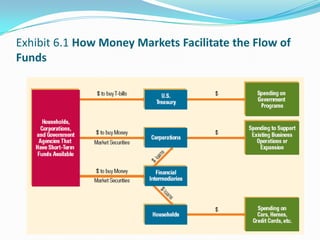

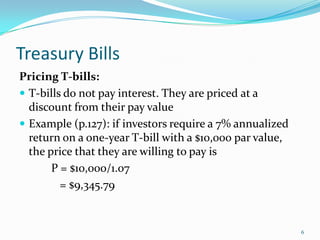

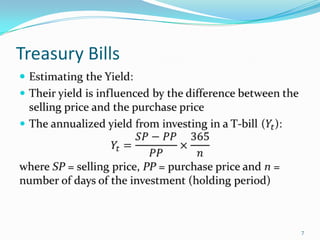

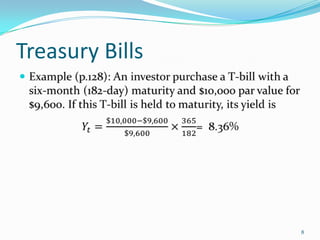

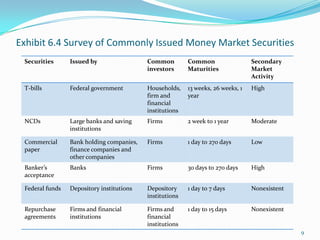

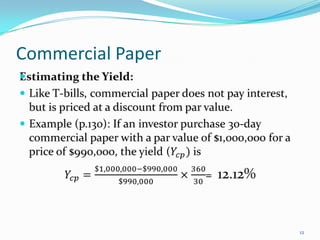

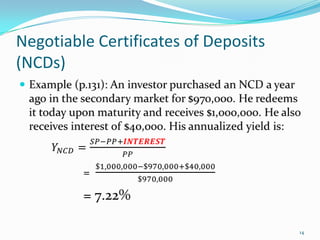

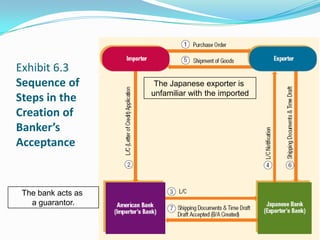

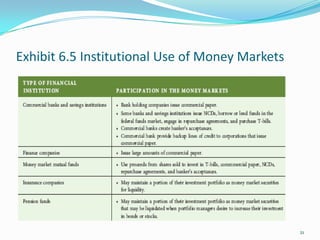

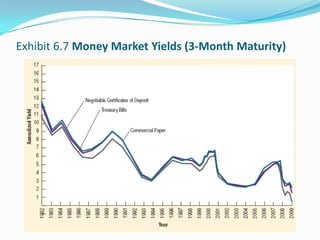

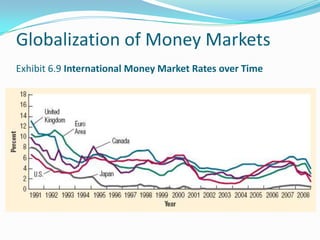

This document outlines key aspects of money market securities and the money markets. It discusses the main types of money market securities including treasury bills, commercial paper, negotiable certificates of deposit, repurchase agreements, federal funds, and banker's acceptances. It also examines how various financial institutions use money markets and how money market securities are valued based on factors like interest rates, risk, and credit risk. Additionally, it explores the globalization of money markets over time.