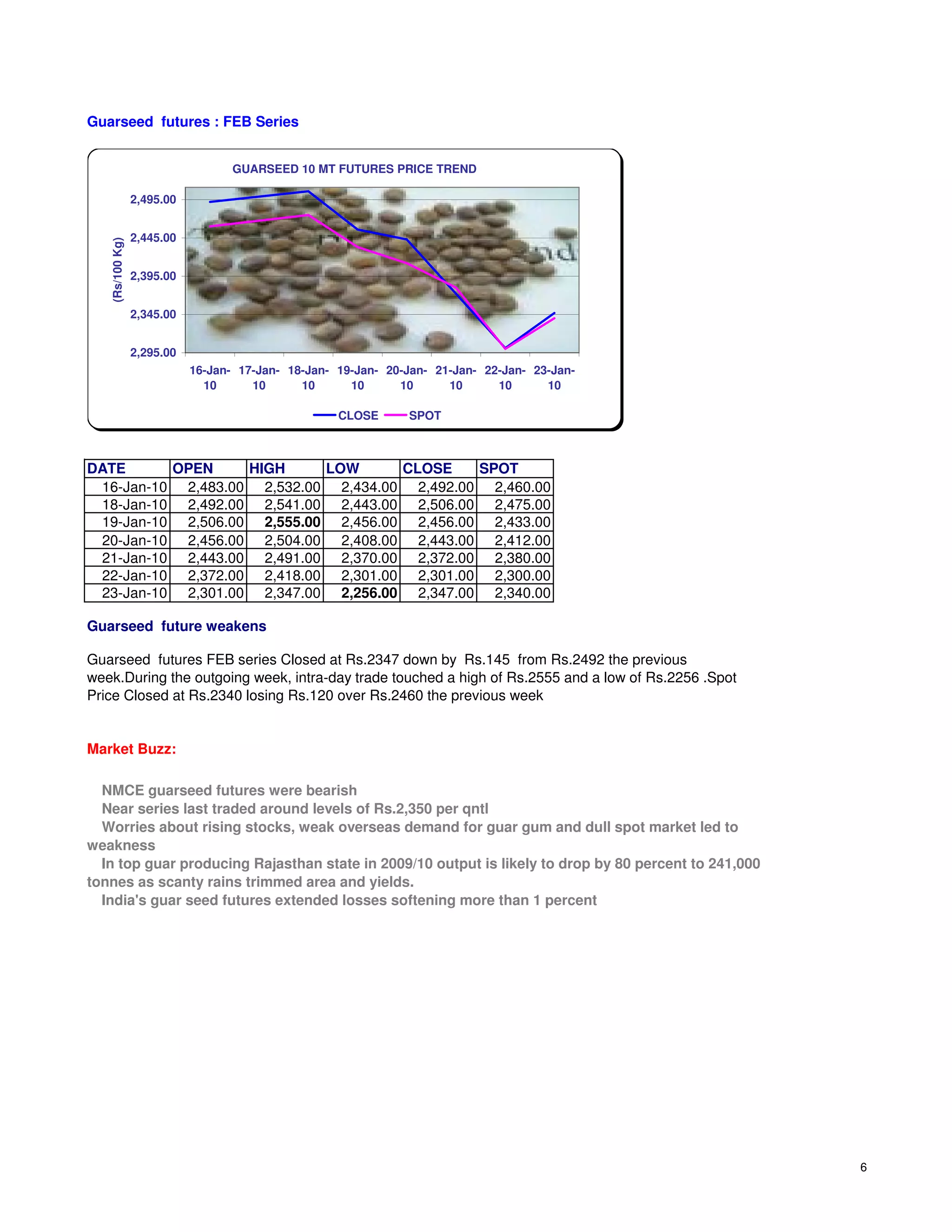

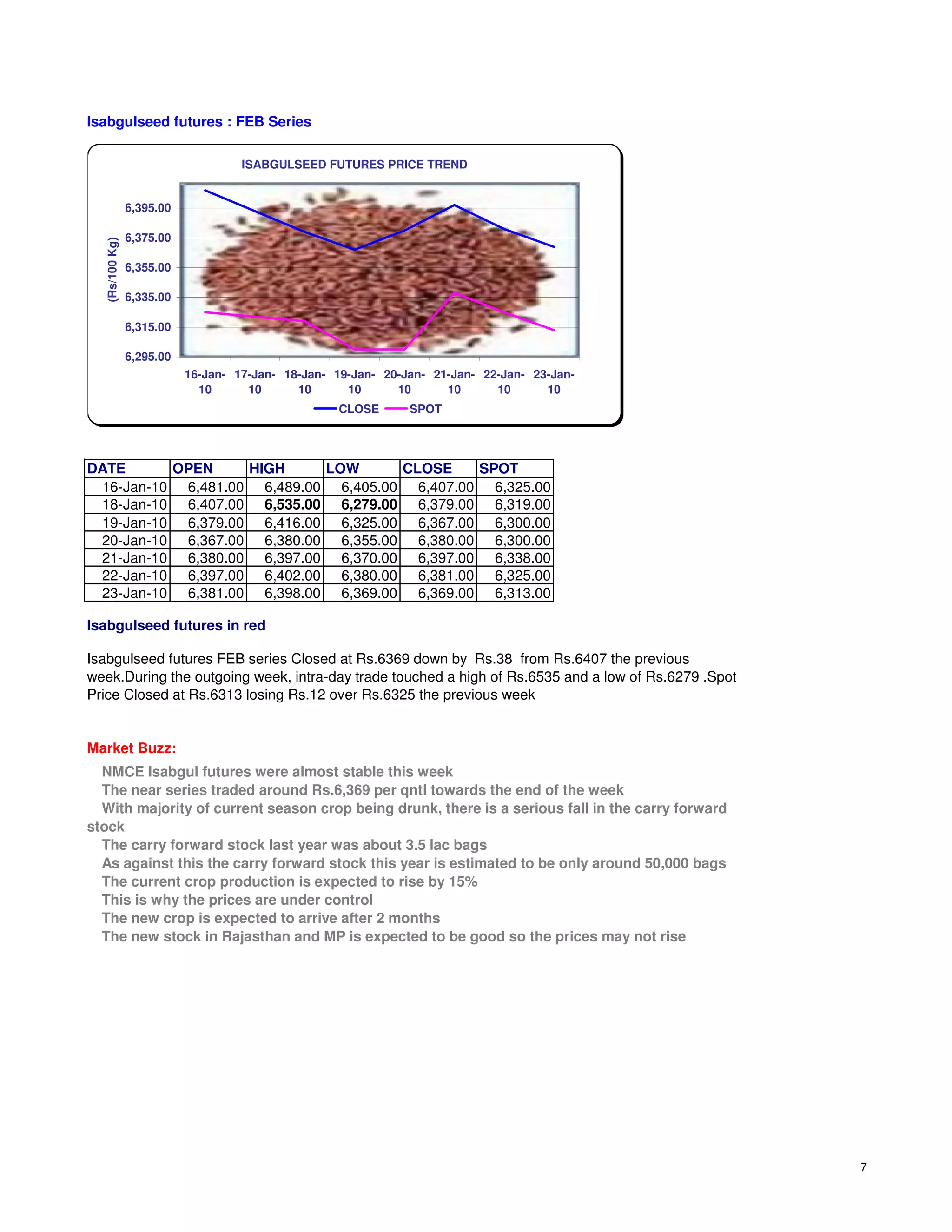

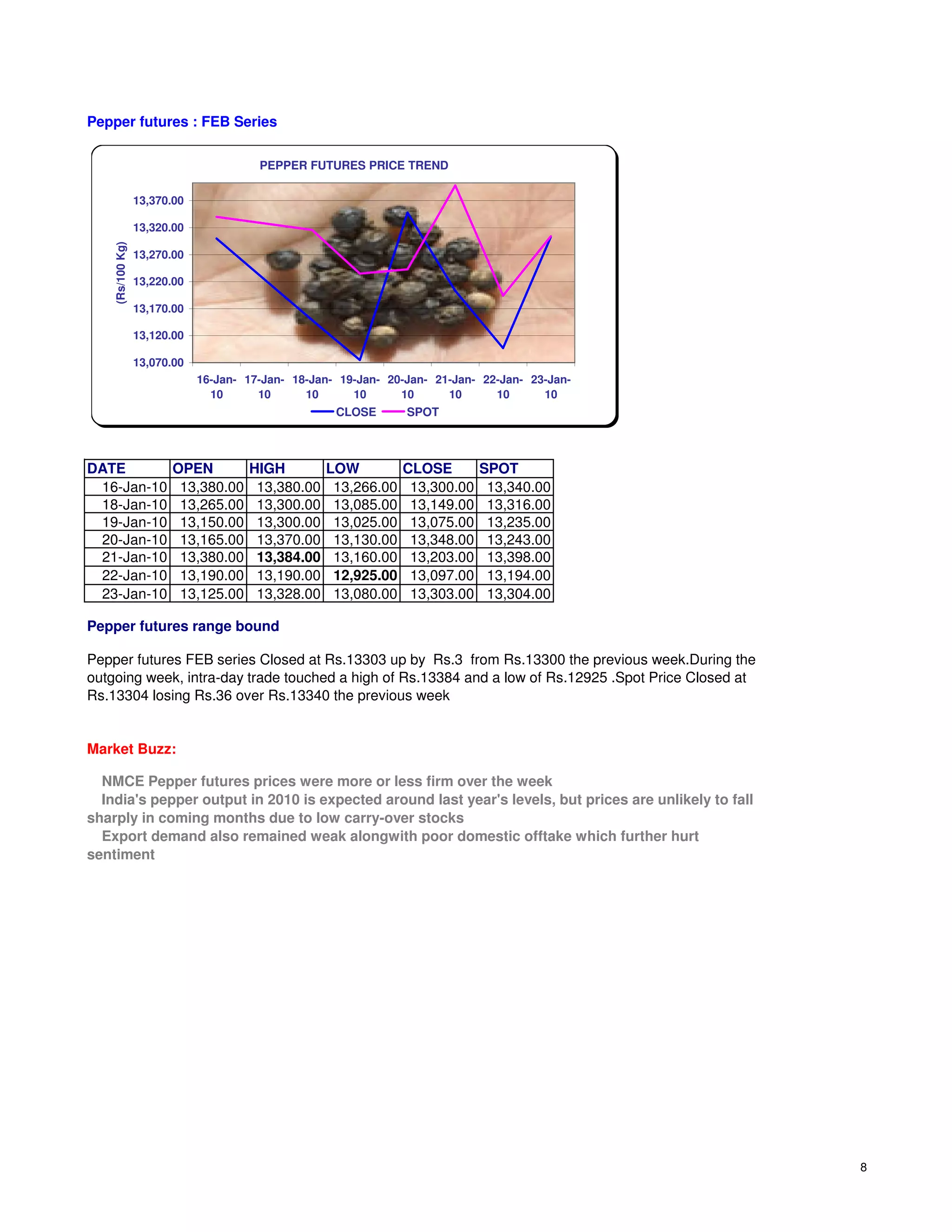

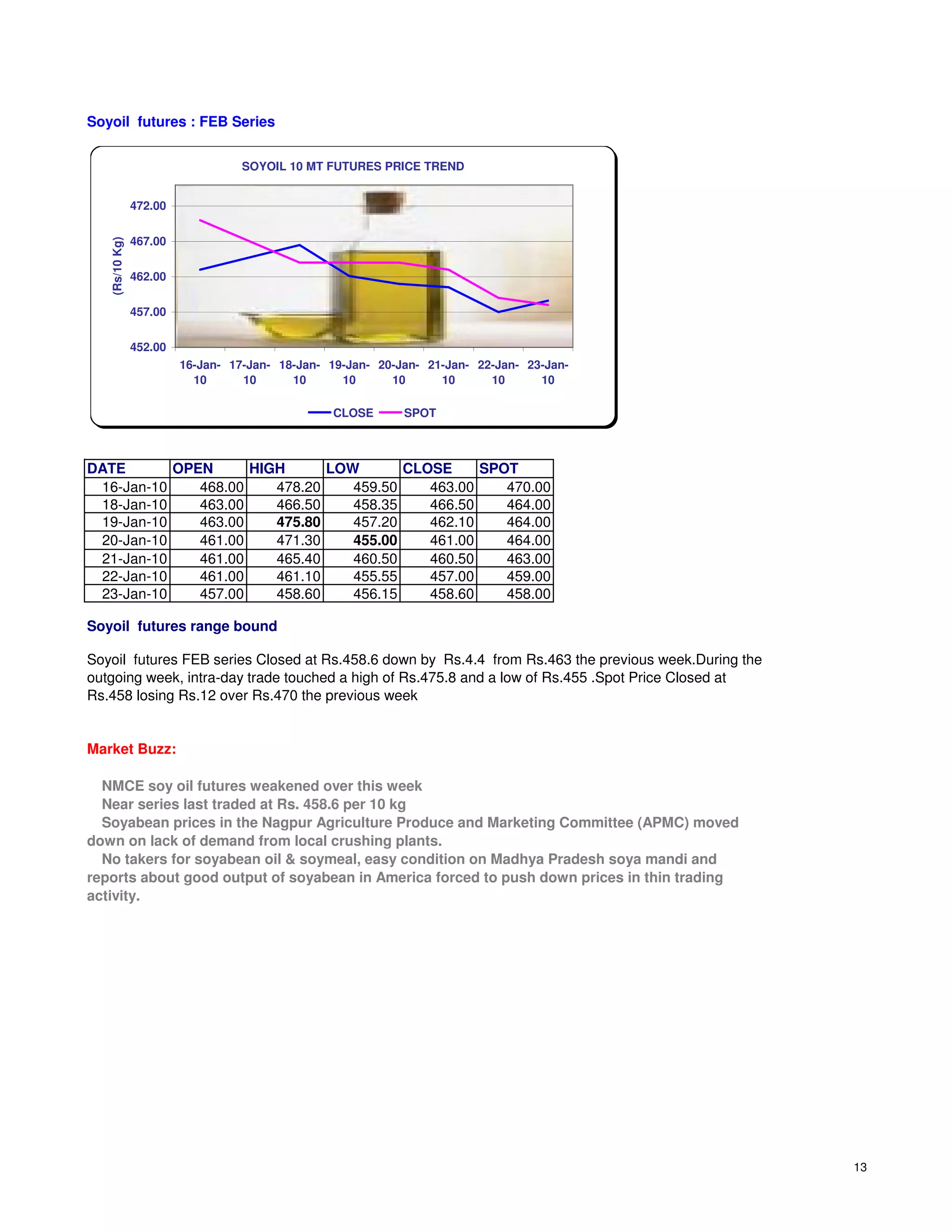

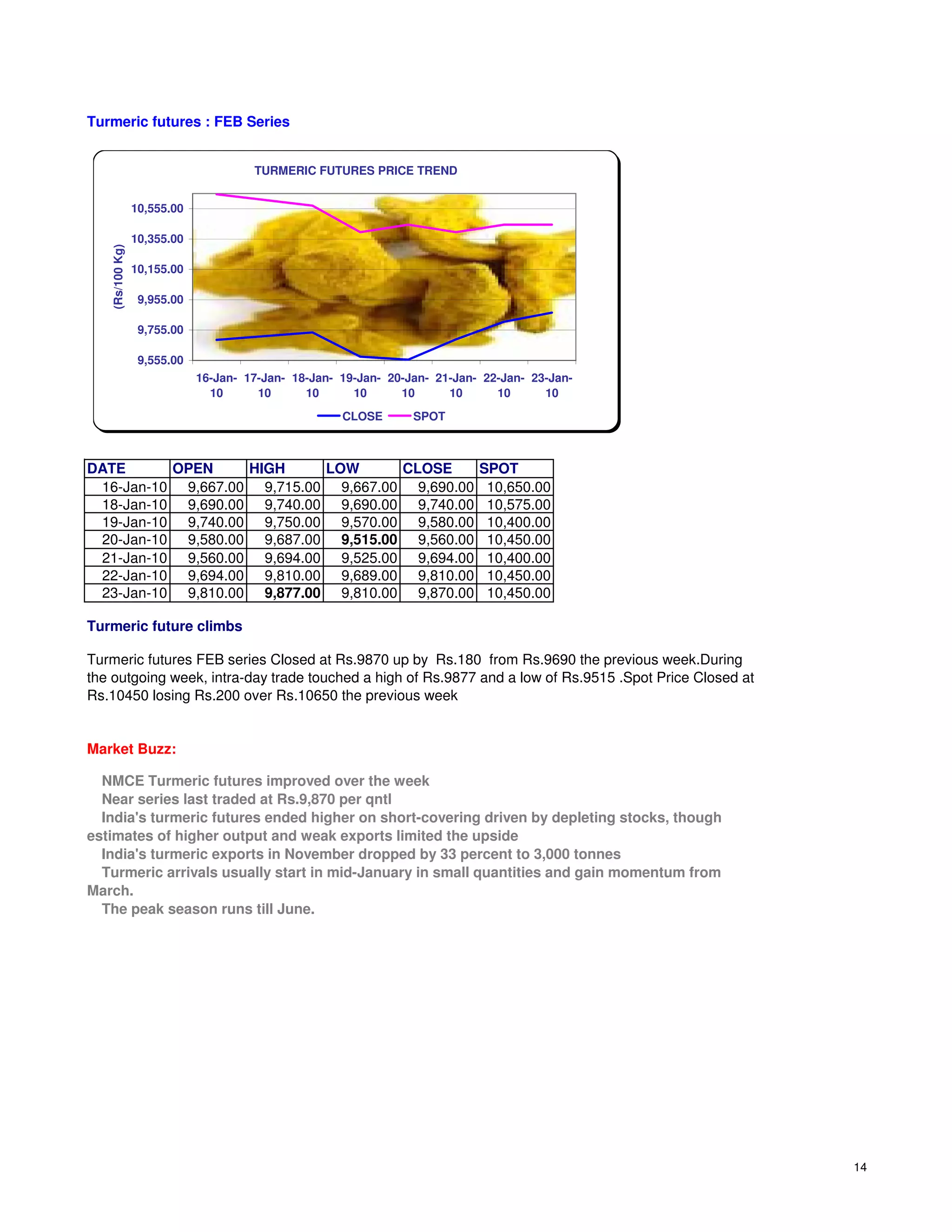

The weekly commodity report summarizes the performance of various commodity futures on the NMCE from January 18 to 23, 2010. Several commodity futures declined over the week, including castor seed, chana, coffee, copra, and guarseed futures. Coffee futures fell the most, dropping by Rs. 260 per quintal. Meanwhile, pepper futures remained range-bound. Overall trading volume on the NMCE increased to Rs. 8,401.27 crores from Rs. 7,662.97 crores the previous week.