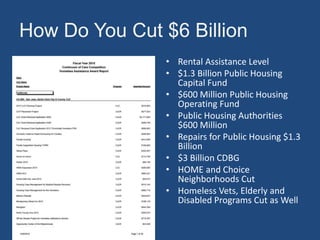

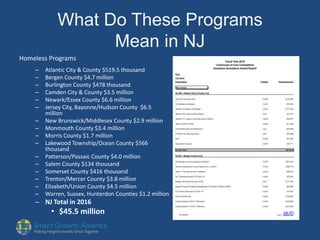

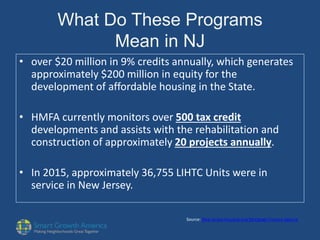

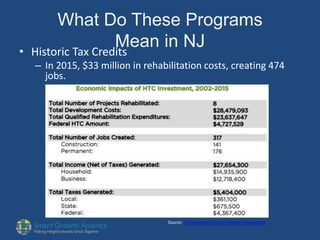

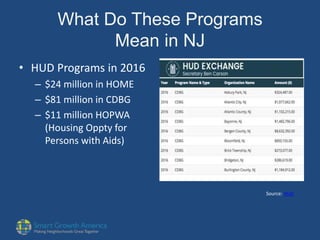

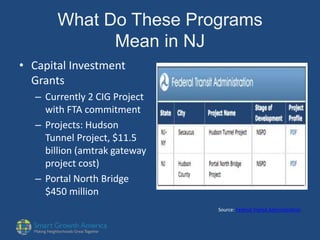

The document discusses various federal redevelopment programs that are at risk of being cut under the new presidential administration, including Community Development Block Grants, Low Income Housing Tax Credits, and HOME funds. It also provides details on how much funding different New Jersey cities and counties receive from federal homeless assistance and HUD programs. The document argues that cuts to these programs would significantly impact affordable housing development and homelessness assistance in New Jersey.