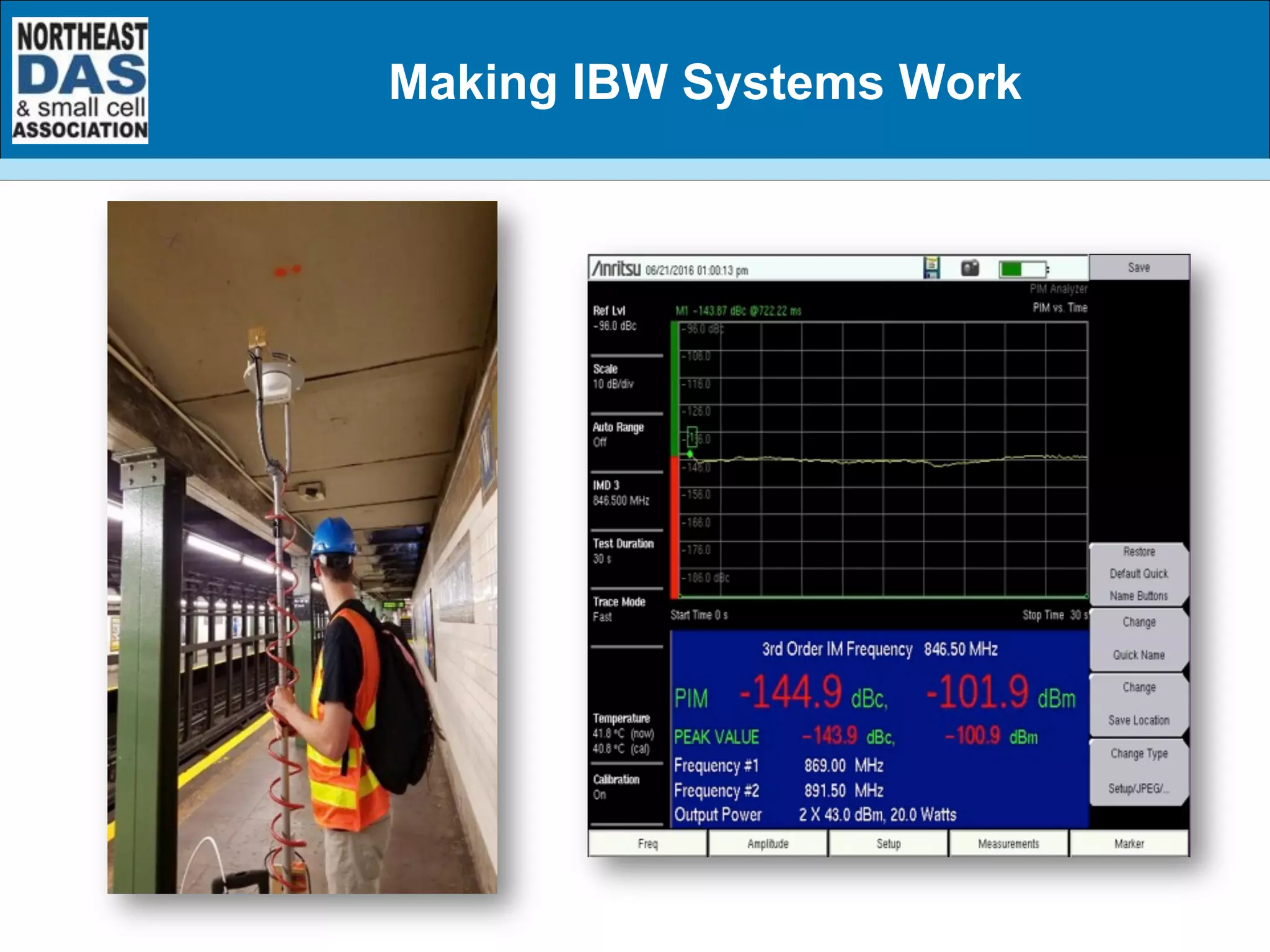

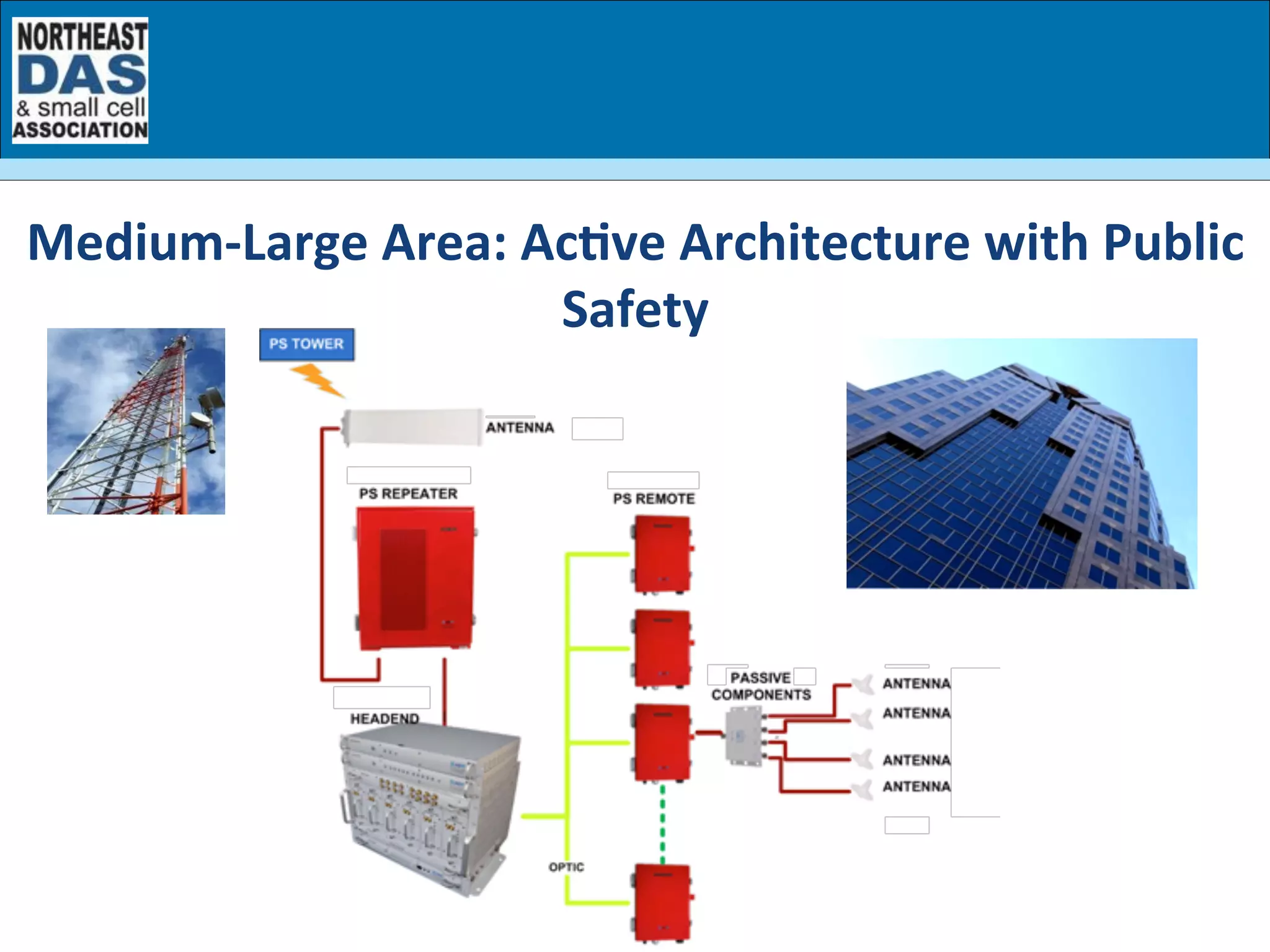

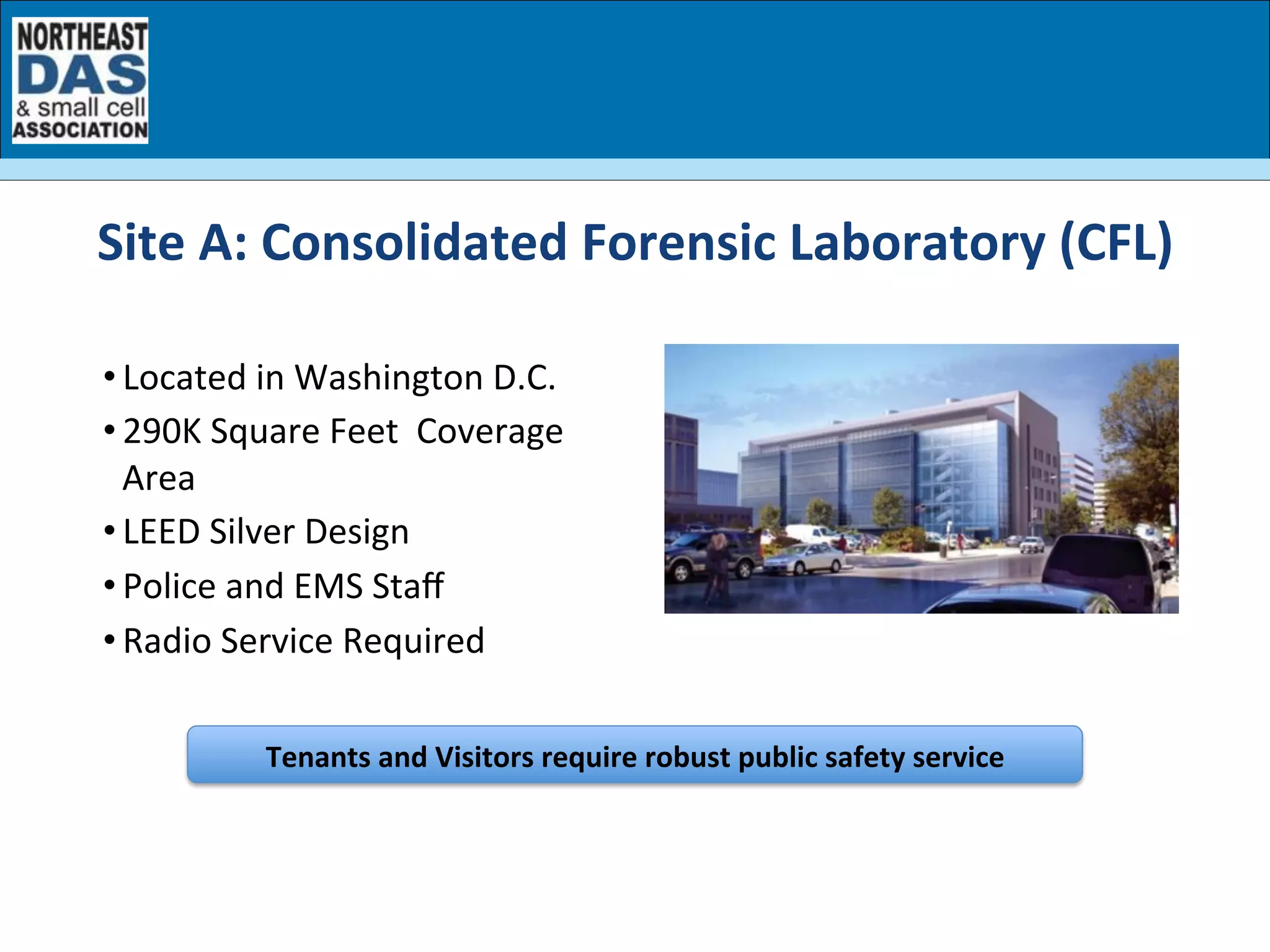

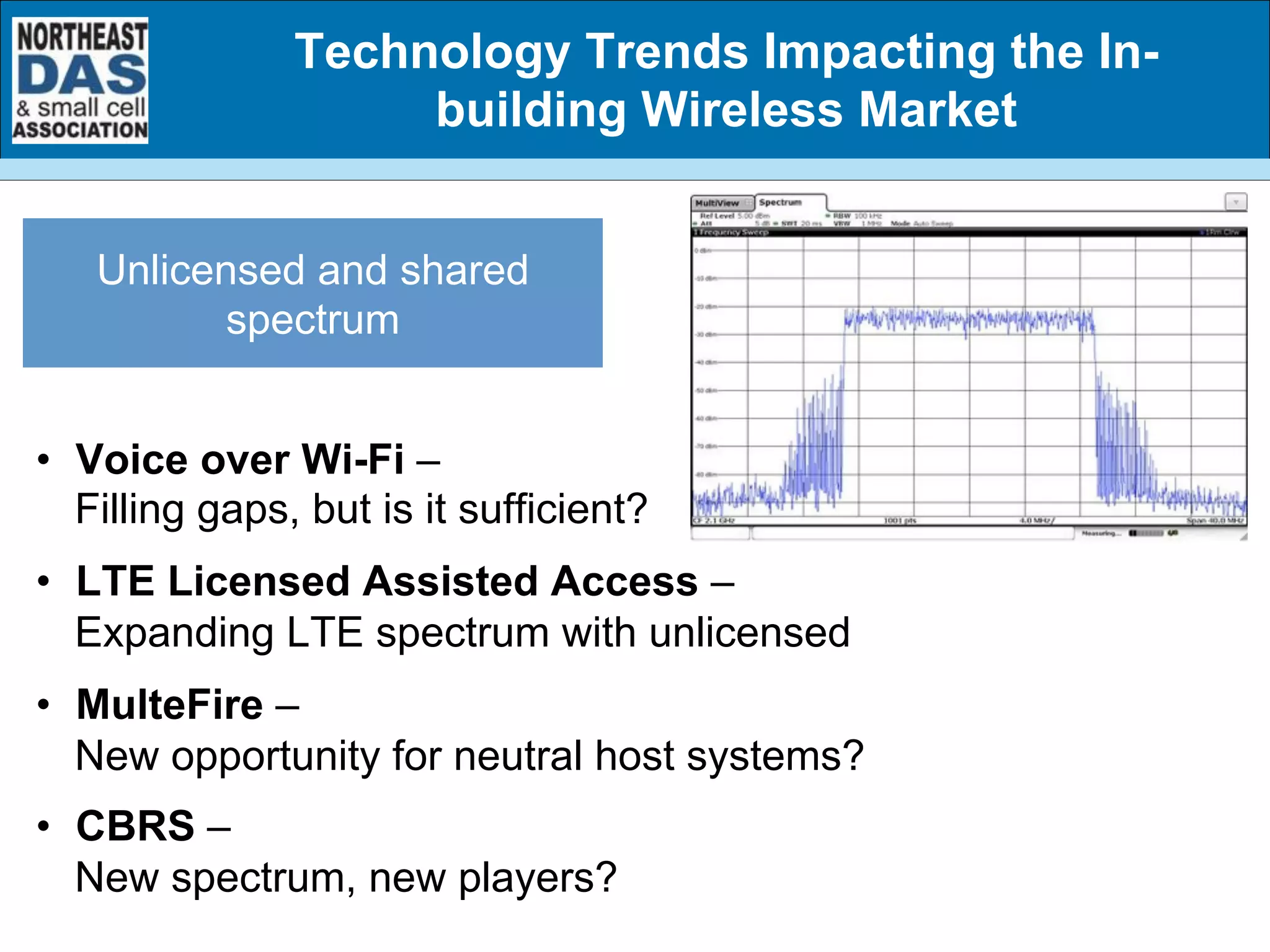

The document discusses the U.S. in-building wireless (IBW) equipment market outlook, focusing on technological trends impacting mobile broadband and public safety communications. Key topics include the growth of mobile traffic, the role of small cells and 5G infrastructure, and regulatory challenges faced by DAS (Distributed Antenna Systems) in various building types. The document highlights the need for robust public safety coverage and compliance with new regulations in the evolving landscape of wireless communications.

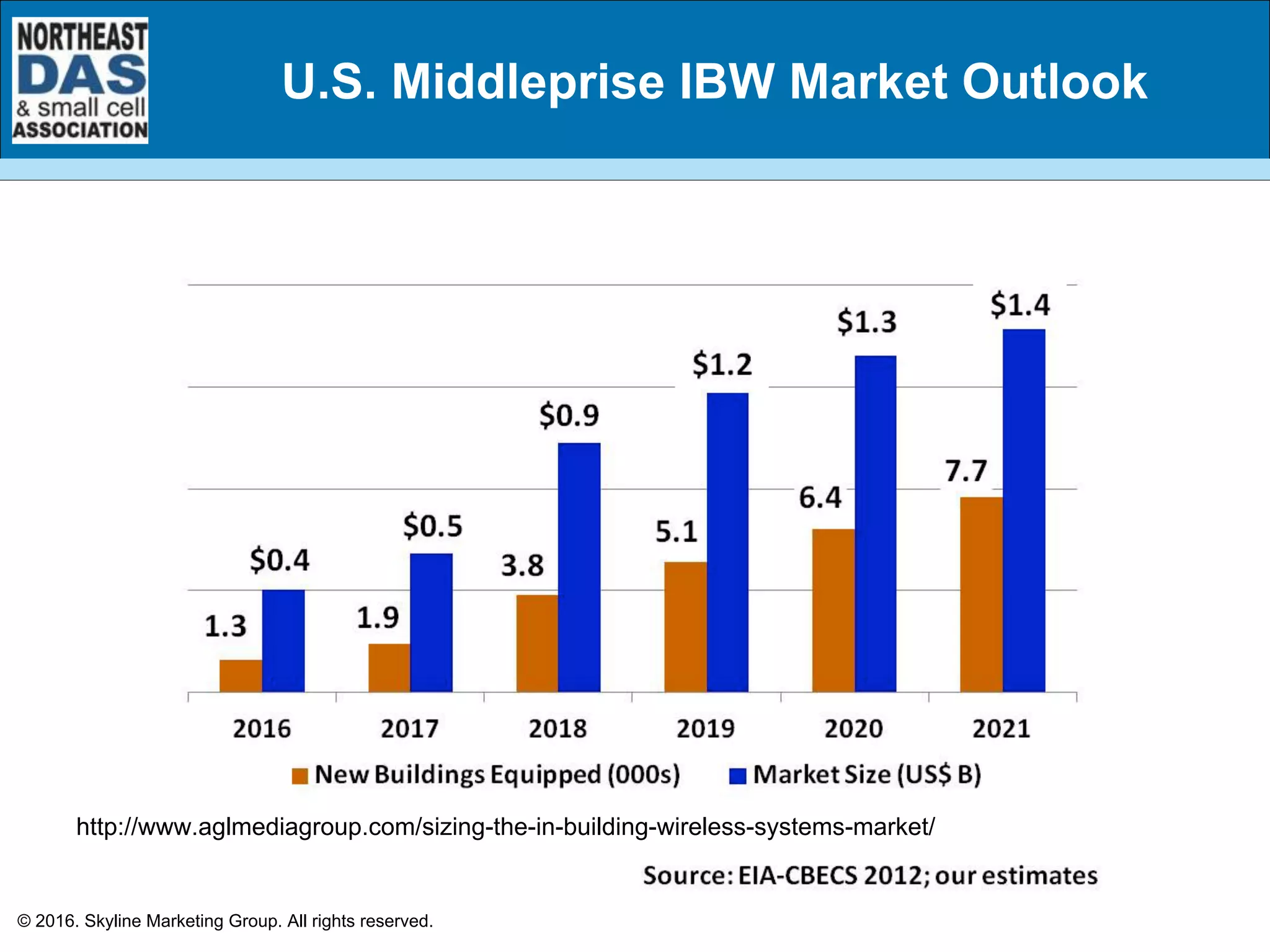

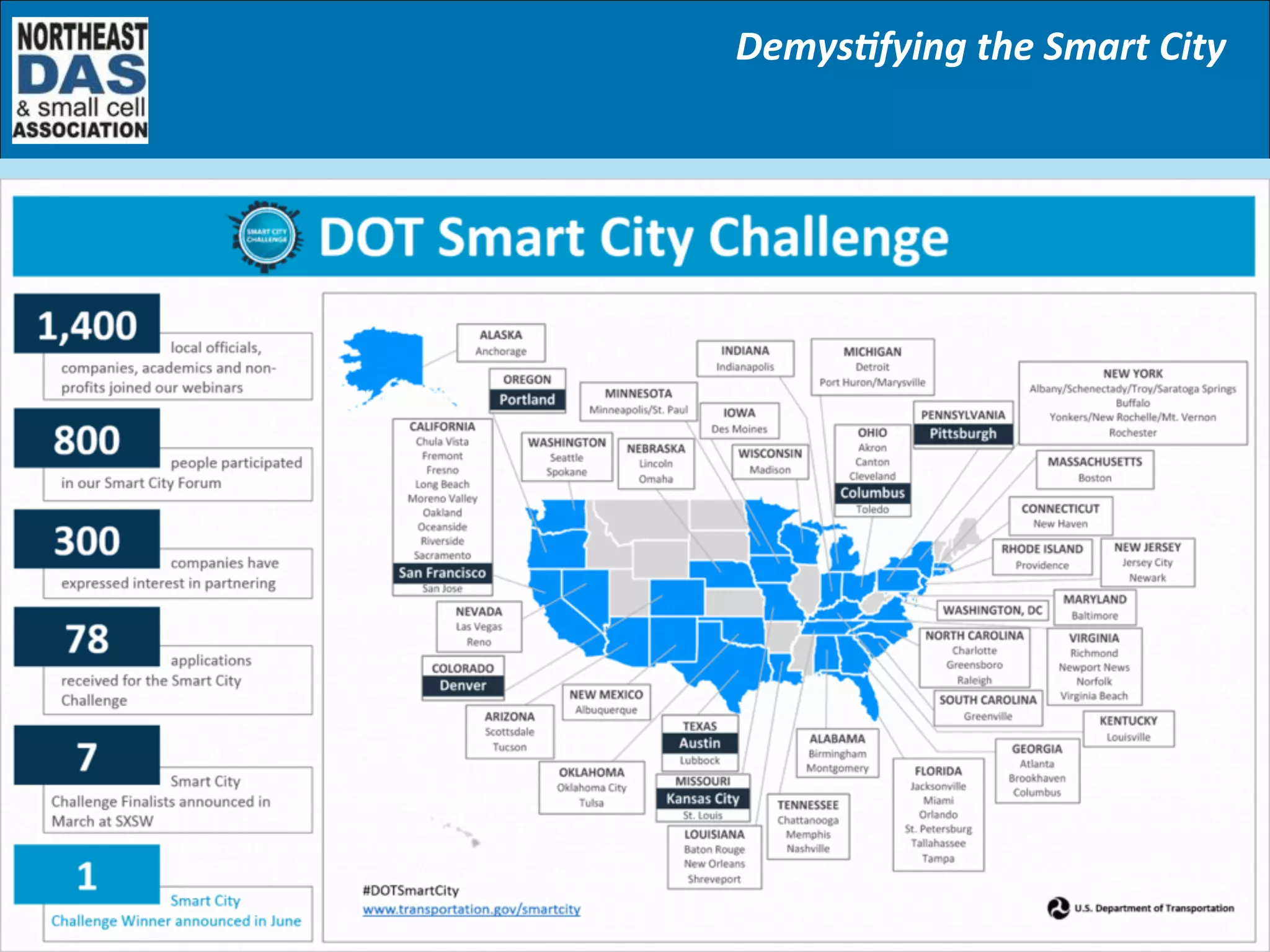

![U.S. Commercial Buildings Installed Base

Source: EIA-CBECS, 2012, our estimates

© 2016. Skyline Marketing Group. All rights reserved.

Tier 1 [8,000]

Tier 2 [128,000]

Tier 3 [199,000]

Tier 4 [5,222,000]

500,000+ sf

<885,000 sf>

100,000-500,000 sf

<210,000 sf>

50,000-100,000 sf

<70,000 sf>

Under 50,000 sf

<16,000 sf>

IBW Complexity

Hi

Lo

Total = 5.6 million buildings](https://image.slidesharecdn.com/nedasdcpresentationdeckmasterfinalv2-161206155731/75/NEDAS-DC-November-29-2016-Presentations-9-2048.jpg)