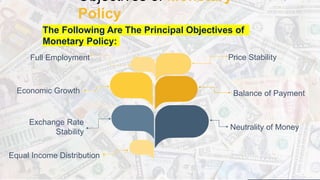

Monetary policy involves actions by a nation's central bank to control money supply and achieve economic goals such as full employment, price stability, and economic growth. Key types of monetary policies include expansionary, contractionary, countercyclical, rule-based, and discretionary policies, each serving different economic objectives. The tools used in monetary policy include open market operations, bank rates, and cash reserve requirements among quantitative and qualitative methods.