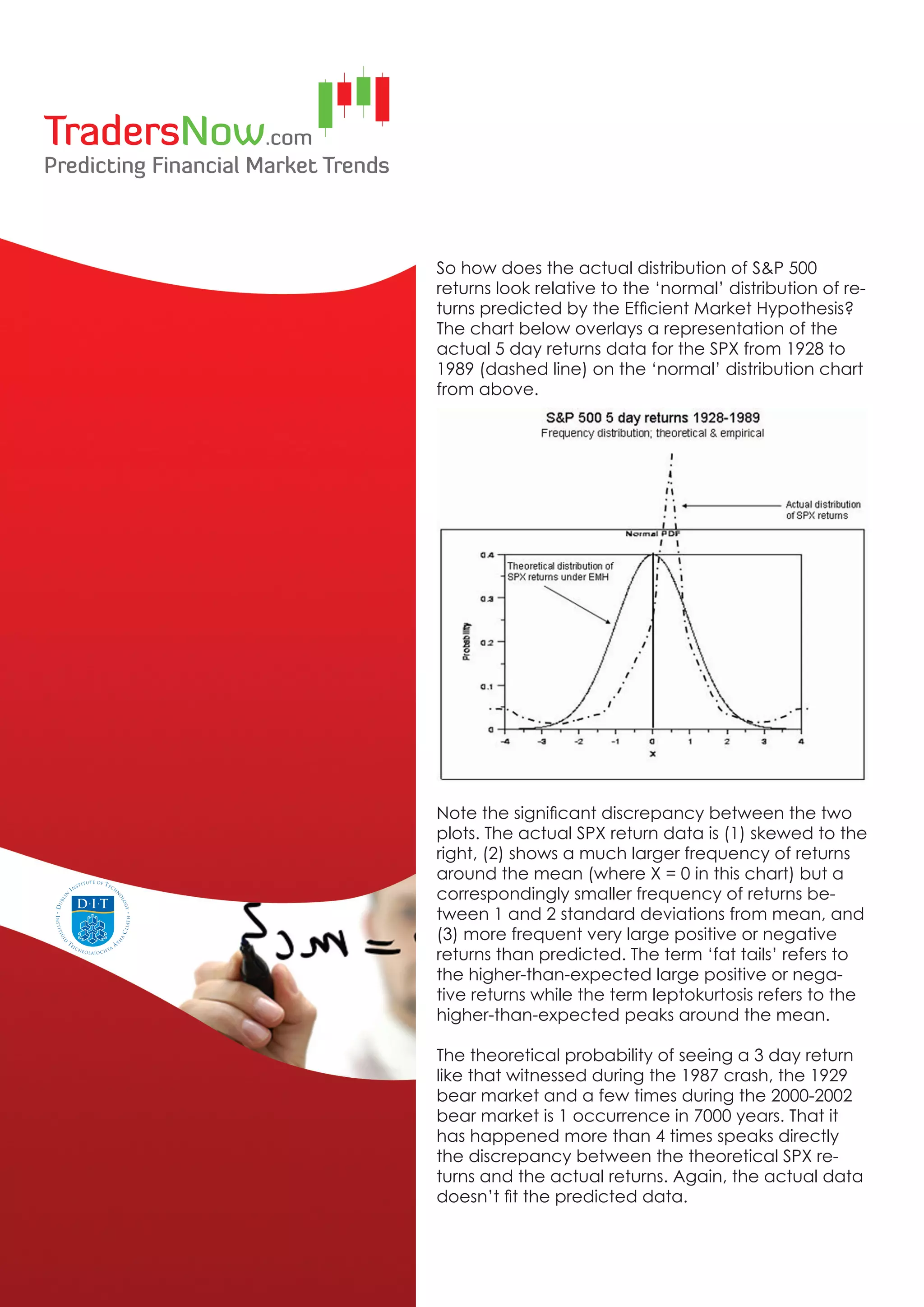

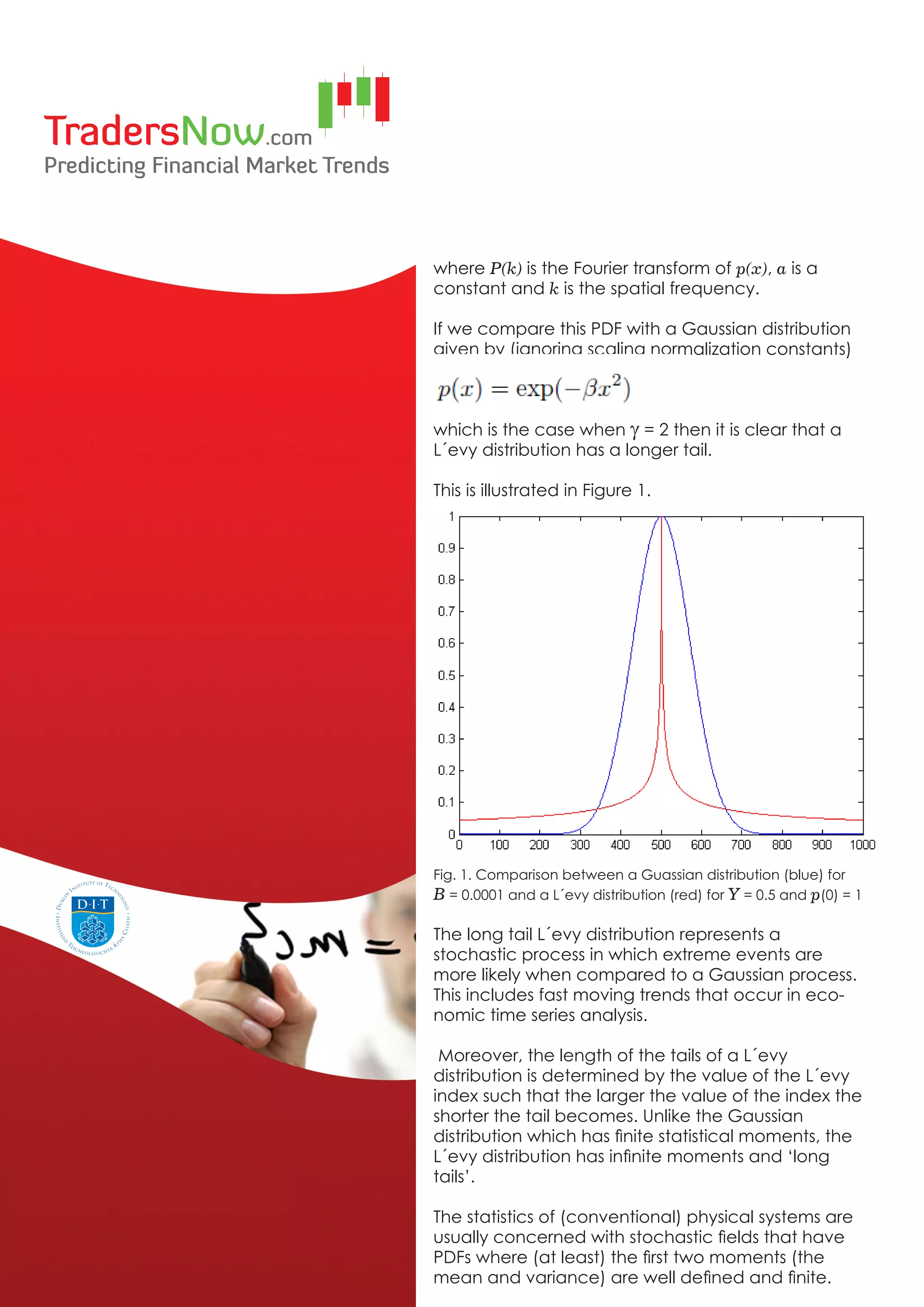

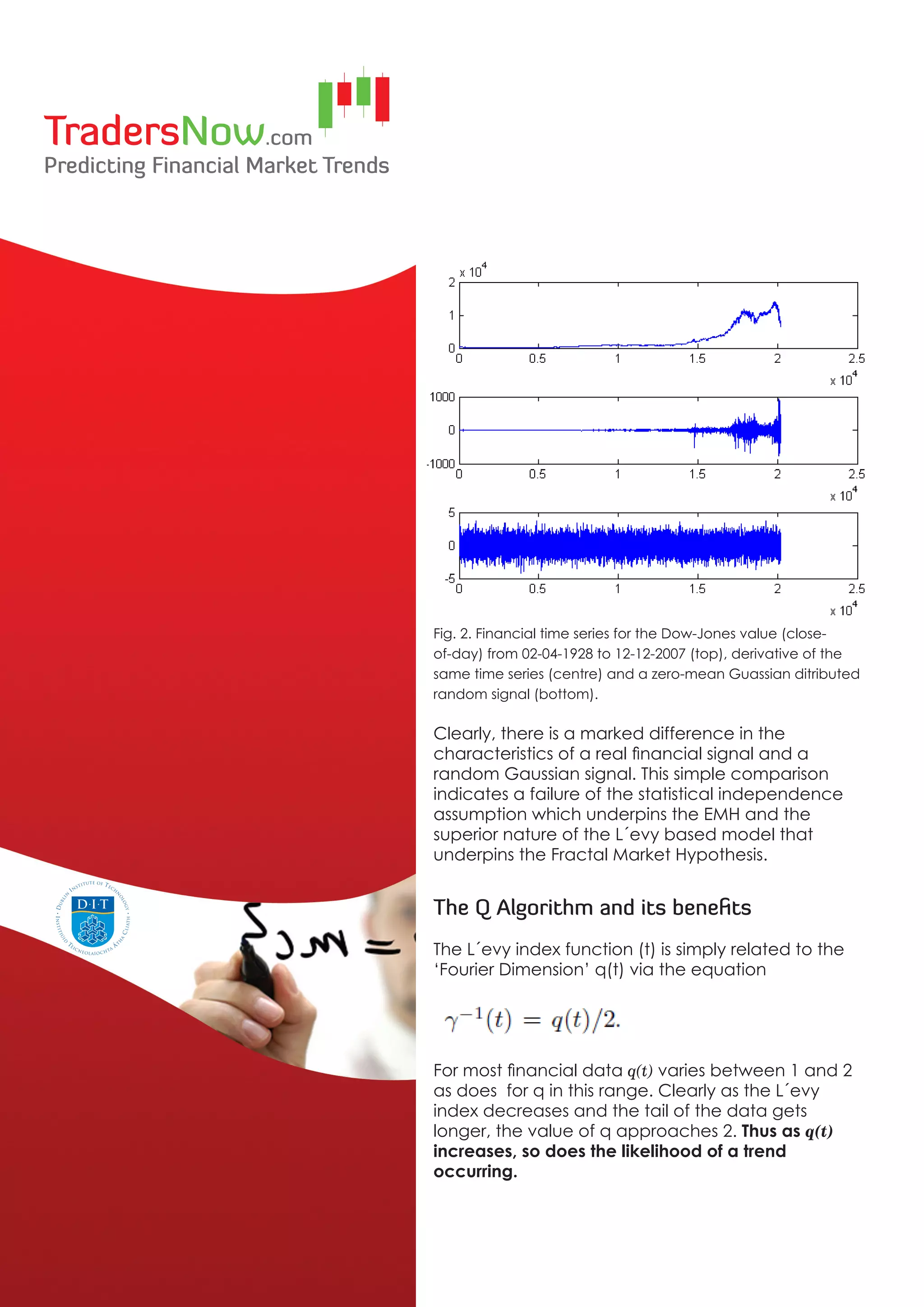

The document discusses the limitations of the Efficient Market Hypothesis (EMH) in explaining real financial market behavior, arguing for the Fractal Market Hypothesis (FMH) as a more accurate model. It highlights how actual market returns contradict the normal distribution predicted by EMH, exhibiting characteristics such as fat tails and leptokurtosis that suggest deeper underlying dynamics. The Q algorithm developed by TradersNow leverages the Levy index to forecast market trends by analyzing the behavior of financial time series data.