This document discusses accounting and reporting for foreign currencies. It covers key concepts like foreign exchange rates, foreign currency transactions, accounting for imports and exports, and accounting standards. The two-transaction perspective requires companies to account for foreign currency sales and subsequent cash collections as separate transactions. Exchange differences from changing rates are reported as foreign exchange gains or losses. Journal entries are provided to illustrate accounting for a sample import transaction over multiple periods as the exchange rate fluctuates.

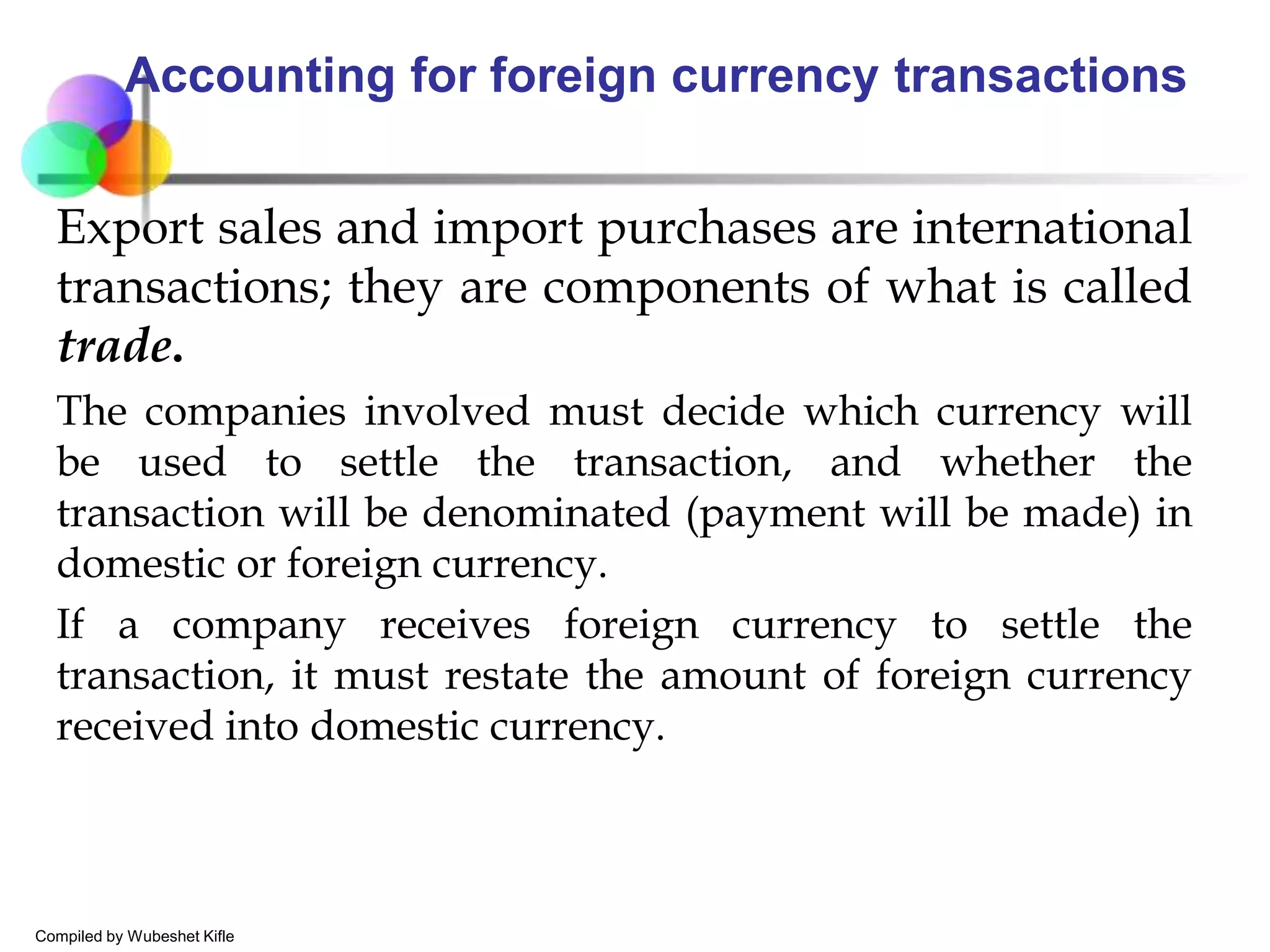

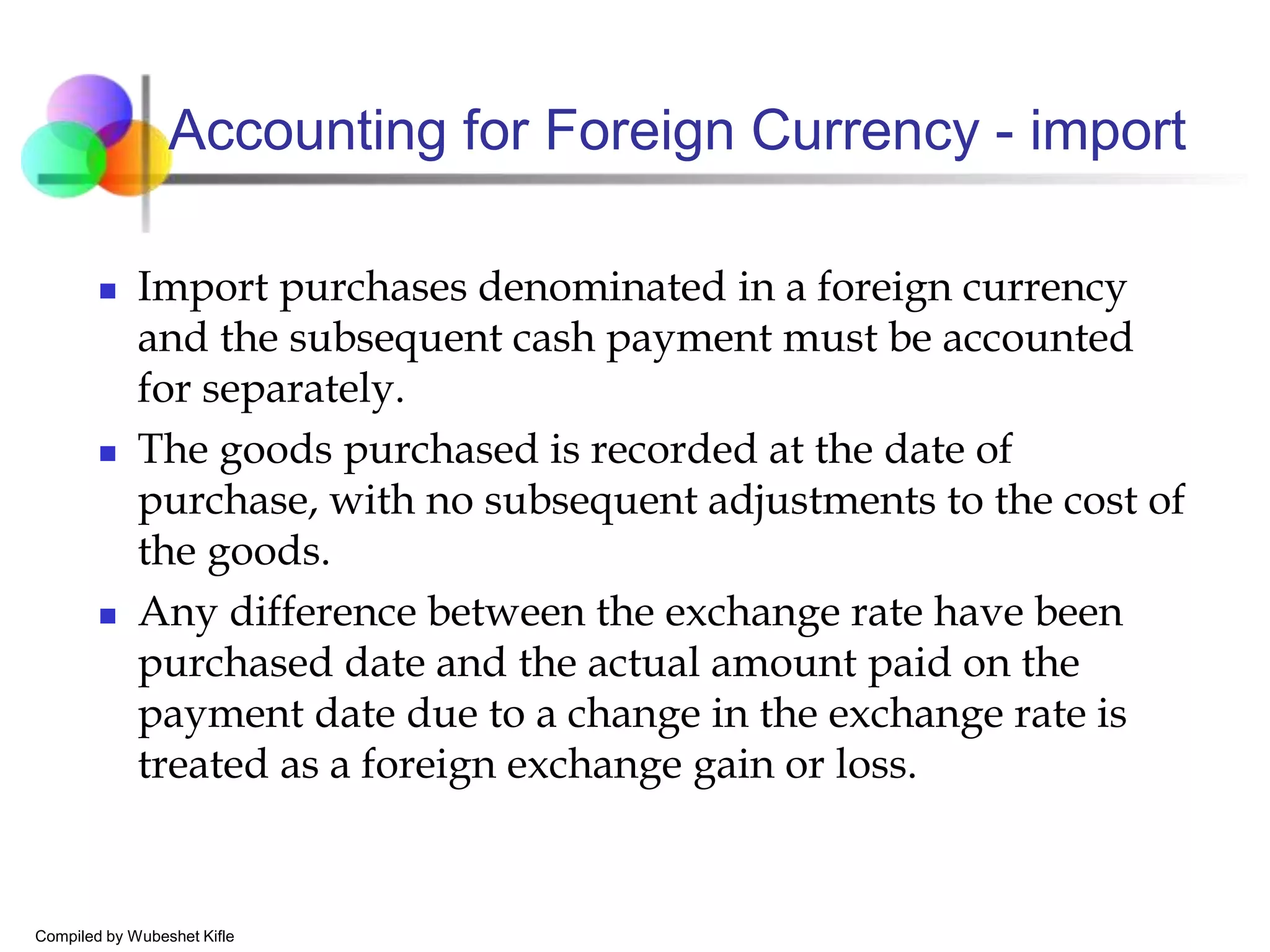

![Cont’d - Problem 2.3

Prepare journal entries for a foreign currency borrowing Solution

5/1/20 Cash 15,360,000

Note Payable 15,360,000

[300,000 @ 51.10]

11/1/20 Interest Expense 384,300

Cash 384,300

[300,000 x 5% x 6/12 x ETB51.24] 384,300

12/31/20 Interest Expense 128,150

Interest

Payable

128,150

{300,000 x 5% x 2/12 x $51.26] 12,815

Foreign Exchange Loss 18,000.00

Note Payable (euro) 18,800.00

Compiled by Wubeshet Kifle](https://image.slidesharecdn.com/accountingandreportingforforeigncurrencies-220204030844/75/Accounting-and-reporting-for-foreign-currencies-44-2048.jpg)

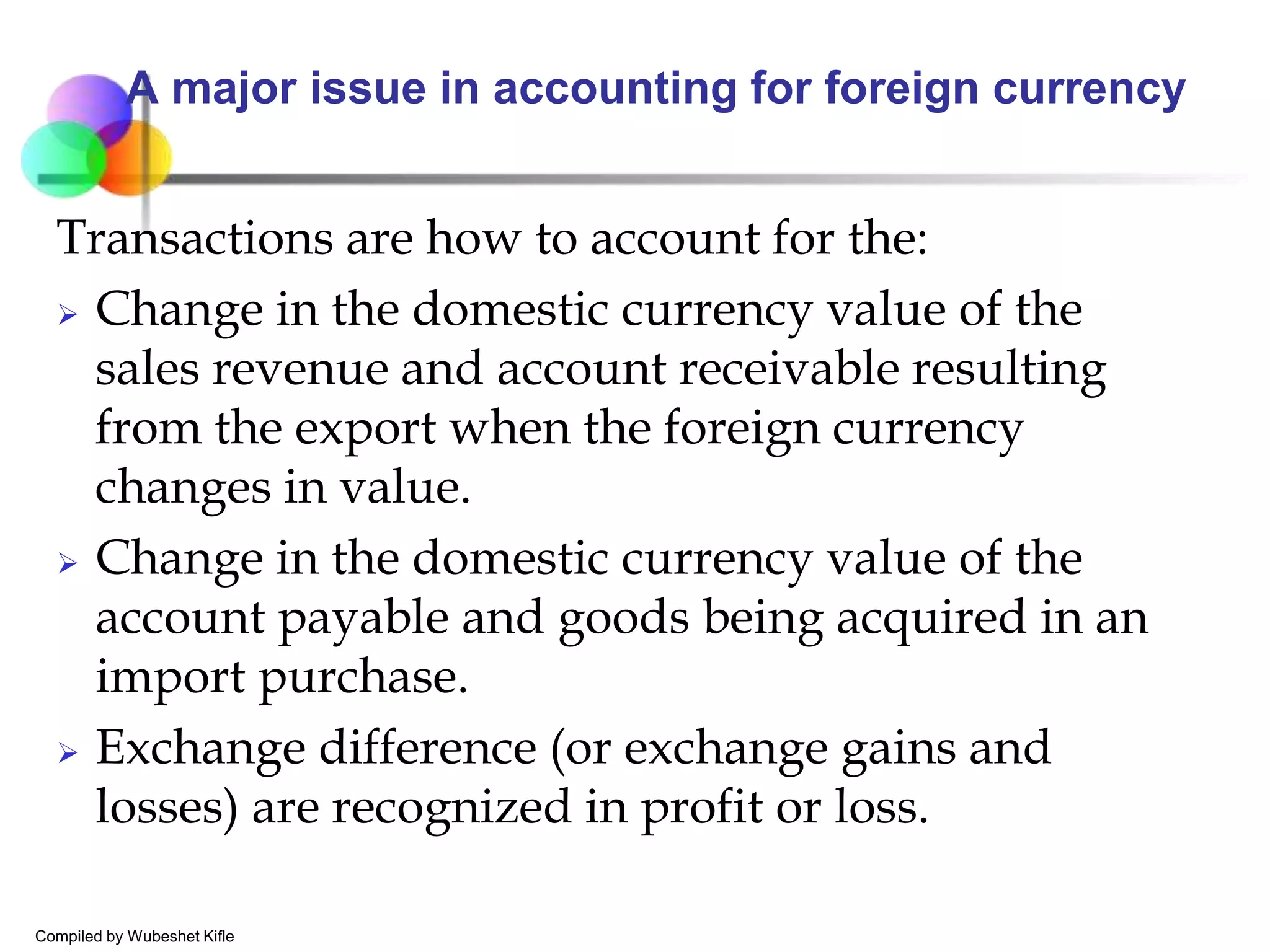

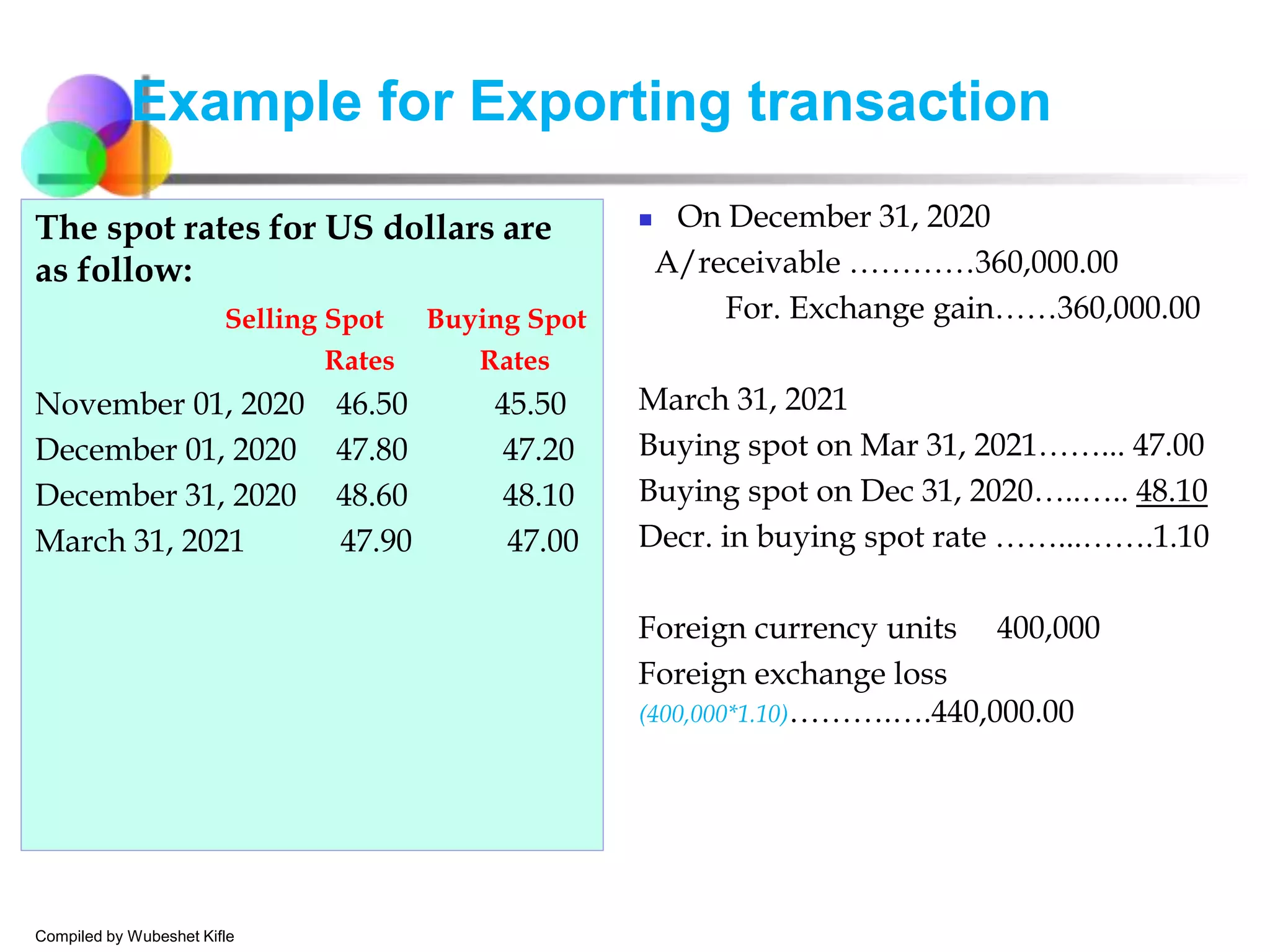

![Cont’d - Problem 2.3

April 30, 2021 Interest Expense 256,400.00

Interest Payable (euro) 128,150

Foreign Exchange Loss 50

Cash 384,600

[300,000 x 5% x 4/12 x ETB 51.28] 256,400

[300,000 x 5% x 2/12 x (ETB51.28 – $51.26)] 50

[300,000 x 5% x 6/12 x ETB51.28] 384,600

Note Payable 378,000

Foreign Exchange Loss 6,000

Cash 384,000

[300,000 x ($1.28 - $1.26)] 6,000

Compiled by Wubeshet Kifle](https://image.slidesharecdn.com/accountingandreportingforforeigncurrencies-220204030844/75/Accounting-and-reporting-for-foreign-currencies-45-2048.jpg)