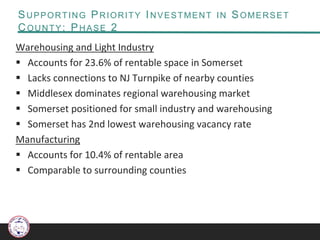

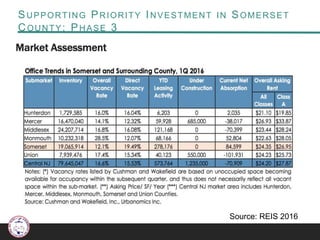

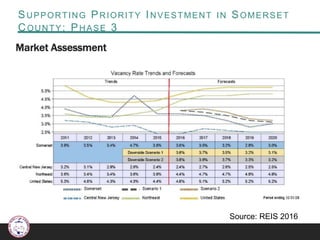

This document summarizes phases 1-3 of a study supporting priority investment in Somerset County, New Jersey. Phase 1 findings include socioeconomic analysis showing demand for senior and multifamily housing and identification of areas with low land value suitable for redevelopment. Phase 2 assesses real estate market trends, finding high office and retail vacancy rates but opportunities for mixed-use and small industry. Phase 3 further analyzes real estate data to identify target areas. The overall goals are to align land use and infrastructure plans to convey clear development priorities and leverage resources.