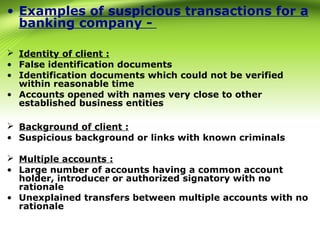

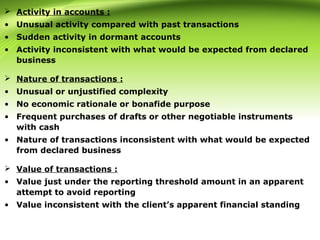

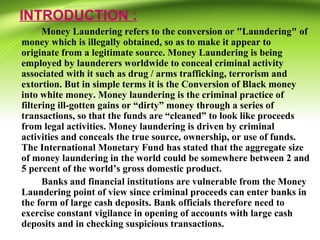

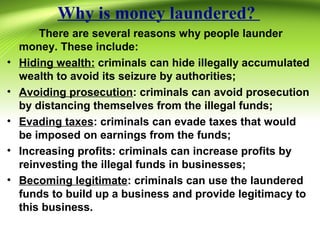

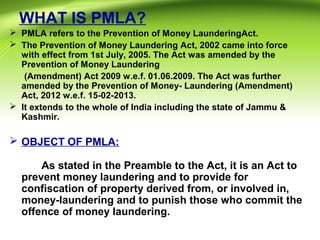

Money laundering is the process of making illegally obtained money appear legal. It occurs in three steps: placement, layering, and integration. The Prevention of Money Laundering Act (PMLA) was implemented in India to prevent money laundering and confiscate illegally obtained funds. Under PMLA, banks and financial institutions must maintain records of all transactions and report any suspicious activity. Common red flags include false identification documents, inconsistent transaction history or amounts, and links to known criminals.

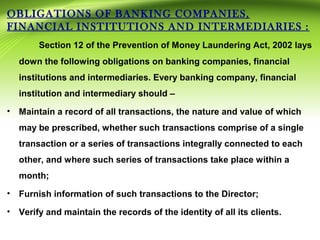

![Monetary Penalties for Non Maintenance of

Records 46

• Monetary penalties can be imposed on

defaulting reporting entity or its designated

Director on the Board or any of its employees,

which shall not be less than ten thousand

rupees but may extend to one lakh rupees for

each failure [Section 13(2)(d)].](https://image.slidesharecdn.com/amlpresentation-180326150919/85/Aml-presentation-12-320.jpg)