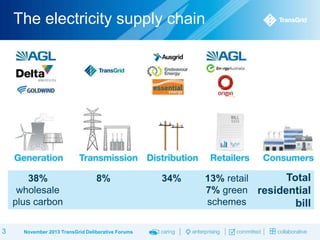

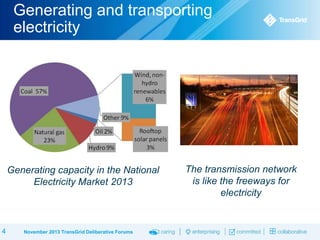

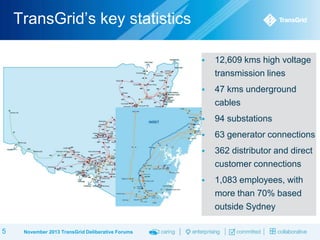

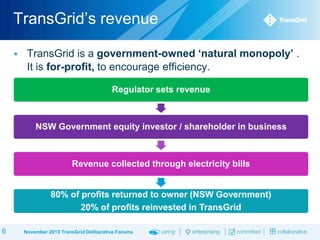

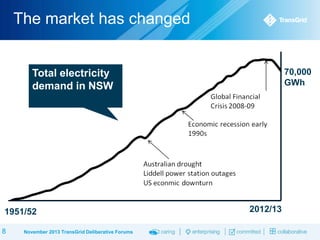

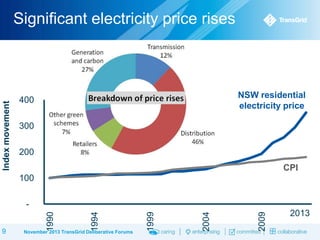

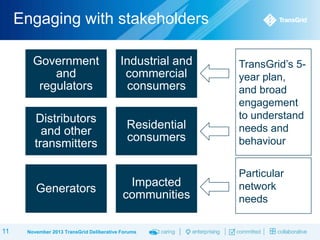

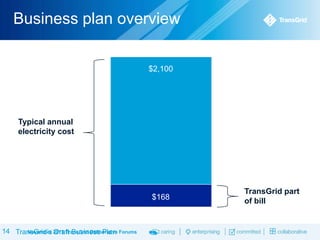

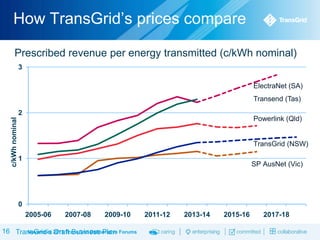

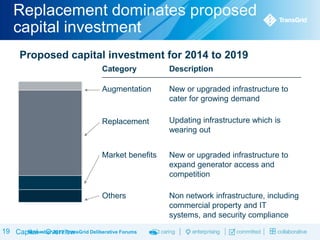

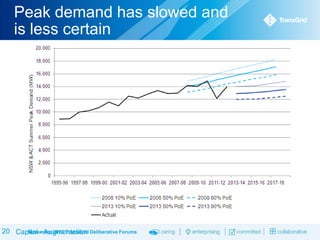

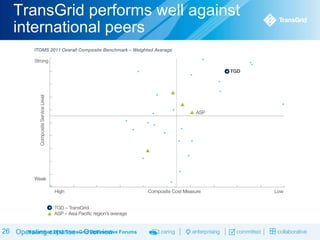

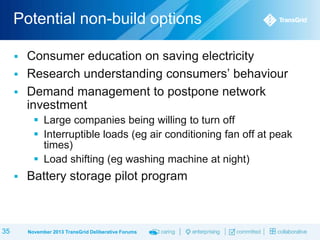

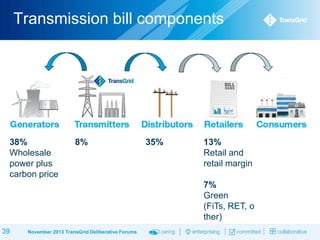

Transgrid held deliberative forums in November 2013 to gather consumer feedback on its five-year business plan and revenue proposal, addressing the changing energy market and its impact on electricity prices. The presentations highlighted Transgrid's role as a government-owned entity managing electricity transmission in NSW, with significant infrastructure details and revenue distribution outlined. Key focus areas included adaptive planning, stakeholder engagement, and strategies for managing future demand and maintaining system reliability.