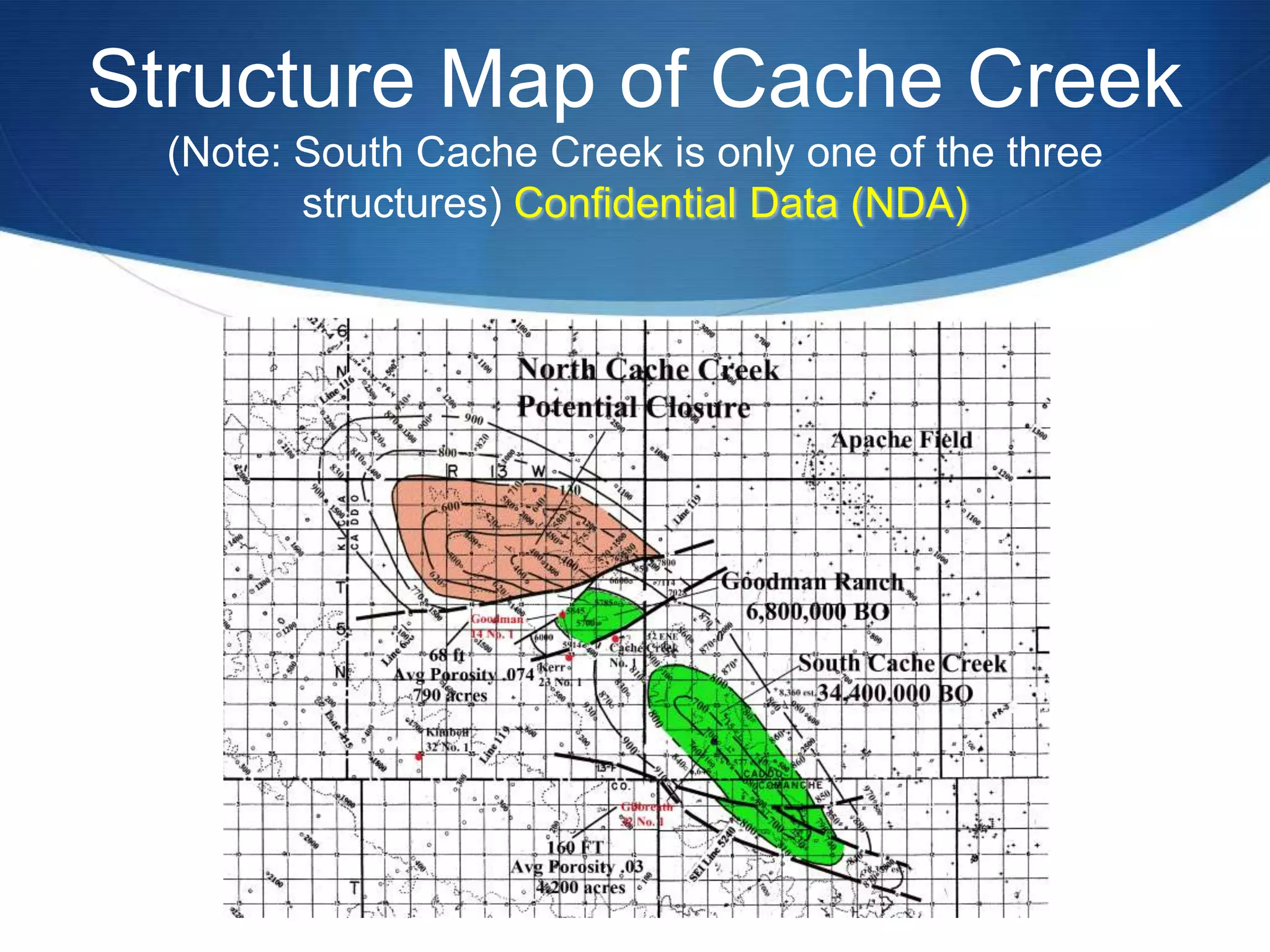

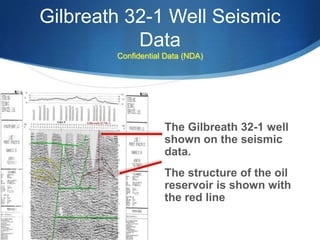

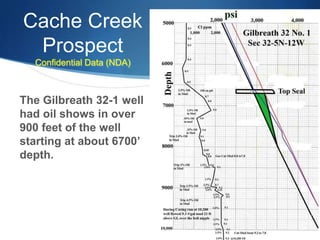

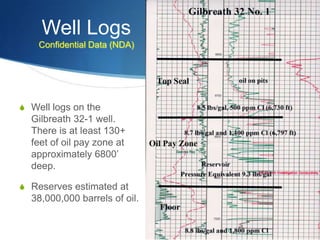

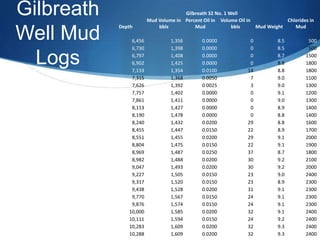

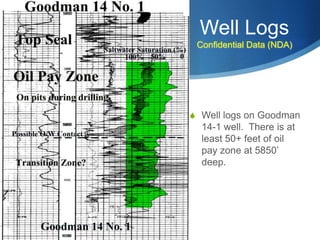

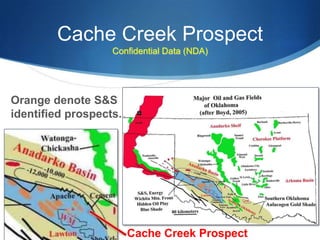

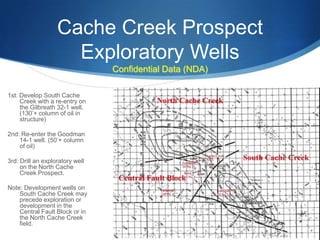

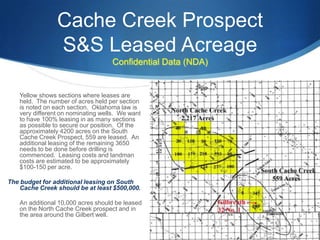

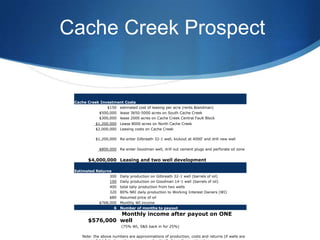

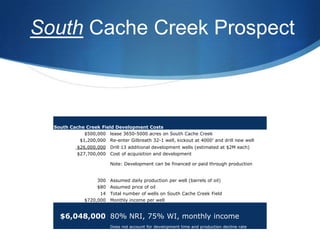

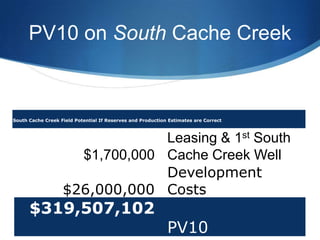

The document discusses the Cache Creek oil prospect in Oklahoma. It details the structure of the South Cache Creek reservoir based on seismic data and well logs. Well logs indicate there is over 130 feet of oil pay zone in the Gilbreath 32-1 well and over 50 feet of pay in the Goodman 14-1 well. The prospect involves leasing acreage, re-entering existing wells, and drilling additional wells. Initial investment is estimated at $4 million with potential returns of $319.5 million based on reserves and production estimates.