MPGC17 to discuss oil market recovery

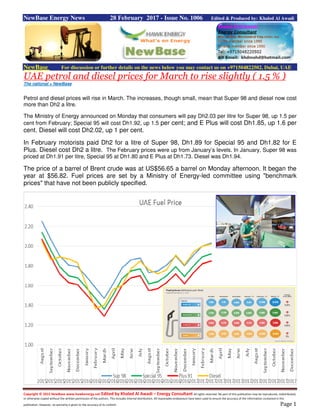

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 28 February 2017 - Issue No. 1006 Edited & Produced by: Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE petrol and diesel prices for March to rise slightly ( 1.5 % ) The national + NewBase Petrol and diesel prices will rise in March. The increases, though small, mean that Super 98 and diesel now cost more than Dh2 a litre. The Ministry of Energy announced on Monday that consumers will pay Dh2.03 per litre for Super 98, up 1.5 per cent from February; Special 95 will cost Dh1.92, up 1.5 per cent; and E Plus will cost Dh1.85, up 1.6 per cent. Diesel will cost Dh2.02, up 1 per cent. In February motorists paid Dh2 for a litre of Super 98, Dh1.89 for Special 95 and Dh1.82 for E Plus. Diesel cost Dh2 a litre. The February prices were up from January’s levels. In January, Super 98 was priced at Dh1.91 per litre, Special 95 at Dh1.80 and E Plus at Dh1.73. Diesel was Dh1.94. The price of a barrel of Brent crude was at US$56.65 a barrel on Monday afternoon. It began the year at $56.82. Fuel prices are set by a Ministry of Energy-led committee using "benchmark prices" that have not been publicly specified.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Malaysia: Saudi Aramco to invest $B7 in Petronas' RAPID oil refinery Source: Reuters Malaysia's Prime Minister Najib Razak announced on Monday that Saudi Arabia's state oil company Saudi Aramco will invest $7 billion (5.6 billion pounds) into an oil refinery and petrochemical project in Malaysia's southern state of Johor. Najib said the decision was made before noon on Monday after discussions between top executives from Saudi Aramco and Malaysia's state-owned energy company Petronas, the sponsor of the $27 billion Refinery and Petrochemical Integrated Development (RAPID) project. Najib's statement marks a dramatic reversal in RAPID's fortunes after industry sources familiar with the matter said in January that Aramco planned to drop its participation in a partnership with Petronas in the project. At the time, Petronas said it would move ahead in spite of Aramco dropping out. Najib did not give any details on the change of heart. The RAPID project, located at Pengerang in Johor, is expected to begin operations in the first quarter of 2019. RAPID will contain a 300,000 barrel-per-day oil refinery and a petrochemical complex with a production capacity of 7.7 million metric tonnes. The complex will sit alongside an existing oil storage site at Pengerang.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 UAE: MPGC 2017 to discuss prospects for oil market recovery (WAM) --The 25th Annual Middle East Petroleum & Gas Conference (MPGC 2017) will convene under the theme "The Turbulent Path to an Oil Market Recovery: The Challenge of Reaching a Balanced and Sustainable Price," providing the framework of opportunities for the oil and gas markets despite the turbulence as well as the new and ongoing strategies for the global oil and gas markets. Global energy leaders including ministers, CEOs, oil company senior management will join as speakers at the MPGC 2017 to be held in Dubai, UAE, from April 30 - May 2. More than 400 delegates are expected at MPGC 2017 and 650 for MPGC Week events being held from April 29 to May 4. Sheikh Ahmed bin Rashid Al Maktoum, Chairman of the Supreme Council for Energy, and Saif Humaid Al Falasi, Group CEO of Emirates National Oil Company (Enoc), are both expected to attend the MPGC inauguration on May 1, 2017. Keynote addresses will be delivered Bakhit Al-Rashidi, CEO and President of Kuwait Petroleum International Ltd.; Eelco Hoesktra, CEO of Royal Vopak; and Sanjiv Singh, Refineries Director of Indian Oil Corporation Limited (CMD designate). Harold Hamm, Chairman and CEO of Continental Resources, will give a special address on US ‘Tight Oil Production: Where We are Heading’. Heads of trading and supply at the corporate level will take the helm with keynote trading addresses by Colin Parfitt, President, Supply and Trading of Chevron Corporation; Christopher Bake, Executive Committee and Head of Origination of Vitol; and Keith Martin, CEO of Uniper Global Commodities. Other distinguished speakers include Eng Ahmed Mohammed Alkaabi, Assistant Undersecretary for Petroleum gas and Mineral resources, Ministry of Energy and UAE Opec Governor; Dr Sun Xiansheng, Secretary-General of International Energy Forum; and Mohamed Firouz Asnan, Vice President, Marketing and Refining of Petronas. In its ninth year as a host of MPGC, Enoc’s high-profile attendance includes speakers and chairs from the group’s executive leadership team including Hesham Ali Mustafa, Executive Director, Group Strategy and New Business Development, who will represent Enoc on the MPGC 2017 International Advisory Committee, as well as Farid Badri, Director of Refinery, and Aakash Nijhawan, Head of Investments and Corporate Solutions, as speakers.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Commenting on Enoc’s participation, Saif Humaid Al Falasi, group CEO of Enoc and co-chairman of MPGC 2017, said: "Oil remains the key contributor to the direction of GCC markets for the second consecutive year, after the oil output cut agreement was sealed. With oil prices surging to an 18-month high by year-end 2016, the priority for GCC economies will be to sustain a balanced budget for their respective nations by 2020. Given the impact of volatile price environment and strict sustainability targets on the energy industry, national oil companies are looking at alternative models of doing business and events like MPGC offer an apt platform to discuss how we can integrate the outcomes of the new oil future into our long-term goal to diversify the energy mix. Our support of the event reinforces our commitment to further developing the Middle East oil and gas sector and eventually redefining the industry for the betterment of the communities we serve." Dr Fereidun Fesharaki, Chairman of FGE, leading oil and gas industry advisors for the Middle East and Asia and Co-chairman of MPGC 2017, said: "The oil market has entered into a new phase. Market share policy is supplemented by market management policy. The historic Opec decision to cut production by 1.2 mmb/d in late November supported by the non-Opec commitment of some 600 kb/d have impacted oil prices dramatically. Meanwhile oil demand continues to be strong with some 1.5 mmb/d of growth expected in 2017. "The refining business seems poised for a smooth ride over the next few years, but there is likely to be another round of refinery construction in Asia and the Middle East. The IMO bunkering regulation putting a sulfur cap of 5,000 ppm (0.5%) is creating a turmoil in the market and many options to respond to this dramatic change are on the table. The natural gas market faces a different set of challenges with re-balancing for LNG taking much longer than oil markets. The upstream projects in Iran are in full swing, but all may be impacted by President Trump’s policy, while Iraq continues to expand output in the face of political and economic challenges. MPGC 2017 will address and critique all these issues and more," Dr Fesharaki said.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 U.S. crude oil imports from Saudi Arabia and Iraq recently increased, but may decline soon..U.S. EIAWeekly Preliminary Crude Imports U.S. crude oil imports from Saudi Arabia and Iraq, two of the United States’ main sources for imported crude oil, have risen since reaching relatively low points in 2014 and 2015. On a combined basis, crude oil imports from these countries are the highest since late 2012. However, recent market developments, including the November 2016 agreement among certain members of the Organization of the Petroleum Exporting Countries (OPEC) to reduce production and the recent widening of price differences between Dubai/Oman crude oil and U.S.-produced Mars crude oil, suggest that U.S. imports from Saudi Arabia and Iraq are now becoming less attractive to U.S. refiners. In late 2016, high production in Saudi Arabia and Iraq, as well as seasonally low internal demand in Saudi Arabia, contributed to record crude oil exports from Iraq and near-record exports from Saudi Arabia, according to data from the Joint Organizations Data Initiative (JODI). Saudi crude oil exports reached 8.3 million barrels per day (b/d) in November 2016, the highest level since May 2003, before declining to 8.0 million b/d in December. Saudi exports generally increase from August to November as seasonal declines in domestic consumption increase availability of crude oil for export. In Iraq, exports reached a record high of nearly 4.1 million b/d in November 2016 and remained at that level in December. According to JODI data, Saudi and Iraqi production levels were relatively high prior to the pledged January 2017 production cuts , with December 2016 volumes up 321,000 b/d and 700,000 b/d, respectively, from their year-ago levels, creating an opportunity to increase exports.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 Source: U.S. Energy Information Administration, based on Joint Organizations Data Initiative Although crude oil exports from Saudi Arabia and Iraq increased in November and December, transit times result in delays before these shipments arrive in the United States. Shipments take about seven weeks to reach the U.S. Gulf Coast from the Persian Gulf after traveling around the southern tip of Africa. Using a smaller vessel capable of transiting the Suez Canal in Egypt, a voyage from the Persian Gulf to the U.S. East Coast takes an estimated five weeks. Traveling from the Persian Gulf to the U.S. West Coast on a Trans-Pacific route requires about six weeks. Given transit times, cargos exported from Saudi Arabia and Iraq in November and December 2016 would be expected arrive in the United States between December 2016 and February 2017. Imports from Saudi Arabia into the United States increased for five consecutive weeks, rising from 1.0 million b/d for the week ending January 6 to 1.3 million b/d for the week ending February 10.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Similarly, U.S. imports from Iraq grew for five consecutive weeks, increasing from 373,000 b/d for the week ending December 9, 2016, to 723,000 b/d for the week ending January 13, 2017. The trend of increasing U.S. imports from Saudi Arabia and Iraq seems unlikely to continue given recent market developments. The price difference between Dubai/Oman medium, sour grade oil, which serves as a benchmark price for similar grades produced throughout the Middle East, and Mars, a U.S. crude oil with similar properties, was relatively low during 2016. For this reason, medium and heavy crude oils from Saudi Arabia and Iraq were relatively attractive to U.S. refiners because they produced a profitable slate of finished products when processed in complex refineries. After OPEC announced crude oil production cuts in late November 2016, the relative price of Dubai/Oman crude oil rose because the supply reductions pledged by Middle East producers disproportionately affected medium, sour crudes. In January 2017, the price premium of Dubai/Oman over Mars reached its highest level in more than a year, likely encouraging U.S. refiners to process more domestic medium, sour barrels while reducing imports of comparable grades from the Middle East.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 India: Wind power costs plunge in Asia’s contract auction India is among a growing list of countries stretching from Asia to Europe that have used auctions to make clean energy more affordable. The result should help Prime Minister Narendra Modi’s government meet pledges to install 175 gigawatts of renewable capacity by 2022 and spur discussion about whether green energy can replace coal as India’s dominant source of energy. The cost of power generated from wind turbines plunged in Asia’s first auction for contracts to deploy the technology, a victory for India’s effort to reduce pollution and ensure supplies. Solar Energy Corp of India Ltd, which conducted the auction for the government, said late Friday that it received bids to supply wind power for Rs3.46 (5 US cents) a kilowatt-hour. Previously, feed-in tariffs for wind energy ranged from Rs4 to Rs5 a kilowatt-hour across India’s windy states. The contest was the first of its kind for wind anywhere in Asia, repeating similar auctions for solar capacity that brought the cost of that technology to record lows. It underscores the success of auction mechanisms in forcing companies to reduce the price of renewable energy, increasing the competitiveness of wind and solar against fossil fuels. “Successful completion of this auction will encourage states also to gradually move from feed-in tariffs to bids,” said Srishti Ahuja, a director at Ernst & Young. “However, the realised tariffs in state bids may be much higher than the current federal auction, as each such auction will depend on state-specific factors like wind resource, ratings of their power retailers and evacuation infrastructure.”

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 The auction was for contracts to develop 1 gigawatt of wind capacity in India. It drew 14 developers who cumulatively submitted bids for about 2.7 gigawatts, the agency said in a statement. Five successful bidders quoting the same tariff were London-listed Mytrah Energy Ltd’s India arm M/s Mytrah Energy (India) Pvt, M/s Green Infra Wind Energy Ltd, Turbine maker Inox Wind Ltd’s arm Inox Wind Infrastructure Services Ltd, Private Equity Actis LLP’s backed Ostro Kutch Wind Pvt Ltd and International trading company Adani Enterprises Ltd’s Adani Green Energy (MP) Ltd. They will now be required to commission their projects within 18 months, SECI said. “The auctions have been hard fought and have led to tighter pricing than one would have foreseen even a few months earlier,” Vikram Kailas, managing director at Mytrah Energy, said by e-mail, adding that this will pave the way for the growth of the Indian renewable energy industry. The state-owned transmission utility Power Grid Corp of India Ltd helped ensure the success of the auction by “guiding selected developers in connecting their projects to central transmission,” SECI said in the statement. The government’s power ministry recently waived charges on transmission of electricity between states for wind projects, which also helped the bidders. Turbine manufacturers and power producers bid against each other to grab a share of the contracts on offer in the bidding. The success of the process may end the era in which power generators stimulated renewables by offering a fixed feed-in tariff, or above-market power price, for all projects that qualified, Bloomberg New Energy Finance said. A solar auction earlier this month showed a record low bid of Rs3.30 a kilowatt-hour on for 750 megawatts of projects in Madhya Pradesh state. “Wind and solar photovoltaic power prices were headed in opposite directions till now, but this auction proves that wind projects can produce electricity as cheap as the best solar projects in the country,” said Shantanu Jaiswal, an analyst at Bloomberg New Energy Finance in New Delhi. India is among a growing list of countries stretching from Asia to Europe that have used auctions to make clean energy more affordable. The result should help Prime Minister Narendra Modi’s government meet pledges to install 175 gigawatts of renewable capacity by 2022 and spur discussion about whether green energy can replace coal as India’s dominant source of energy.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 NewBase 28 February 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE US oil ticks up for 2nd day on record OPEC output cut compliance Reuters + NewBase U.S. crude oil edged higher for a second day on Tuesday, underpinned by high compliance with OPEC's production cuts even as the market remains anchored by rising U.S. production. The Organization of the Petroleum Exporting Countries (OPEC) has so far surprised the market by showing record compliance with oil-output curbs, and could improve in coming months as the biggest laggards - the United Arab Emirates and Iraq - pledge to catch up quickly with their targets. "With the prospect of OPEC extending the current cuts even longer, we would expect to see prices continue to push higher from here," ANZ said in a note. West Texas Intermediate crude oil added 11 cents, or 0.2 percent, to $54.16 a barrel by 0337 GMT, while benchmark Brent crude oil added 17 cents, or 0.3 percent, to $56.10 a barrel. For the month, U.S. crude oil is up 2.6 percent after falling in January, while Brent oil has risen marginally. Under the deal, OPEC agreed to curb output by about 1.2 million barrels per day (bpd) from Jan. 1, the first cut in eight years. Russia and 10 other non-OPEC producers agreed to cut around half as much. A Reuters survey of OPEC production later this week will show compliance for February. Passive investment funds are poised to shift an estimated $2 billion from far-term to near-term crude futures over the next week, anticipating an energy market rally as the OPEC output cut slashes supply. At the same time rising U.S. oil production continues to limit gains. Oil price special coverage

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 "Talking about more OPEC cuts, they can't have too much higher cuts as it will lead to more U.S. shale oil coming into the market," said Jonathan Barratt, chief investment officer at Sydney's Ayers Alliance. U.S. producers boosted crude production to over 9 million bpd during the week ended Feb. 17 for the first time since April 2016 as energy firms search for more oil, according to federal data. U.S. drillers added five oil rigs in the week to Feb. 24, bringing the total count up to 602, the most since October 2015, energy services firm Baker Hughes said on Friday. A bearish target at $53.37 per barrel has been aborted for U.S. oil, as it seems to have stabilized around a support at $53.99, said Wang Tao, Reuters market analyst for commodities and energy technicals. Brent oil looks neutral in a range of $55.93-$57.26 per barrel, and an escape could suggest a direction. Oil after Opec expected to remain in $55-$60 range: QNB Gulf Times As Opec cuts have expedited the clearing of the global oil market, the key determinant of oil prices is shifting to US shale oil breakevens, which are expected to remain in the $55-60 range, QNB has said in an economic commentary. This, QNB said, keep oil prices at around this level in 2017. Oil markets have been in waiting mode during the early part of this year to see how effective Opec’s November agreement to cut production in 2017 would actually be. The first round of January data has now come in and it suggests that compliance with the agreement is high, lending support to prices, QNB said. With this new data in hand, QNB has refreshed its outlook for oil prices. With excess supply in global markets now expected to clear in 2017, the key determinant of prices is likely to shift to the costs of the marginal producer, in this case US shale companies, which are currently estimated to be around $55-60. At the end of November 2016, Opec surprised markets by reaching a comprehensive agreement to cut production by 1.2mn barrels per day (bpd) for six months, effective from January 1, 2017. Additionally, an agreement was also reached with a number of non-Opec producers to cut output by 0.6mn bpd, including 0.3mn of cuts from Russia. As a result, oil prices rose 8.8% to $50.5 from $46.4 the day before the meeting and have averaged $55 since. The compliance of producers with the Opec agreement will be key to determining the future trajectory of oil prices. Based on the latest data from Opec and the IEA, it appears that compliance has been high.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Opec has cut production by 1.1mn bpd compared with a target of 1.2mn (93% compliance), with 0.6mn of these cuts coming from Saudi Arabia. Non-Opec is expected to achieve production cuts of around 0.3mn bpd in early 2017, compared with a target of 0.6mn. “To calculate the balance of supply and demand in global oil markets in 2017, we assume 100% compliance with Opec production targets during the first half of 2017,” QNB said. “We assume that the agreement will not be extended in June and production will revert to pre- agreement levels during the second half of the year. This implies a 0.3mn bpd increase in Opec production on average over 2017 compared with 2016,” QNB said. Based on IEA data, the global oil market was oversupplied by 0.4mn bpd on average in 2016. Demand is expected to grow by 1.4mn bpd in 2017, which would totally wipe out the surplus. However, this will be partly offset by increases in supply from Opec, US shale and other non-Opec producers. The net effect would be a shift from an oversupplied oil market to one that is undersupplied by 0.25mn bpd in 2017. Taken in isolation, the clearing of the oil market should be sufficient to raise oil prices above the $60/b level. However, higher prices are likely to bring marginal producers back into the market, leading to higher supply and capping price increases. The average breakeven price for US shale is estimated at around $55/b currently. Having been in steady decline since April 2015, US production has increased since November 2016. Therefore, QNB expects oil prices to remain bound in the $55-60 range, on average, during 2017 as US shale oil production puts a lid on prices. Changes in US shale breakeven prices are likely to determine oil prices in 2017. US shale breakeven prices have fallen from $80-90 a few years ago to around $55-60 currently. The costs of production were brought down by targeting low cost fields, productivity gains as technological advances allowed more oil to be extracted from each well as well as by falling costs for labour and other oil services thanks to excess capacity in the industry. “It is not clear whether the drivers of lower costs will continue in 2017,” QNB said.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase Special Coverage News Agencies News Release 28 Feb. 2017 With Shale Oil Production Like This, Who Needs Trump? By Julian Lee The second coming of shale could be even more powerful than the first. OPEC seems to be getting caught unawares. The current boom in U.S. oil production is even stronger now than the run from July 2011 to April 2015. And this is with oil prices at half their previous level and before President Donald Trump has done anything to meet his pledge to "lift the restrictions on American energy and allow this wealth to pour into our communities." Output growth could accelerate if prices rise, or costs fall further. This is not how it was meant to be. OPEC launched a strategy to protect market share in 2014 with a specific aim to knock out high-cost oil production such as shale. After the group succumbed to internal financial pressures and agreed in November to cut output by around 1.2 million barrels a day, Saudi oil minister Khalid Al-Falih said he didn't expect a big supply response from American shale producers in 2017. Turbocharged U.S. oil production is growing faster now than it did during the first shale boom It turns out the response was already well under way, and Al-Falih may not like the numbers. Data from the Department of Energy show U.S. oil production bottomed out in September. Since then

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 oil companies have added an average of 125,000 barrels a day of production each month, taking output back above 9 million barrels a day for the first time since April. What should really trouble OPEC, though, is that this rate of growth is even faster than the first shale boom. Over that earlier period, U.S. oil production rose at an average monthly rate of 93,000 barrels a day. Market anticipation of the agreement between OPEC and its friends in November last year, and the actual deal, lifted WTI from a low reached in early 2016 of around $26. This time, shale producers aren't waiting around -- their output started picking up with WTI crude selling for around $45. During the last boom, WTI traded in a range at about double or triple that. Okay, so part of the growth is coming from the Gulf of Mexico, where BP Plc's Thunder Horse South and Royal Dutch Shell Plc's Stones projects have both started producing in recent months. But that region also made a positive contribution to the earlier boom, as did Alaska. Most of the current growth is coming from the onshore, lower 48 states -- home of the shale industry. Increasing production from the U.S. is rapidly undermining the output cuts that OPEC is making and, unless those cuts get deeper in the coming months -- which looks unlikely, given that compliance is already above 90 percent -- things can only get worse for the producer group. Far from bringing the market back into balance, they run the risk that they have seriously underestimated the ability of U.S. domestic producers to adapt to lower prices. And what's worse is that they may be able to raise production even faster if OPEC succeeds in pushing the price up. Cutting the Oil Cuts Partial implementation by OPEC and rising output elsewhere have halved pledged reductions What OPEC has failed to understand is that the shale revolution owes it success more to a new business philosophy to deal with a new type of resource, than it does to new technology. As Thomas Reed, chief executive of JKX Oil & Gas Plc, pointed out at last week's International Petroleum Week conference in London, horizontal drilling and hydraulic fracturing have both been in use in the oil industry for around 50 years. What is really new is not just combining the two

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 techniques in a single well but, more importantly, the industrialization of the process of drilling and completing wells. The long lead-times, complex development plans and huge up-front capital requirements associated with conventional oil fields simply don't apply in the shale sector. Yes, costs will eventually rise as shale output grows. The industry's retrenchment has left it employing only the best rigs and crews and focused on the best of the resource. But it is able now to extract so much more with so much less drilling that it is almost certain to keep growing. OPEC has put itself back on the path of cutting output to support competing producers. It just doesn't seem to have realized it yet.Oil pared declines after an industry report was said to show that U.S. crude inventories shrank. Stockpiles fell 884,000 barrels last week according to an American Petroleum Institute report Wednesday, people familiar with the data said. That contrasted with analysts surveyed by Bloomberg who said supplies probably rose by 3.25 million barrels ahead of Energy Information Administration data Thursday. OPEC must prolong output curbs beyond six months to have a significant impact on bloated world stockpiles, said Total SA Chief Executive Officer Patrick Pouyanne. A surge in U.S. crude stockpiles to the highest level in more than three decades has kept oil futures in a tight range above $50 a barrel this year, offsetting supply cuts by OPEC and 11 other nations. It’s too early to say whether the production agreement could be extended beyond its initial six-month term, OPEC Secretary General Mohammad Barkindo said. "The fundamentals actually do matter sometimes," Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York, said by telephone. "The focus is returning to the reality that fundamentally we’re oversupplied."

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Shell Shuns New Oil-Sands Projects as Low Prices Force Cost Control by Rakteem Katakey Royal Dutch Shell Plc is unlikely to take on new oil-sands projects as it maintains a grip on costs after crude’s crash forced competitors to write down Canadian reserves. While Shell’s existing oil-sands operations generate strong cash flows, the expense of developing new projects discourages additional investments, Chief Executive Officer Ben Van Beurden said in an interview. Oil sands, the reserves of heavy crude found primarily in northern Alberta, lured investors in the past decade as oil’s surge above $100 a barrel made the difficult extraction process economic. But they’ve fallen out of favor following the subsequent market collapse as companies dump expensive projects amid fears that competition from low-cost crude could strand costlier assets. “All of those are reasons we are unlikely to develop new oil-sands projects,” Van Beurden said in London. “There are no plans for growth capital to be invested in oil sands.” Exxon Mobil Corp. slashed reserves after removing the $16 billion Kearl oil-sands project in Athabasca from its books last week. A day earlier, ConocoPhillips said that erasing oil-sands barrels had reduced its reserves to a 15-year low. In 2015, Shell itself took a $2 billion charge as it shelved an oil-sands project in Alberta, and last year sold other assets in the area for about $1 billion. The oil-sand mines in the region are among the costliest petroleum projects because the raw bitumen extracted must be processed and converted to a synthetic crude before being transported to refineries, mainly in the U.S. In addition, Canadian oil sells for less than benchmark U.S. crude because of the cost to ship it and an abundance of competing supplies from shale fields. BP Plc said last month that there’s enough oil in the world to meet demand to 2050 twice over and this may prompt producers of low-cost crude, like those in the Middle East, to bring production forward.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 While oil prices have recovered from the sub-$30 lows of early 2016, they’re still far below the levels of 2012 and 2013. Shell has promised investors it’ll keep annual spending between $25 billion and $30 billion for the rest of this decade -- and at the lower end of that range this year -- following its $54 billion acquisition of BG Group Plc in 2016. That purchase drove up debt near to $80 billion last year, the highest in the industry after Brazil’s Petroleo Brasileiro SA. Shell has been selling assets to pare borrowings and Canadian oil-sands have been part of that plan. Shell told investors in a presentation last June that although oil sands were among its “cash engines,” future growth would be focused on deep-water, chemical and shale projects. The company said the return on average capital employed in oil sands from 2013 to 2015 was 1 percent at an average oil price of $90 a barrel; it expects that to rise to about 5 percent from 2019 to 2021 at $60 crude, according to the presentation. Shell holds a 60 percent stake in Canada’s Athabasca Oil Sands Project, and also runs a bitumen processing plant and a carbon-capture facility.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 26 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase February 2017 K. Al Awadi

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19