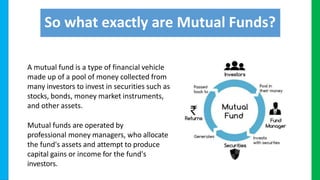

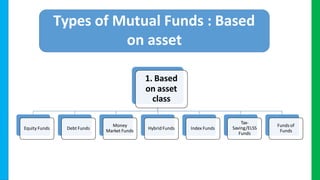

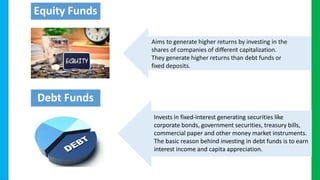

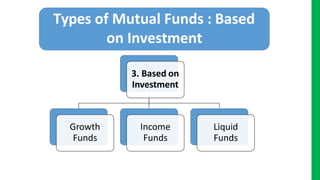

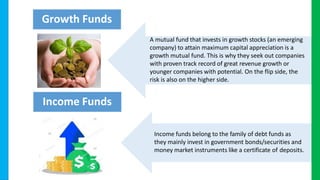

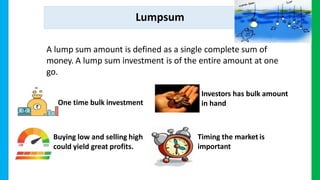

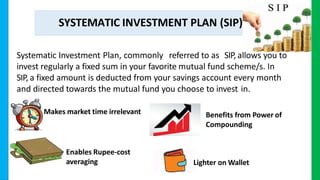

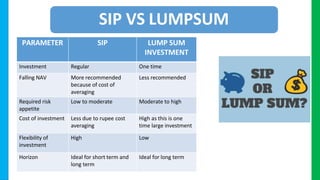

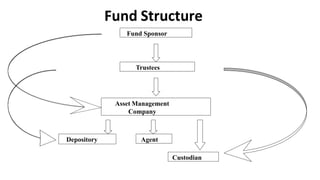

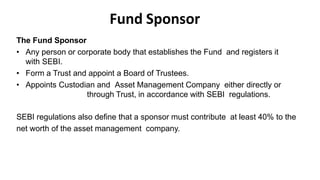

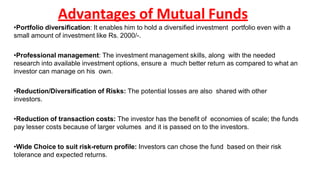

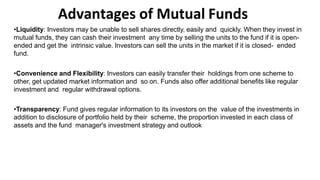

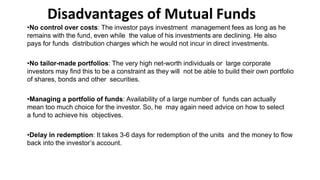

The document provides a history of mutual funds in India in 4 phases from 1964 to 1996. It begins with the establishment of UTI in 1963, which was given a monopoly until 1986 when the first equity fund was launched. In phase 2 from 1987-1993, other public sector mutual funds were established. Phase 3 from 1993-1996 introduced private sector funds. Phase 4 saw investor friendly regulatory measures by SEBI. The document then provides definitions of mutual funds, reasons for investing through them, different types of funds categorized by asset class, structure and investment, and ways of investing through lump sums or SIP. It outlines the structure of a mutual fund including sponsors, trustees, AMC, custodian and depositories. Distribution channels and advantages