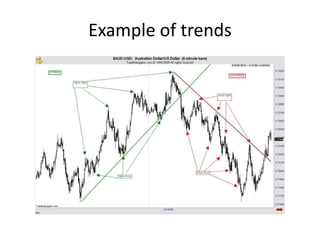

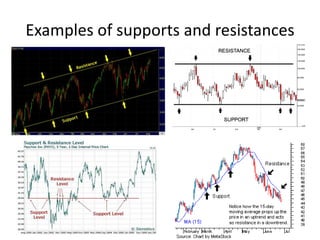

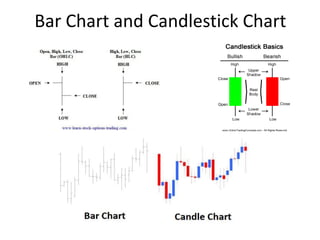

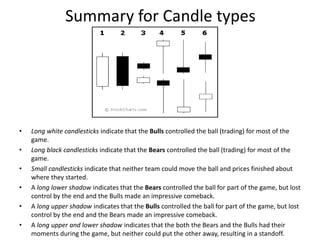

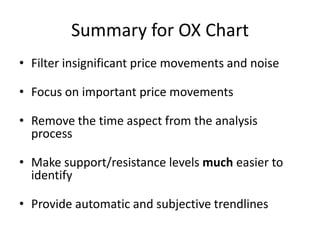

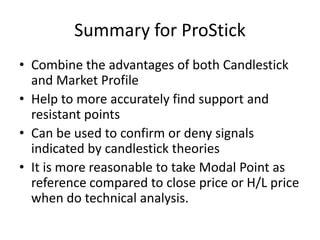

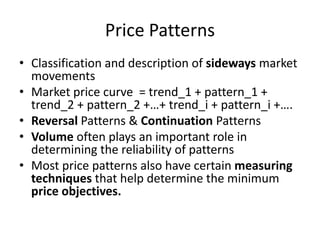

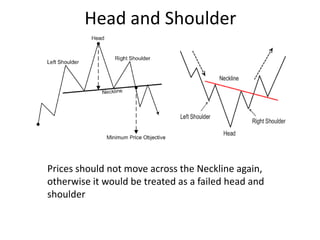

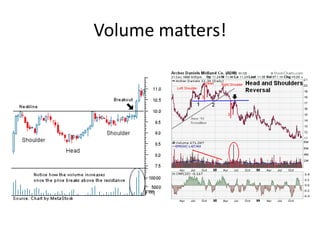

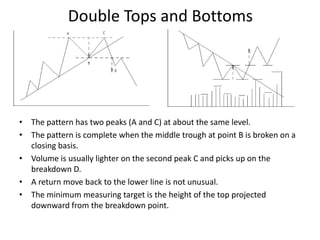

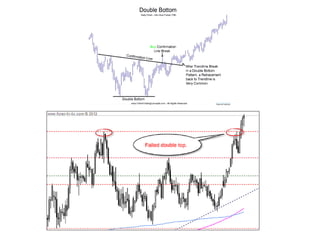

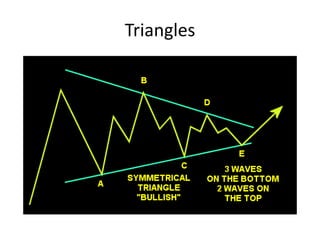

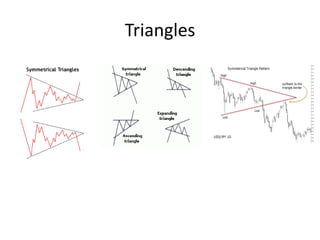

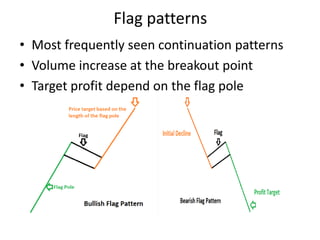

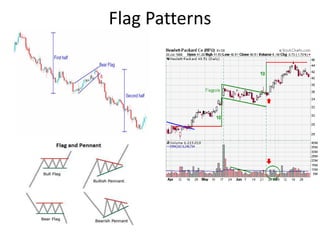

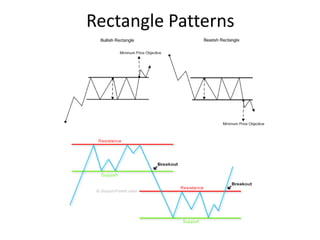

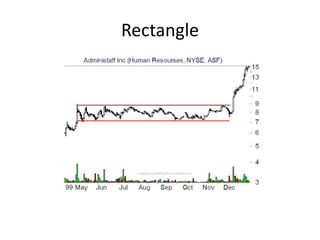

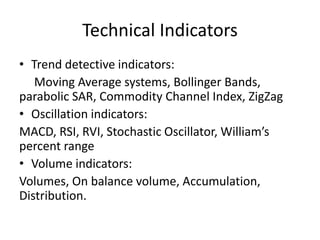

This document provides an overview of technical analysis approaches for understanding the market. It discusses the philosophy and assumptions behind technical analysis, including that prices move in trends and history repeats itself. It defines key concepts like trends, support and resistance, and different charting styles. It also covers reversal and continuation patterns, the principle of confirmation and divergence, and introduces MetaTrader 4 platform and indicators. The document is the first part of an outline on technical analysis and previews topics to be covered in more depth in part two.