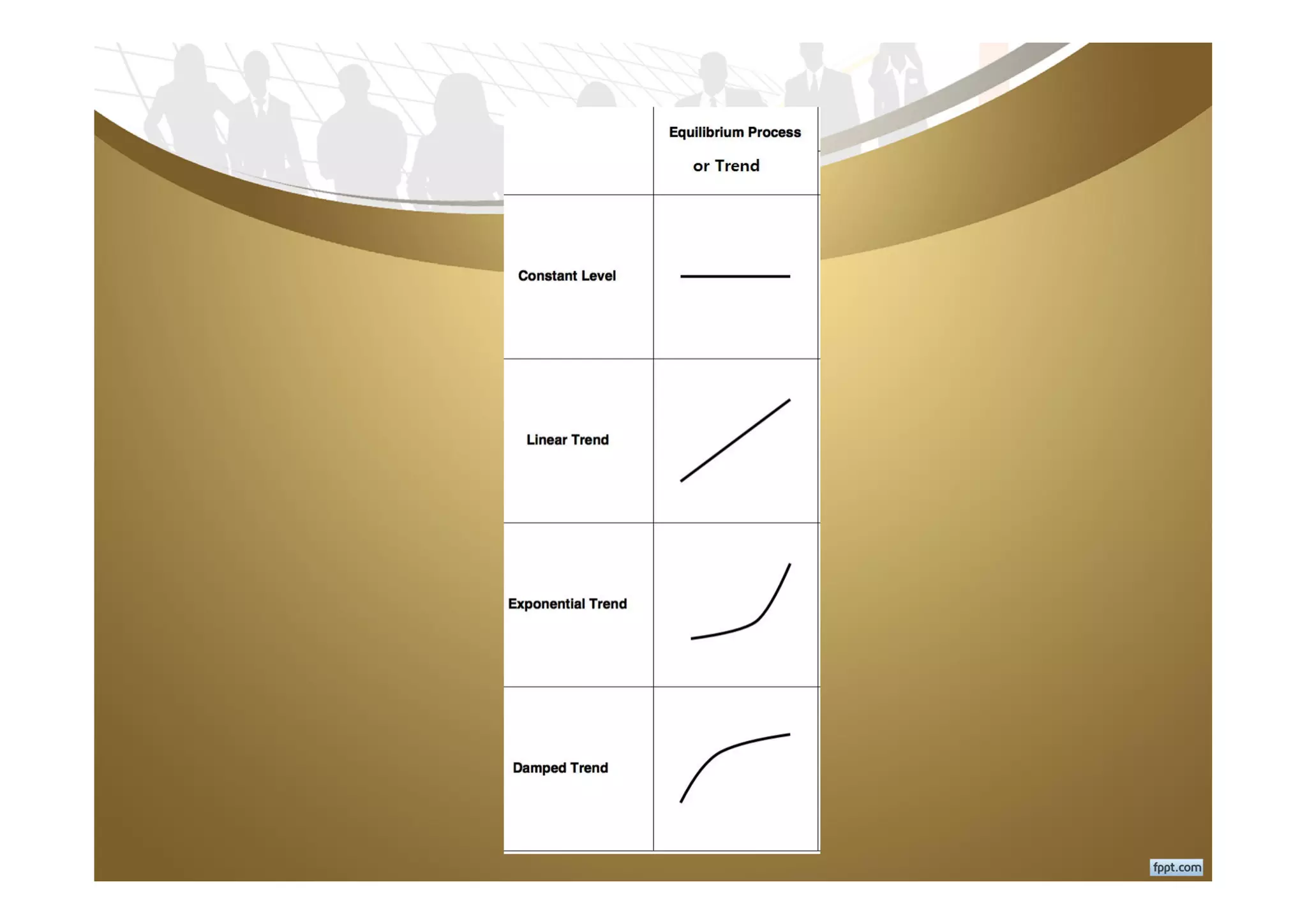

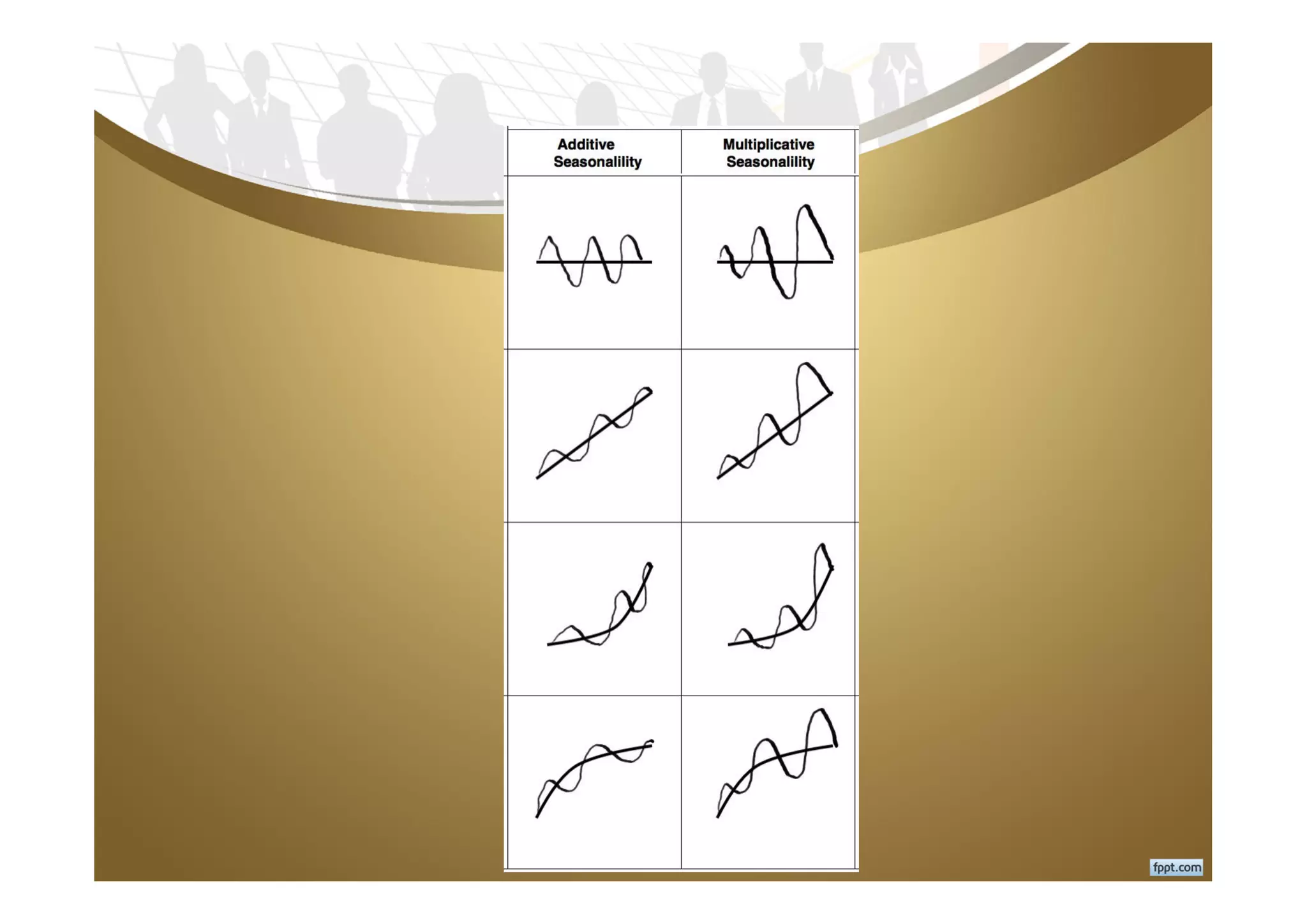

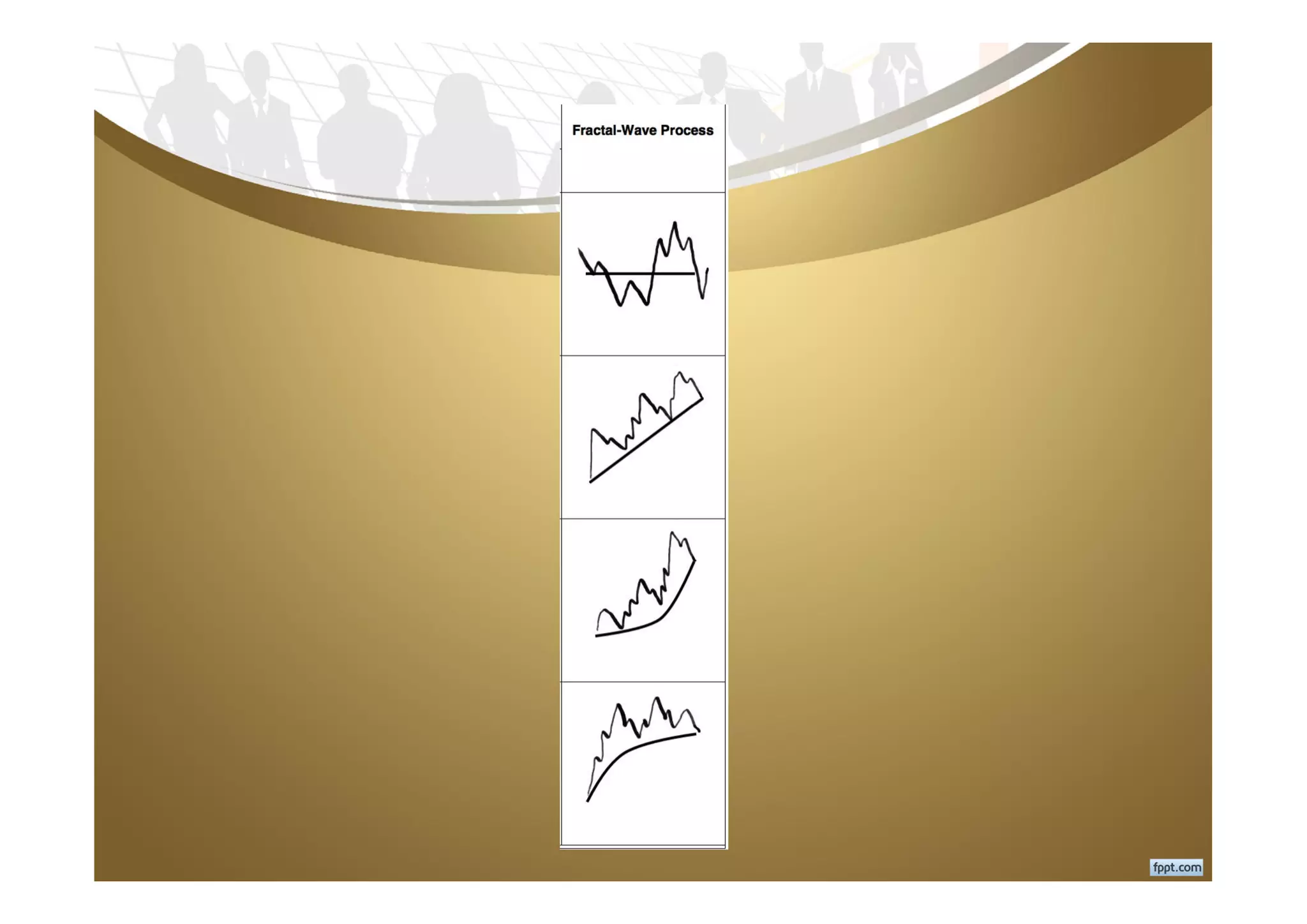

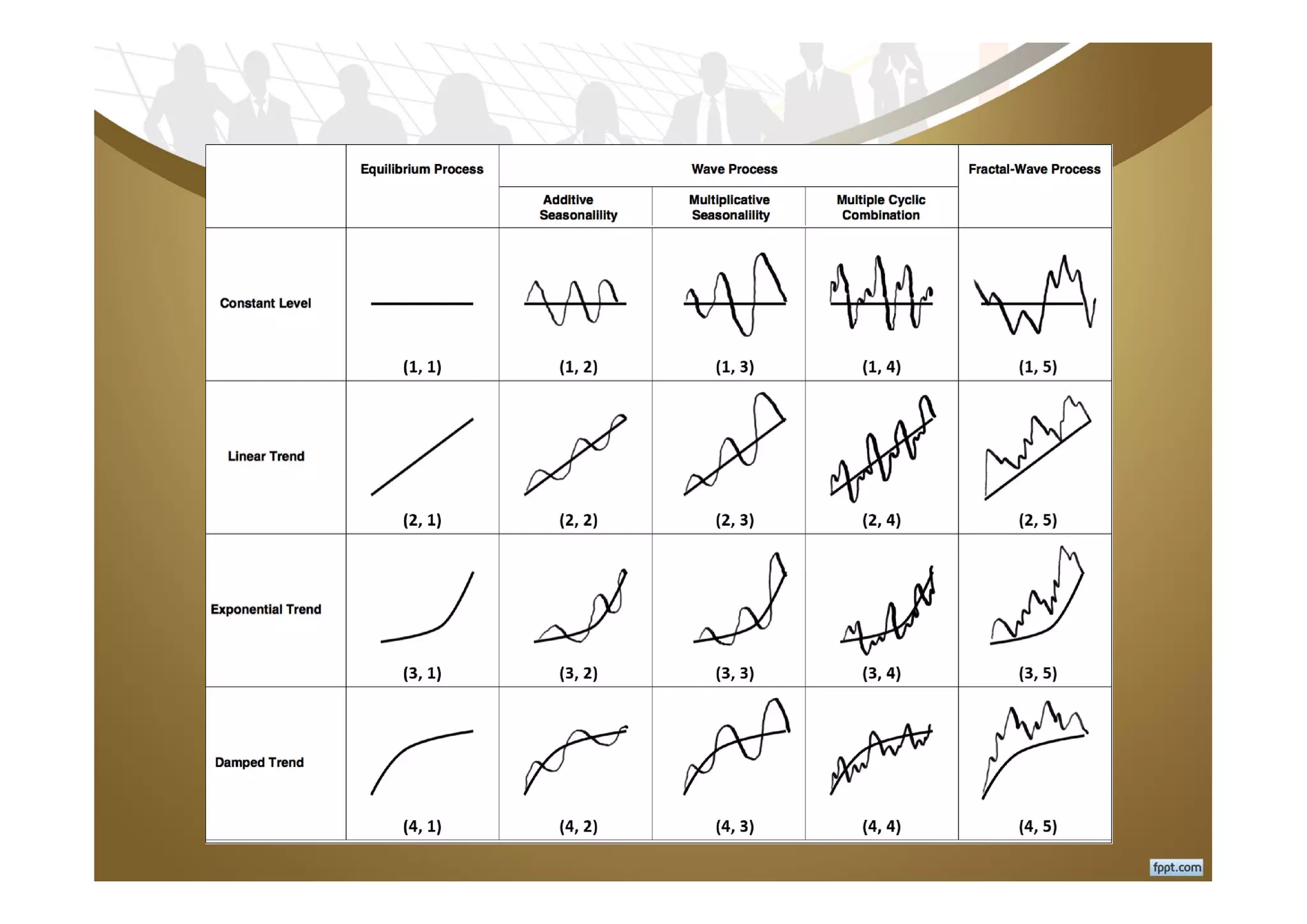

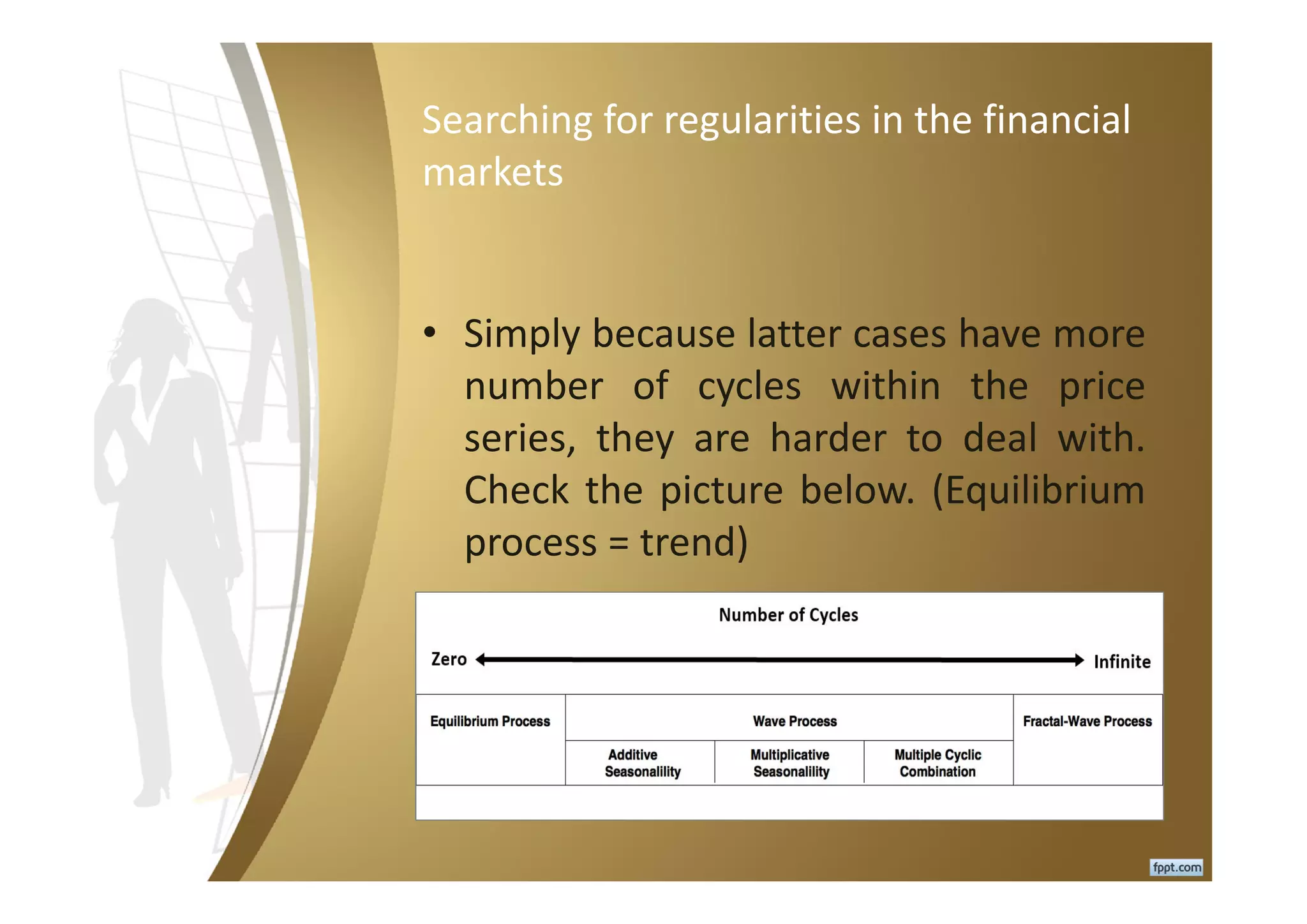

This document discusses searching for regularities in financial markets to develop effective trading strategies. It outlines several common regularities: trends, seasonality, cycles, and fractal waves. It notes that real-world financial series often exhibit combinations of these, like trends plus multiple cycles or fractal waves. Techniques for analyzing these combinations are discussed, including technical indicators, Fourier transforms, and popular patterns like Elliott waves and triangles/wedges. Price action and pattern trading strategies are best suited for discerning fractal wave patterns combined with trends. Understanding the underlying regularities can help traders select appropriate analytical tools.