This document provides an overview of various technical indicators used in stock analysis, including moving averages, stochastics, RSI, MACD, Bollinger Bands, CCI, and directional indicators. Each indicator is defined, accompanied by calculation methods, practical applications, and examples of their use in predicting trends and making trading decisions. The content is aimed at traders and analysts looking to utilize these indicators to enhance their market strategies.

![__________________________________Technical Analysis____________________________________

After determining the optimum moving average for a currency, this average price

line can be used as a line of support in maintaining a long position or resistance in

maintaining a short position. Breaches of this line can also be used as a signal that a

currency is in the process of reversing course, in which case a trader will want to

pare back an existing position or come up with entry levels for a new position

Reference:

1. http://www.forex.com/forex_technical_indicators.html

STOCHASTICS (%K, %D Fast, %D Slow)

Description and Usage:

Stochastic studies, or oscillators, are another useful tool for monitoring the expected

sustainability of a trend. They provide a trader with information about the closing

price in the current trading period relative to the prior performance of the instrument

being analyzed.

Stochastics are measured and represented by two different lines, %K and %D and

are plotted on a scale ranging from 0 to 100. Indications above 80 represent strong

upward movement while level indications below 20 represent strong downward

movements.

Fast stochastics (%K) can be very choppy. One can reduce choppiness by either

increasing the number of periods or by using the further smoothed form, %D Slow.

%D Slow is a moving average of %D. To create %D Slow you must select the

number of intervals to include in the average as well as the parameters used to

create %K and %D.

Calculation:

%K = [ (Close – Low) / (High – Low) ] * 100

Where,

Close = Closing price for that period

Low = Lowest price for that period

High = Highest price for that period

From above equation you will notice that

1. Since, (Close – Low) will always be <= (High – Low), %K will always be

between 0 and 100.

i.e. When Closing Price = Low , %K = 0

When Closing price = High, %K = 100

2. Note: Since (Close – Low) is a fraction of (High – Low) , %K will increase if

the security closes at a higher price i.e. closer to the highest price. Closing

Copyright © 2006 Prashant Ram, All rights reserved_______________________________________ 4](https://image.slidesharecdn.com/introductiontotechnicalanalysisininvestmenttrading-100818161517-phpapp01/75/Introduction-to-Technical-Analysis-in-Investment-Trading-4-2048.jpg)

![__________________________________Technical Analysis____________________________________

Calculation:

RSI = 100 - [ 100 / (1 + RS) ]

RS = (Avg of N period UP Close) / (Avg of N Period DOWN Close)

N is typically, 14 period

Example:

Following example calculates RSI over a 14 day period,

1.

Date Close UP DOWN 22.61 – 22.44

Up close since

1-Nov 22.44 prices are closing

2-Nov 22.61 0.17 up

3-Nov 22.67 0.06

4-Nov 22.88 0.21

5-Nov 23.36 0.48

8-Nov 23.23 -0.13

9-Nov 23.05 -0.18 23.23 – 23.36

10-Nov 22.86 -0.19 Down close since

prices are closing

11-Nov 23.17 0.31

down

12-Nov 23.69 0.52

15-Nov 23.77 0.08

16-Nov 23.84 0.07

17-Nov 24.32 0.48

18-Nov 24.80 0.48

14 Days Total 2.86 0.5

2.

Avg of 14 period UP Close = 2.86 / 14 = 0.204

Avg of 14 period DOWN Close = 0.5 / 14 = 0.036

3.

RS = 0.204 / 0.036 = 5.72

1 + RS = 6.72

4.

RSI (on 19 Nov) = 100 – [ 100 / 6.72 ] = 85.12

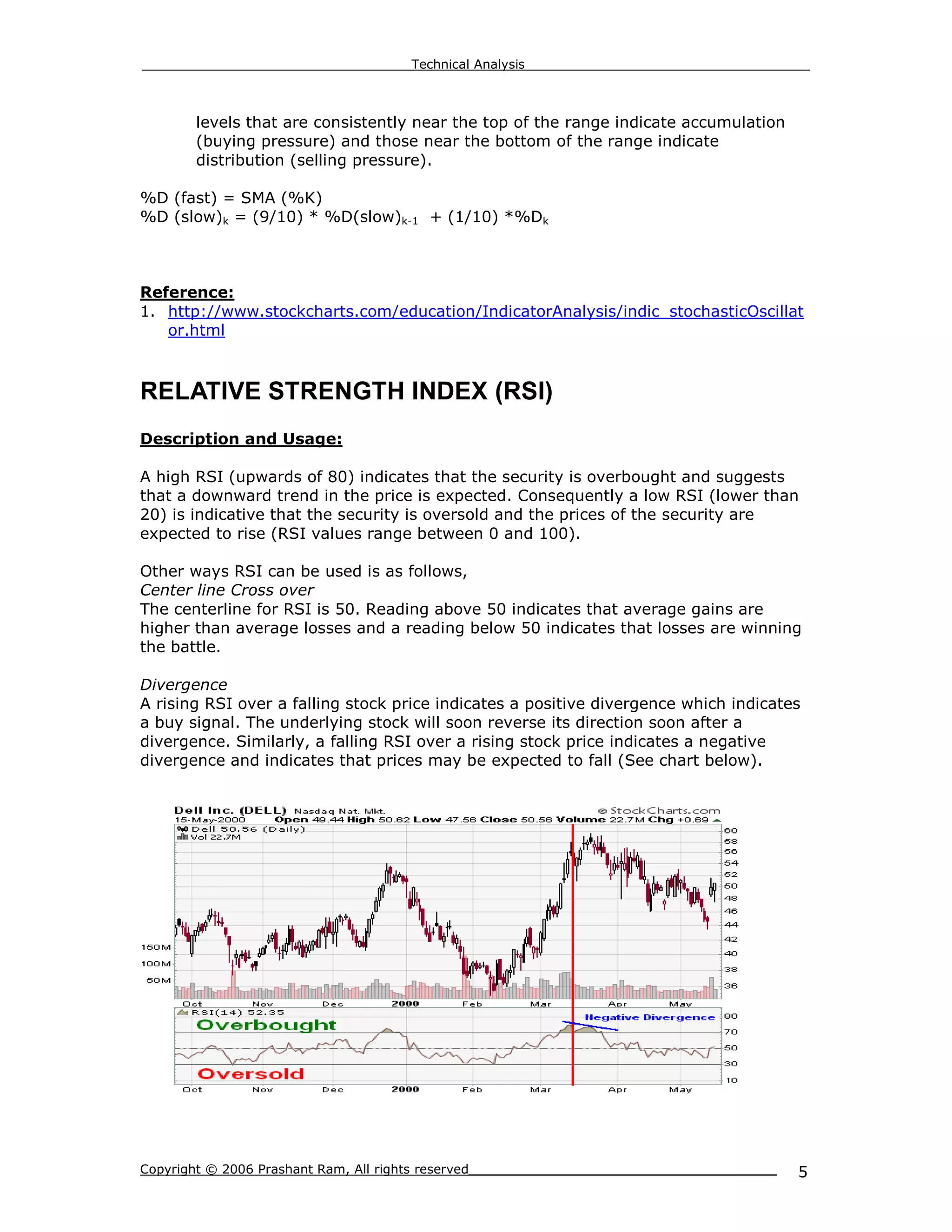

RSI for 19th Nov is 85.12 which is indicative that the stock is possibly overbought

and the stock prices are expected to fall. Note how the large series of up days and

the very small number of down days led to this up extreme reading.

References:

1. http://www.streetauthority.com/terms/r/rsi.asp

2. http://www.stockcharts.com/education/IndicatorAnalysis/indic_RSI.html

Copyright © 2006 Prashant Ram, All rights reserved_______________________________________ 6](https://image.slidesharecdn.com/introductiontotechnicalanalysisininvestmenttrading-100818161517-phpapp01/75/Introduction-to-Technical-Analysis-in-Investment-Trading-6-2048.jpg)