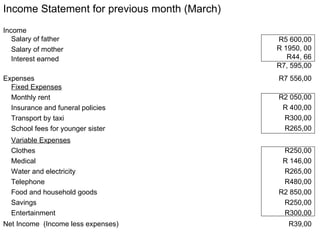

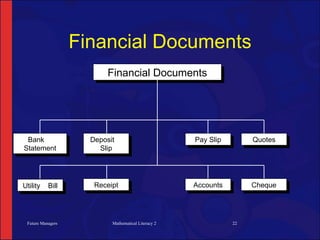

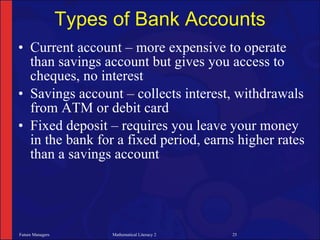

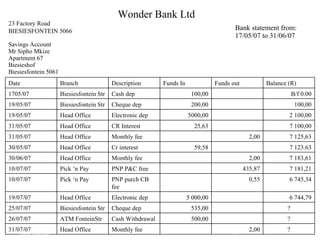

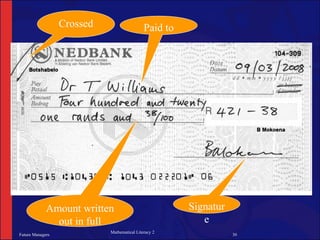

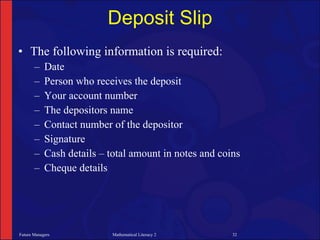

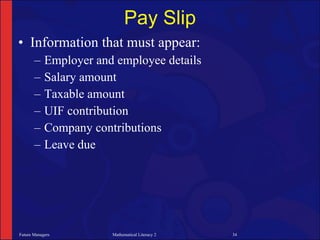

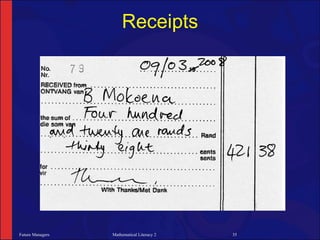

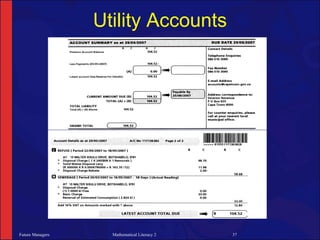

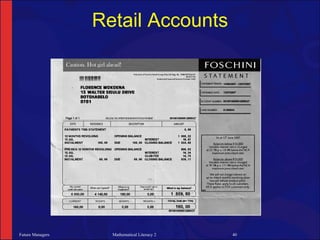

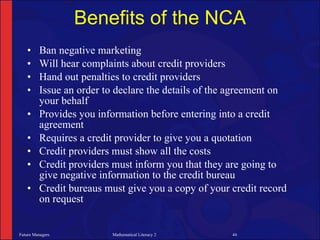

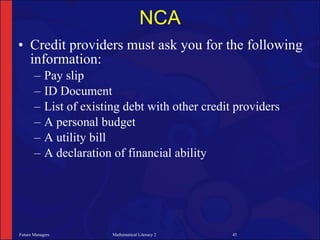

The document focuses on financial literacy for future managers, covering topics such as income, expenses, budgeting, and saving strategies. It explains the differences between gross and net income, fixed and variable expenses, and provides guidance on recording financial information and making informed decisions. Additionally, it touches on bank accounts, financial documents, and the National Credit Act aimed at protecting consumers.