The document discusses IFRS 9, which provides guidance on accounting for financial instruments. Specifically, it covers:

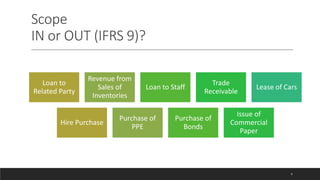

- The scope of financial instruments that fall under IFRS 9.

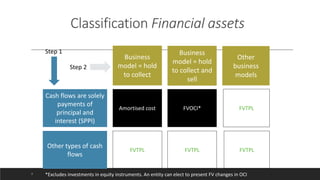

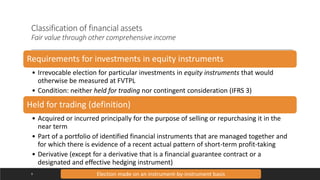

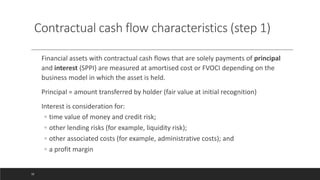

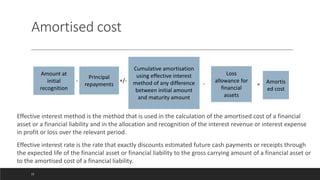

- Classification and measurement of financial assets and liabilities, including categorizing them as amortized cost, fair value through other comprehensive income, or fair value through profit or loss based on contractual cash flow characteristics and business models.

- Initial recognition and measurement of financial instruments at either fair value or transaction price depending on certain conditions.

In 3 sentences it summarizes key aspects of IFRS 9 related to classification, measurement, and initial recognition of financial instruments.

![Expected Loss Model

ECL= 𝑠𝑐=1

𝑁

𝑃𝑅𝑠𝑐 ∗ [ 𝑖=1

𝑚

𝑃𝐷𝑡 ∗ 𝐷𝑓𝑡 ∗ 𝐸𝐴𝐷 ∗ 𝐿𝐺𝐷 ]

ECL= 𝑠𝑐=1

𝑁

𝑃𝑅𝑠𝑐 ∗ [ 𝑖=1

𝑚

𝑃𝐷𝑡 (𝑅𝐷𝑠𝑐,𝑡|𝑠𝑐) ∗ 𝐷𝑓𝑡 ∗ 𝐸𝐴𝐷(𝑅𝐷𝑠𝑐,𝑡|𝑠𝑐) ∗ 𝐿𝐺𝐷(𝑅𝐷𝑠𝑐,𝑡|𝑠𝑐) ]

Legends

PDt = 𝑃𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑜𝑓 𝐷𝑒𝑓𝑎𝑢𝑙𝑡 𝑖𝑛 𝑡th 𝑝𝑒𝑟𝑖𝑜𝑑

t =𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑏𝑒𝑡𝑤𝑒𝑒𝑛 𝑟𝑒𝑝𝑜𝑟𝑡𝑖𝑛𝑔 𝑑𝑎𝑡𝑒 𝑎𝑛𝑑 𝑡ℎ𝑒 𝑑𝑒𝑓𝑎𝑢𝑙𝑡 𝑒𝑣𝑒𝑛𝑡

m = 𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑡𝑖𝑙𝑙 𝑀𝑎𝑡𝑢𝑟𝑖𝑡𝑦

PRsc = 𝑃𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑜𝑓 𝑅𝑖𝑠𝑘 𝑆𝑐𝑒𝑛𝑎𝑟𝑖𝑜

Dft = 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝐹𝑎𝑐𝑡𝑜𝑟 𝑓𝑜𝑟 𝑡th 𝑝𝑒𝑟𝑖𝑜d

EAD = 𝐸𝑥𝑝𝑜𝑠𝑢𝑟𝑒 𝐴𝑡 𝐷𝑒𝑓𝑎𝑢𝑙𝑡 𝑖𝑛 𝑡th 𝑝𝑒𝑟𝑖𝑜𝑑

32](https://image.slidesharecdn.com/ifrs9andeclmodeling-230101192920-11554931/85/IFRS-9-and-ECL-Modeling-pdf-32-320.jpg)

![Expected Loss Model

ECL= 𝑠𝑐=1

𝑁

𝑃𝑅𝑠𝑐 ∗ [ 𝑖=1

𝑚

𝑃𝐷𝑡 ∗ 𝐷𝑓𝑡 ∗ 𝐸𝐴𝐷 ∗ 𝐿𝐺𝐷 ]

ECL= 𝑠𝑐=1

𝑁

𝑃𝑅𝑠𝑐 ∗ [ 𝑖=1

𝑚

𝑃𝐷𝑡 (𝑅𝐷𝑠𝑐,𝑡|𝑠𝑐) ∗ 𝐷𝑓𝑡 ∗ 𝐸𝐴𝐷(𝑅𝐷𝑠𝑐,𝑡|𝑠𝑐) ∗ 𝐿𝐺𝐷(𝑅𝐷𝑠𝑐,𝑡|𝑠𝑐) ]

Legends

PDt = 𝑃𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑜𝑓 𝐷𝑒𝑓𝑎𝑢𝑙𝑡 𝑖𝑛 𝑡th 𝑝𝑒𝑟𝑖𝑜𝑑

t =𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑏𝑒𝑡𝑤𝑒𝑒𝑛 𝑟𝑒𝑝𝑜𝑟𝑡𝑖𝑛𝑔 𝑑𝑎𝑡𝑒 𝑎𝑛𝑑 𝑡ℎ𝑒 𝑑𝑒𝑓𝑎𝑢𝑙𝑡 𝑒𝑣𝑒𝑛𝑡

m = 𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑡𝑖𝑙𝑙 𝑀𝑎𝑡𝑢𝑟𝑖𝑡𝑦

PRsc = 𝑃𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑜𝑓 𝑅𝑖𝑠𝑘 𝑆𝑐𝑒𝑛𝑎𝑟𝑖𝑜

Dft = 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝐹𝑎𝑐𝑡𝑜𝑟 𝑓𝑜𝑟 𝑡th 𝑝𝑒𝑟𝑖𝑜d

EAD = 𝐸𝑥𝑝𝑜𝑠𝑢𝑟𝑒 𝐴𝑡 𝐷𝑒𝑓𝑎𝑢𝑙𝑡 𝑖𝑛 𝑡th 𝑝𝑒𝑟𝑖𝑜𝑑

LGD = 𝐿𝑜𝑠𝑠 𝐺𝑖𝑣𝑒𝑛 𝐷𝑒𝑓𝑎𝑢𝑙𝑡 𝑖𝑛 𝑡th 𝑝𝑒𝑟𝑖𝑜𝑑

RD = 𝐷𝑒𝑝𝑒𝑛𝑑𝑒𝑛𝑐𝑒 𝑜𝑛 𝑅𝑖𝑠𝑘 𝐷𝑟𝑖𝑣𝑒𝑟𝑠

N = 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑅𝑖𝑠𝑘 𝑆𝑐𝑒𝑛𝑎𝑟𝑖𝑜𝑠

40](https://image.slidesharecdn.com/ifrs9andeclmodeling-230101192920-11554931/85/IFRS-9-and-ECL-Modeling-pdf-40-320.jpg)

![Expected Loss Model- Incorporating Scenarios into

Expected Credit Loss

“An entity shall measure ECL of a financial instrument in a way that reflects an unbiased and probability weighted amount that is

determined by evaluating arrange of possible outcomes.” (5.5.17)

“When measuring ECL, an entity need not necessarily identify every possible scenario. However, it shall consider the risk of

probability that a credit loss occurs by reflecting the possibility that a credit loss occurs and the possibility that no credit loss

occurs, even if the possibility of a credit loss occurring is very low.” (5.5.18)

ECL= ∑ [( 𝑃𝐷𝑠1 *𝑆𝑊1 * 𝐿𝐺𝐷𝑠1) ……………….. ( 𝑃𝐷𝑠𝑘 *𝑆𝑊𝑘 * 𝐿𝐺𝐷𝑠𝑘)] * EAD

Legends

𝑃𝐷𝑠1= Probability of Default using Scenario 1

𝑆𝑊1 = Weight of Scenario 1

𝐿𝐺𝐷𝑠1= Loss Given Default using Scenario 1

𝑃𝐷𝑠𝑘 = Probability of Default using Scenario k

𝑆𝑊𝑘 = Weight of Scenario k

𝐿𝐺𝐷𝑠𝑘= Loss Given Default using Scenario k](https://image.slidesharecdn.com/ifrs9andeclmodeling-230101192920-11554931/85/IFRS-9-and-ECL-Modeling-pdf-41-320.jpg)