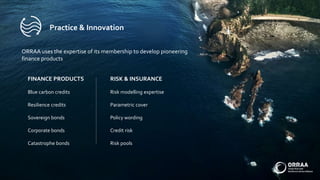

The document highlights the urgent need for transformative changes to combat climate change and ocean risk, particularly for vulnerable regions at risk of coastal flooding. It discusses barriers to private investment in natural capital, including a lack of understanding and inadequate policies, while emphasizing the role of research, innovation, and specialized finance products to promote investment in ocean resilience. Overall, it advocates for the development of projects and policies that enhance resilience and generate financial returns in the face of ocean-derived risks.