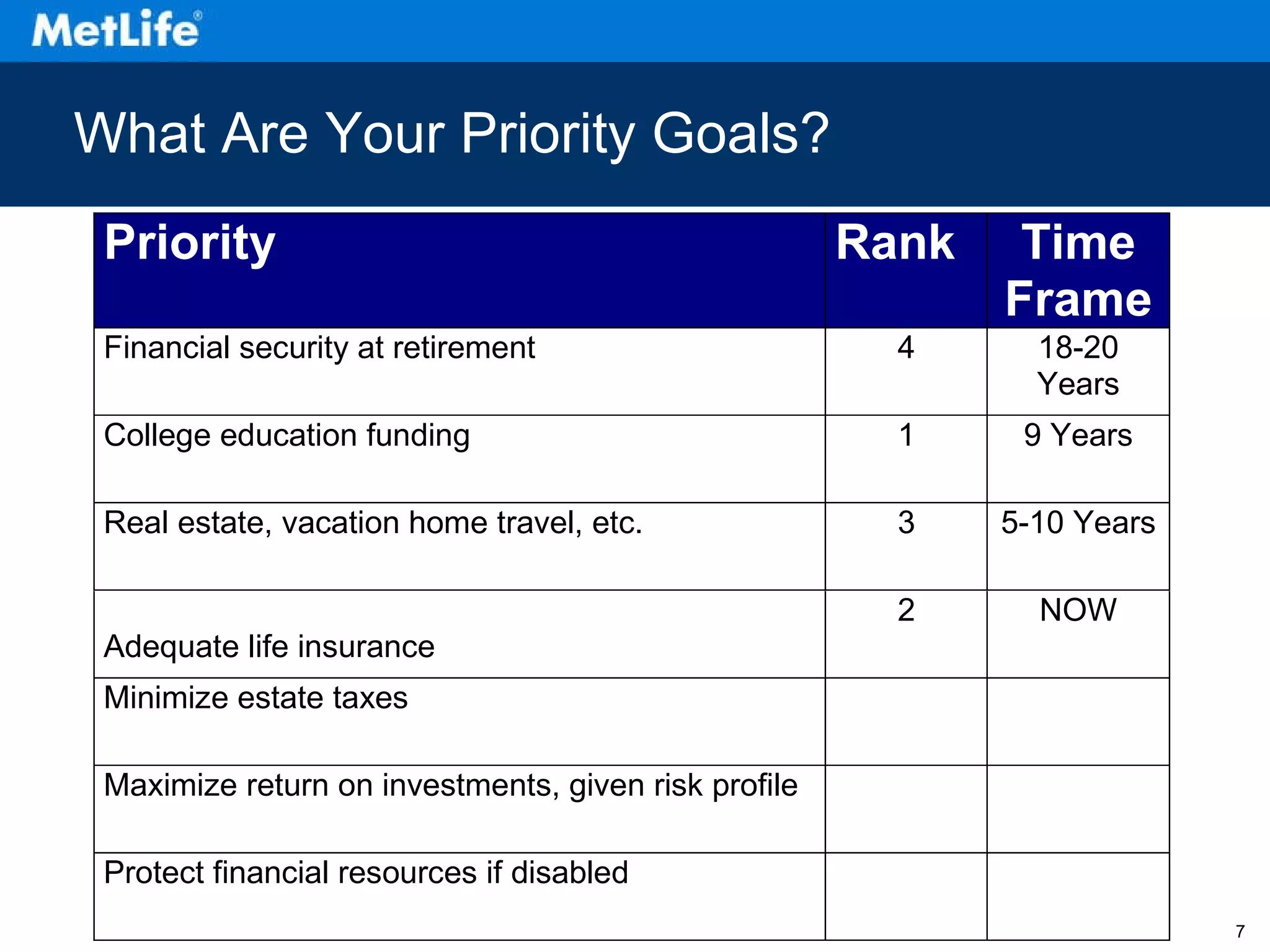

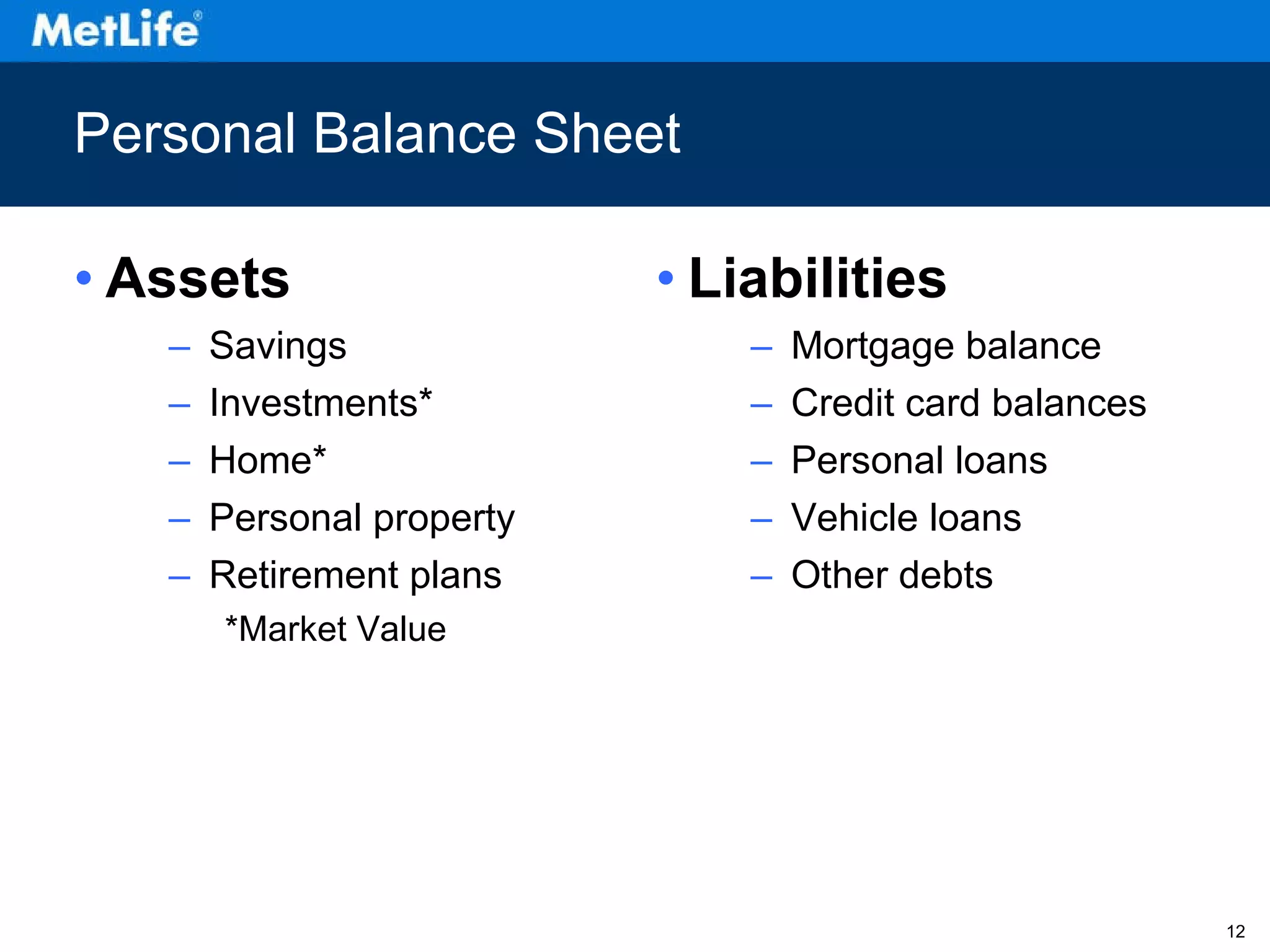

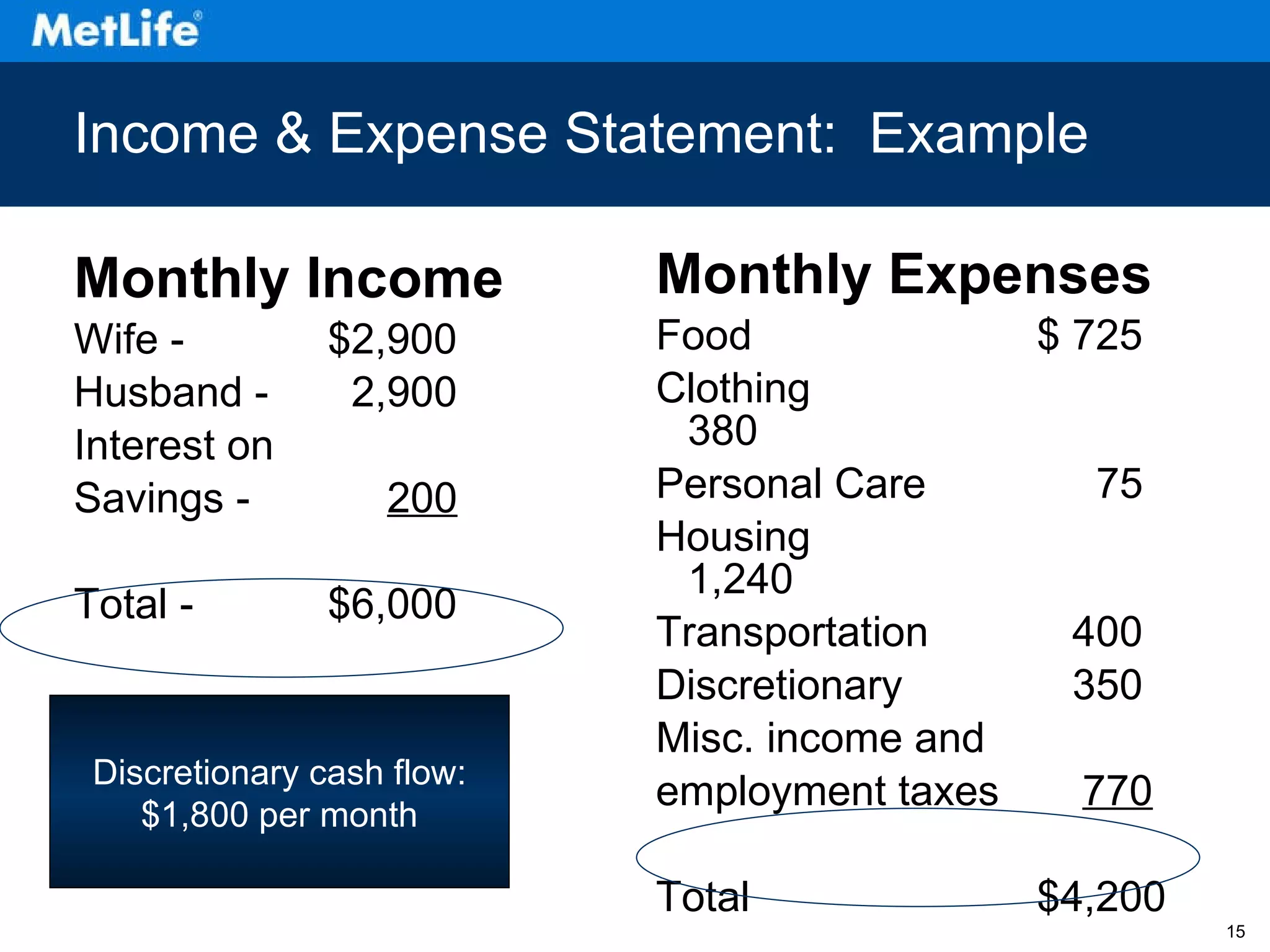

The document provides an overview of financial planning, including the financial planning process, goals, and strategies. It discusses analyzing current financial resources and priorities, developing a personalized plan, implementing recommendations, and keeping the plan updated. It also addresses organizing personal finances through a net worth statement and budget, ways to increase net worth, and the impact of taxes on investments. The overall document serves as an introduction to financial planning concepts.

![Financial Planning 101 Investment Advisory Services offered through Investment Advisor Representatives of MetLife Securities, Inc. (MSI), 200 Park Avenue, New York, NY 10166, a Registered Investment Advisor. MSI is a MetLife, Inc. company L0609046410[exp0510][AZ]](https://image.slidesharecdn.com/naf-seminar-09-110427104744-phpapp01/75/Naf-seminar-09-1-2048.jpg)