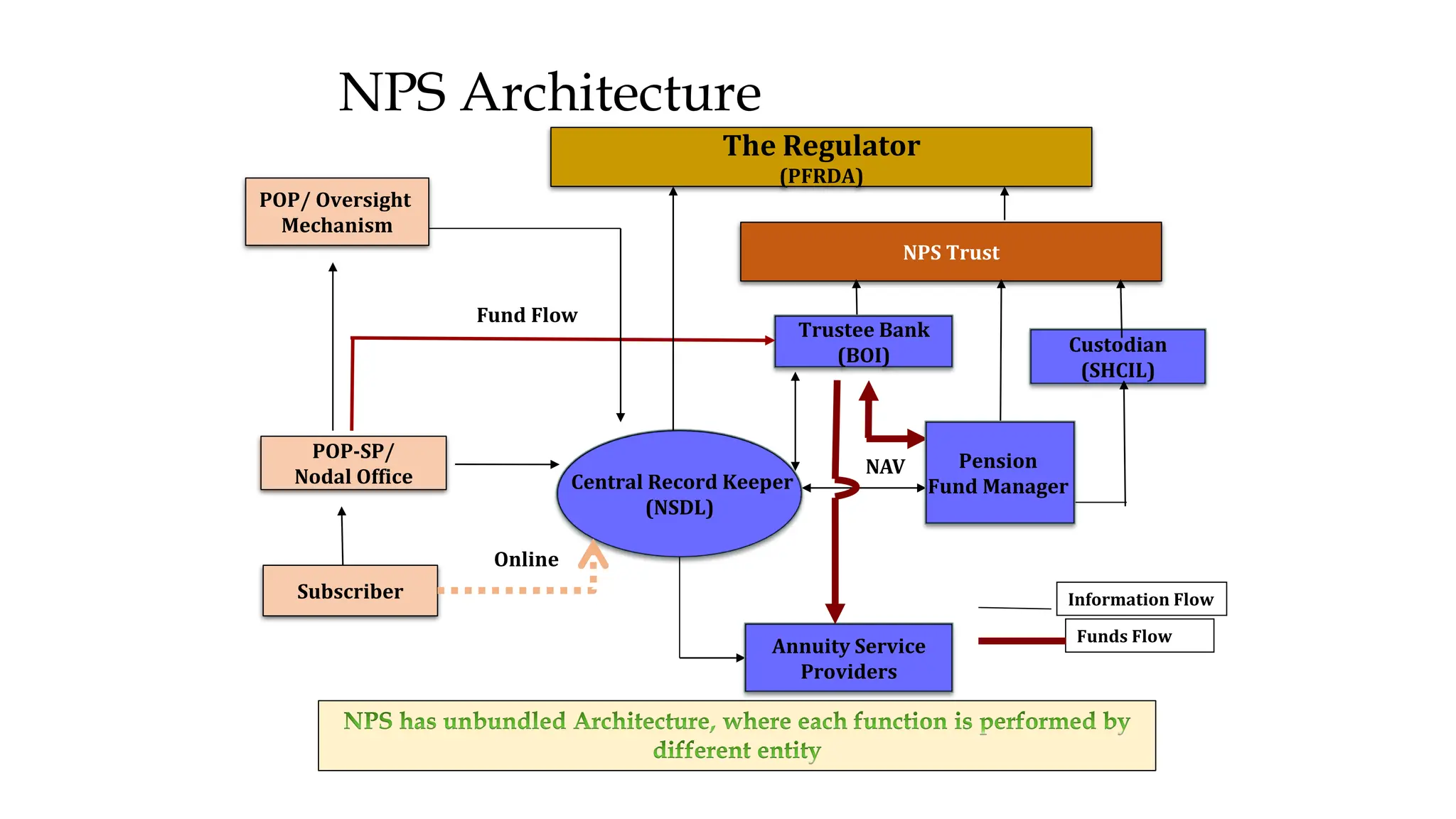

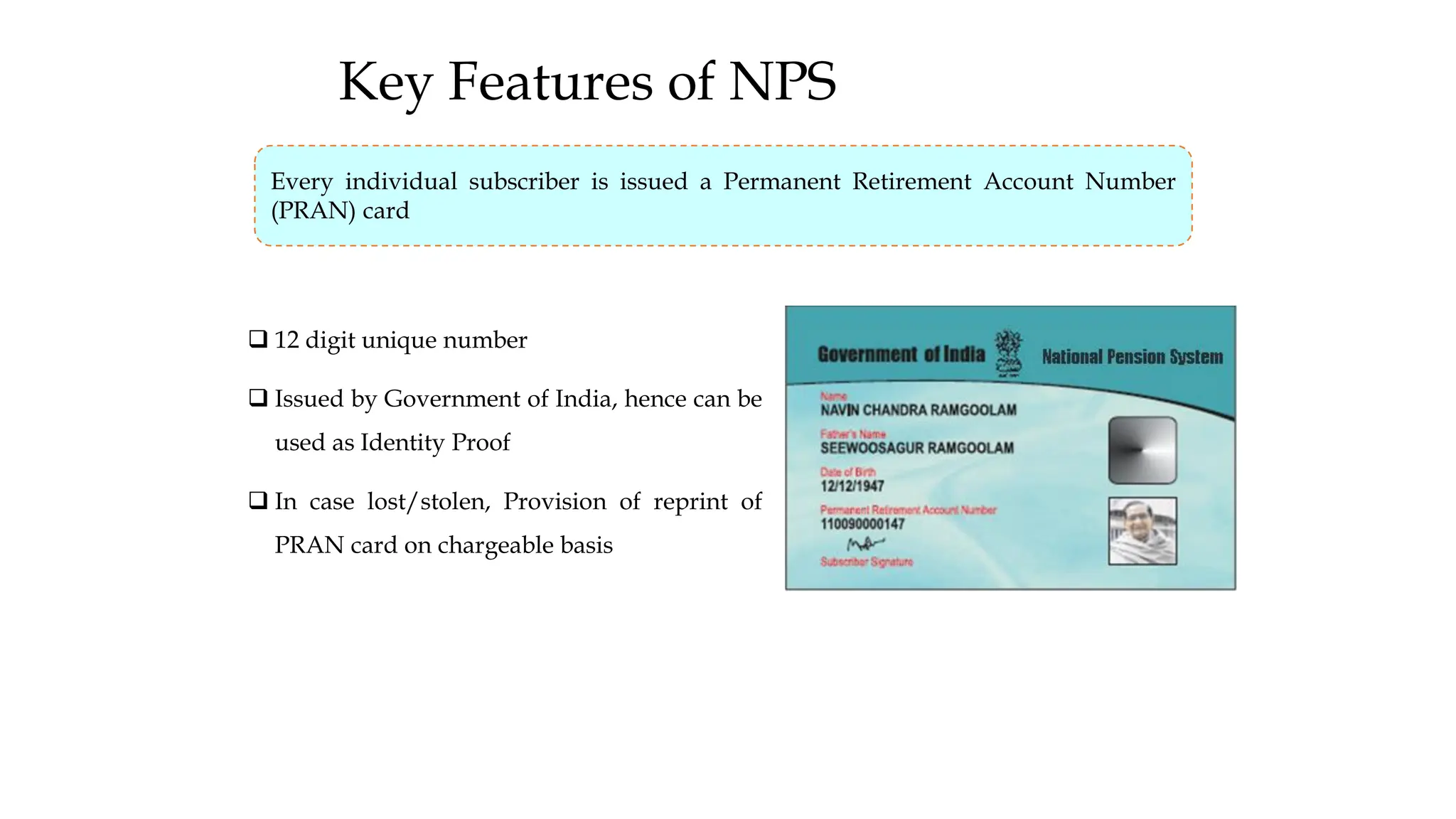

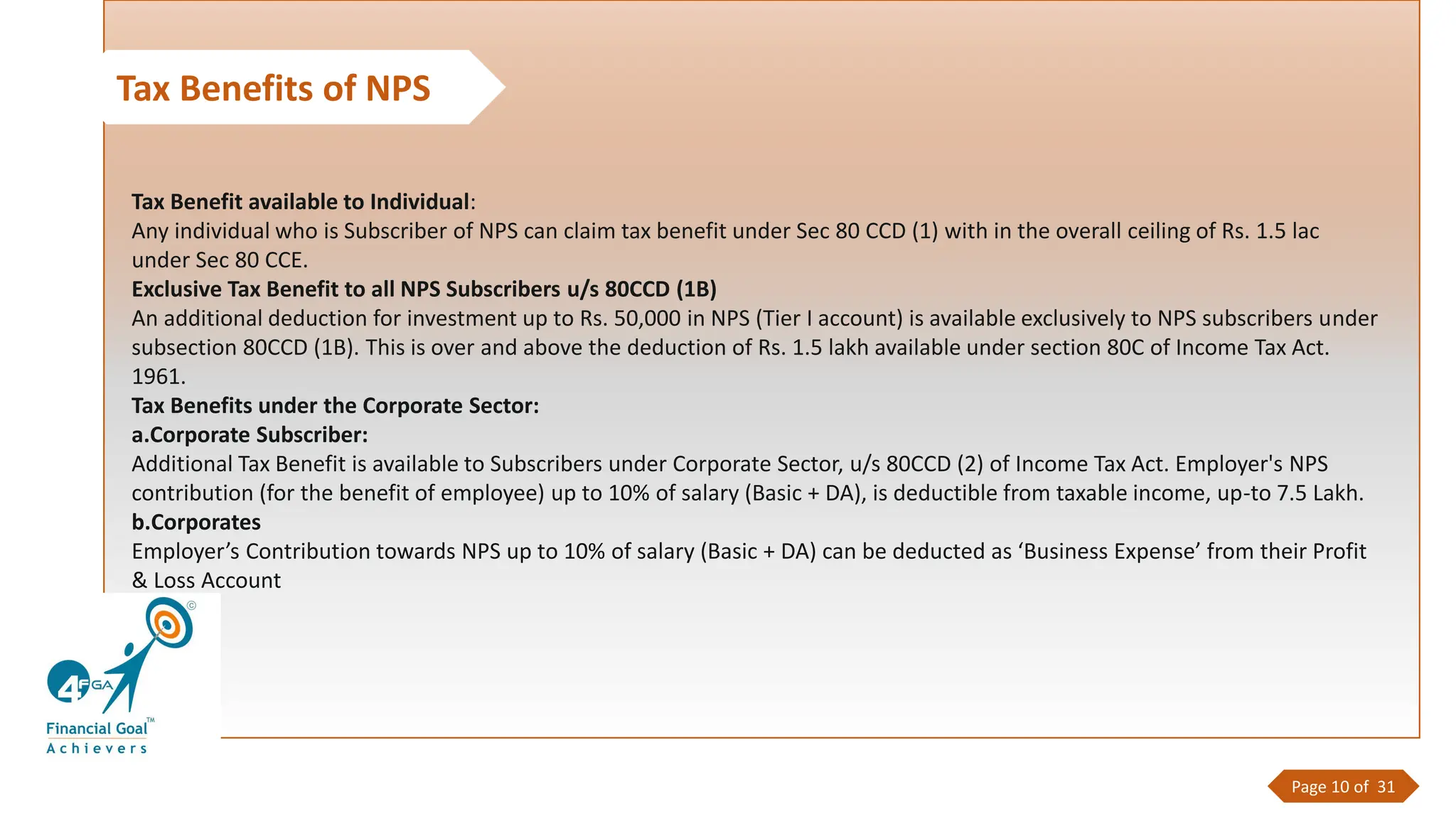

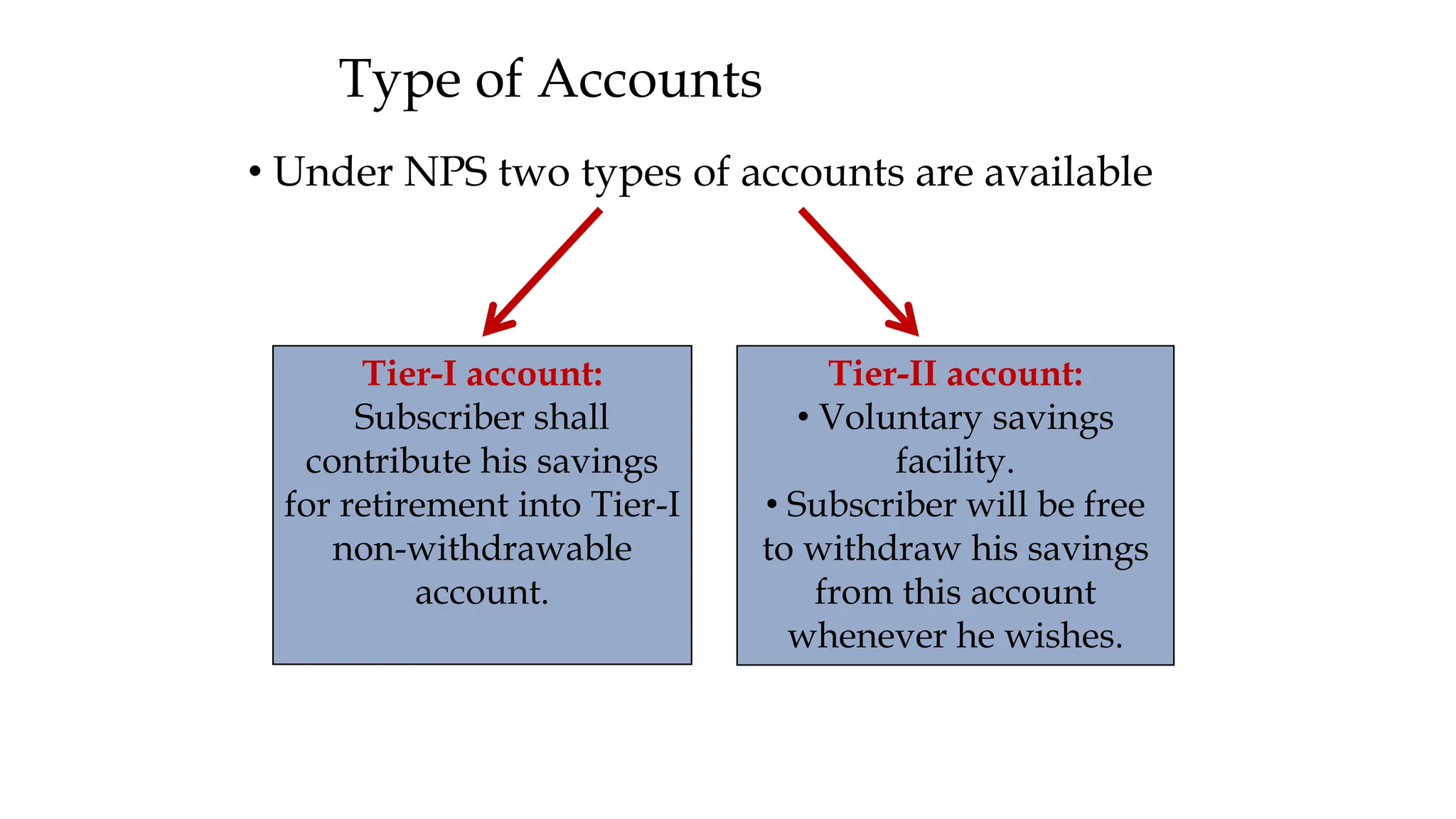

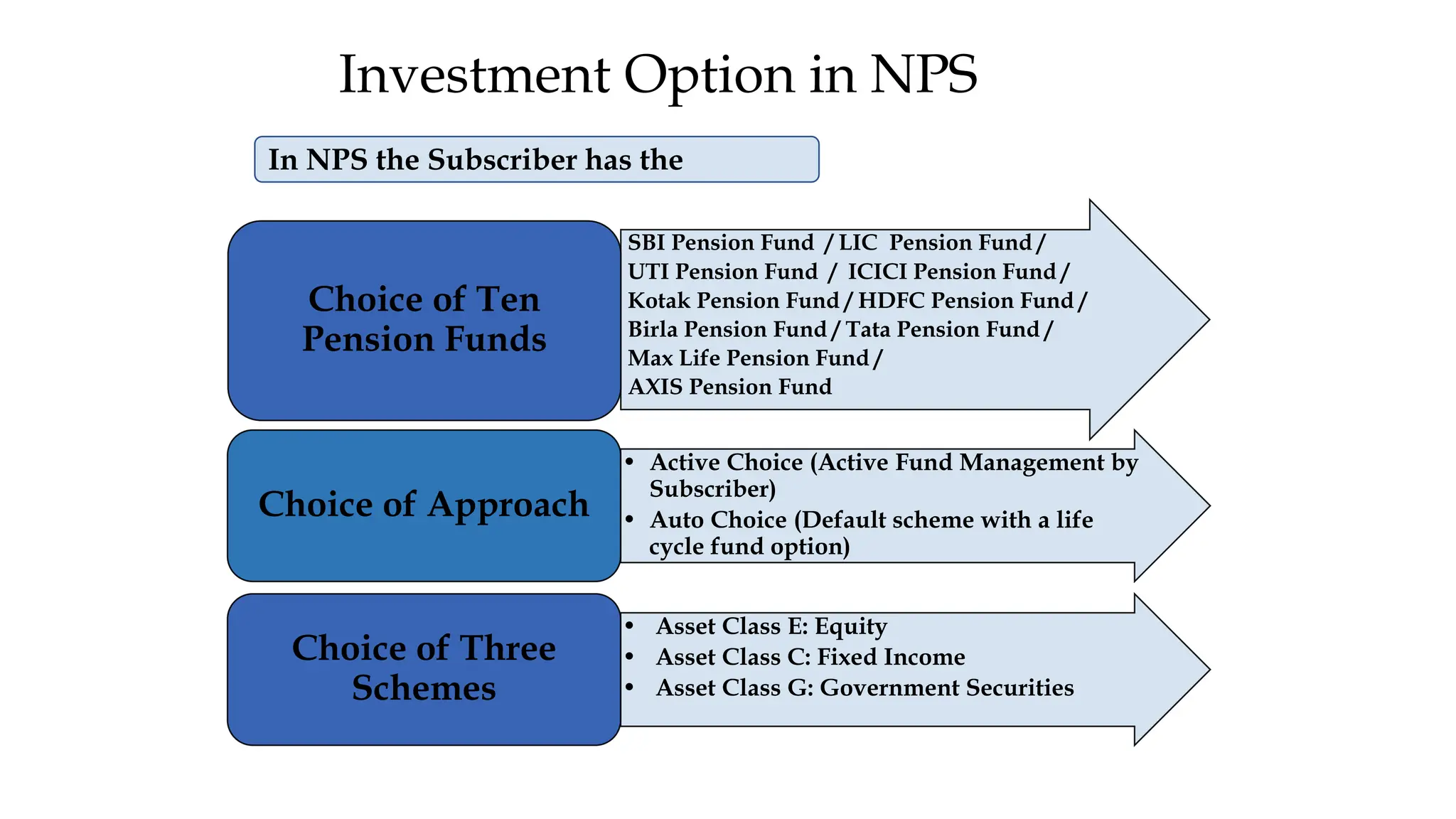

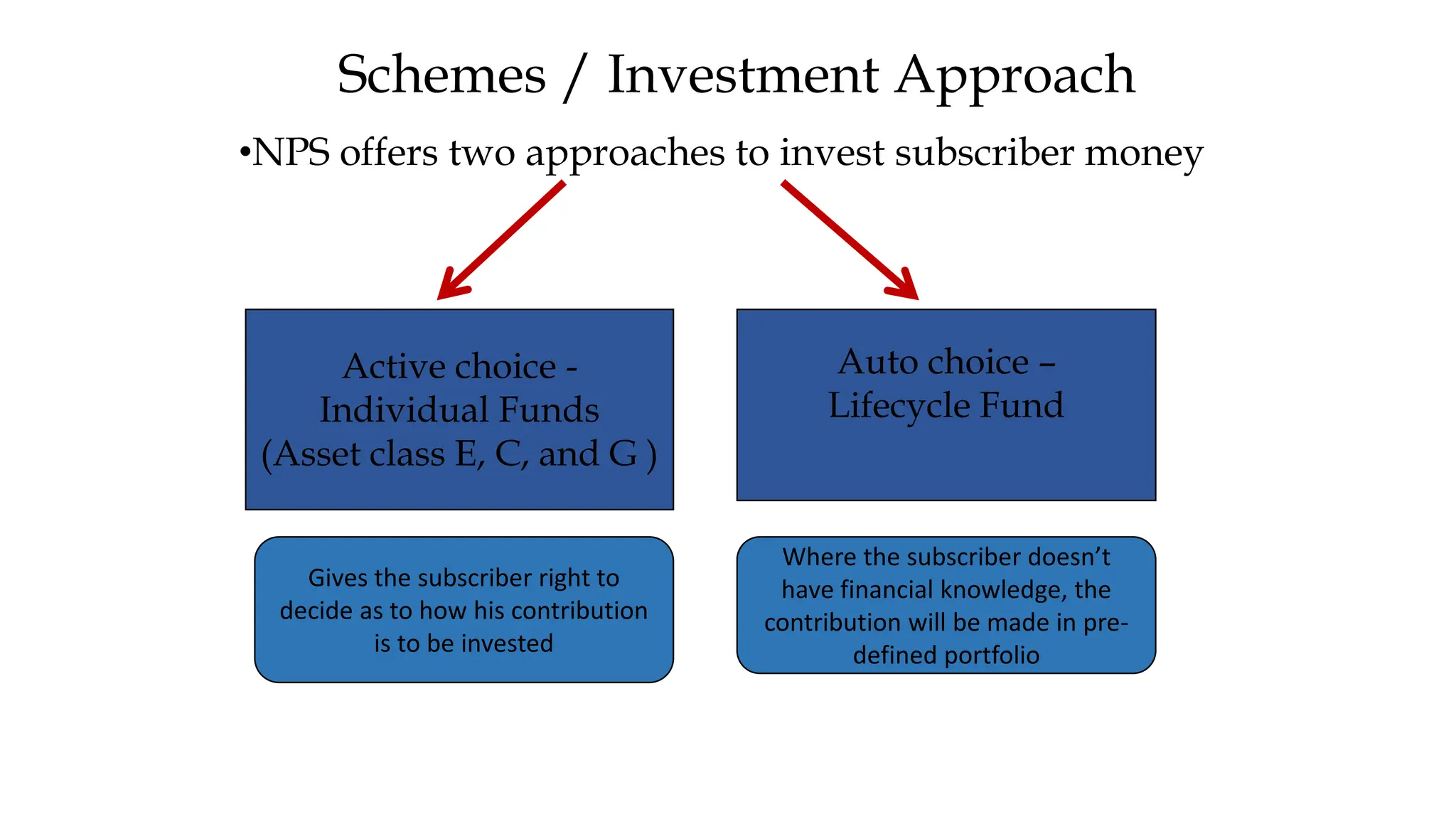

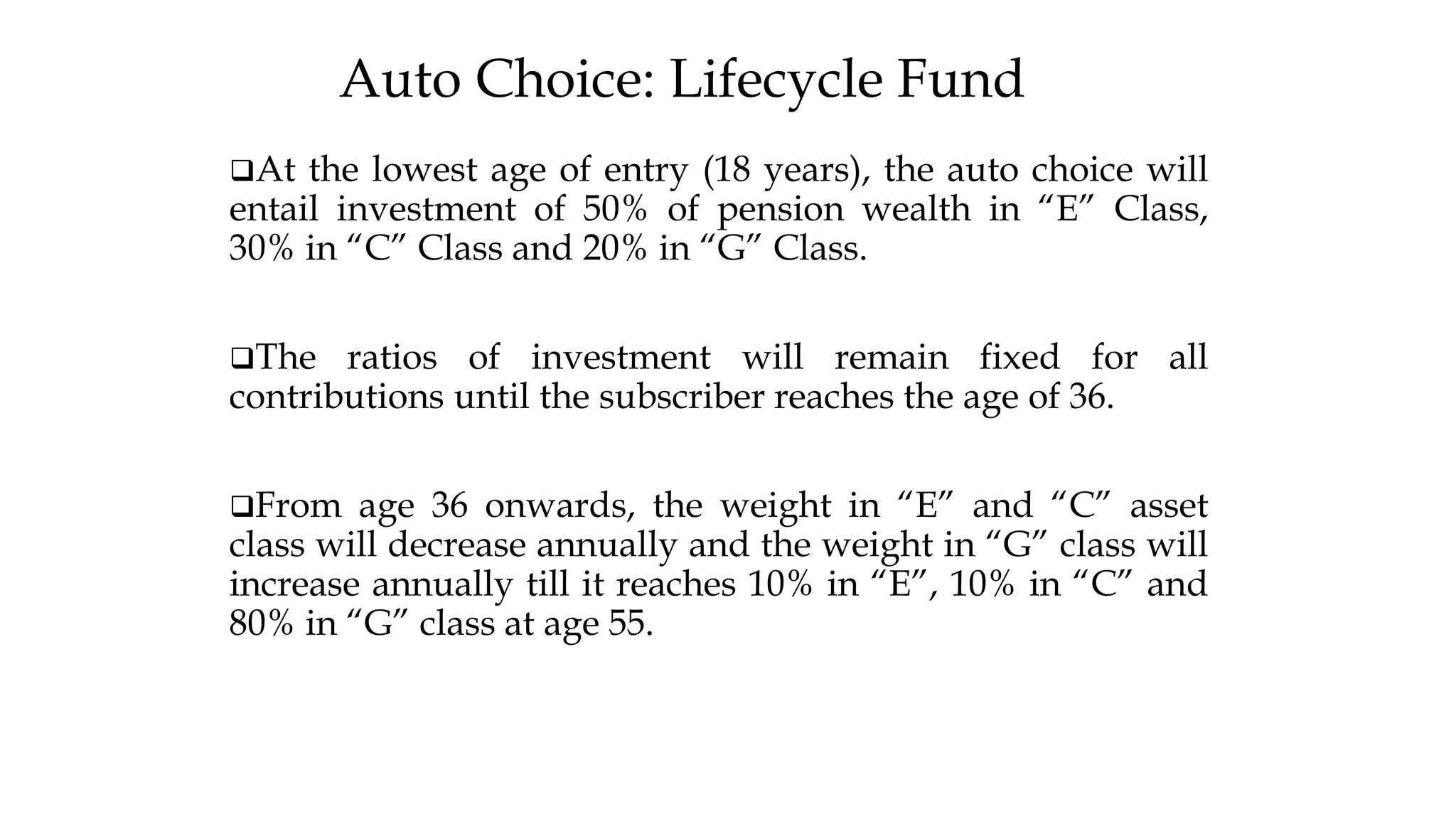

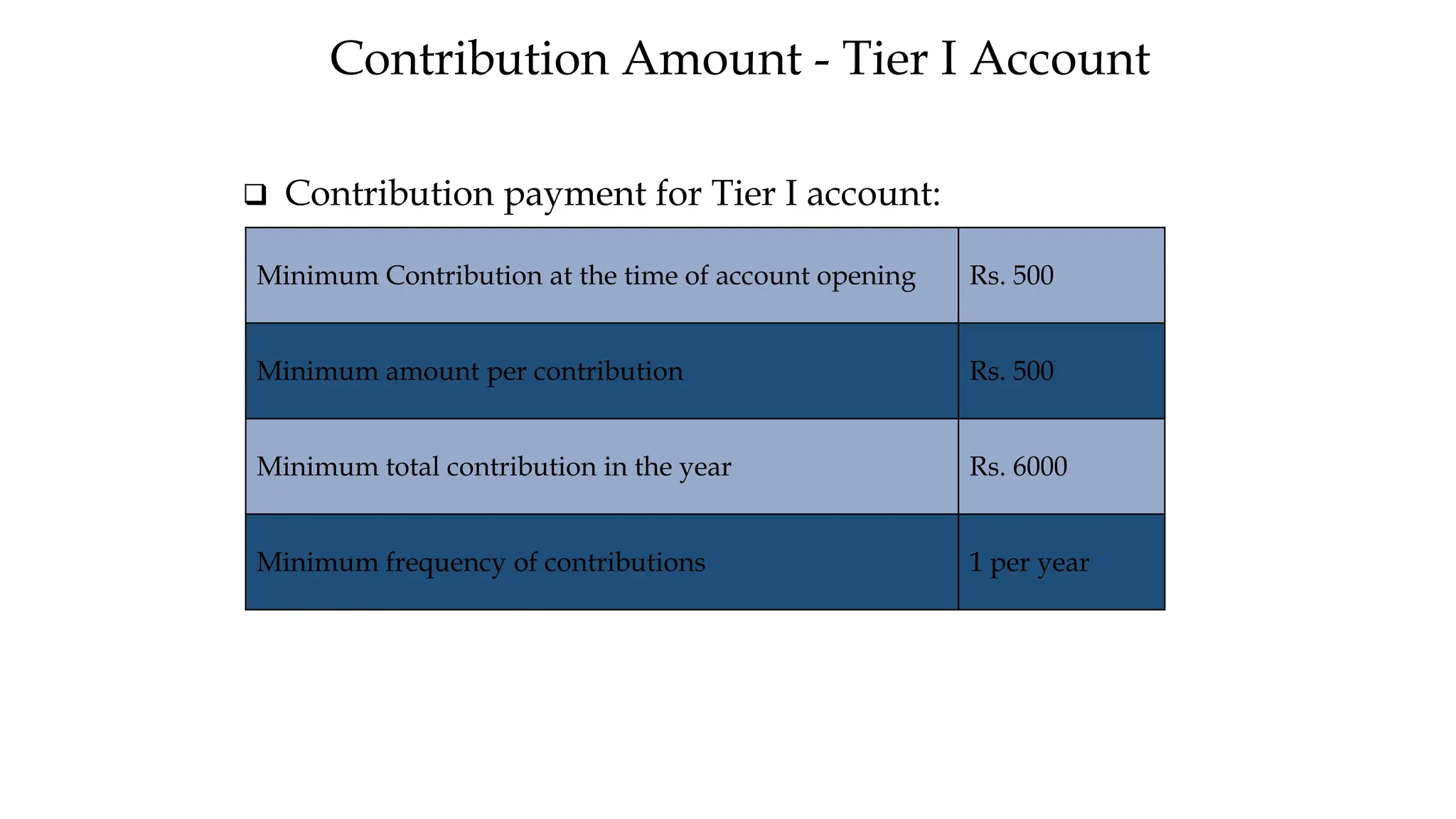

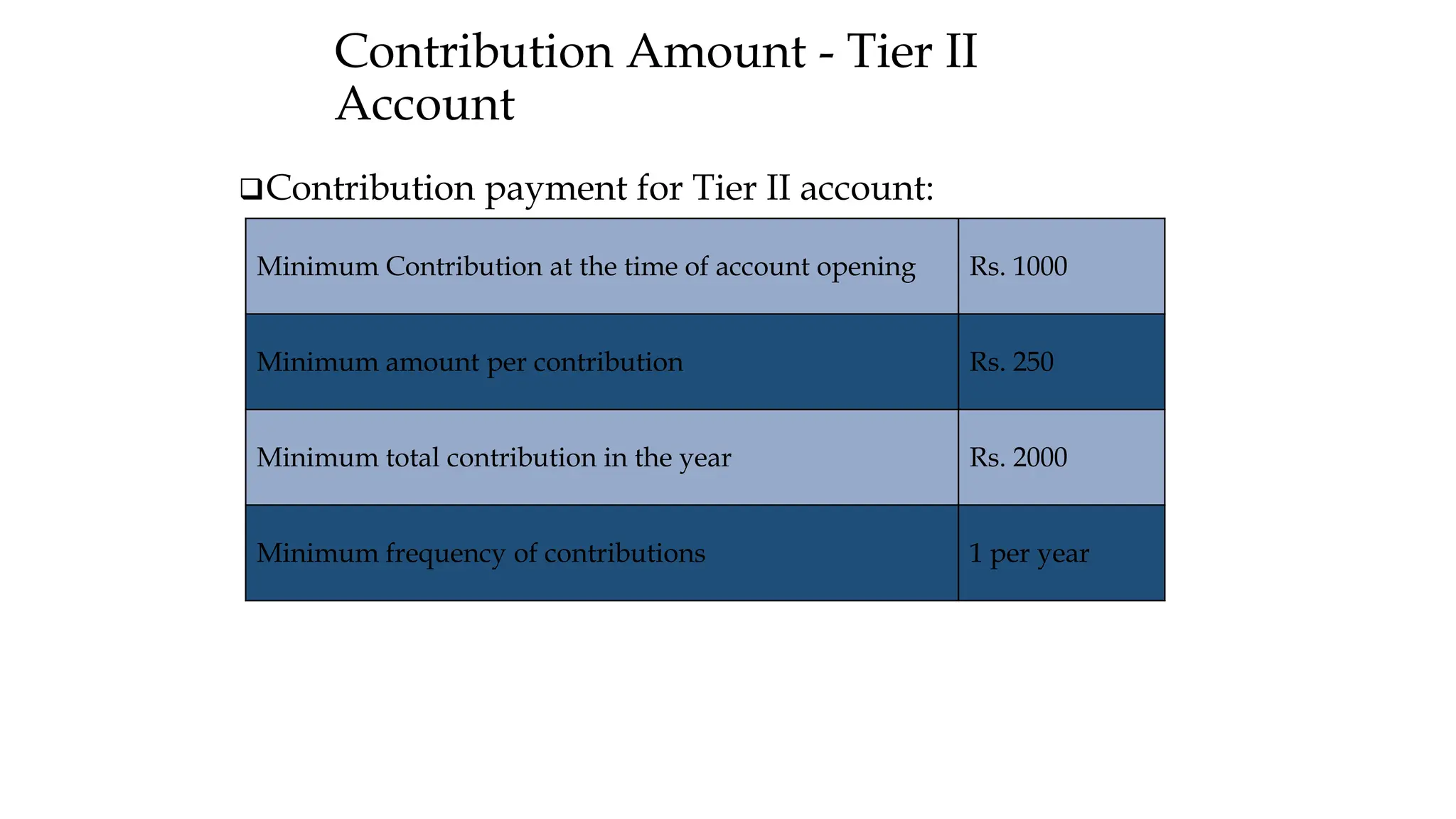

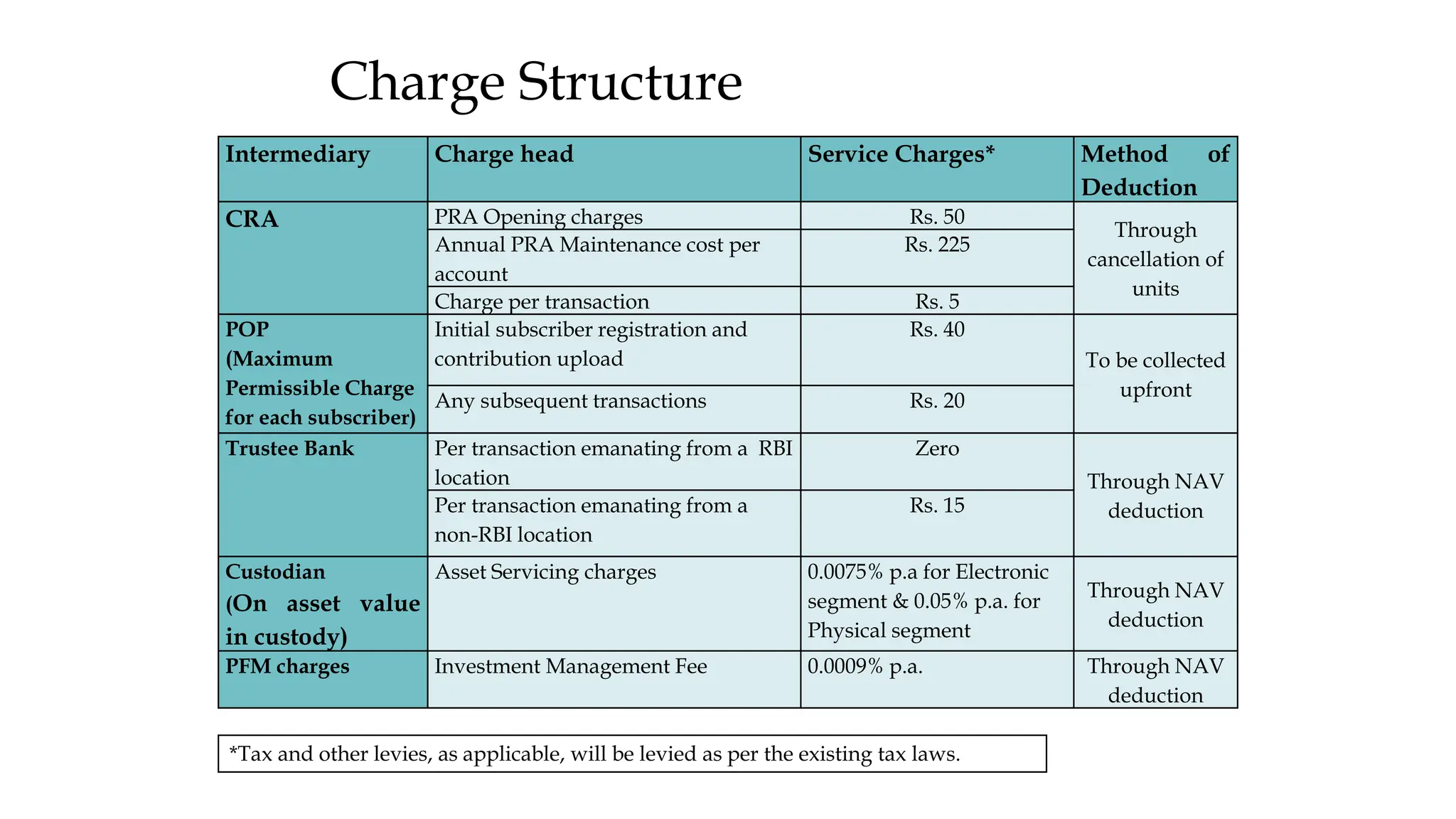

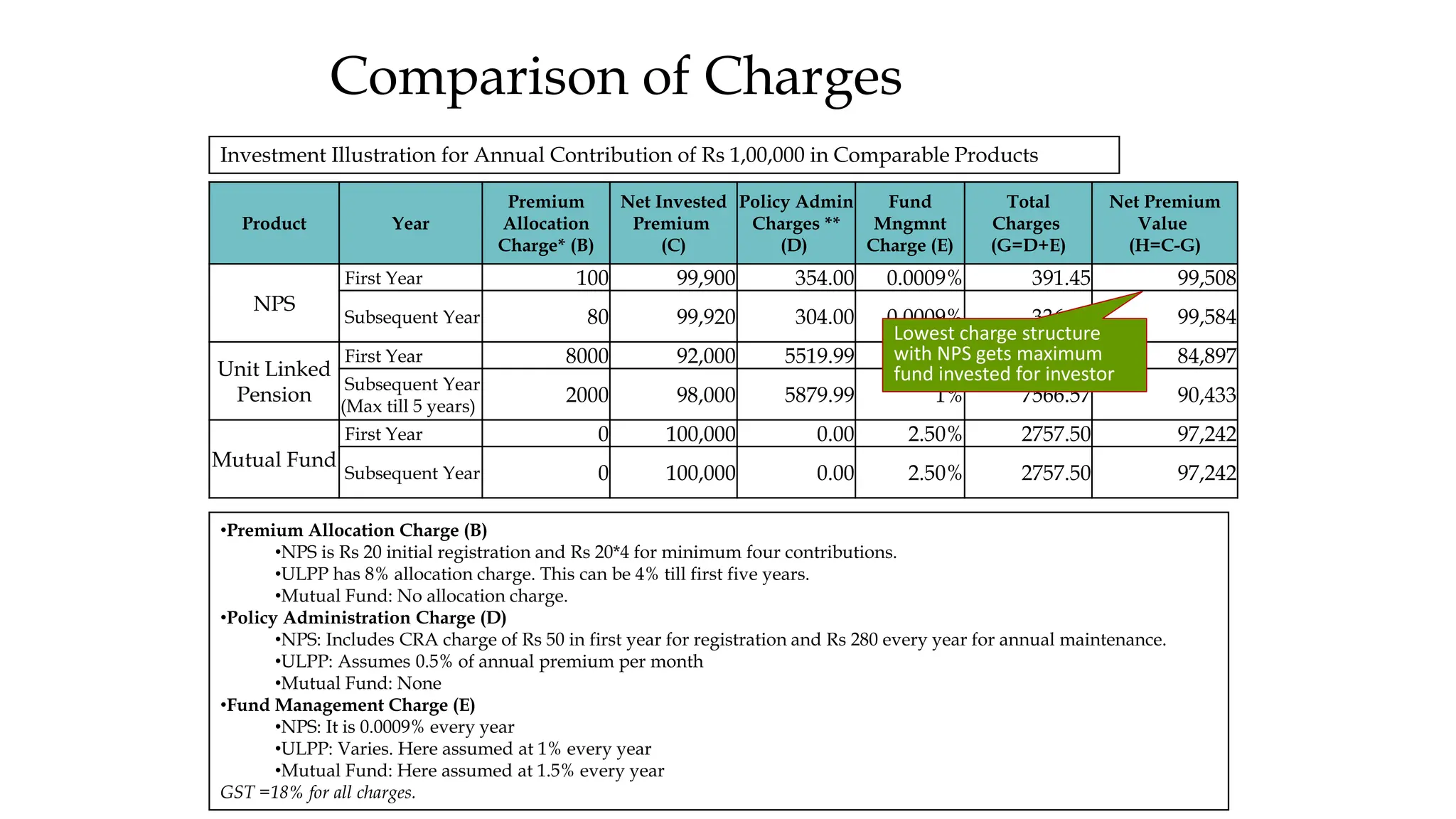

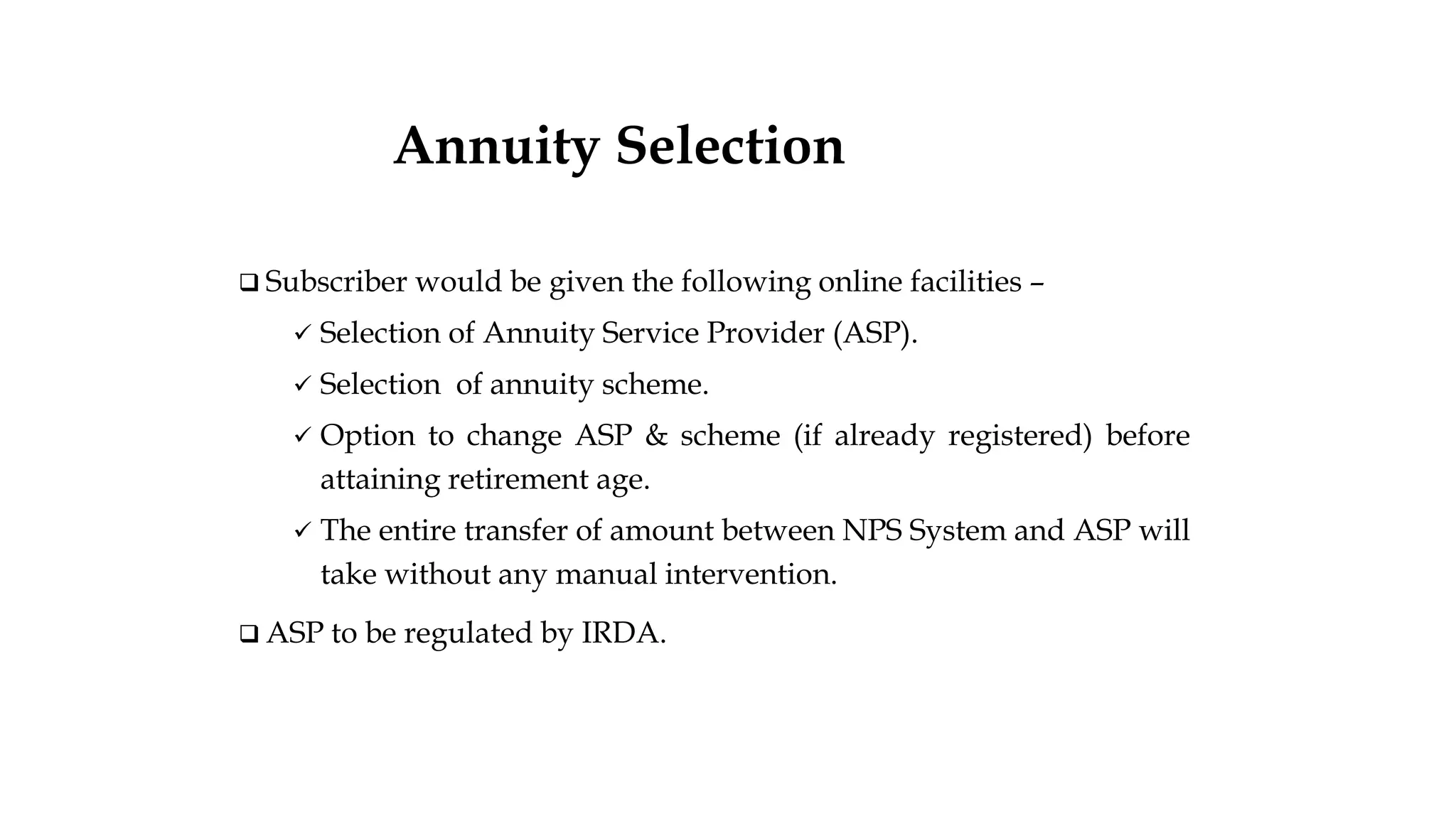

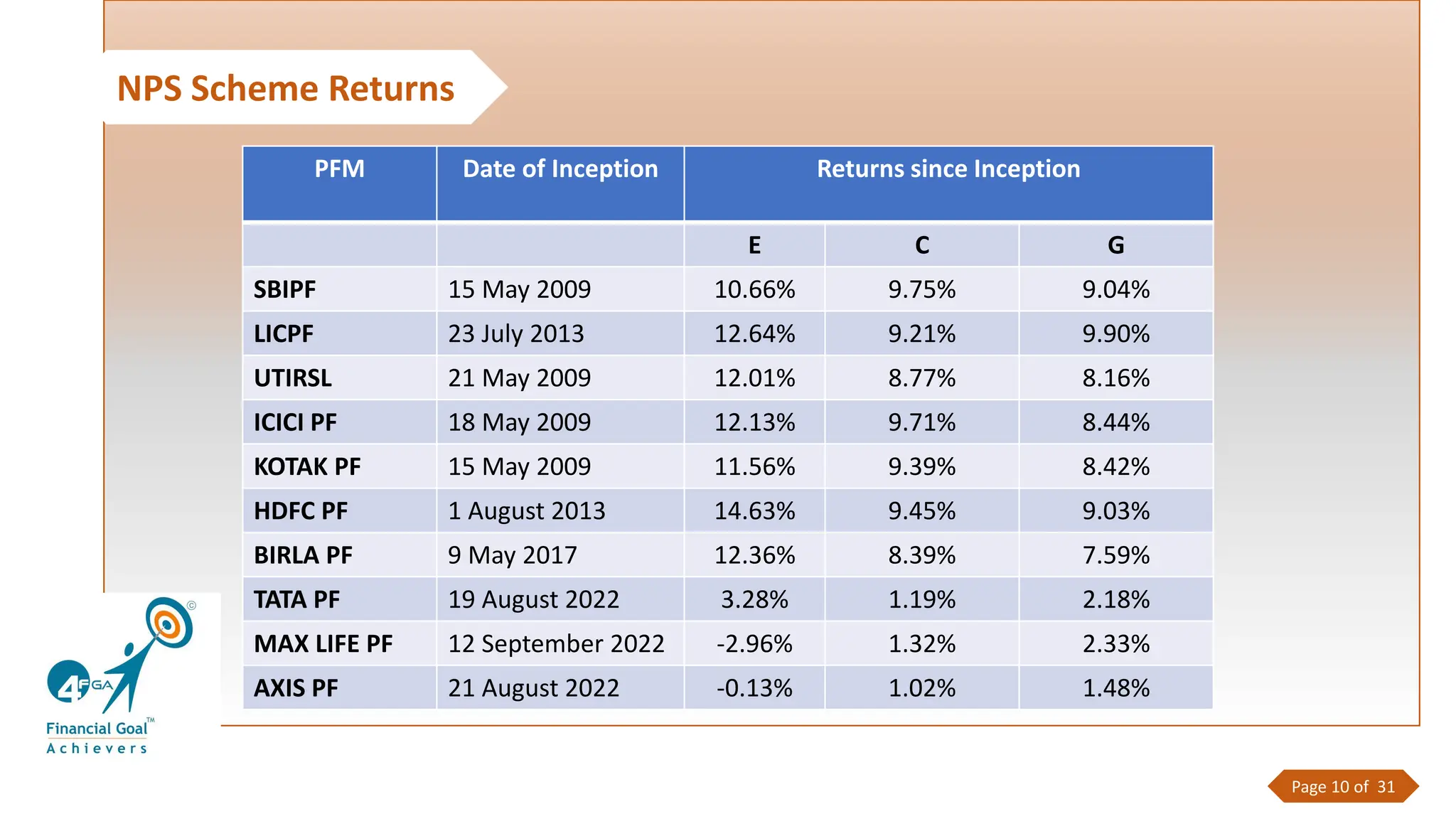

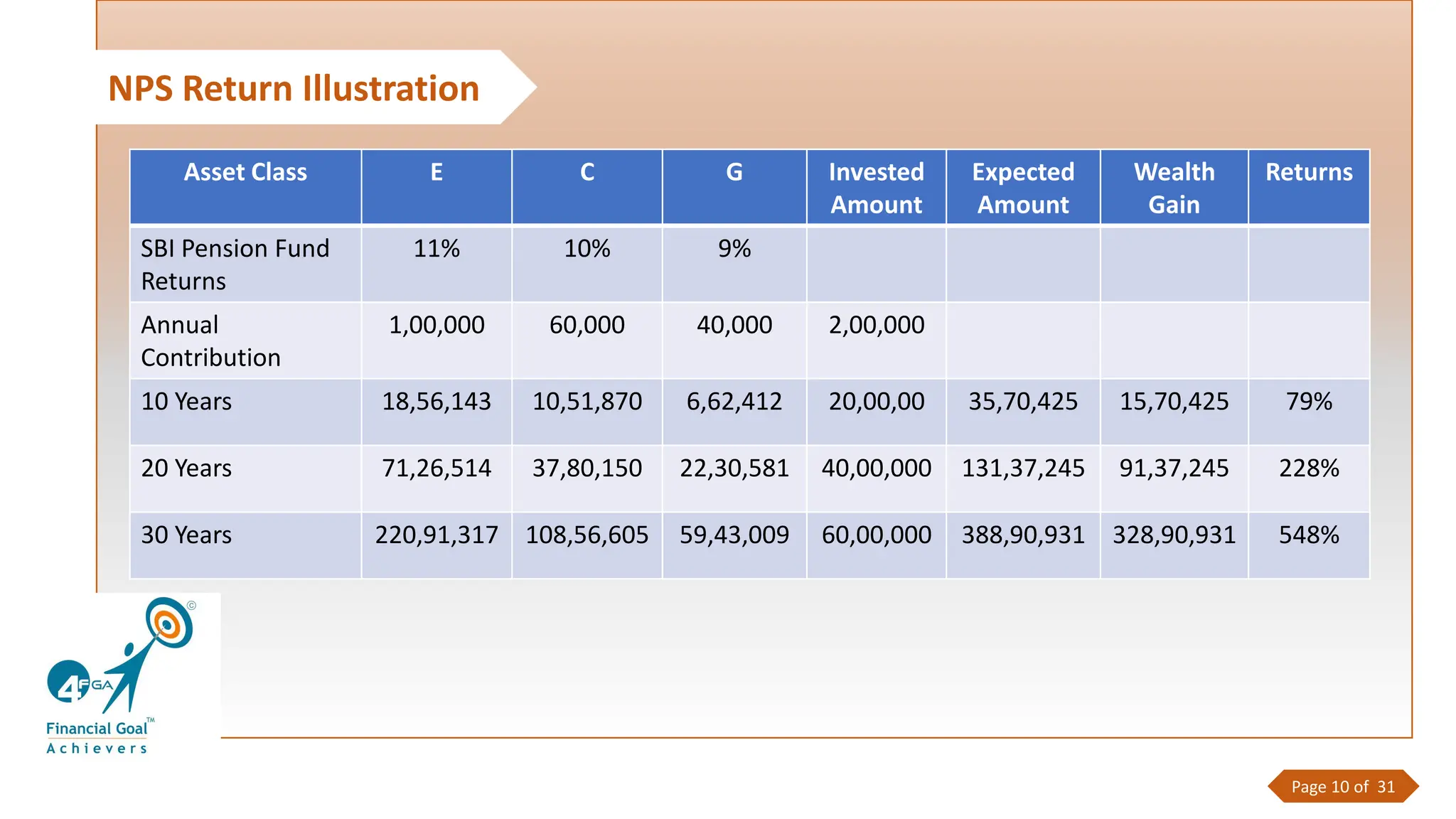

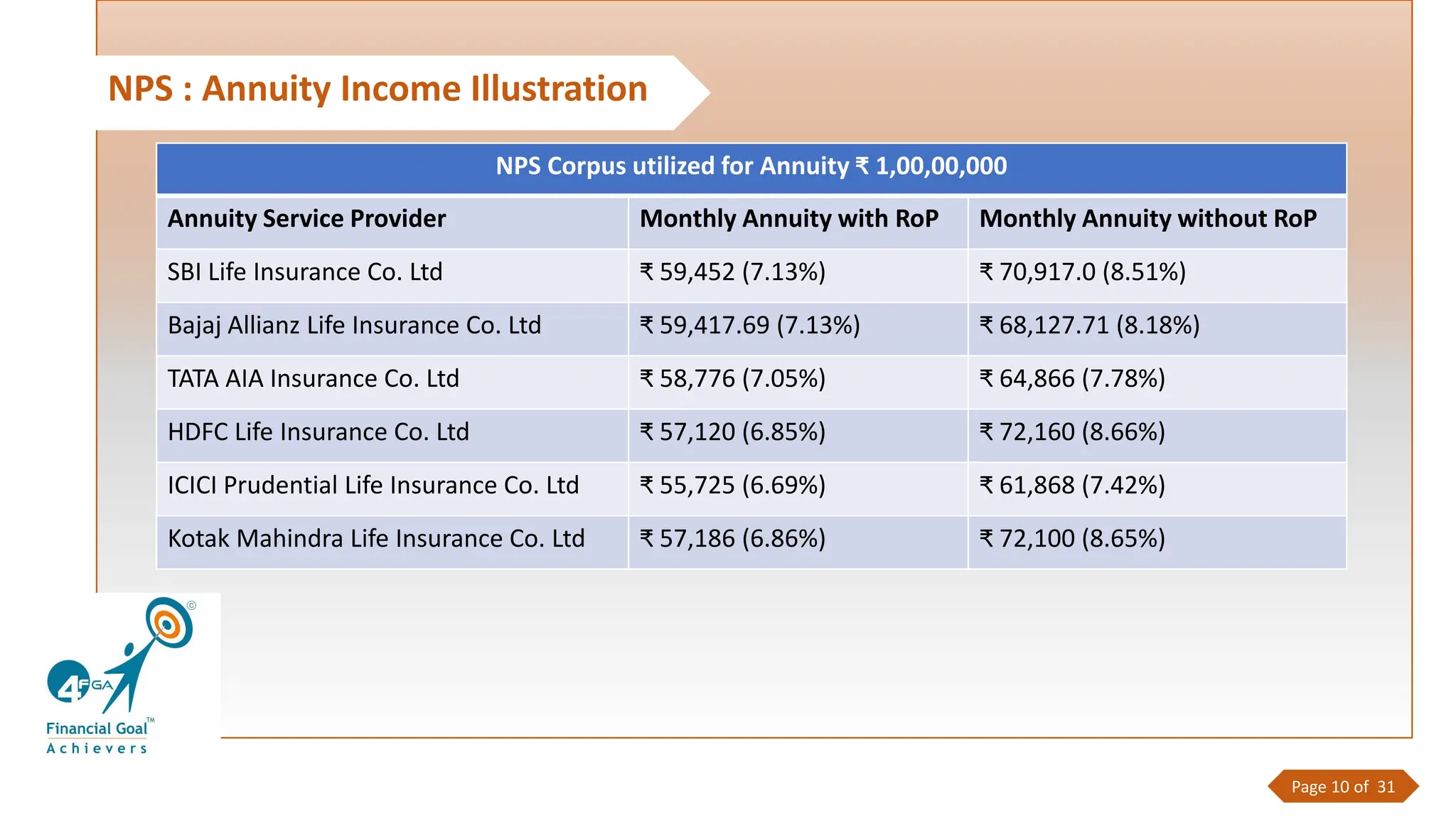

National Pension System (NPS) is a government-sponsored retirement plan that allows individuals to contribute towards building a pension during their working years. NPS provides tax benefits, low costs, and flexibility. Subscribers have two account types - Tier I which contributions cannot be withdrawn from until retirement, and Tier II which allows withdrawals. Funds can be actively managed between equities, corporate bonds, and government securities, or automatically invested in a lifecycle fund based on the subscriber's age. At retirement, subscribers must use at least 40% of the accumulated amount to purchase an annuity to receive regular income for life.