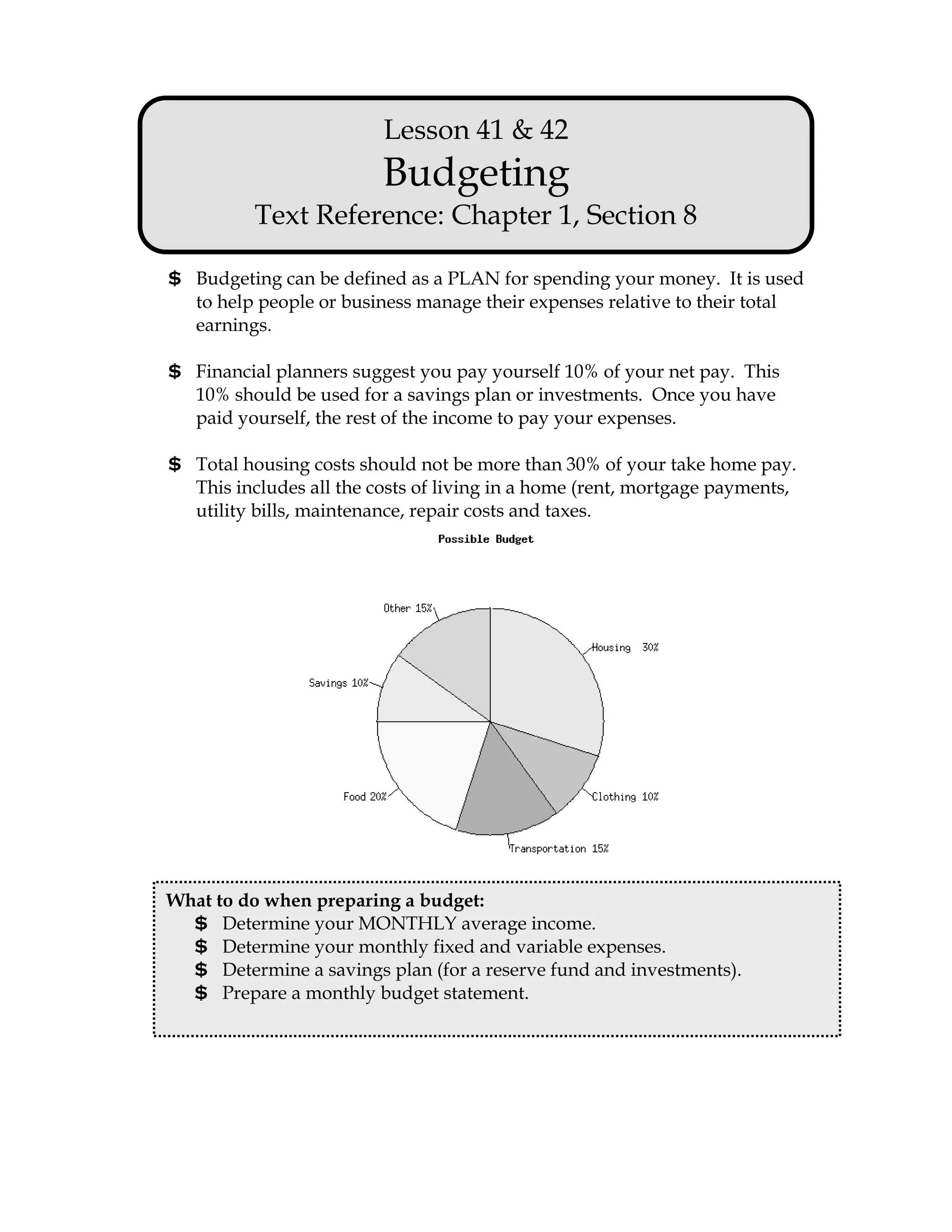

Budgeting involves planning spending based on earnings. People should save 10% of net pay and spend the rest on expenses, with no more than 30% of take-home pay going to housing costs. When preparing a budget, one determines monthly income and expenses, savings plans, and creates a monthly statement. Income sources include regular pay, bonuses, and benefits, while expenses are fixed costs like rent and variable costs like food and recreation. People should have a reserve of 2-3 months' pay for unexpected costs.