Embed presentation

Download as PDF, PPTX

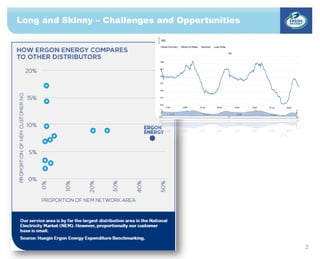

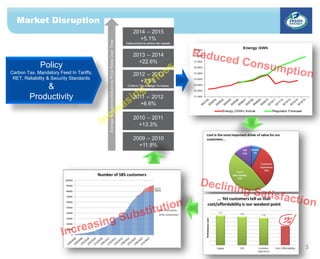

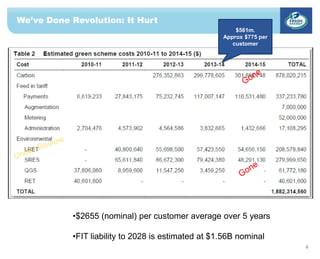

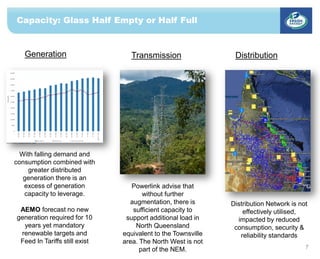

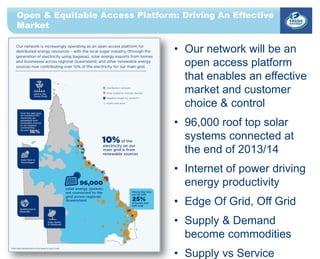

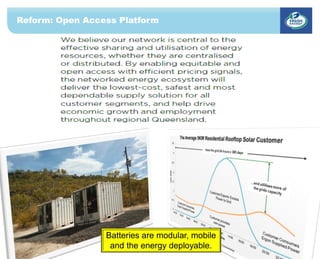

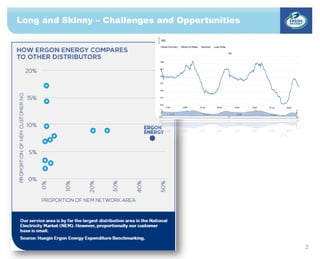

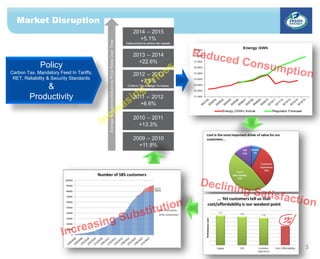

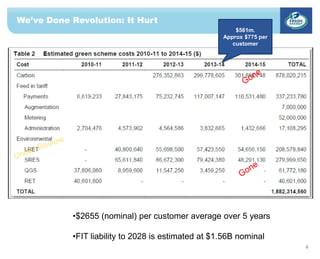

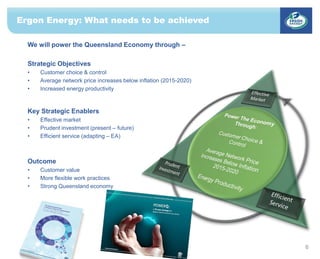

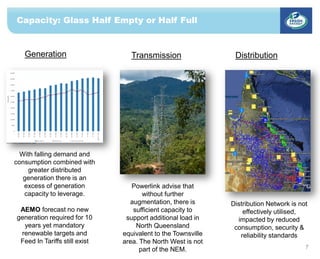

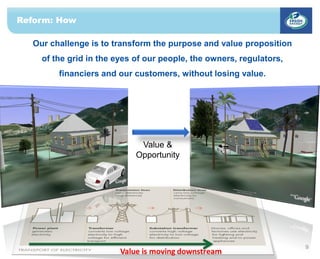

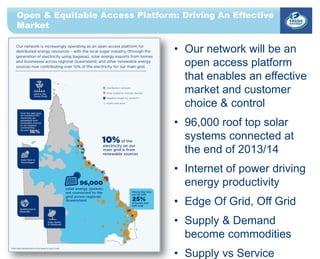

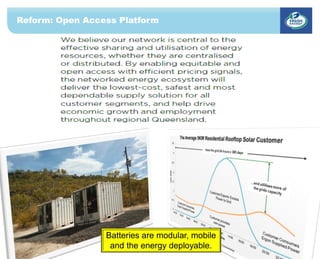

This document discusses challenges and opportunities in electricity distribution models in NSW. It summarizes that the carbon tax, mandatory feed-in tariffs, and other policies have cost customers over $2655 per customer over 5 years. It outlines Ergon Energy's strategic objectives to provide customer choice and control while keeping price increases below inflation. The document also notes excess generation capacity could be leveraged given falling demand, and that distribution networks are not being effectively utilized due to these changes. It proposes possible hybrid future models and reforming distribution to an open access platform that enables customer choice and drives energy productivity.