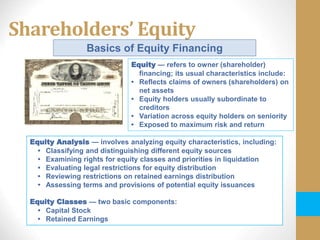

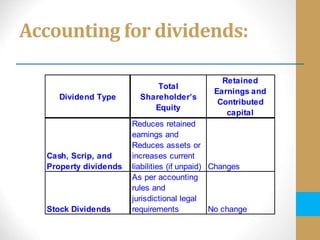

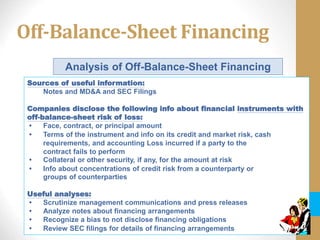

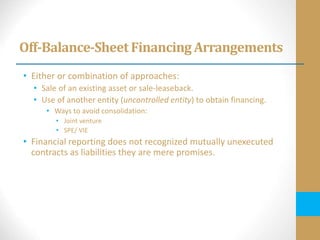

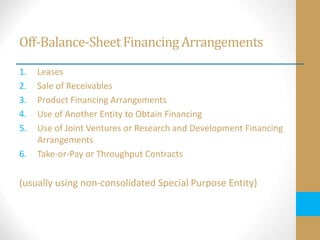

This document provides an overview of financing activities, including equity financing, debt financing, and off-balance sheet financing arrangements. It discusses the key components of shareholders' equity, types of dividends, debt financing instruments, accounting for long-term debt and troubled debt. It also covers hybrid securities, leases, contingencies, commitments, and various off-balance sheet financing techniques such as sales of receivables and use of special purpose entities.