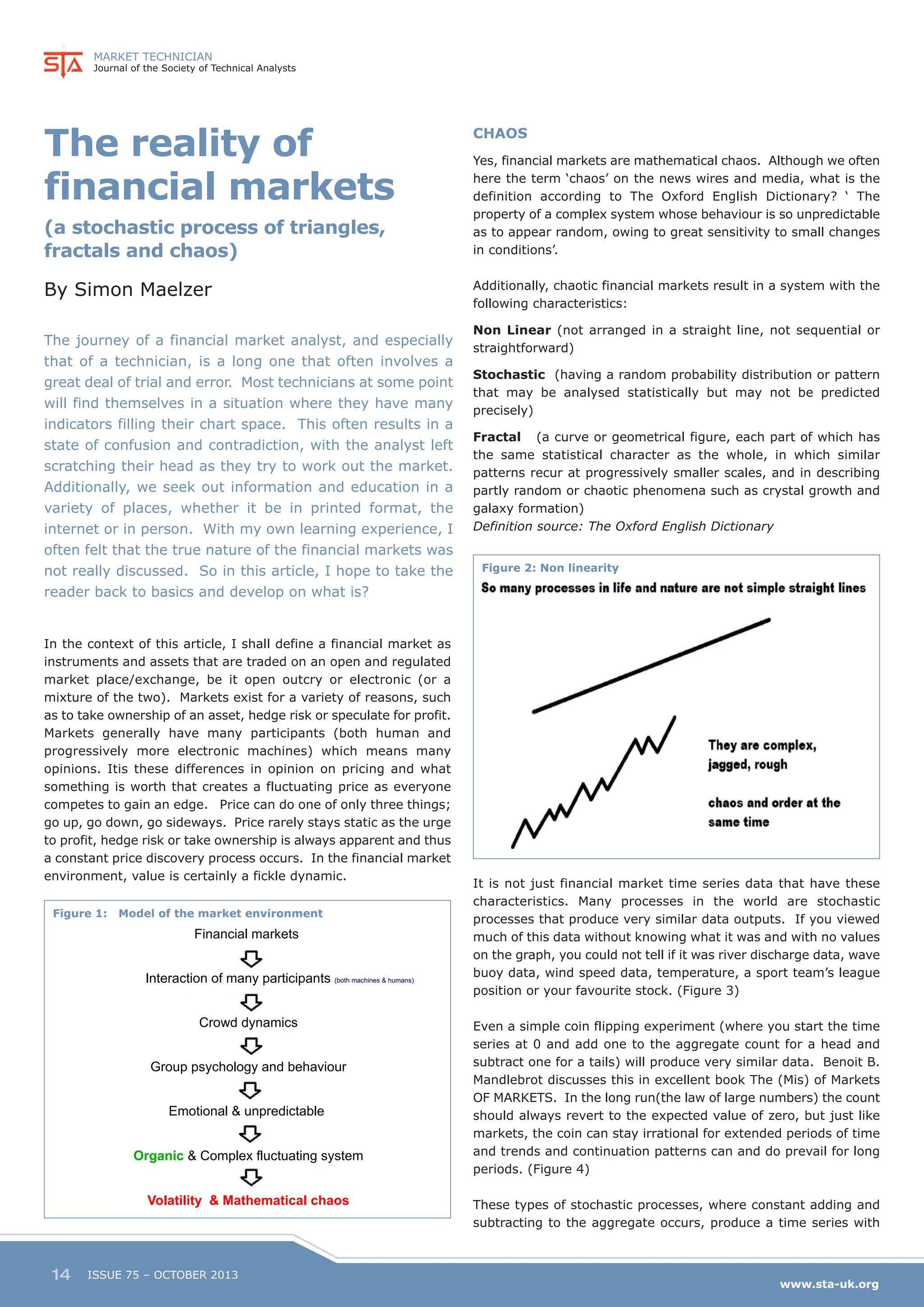

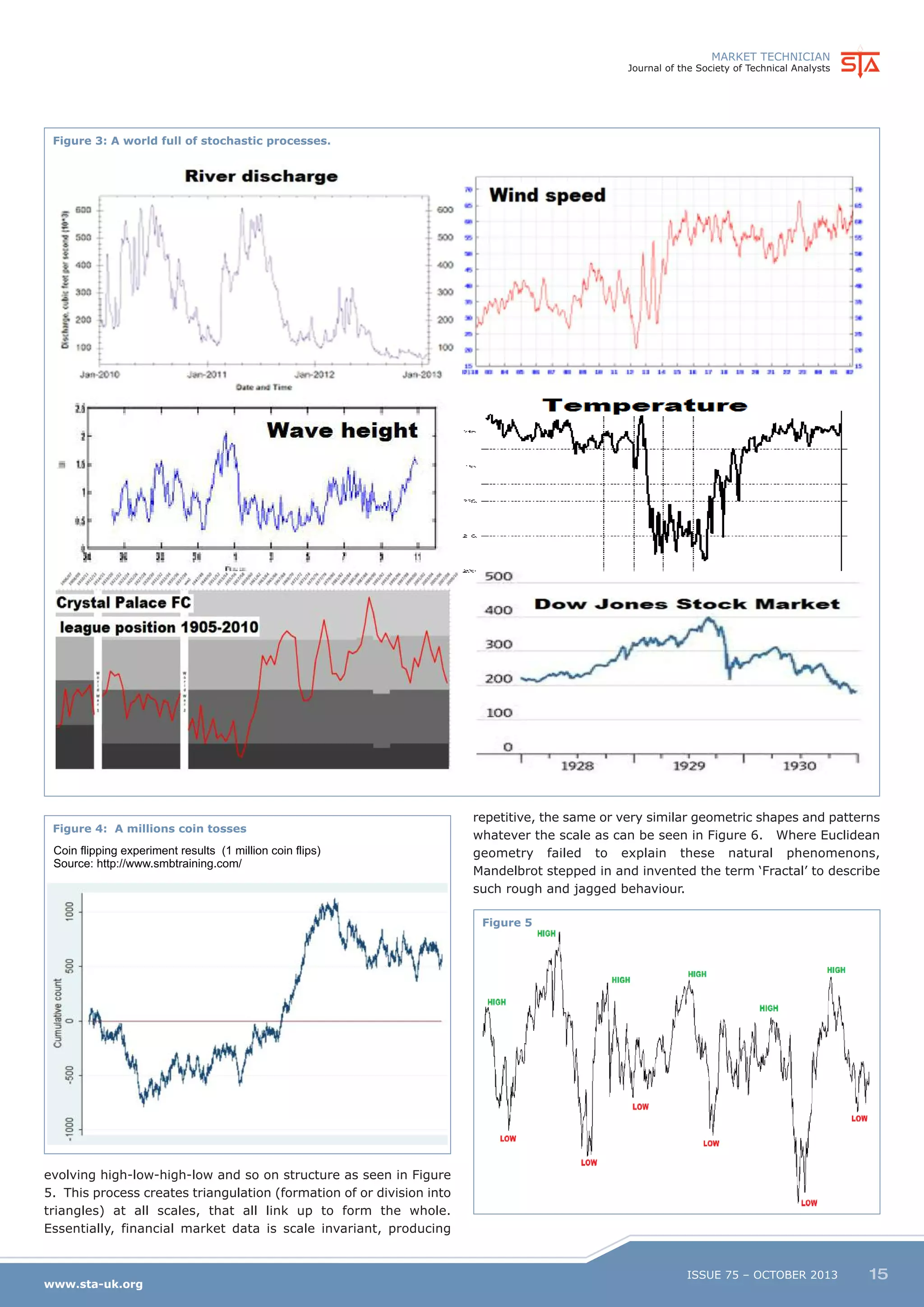

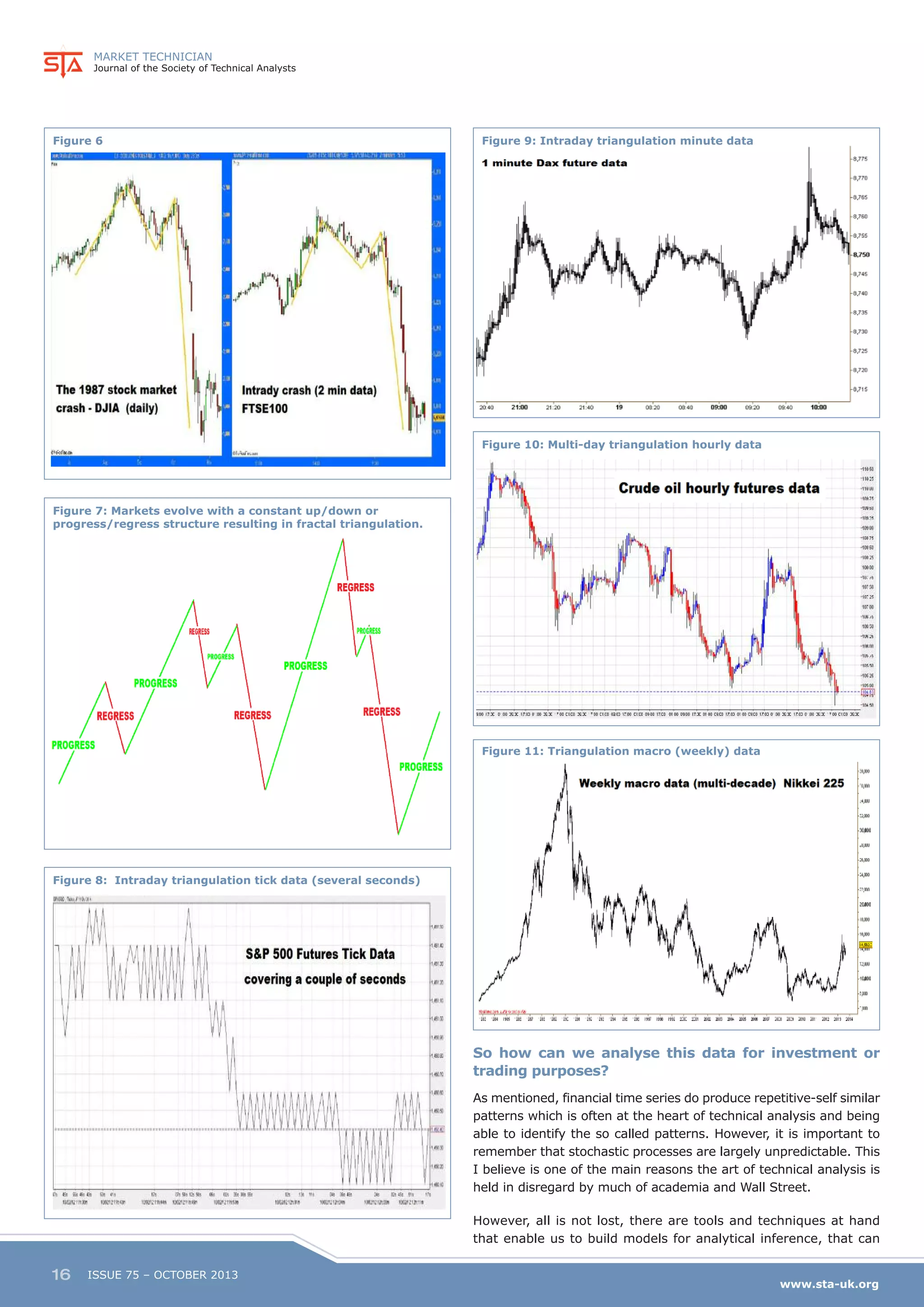

1) Financial markets exhibit characteristics of chaos, nonlinearity, stochastic processes, and fractals. They are unpredictable yet display repetitive patterns at different scales.

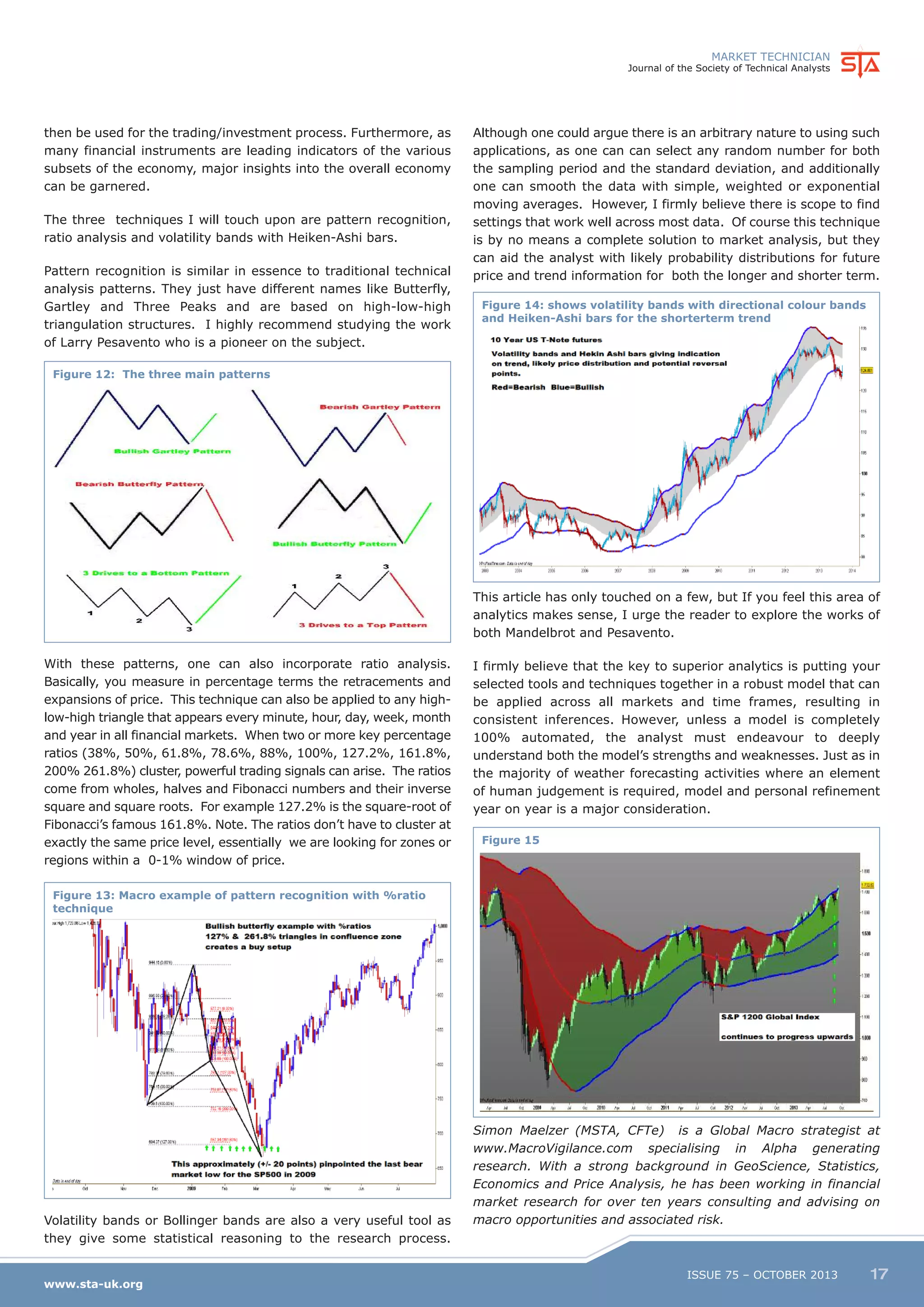

2) Techniques like pattern recognition, ratio analysis, and volatility bands can help analyze chaotic market data and build analytical models, despite the inherent unpredictability. Ratios based on Fibonacci numbers and percentages can signal when patterns are forming.

3) Volatility bands provide a statistical framework to infer future price trends and distributions in the short and long term. Combined models that incorporate multiple techniques applied across timeframes can provide consistent market insights.