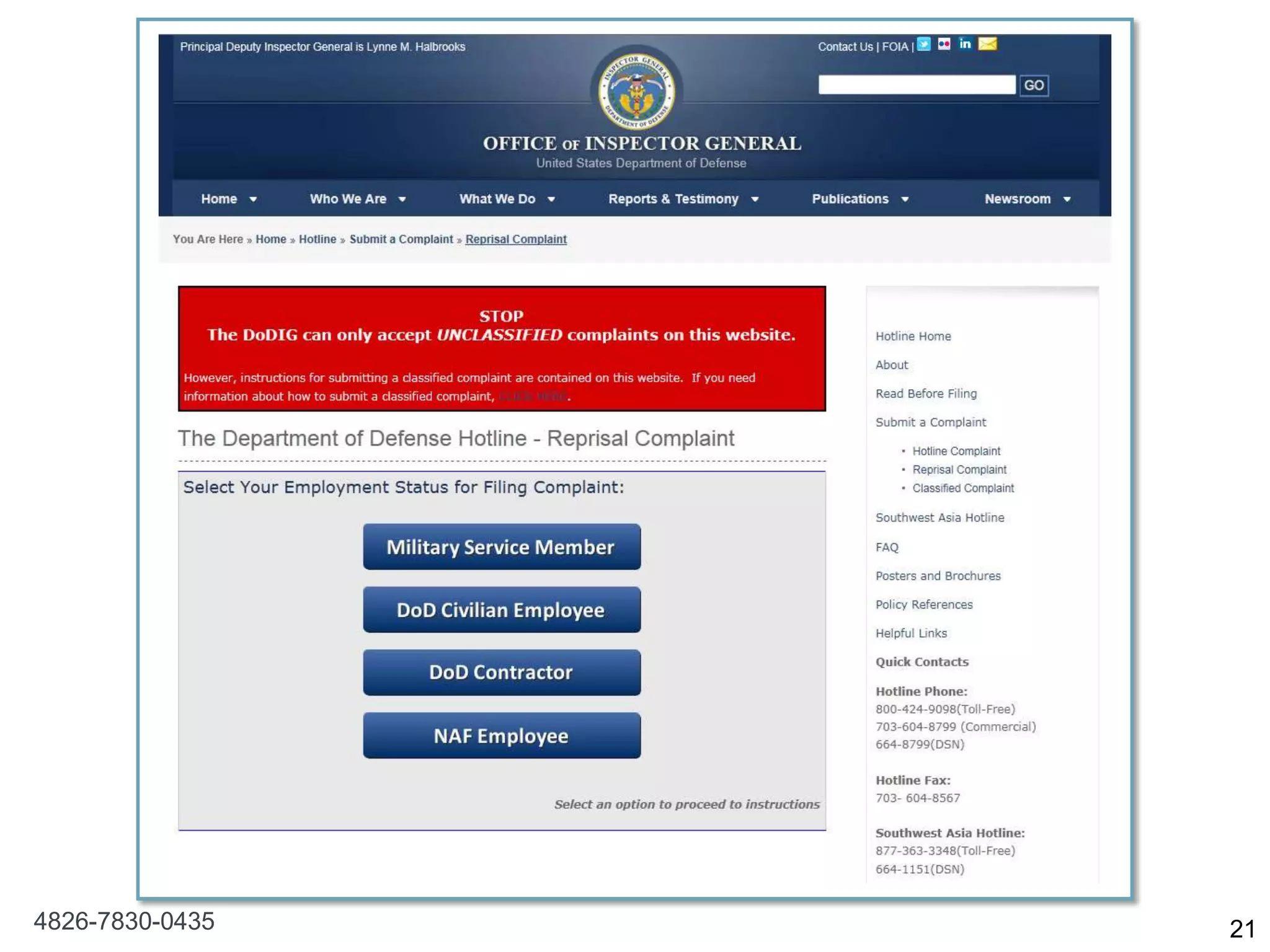

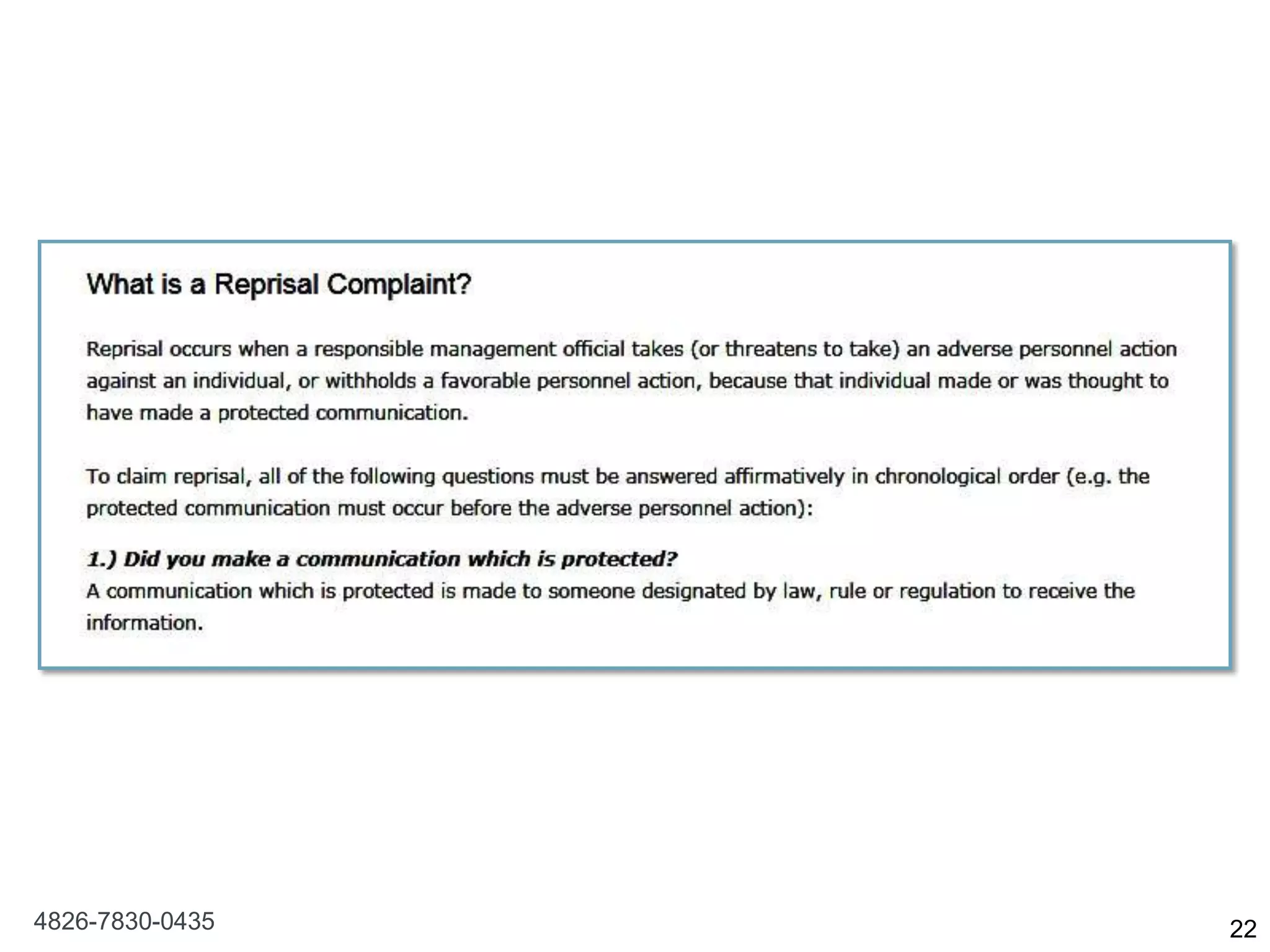

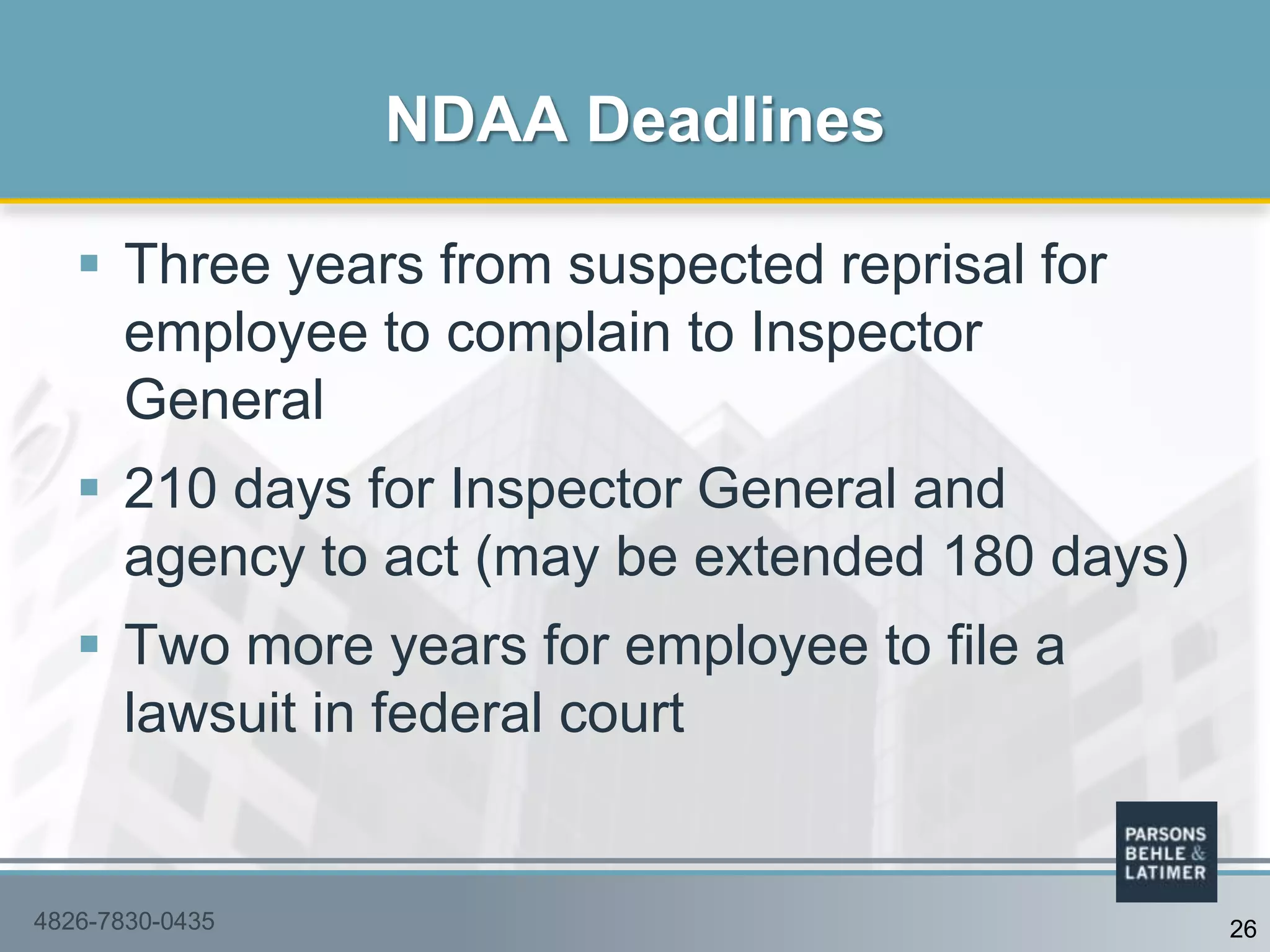

The document discusses new whistleblowing protections for employees of government contractors, emphasizing the critical role of whistleblowers in revealing fraud and misconduct. It outlines existing laws like the False Claims Act, Sarbanes-Oxley, and Dodd-Frank, which protect whistleblowers and provide them with incentives to report wrongdoing. The 2013 National Defense Authorization Act further strengthens these protections, prohibiting reprisals against whistleblowers and establishing reporting procedures.

![If whistleblowers [are not protected], we

are saying to contractors, we don‟t think

wrongdoing by you is that

important….Whistleblowers are the

unsung heroes in our fight to root out

inappropriate and sometimes illegal

behavior…”

– U.S. Senator Claire McCaskell (D. Mo.)

Whistleblowers as Heroes (cont.)

54826-7830-0435](https://image.slidesharecdn.com/2013emplawseminarwmg-130620123250-phpapp02/75/New_Whistleblowing_Protections_for_Employees_of_Government_Contractors-5-2048.jpg)

![ “The purpose of [SOX] is protect people who

have the courage to stand against institutional

pressures and say plainly, „what you are doing

here is wrong‟….Congress chose language

which ensures that an employee‟s reasonable

but mistaken belief that an employer engaged

in [fraudulent] conduct…or that a violation is

likely to happen…is protected.” Wiest v. Lynch

(3rd Cir., 3/19/13)

Importance of SOX Whistleblowers

4826-7830-0435 10](https://image.slidesharecdn.com/2013emplawseminarwmg-130620123250-phpapp02/75/New_Whistleblowing_Protections_for_Employees_of_Government_Contractors-10-2048.jpg)