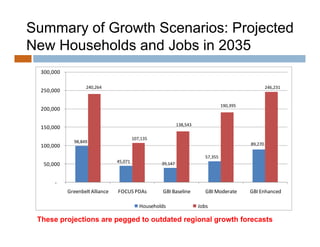

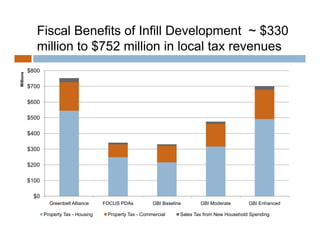

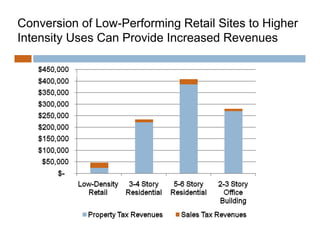

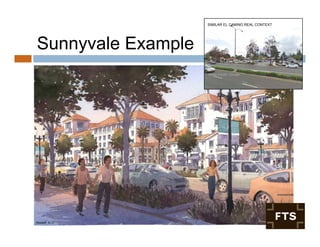

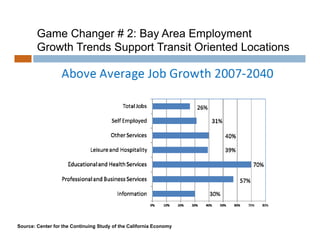

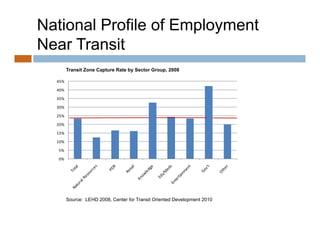

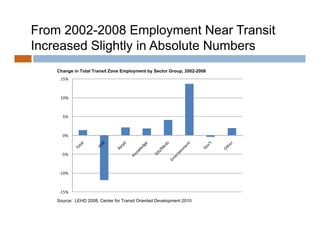

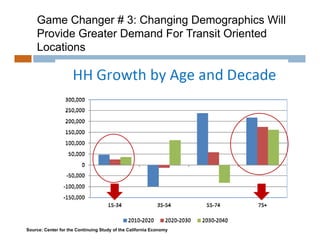

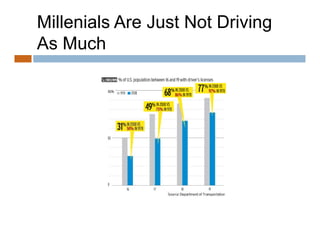

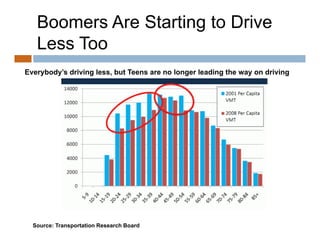

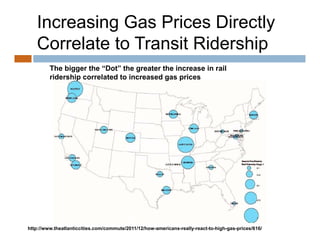

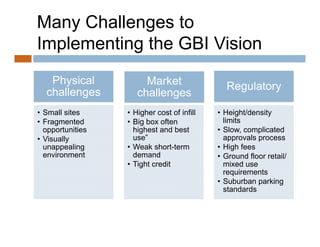

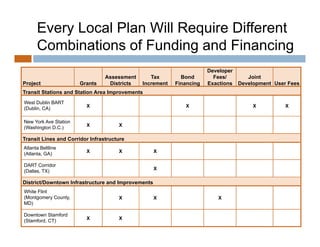

This document discusses strategies for implementing the vision of the Grand Boulevard Initiative (GBI), which aims to encourage transit-oriented development along a 43-mile corridor from Daly City to San Jose. It outlines several "game changers", such as improved transit, employment growth trends favoring transit-oriented locations, changing demographics, and increasing gas prices, that will support the GBI vision. It also discusses challenges to implementation like physical constraints, market challenges, and regulatory barriers. The document emphasizes that each community will need its own tailored approach using various combinations of grants, assessment districts, tax increment financing, bonds, developer fees, public-private partnerships, and user fees to fund different infrastructure projects.