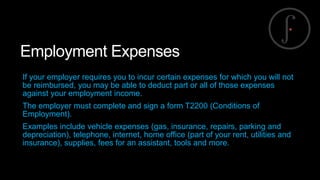

1. The document provides a summary of 12 tax deductions that are often overlooked or missed by taxpayers, including employment expenses, fitness and arts tax credits for children, transit passes, optimizing deductions with a spouse, the equivalent to spouse exemption, tuition, moving expenses, the home buyers plan (RRSP), income splitting, the disability tax credit, premiums on group health benefits, and interest paid.

2. It also discusses in more detail what each of these deductions are and provides examples to help taxpayers understand if and how they could claim these deductions to reduce their taxes.

3. The document encourages taxpayers to use a tax expert who has the knowledge, experience, and judgment to help ensure taxpayers claim all deductions they