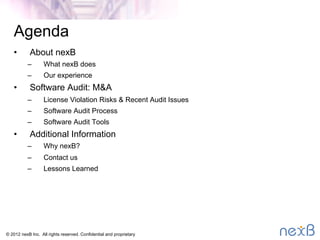

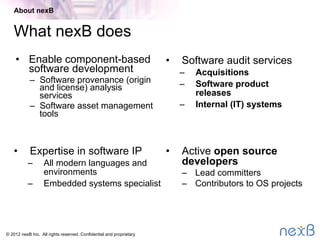

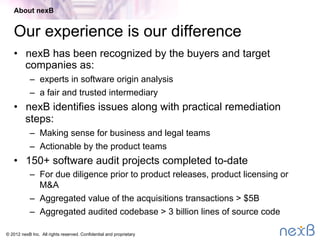

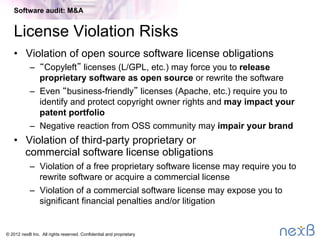

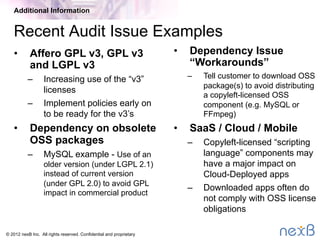

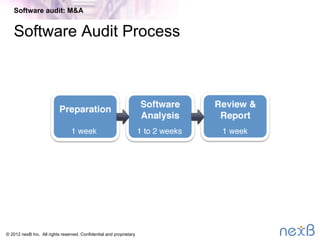

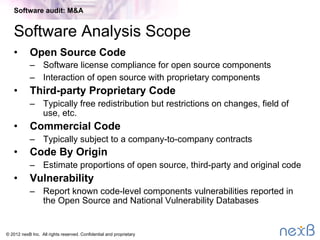

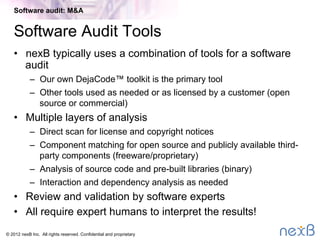

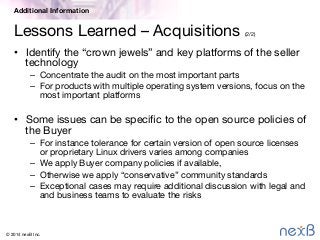

This document provides an overview of a software audit process conducted by nexB for acquisition due diligence. It discusses nexB's experience and services, common license violation risks found in audits, the audit process including preparation, analysis, review and reporting, tools used, reasons to choose nexB, and lessons learned from past acquisitions.