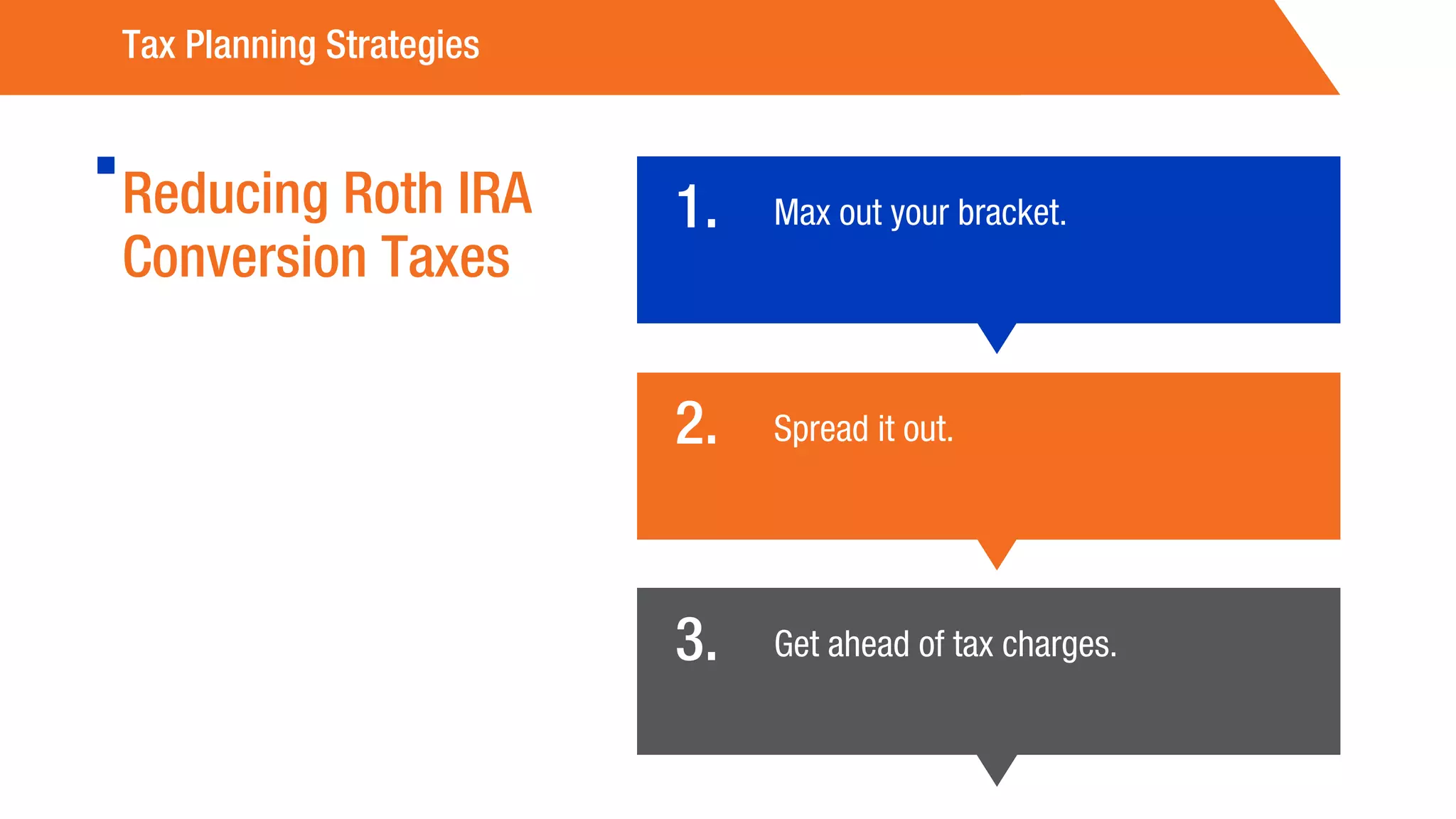

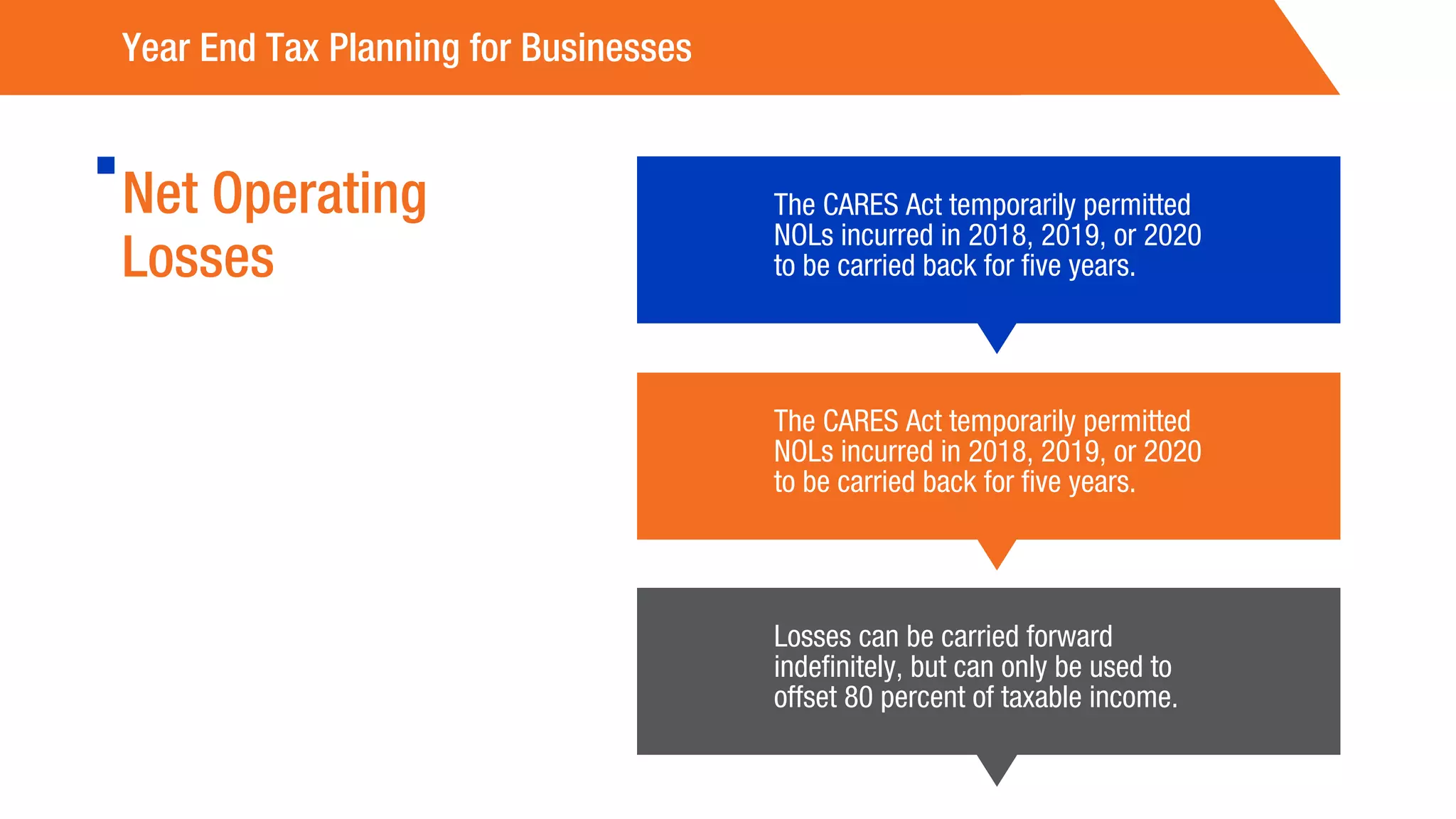

This document provides information on 2021 tax planning strategies for individuals and businesses. It discusses the difference between reactive tax preparation and proactive tax planning. The stages of effective tax planning include planning, implementation, quarterly maintenance, and tax return preparation. Various tax planning strategies are outlined for deferring or accelerating income, bunching deductions, maximizing retirement contributions, checking IRA distribution requirements, converting traditional IRAs to Roth IRAs, and reducing Roth conversion taxes. Year-end tax planning considerations for businesses include employee retention credits, net operating loss carrybacks, and research and development cost deductions and amortization.