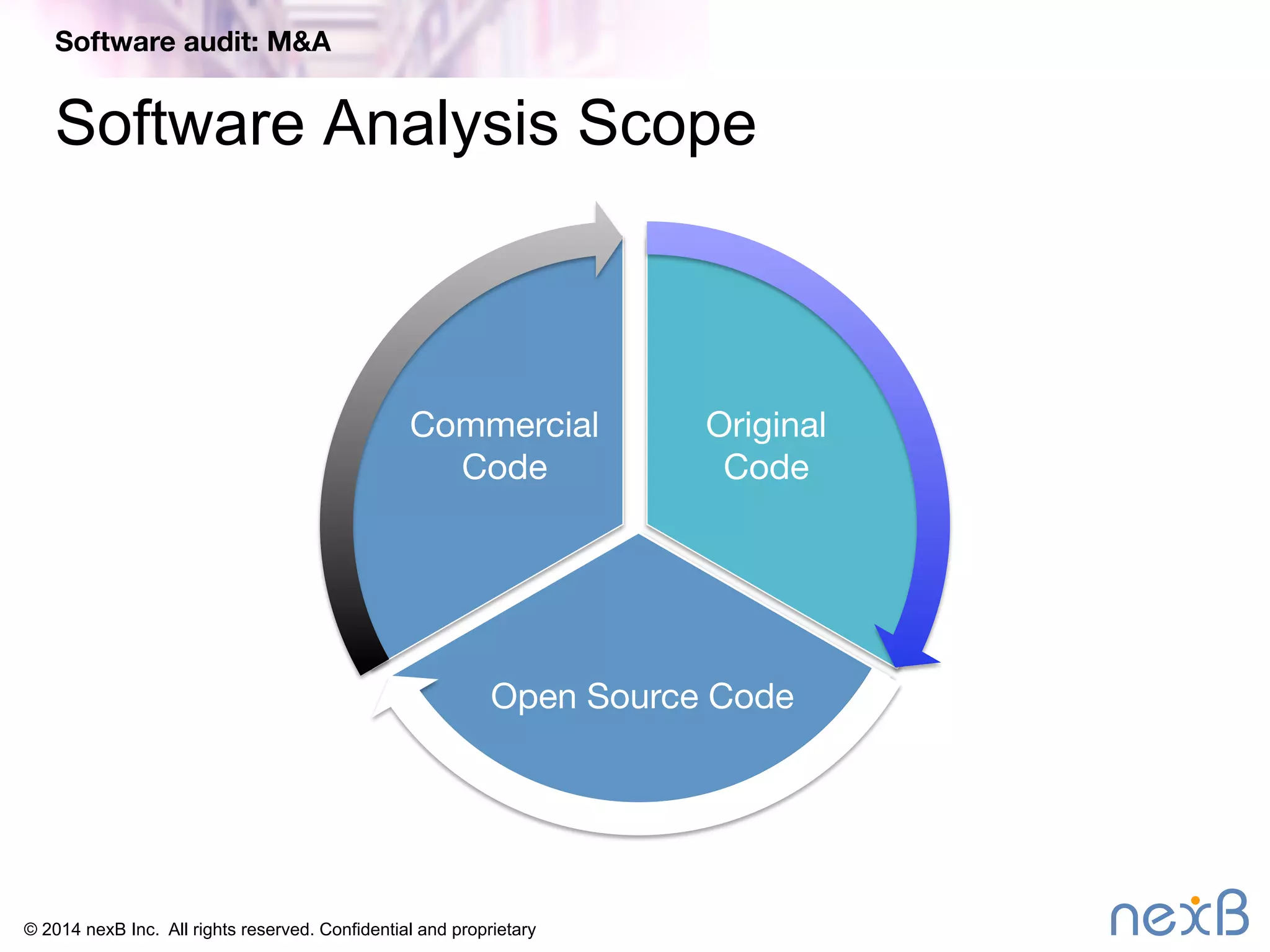

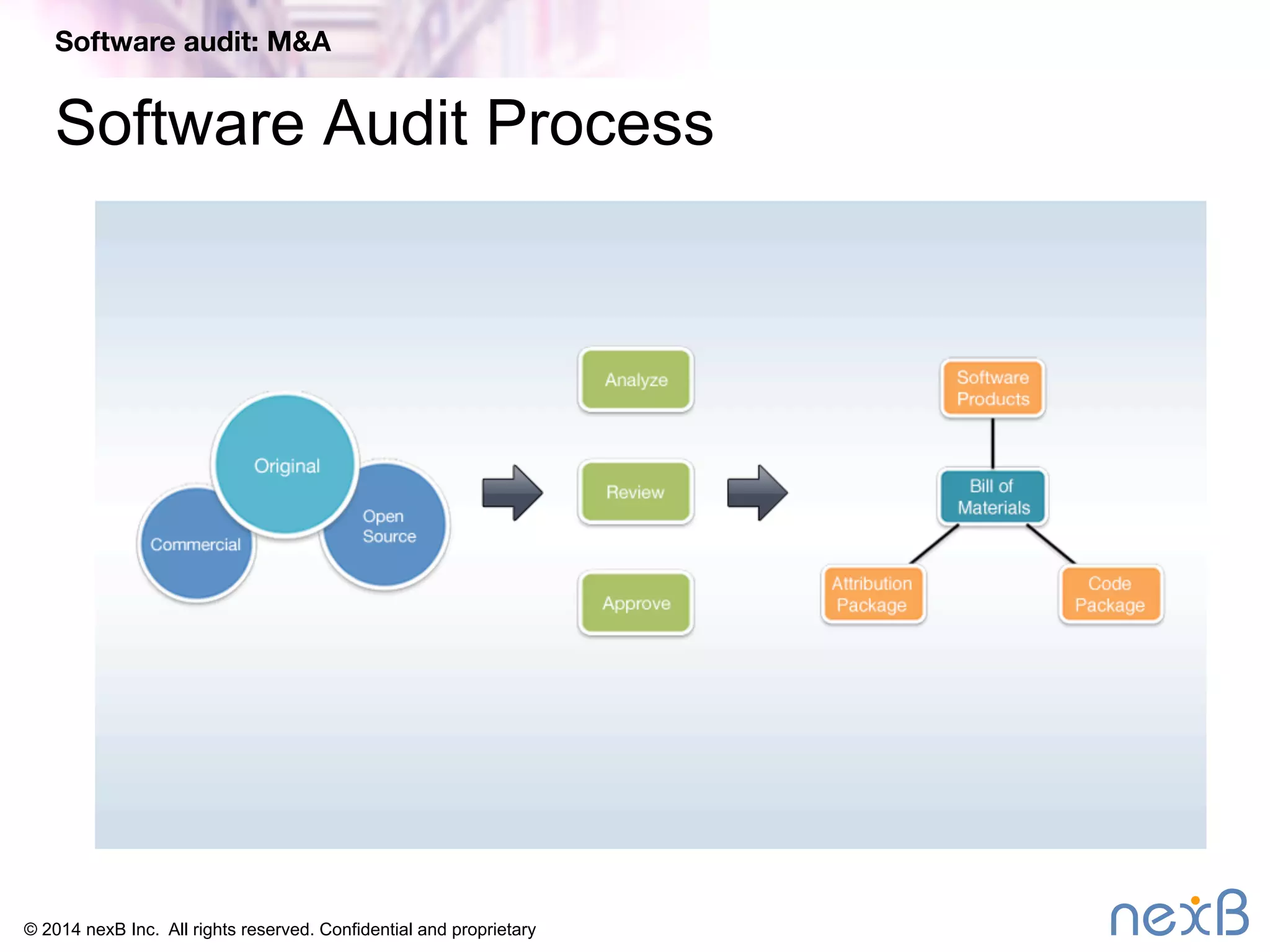

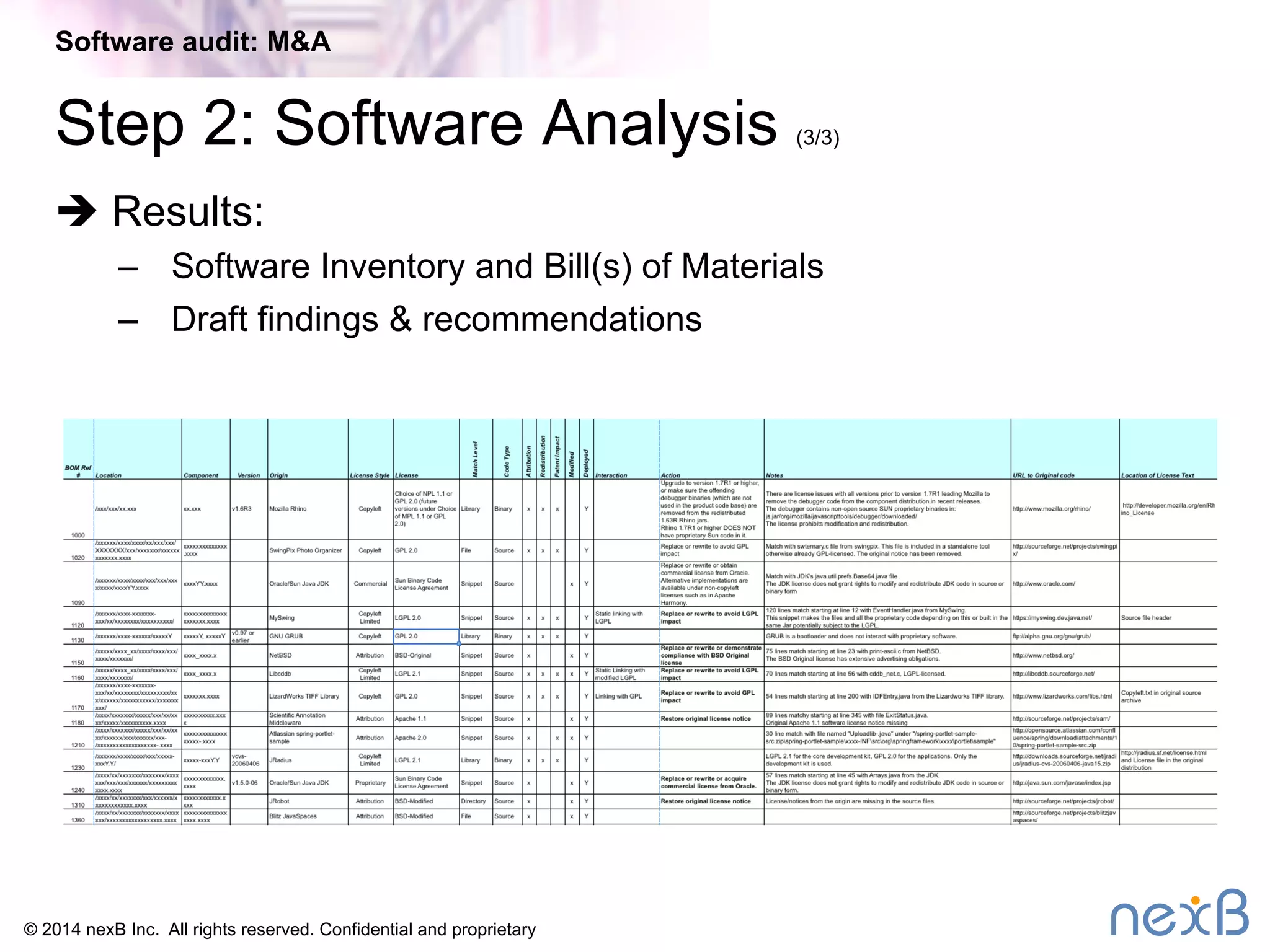

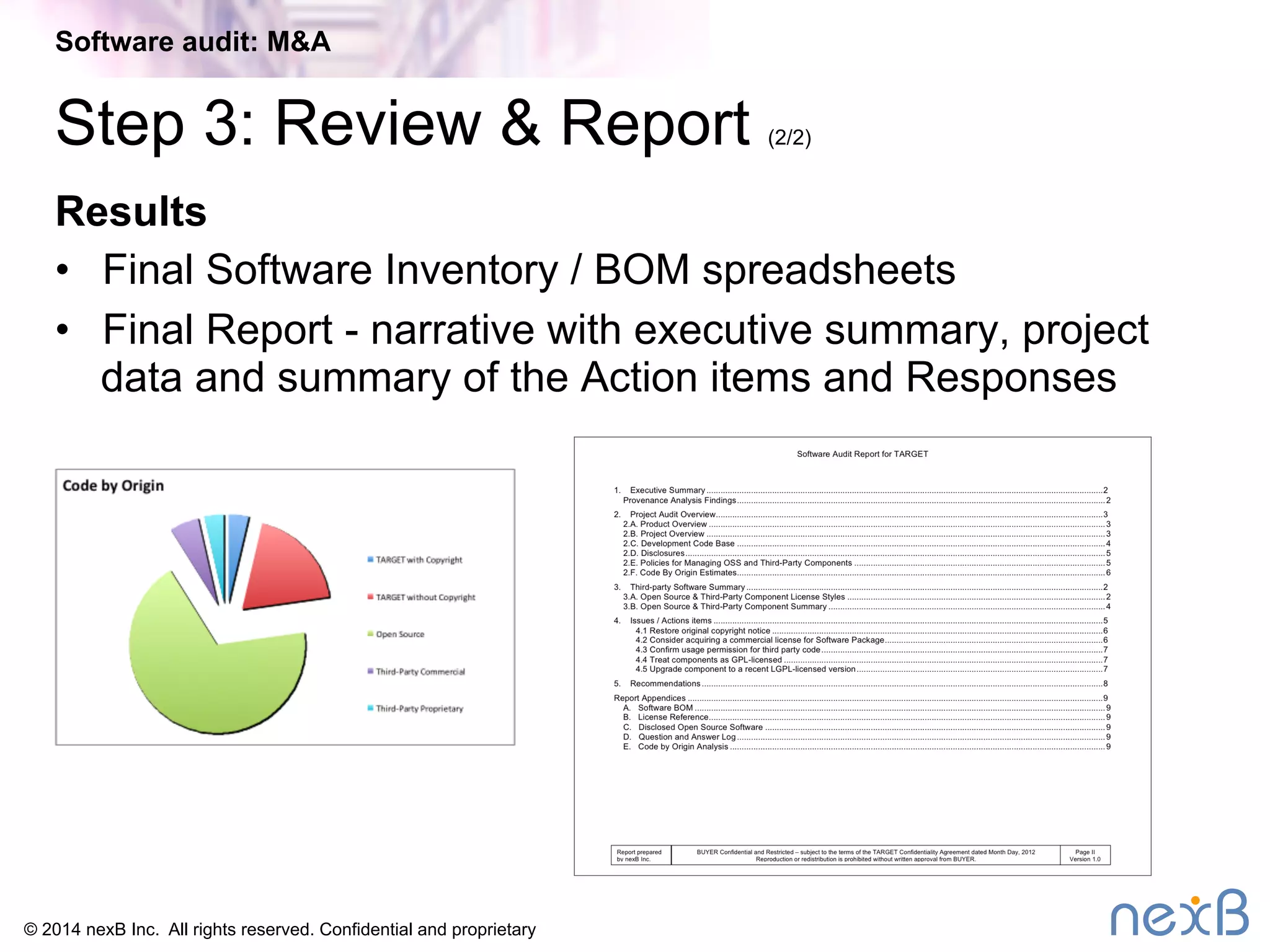

The document outlines NexB's software provenance analysis services, particularly in the context of acquisition due diligence. It details the software audit process, including preparation, software analysis, and reporting stages, while highlighting NexB's expertise and tools used for auditing. It emphasizes the importance of thorough documentation and communication for a successful software audit during mergers and acquisitions.