Global Trends Driving Corporate Mobile Banking Adoption

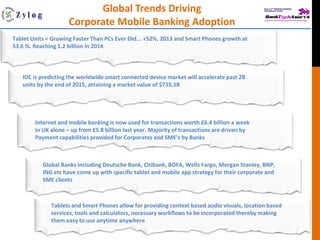

- 1. Global Trends Driving Corporate Mobile Banking Adoption IDC is predicting the worldwide smart connected device market will accelerate past 2B units by the end of 2015, attaining a market value of $735.1B Barriers to mobile payment success Tablet Units = Growing Faster Than PCs Ever Did... +52%, 2013 and Smart Phones growth at 53.6 %. Reaching 1.2 billion in 2014 Internet and mobile banking is now used for transactions worth £6.4 billion a week in UK alone – up from £5.8 billion last year. Majority of transactions are driven by Payment capabilities provided for Corporates and SME’s by Banks Global Banks including Deutsche Bank, Citibank, BOFA, Wells Fargo, Morgan Stanley, BNP, ING etc have come up with specific tablet and mobile app strategy for their corporate and SME clients Tablets and Smart Phones allow for providing context based audio visuals, location based services, tools and calculators, necessary workflows to be incorporated thereby making them easy to use anytime anywhere

- 2. Global Tablets Enterprise Adoption Market Competition Trends A 50 percent market share for tablets will equate to around 285 million units shipped in 2014. By 2017, that figure will soar to 396 million devices Tablets running the Android operating system are likely to lead the way, accounting for 65 percent of all shipped tablets Competition and prices of tablets available in the market would give end consumers and affordable option thus increasing the market size. Enterprise adoption of tablets Forrester predicts 18 percent of tablet sales to come from businesses Enterprise tablets will make up around 12 percent of the 186 million tablets Business adoption for internal and customer-facing purposes will drive tablets to become 18 percent all tablets in use by 2017 Forrester also forecasts that the total installed base of tablets will reach 905 million by 2017, rising from 327 million tablets this year, to 654. million by 2015 and 795 million by 2016. By 2017, one in eight people in the world will own a tablet.

- 3. Corporate Mobile Banking – Trends and Implications Implications Trends A global survey conducted by Fundtech and AiteGoup found that 65% of treasury executives are already interested in using tablet & mobile corporate banking services. For many corporate treasurers and financial officers, their mobile device is no longer their 'back-up' but the first tool they go for when they need to take care of corporate banking business Moving from account snapshots to being able to initiate payments and approve wire transfers Action-oriented tools are heavily influenced by the explosion in the use of big screen tablets in Banking Corporate tablet and mobile banking deployment has increased from 1 in 2009 to estimated 15 in 2013 in top 25 US banks. Banks with CMB on their roadmap state that the main reasons for providing a CMB application are: addition of a new delivery channel, paradigm shift, competitive differentiation & revenue generation CMB users would prefer to have basic features like checking balances & transferring funds with high openness to use advanced functions like approving transactions and initiating payments.

- 4. Channel Integration & Cost Management have become important Implications Trends In the last few years, there has been tremendous increase in the number of customers using mobiles, tablets & social media. Banks need to expand their service offerings to various direct channels. These channels need to be integrated with the older channels of banking. Corporate customers now want to bank through their smartphones & tablets. In fact they use a mix of all banking channels. Banks must provide a consistent look & feel throughout all the banking channels (Omni channel). Banks must Integrate the channels in order to provide a consistent experience. Expensive to maintain branches Regulatory reforms like Basel III and IV will make funds more expensive for the bank. Direct Channels are more cost saving than other traditional channels like branches. So banks are now concentrating in developing and integrating the direct channels with the traditional. Banking products & services are becoming almost similar throughout the industry and achieving a differentiating point has become difficult for banks . The number of customers shifting banks have increased Multi channel integration has become all the more important because banks are trying to earn competitive edge by improving the customer experience.

- 5. Global Trends in Corporate Banking Channels 0% 50% 100% Inadequate Products & Services Ease of acess to services (Channels) Interest rates and fees Insufficient geographc coverage /… Insufficient turnaround time Financial Weakness Top Reasons Cited by Banks for Lost Corporate Business Top Reasons Cited by Banks for Lost Corporate Business Source: Finextra / Pegasystems “Corporate Banking Satisfaction Survey 2013” Trends Multi-Channel: •Multi Channel access is demanded by corporate clients of Banks •Tablets/smartphones are widely regarded as a game changer for Banks wanting to provide the best of services to their corporate clients User Experience: •Ease of Access – Primary reason for banks losing our corporate business •Banks are struggling to execute their portal vision of a unified cash/treasury management portal. Implications Multi-Channel: •Creating applications compatible with tablets and mobile devices. •Existing apps need to be elevated to the power and flexibility of the dashboard experience. •Banks require a common framework for creation of device agnostic components accessible on varied devices. User Experience: •Revamp user administration and entitlements online user experience. •Implement Electronic Bank Account Management (EBAM). Large global banks have gone through pilots (e.g., RBS, Citi, JPMorgan, BNY Mellon). •Consistent user experience should be the core around which the entire portal strategy needs to hinge upon. •Critical to Categorize dashboard elements to strike a balance between usability and functionality. Workforce who have requested a Tablet Senior managers who have been issued a tablet Personal devices used irrespective of company's policy 21% 38% 57% Tablet adoption within enterprises Google, 51.70% Apple, 38.90% BlackBerry, 5.40% Microsoft, 3.20% Symbian, 0.50% Google Apple BlackBerry Microsoft Symbian Source : Comtrade Feb 2013 Market share (OS ) in Global market

- 6. Global Trends in Corporate Banking Channels Trends: •Forecasting cash flows / liquidity remains to be a challenge •Remote Cash Capture Solution Space Heating Up Cash Management Payments Trend: Global Electronic Transaction Volumes Continue to Increase Creation & Approval of RTGS and SWIFT payments on mobile Implications: •Reporting to providing value-added real-time analytics with the ability to aggregate, analyze, and parse data. •Increasing adoption of RCC by banks is creating better value proposition for merchant. •Software applications providing business intelligence to RCC clients leads to retention. Implications: •Key initiatives for achieving real time commerce. •Seamless mobile experience to enable approvals and reporting. •Configurable reports and dashboards to keep track of payments.

- 7. Global Mobile Banking Trends in Corporate Banking 33% 29% 26% 31% 26% 28% Check Balances Pay Bills Transfer Funds ( Within the Bank) Currently Using Interesting in Using Small Business Adoption of the Most Common Mobile Capabilities Source: Aite Group: August 2011 “Small Business Mobile Banking: A Promising Opportunity” 19% 17% 15% 14% 12% 33% 32% 23% 26% 32% Make Expedited Payments Approve Credit Card Transactions Approve Payroll Batches/ ACH Payments Approve Wires View and make positive pay decisions Currently Using Interesting in Using Small Business Interest in More Advanced Mobile Capabilities Source: Aite Group: August 2011 A Survey of 291 US Small Businesses 42% 39% 33% 25% 19% Forecasting Cash Flow Being able to borrow money or get a credit card Effectively collect money owed/Accounts receivable Tracking Cash Flows Efficiently Processing Payroll % Stating "Challenging" or "extremely Challenging" Significant Pain-points for SMEs Implications Innovation Drivers •Banks can gain significantly by increase in market share by providing solutions to key pain points for the corporate & SMB users. •Building solutions catering dynamic cash flow forecasting, access to easy short term capital and managing account receivables should be key factors driving innovation to gain market share. Capturing latent demand •Expedited Payments & Credit card transaction approval has a strong latent demand focusing on these offerings should be key future initiatives •Positive pay decisions can be a critical component to be used by SMB for Fraud management and can be a potential differentiating factor for mobile Banking. •Transfer Funds, Pay bills & Transfer are must to have offerings for all mobile solutions considering their wide usage Trends Rate of Adoption •An increasingly number of Small Business enterprises are considering Mobile offerings as an important element in Bank Selection. •Corporates & Small Business enterprises primarily use Check Balances, Pay Bills & Transfer Funds Features and there is a strong latent demand among non users for these features as well. •Among advanced features expedited payments is one of the key attractions. Business impact trend •Dynamic cash flow forecasting, account receivable management, short term capital access are key success factors for SMB mobile solutions.

- 8. Global Mobile Banking Trends in Corporate Banking Source: Aite Top 10 Trends in Wholesale Banking Jan 2013 Will have rolled out or piloted, 45% Will not have rolled out or piloted, … Percentage of top 100 Global Banks that will have rolled out or piloted Corporate Mobile Banking by Year end-2013 Corporate Financial Institutions • Increased Productivity • Continuity of Job Performance • Anytime, anywhere access • Stickiness of Relationship • Innovation • Revenue Opportunity $4 $3.75 $1.25 $0.85 $0.17 $0.08 Branch Call Center IVR ATM Online Mobile Transaction Costs by Channel Challenges Benefits Changing Technology • Customer Experience • Consolidated global multi-bank reporting • Cash position snapshot • Approval • Account Transfers • Alerts • Positive pay decisions • Security • Public Wi-Fi, Rogue apps, Jail breaking, BYOD Account Info Wire Approval ACH Approval Account Transfers Loan Info Positive Pay Exceptions Wire Initiation ACH Initiations Administration Remote Deposit Capture C2B Payment Alternative Corporate Mobile Banking Innovative Customer Experience Business Convenience Advent of Tablets The Cost & Revenue Factor The Payment Push Desired Corporate Mobile Features

- 9. Corporate Mobile Banking – Possibilities for Innovation Mobility Solutions •Mobile payments •Mobile collections and disbursements •Mobile solutions to forecast liquidity •Mobility Interface for initiating and approving transactions Build Integrated Solutions •Provide comprehensive solutions to customers across cash management, financial markets and Trade finance •Provide on and Off-Balance sheet options to clients •Improved MIS and operation efficiency Enhanced Analytical Information •Provide Information to customers based on profile – e.g, trends , forecasts •Bring about transparency – including transaction fees, Foreign exchange rates etc •Serving and advising clients about doing business within the new regulatory framework •Enable banks to provide focused solutions based on Customer profile / Risk appetite •Risk management including country and exposure risk •Regulatory Compliance •Improved Cash Flow management by effective Forecasting •Client profile Specific Dash Board

- 10. A Day in the Life of a Corporate Treasurer Brian starts his day by checking the funds position through his tablet application. He then proceeds for his workout. 7:00 am On his way to office, Brian checks the status of his incoming remittances using the tablet application. 9:30 am Brian is stuck in a meeting with a client at a restaurant. Thankfully, he has the tablet application through which he can approve the wires before the cut off time without going back to the office. 2:00 pm Brian is about to leave home when he got the bank security alerts on his tablet. He returns to his deskto solve the issues before it gets late. 7:00 pm •Account Information •Cash flow management •Administration •ACH Approval •Wire Approval •Account Transfers •Wire Initiation Brian receives a notification, that his bank’s RM has suggested a video to him. It was on how cash flow management can be done better with the help of few tools suggested by the bank. He opens and sees the video. 6:00 pm •View Collateral selected by the RM A payment scheduled to come in on that day, does not happen and Brian calls the Bank to check on the same. Alternatively he transfers funds from his other account to honor his outgoing payments. 11:30 am •Exception alerts •Payment Fulfillment •Contact management •Alerts & Notifications

- 11. A Day in the Life of a Small Business Owner Julie, a bakery owner gets up and reaches her bakery. She then decides on the number of cupcakes and cakes they’re baking that day. She then checks her account balances and then transfers money from her checking account for petty cash requirements for the day using her iPad. 5:30 am •Report Generation •Intra Account transfer One of the bakery’s employee goes out to buy few materials with a supplier. She transfers funds to the supplier using her blackberry application. The transaction comes to Julief or authorization. She authorizes it instantly from her approvals module on her iPhone. Julie also checks how much cash she will need today to pay to the suppliers and how much incoming cash she can expect during day. 2:00 pm Julie looks at her e-mails again, files her invoices and checks for all the card bills that she has to pay and transport expenses of the previous week that she has to pay to her helpers. All this can be done easily using her iPhone or iPad. 4:30 pm This is the close of the day, so Julie does a remote deposit of all the checks she got today. She also checks if she has any exception items pending for his approval on Positive Pay. 7:30 pm Julie has around 5 helpers. Today is the day to pay salary to them. So before the day starts, Julie releases her payroll instruction to the bank. She also paid the monthly installment for the loan that she had taken for buying the ovens. It was quite a simple one-touch process from his iPad. 7:30 am •Payroll Management •Pay Loan Installment Delivery person comes to do the pickup of the orders. Julie sends out the invoices with the deliveries which she has created on his iPad. The delivery person can see it on his Android phone and can get customer signatures against each delivery on the phone itself. 11:30 am •Invoice Management •Workflow management •Cash Flow management •Card Management •Manage petty cash •Approve reimbursements •Remote Deposit •Positive Pay

- 12. Corporate Mobile Banking Solution •Corporate mobile banking solution should allow banks to extend mobile applications to Corporates and Small and Medium Enterprises: •Real time workflow approval and worklist management for approval of key transactions like funds transfers, Payments etc •Positive Pay – viewing and approving of exceptions •Money transfers – intrabank, domestic and international Solution Highlights •Payroll Management, Timesheet, Account Summary, Augmented Reality based Branch Location etc •Dashboards •Portlets •Personalization •SOA •Enhanced branding and packaging •Customization of reports and workflows •Analytics Features Value Differentiators Corporates & Small Business Time & Effort Saving 1.Smartphone based solution for SMBs 2.Bank available on the go Financial Control 1.Payments, Positive Pay, RDC 2.Workflow based approval system Value Added Services 1.Payroll Management 2.Compensation Management 3.Expense Claims 4.Timesheets 5.User Management One stop shop for all financial needs 1.Traditional banking 2.Value added features 3.SMB specific features Bank Competitive Differentiation 1.Smartphone based solution for SMBs 2.RDC on mobile 3.ERP on mobile Fee Based Revenue 1.Payments, Positive Pay, RDC 2.Per user charge/per module charge Customer Stickiness 1.Value added services for SMBs 2.SMB dedicated applications Customer Insight 1.Mobile analytics 2.Cash Management 3.Product analysis