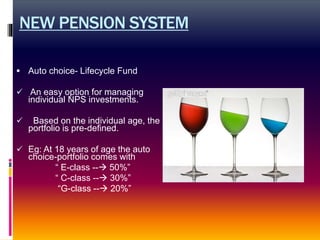

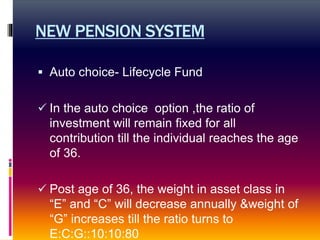

This document provides an overview of the New Pension Scheme (NPS) in India. The NPS aims to provide retirement income, reasonable market returns over the long term, and pension coverage for all citizens. It allows all Indians aged 18-60 to contribute a minimum of Rs. 500 per year. Contributions can be invested through an Active Choice model with equity, fixed income and government funds, or an Auto Choice lifecycle fund that adjusts the asset mix based on the investor's age. The NPS provides tax benefits according to Indian tax law.