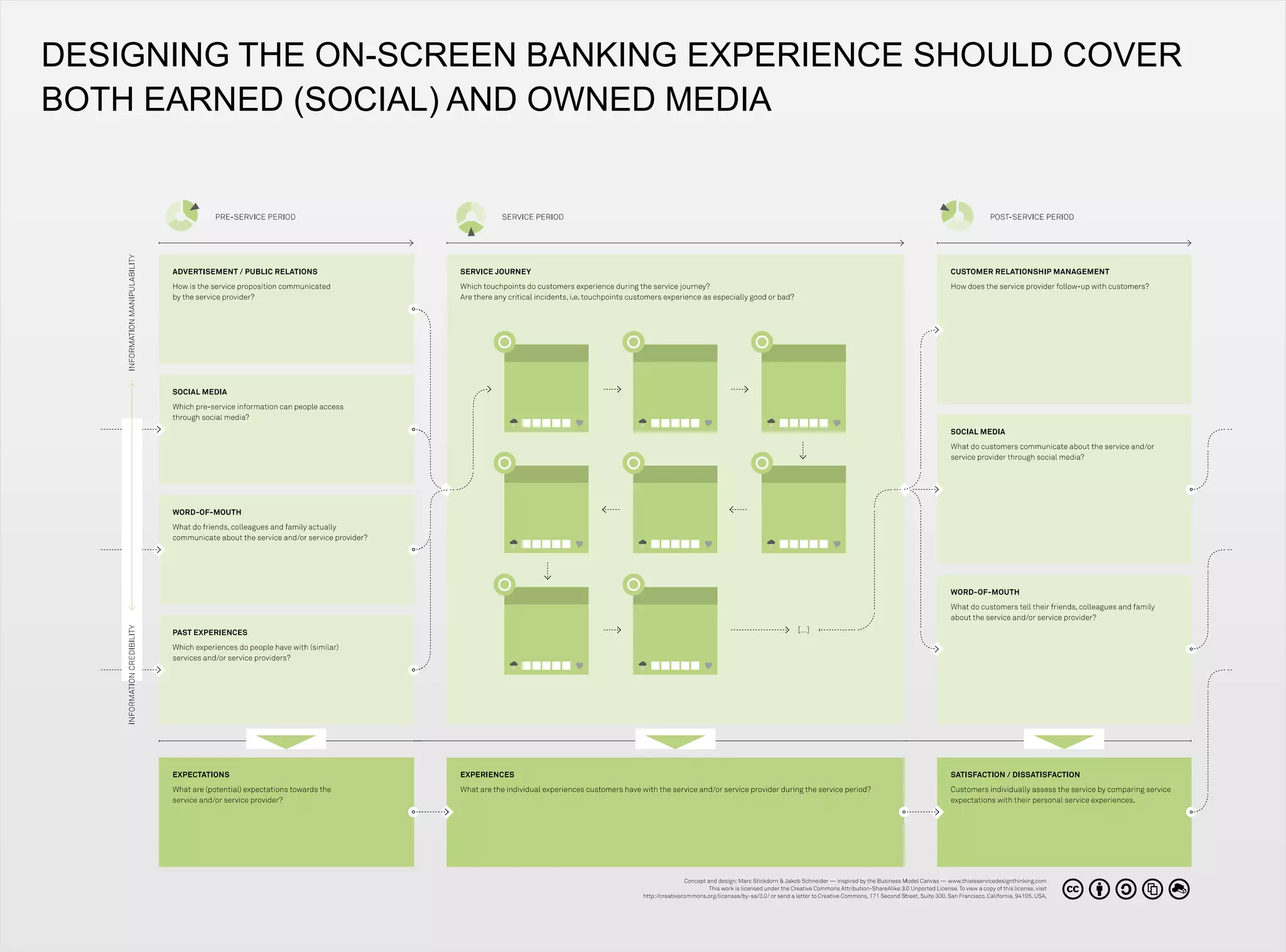

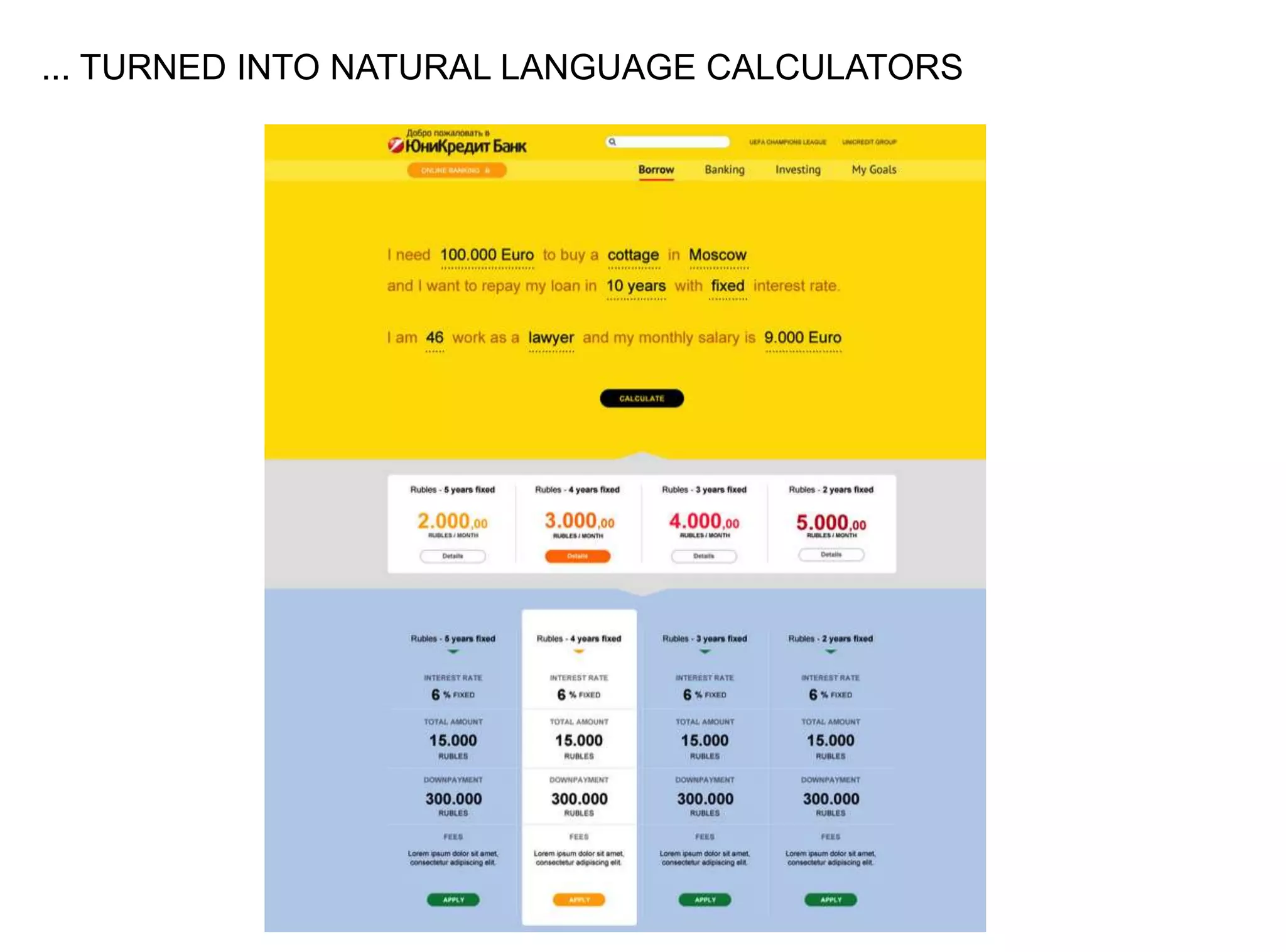

The document discusses the transformation of traditional banking organizations to embrace digital challenges, emphasizing the need for an upgraded on-screen banking experience to attract and retain customers. It highlights the importance of designing seamless user experiences across various platforms and encourages banks to think in terms of ecosystems rather than silos. Additionally, it stresses the significance of engaging customers through easily navigable interfaces and empowering them with financial tools.