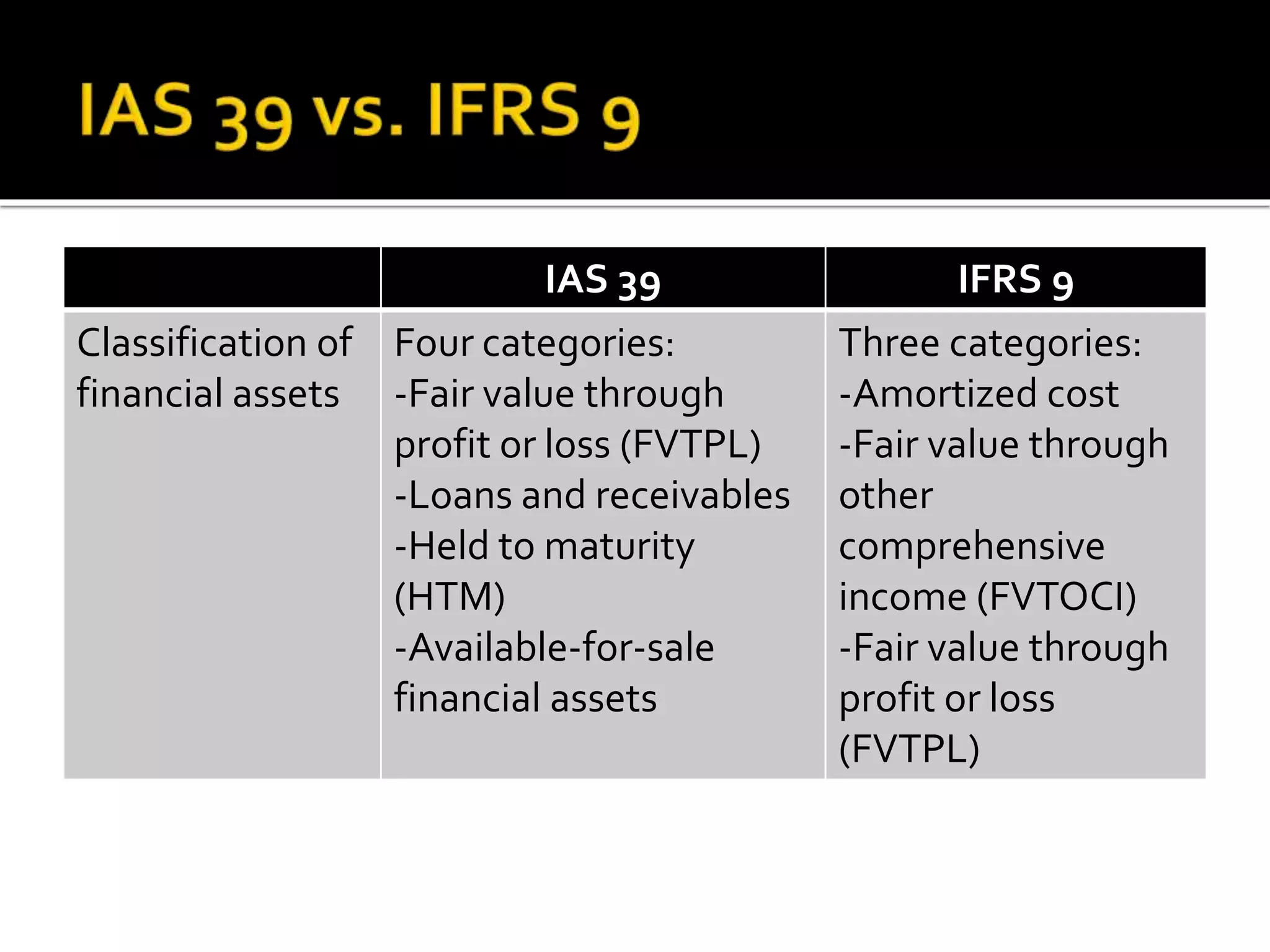

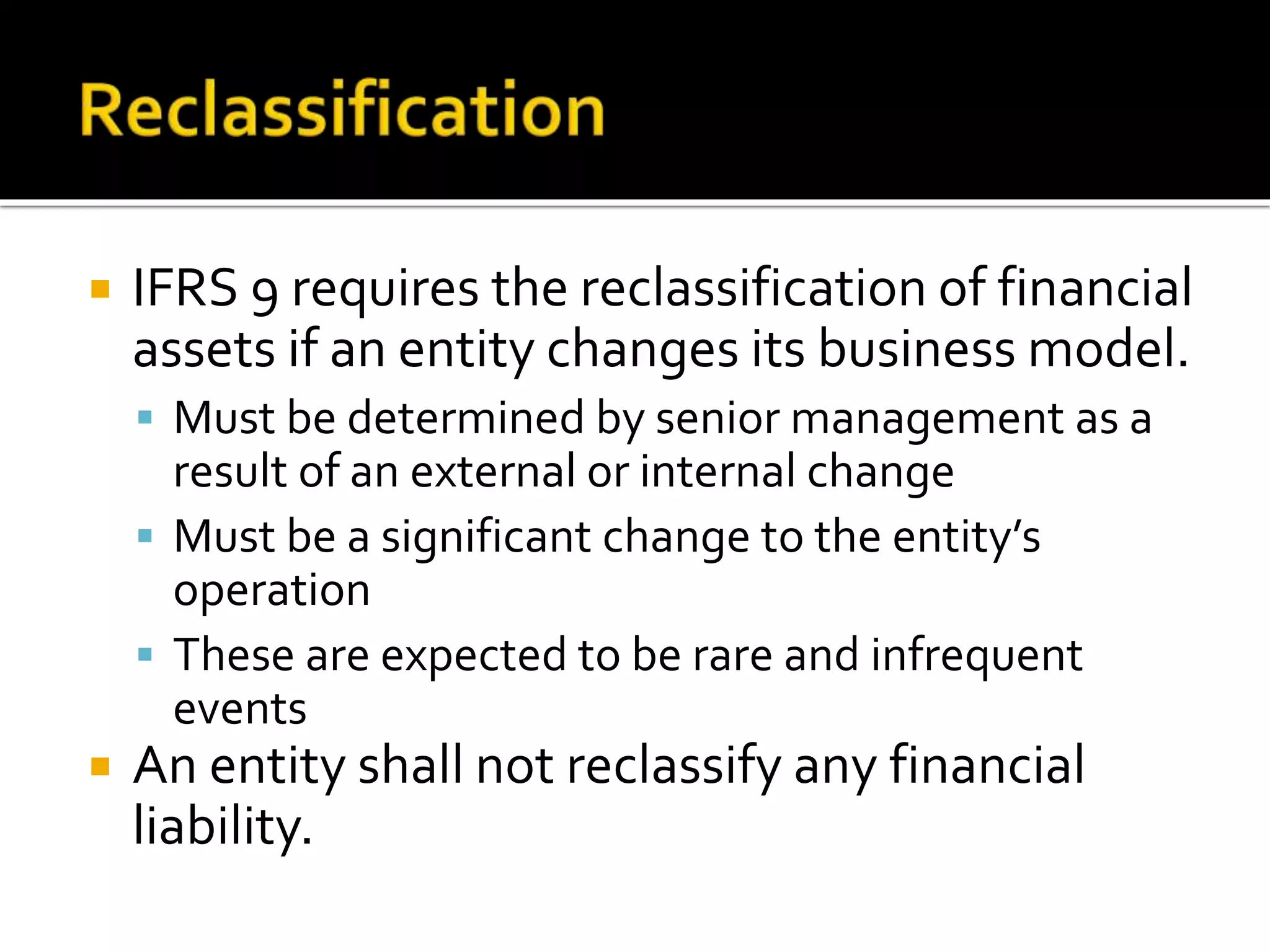

The document outlines the development and implementation of IFRS 9, which replaces IAS 39 and sets new requirements for the classification and measurement of financial assets and liabilities. Key changes include the introduction of a new expected credit loss model and adjustments to categorization for financial assets, such as fair value through profit or loss, amortized cost, and fair value through other comprehensive income. The document also details rules regarding reclassification, impairment recognition, and fair value options for financial instruments.