NPS is India's national pension system that allows individuals to save for retirement. Key points:

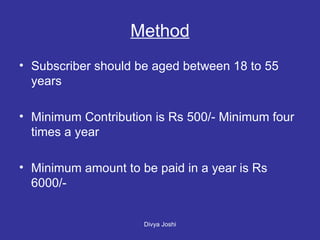

1. Individuals between 18-55 can contribute a minimum of Rs. 500 four times a year (Rs. 6,000 annually) to their PRAN (Permanent Retirement Account Number).

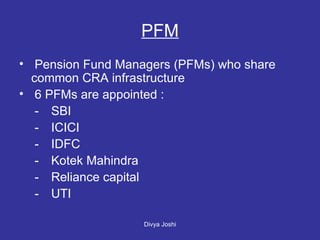

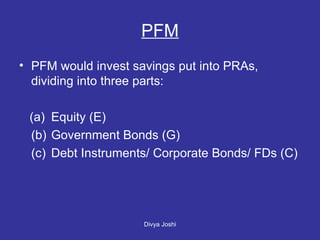

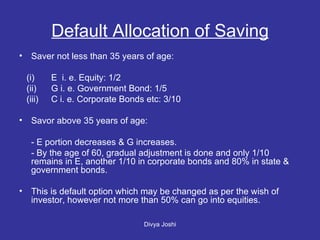

2. Contributions are invested by Pension Fund Managers in a mix of stocks, government bonds, and corporate bonds. The default allocation depends on the saver's age.

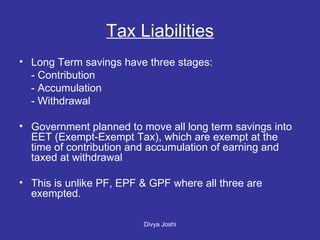

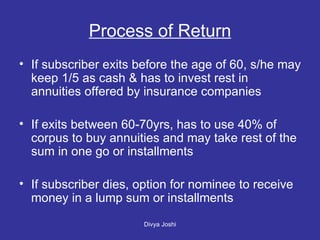

3. At retirement (age 60 or older), up to 60% can be withdrawn tax-free, with the remainder used to purchase an annuity from an insurance company.

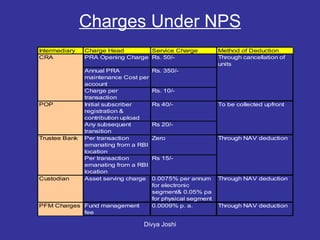

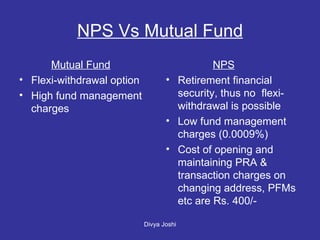

4. NPS has lower fees than mutual