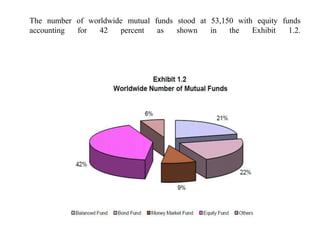

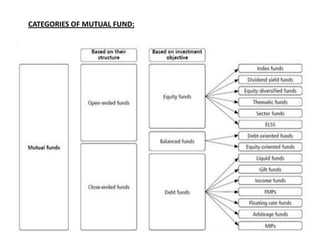

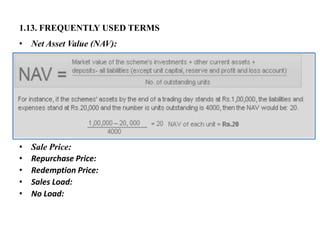

The document is a presentation on the role of microfinance in industry and regional growth. It discusses the history and structure of mutual funds in India. Some key points:

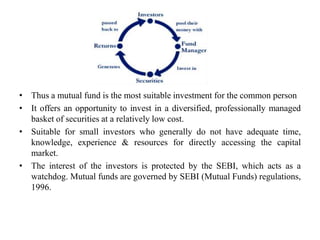

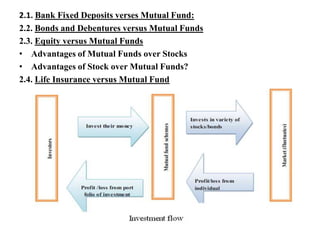

- Mutual funds pool money from investors and invest in stocks, bonds, and money market instruments, allowing small investors to participate in markets.

- The mutual fund industry in India began in 1963 with the formation of UTI. It has since grown to include public and private sector funds.

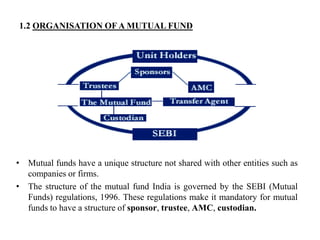

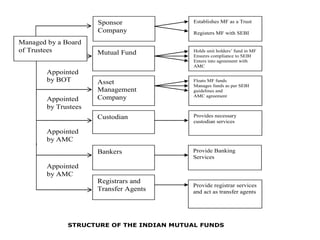

- SEBI regulations govern mutual funds to protect investors. Funds must have a sponsor, trustee, asset management company and custodian.

- Mutual funds offer investors a diversified, professionally managed way to invest

![Presentation On

“The Role of Micro Finance in the Growth

of an Industry and Region”

Submitted by : Ashokkumar Hegde

511135575

In partial fulfillment of the requirement for the award of the degree of

MBA [Finance]

Trinity Academy for corporate training ltd

[Study Centre – 03216]](https://image.slidesharecdn.com/roleofmicrofinance-130706045712-phpapp01/75/Role-of-micro-finance-1-2048.jpg)