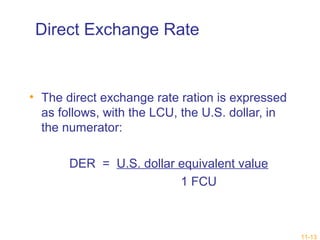

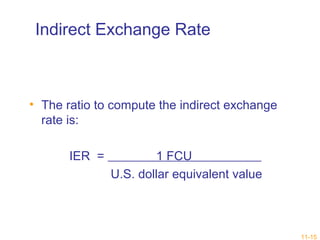

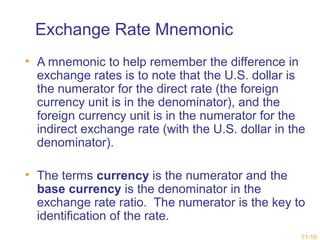

This chapter discusses accounting issues related to foreign currency transactions and financial instruments for multinational companies. It covers how to record and report transactions involving foreign currencies, the different types of exchange rates used to translate balances, and how to account for imports/exports and hedging strategies using financial instruments. The key aspects are translating foreign currency transactions and balances to the reporting currency, managing foreign currency risk, and designating hedges as either fair value, cash flow, or net investment hedges for accounting purposes.