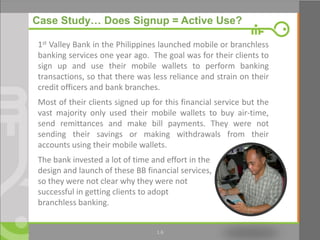

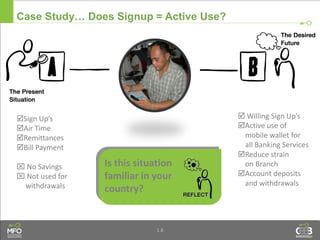

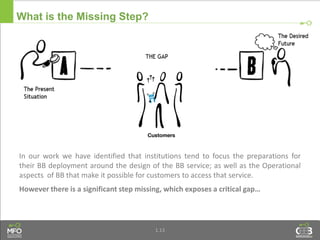

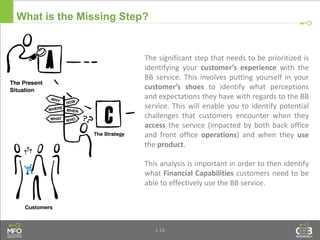

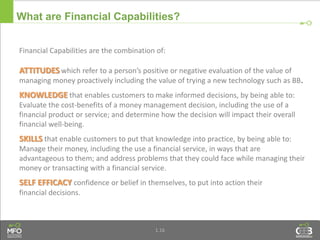

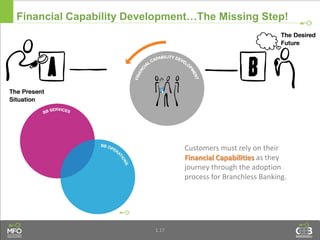

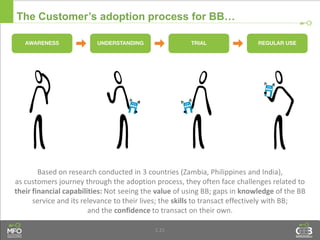

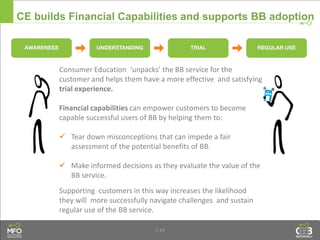

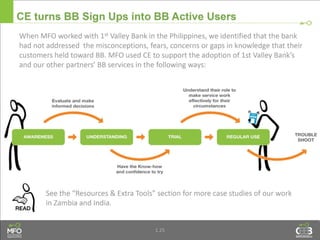

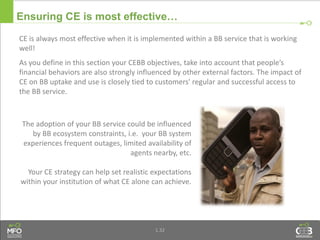

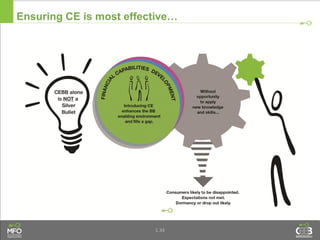

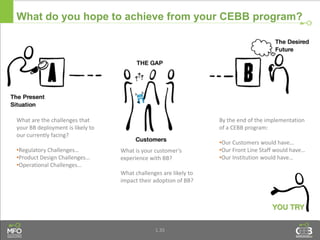

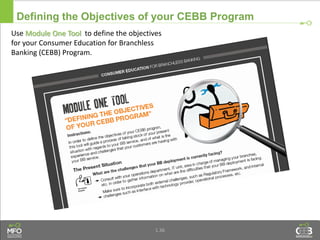

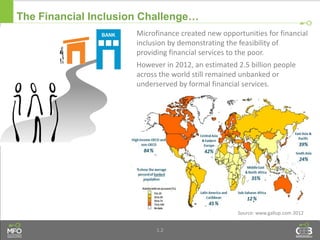

The document discusses how developing customers' financial capabilities through consumer education can help address challenges to adopting branchless banking and support building an active customer base. It explains that focusing on understanding the customer experience, identifying financial capability gaps, and designing education to build relevant knowledge, skills, attitudes and self-efficacy can help customers more successfully adopt and regularly use branchless banking services. The case study of a bank in the Philippines highlights how simply signing customers up did not translate to active use of mobile wallets, showing the importance of the missing step of financial capability development.

![1.4

The Rapid Global Expansion of Mobile Money

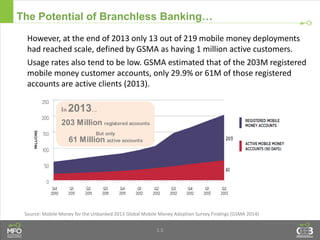

Source: Mobile Money for the Unbanked 2013 Global Mobile Money Adoption Survey Findings (GSMA 2014)

Branchless Banking [BB] has the potential to expand access and support financial

inclusion efforts amongst previously hard to reach consumer segments.

BB opens up new access channels able to bring unbanked households into

formal financial services for the first time.

In 2013alone …

219 Live services

84 Countries](https://image.slidesharecdn.com/module1introductiontocebbpptslideshare-140710155341-phpapp01/85/Module-1-introduction-to-cebb-ppt-slideshare-12-320.jpg)