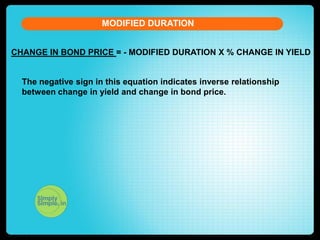

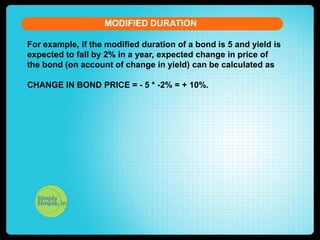

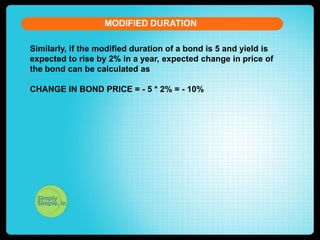

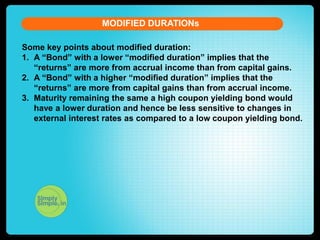

Modified duration is a measure of how much a bond's price will fluctuate given a change in interest rates. It is calculated by dividing the expected change in price by the expected change in yield. A bond with higher modified duration will see greater price fluctuations from small changes in interest rates compared to a bond with lower modified duration. Modified duration can be used to estimate how much a bond's price will change given an expected change in interest rates. For example, a bond with a modified duration of 5 that has interest rates fall by 2% could be expected to increase in price by 10%.

![CURRENT ACCOUNT DEFICIT

MODIFIED DURATION

Let us see the formula of the Current Account Balance (CAB)

CAB = X - M + NI + NCT

X = Exports of goods and services

M = Imports of goods and services

NI = Net income abroad [Salaries paid or received,

credit / debit of income from

FII & FDI etc. ]

NCT = Net current transfers

[Workers' Remittances

Modified Duration by definition

(unilateral), Donations, Aids &

expresses the sensitivity of the price of

Grants, Official, Assistance and a bond to a change in interest rate.etc]

Pensions

The change in interest rate can be

linked with the season change as

explained in the previous example.](https://image.slidesharecdn.com/modifieddurationnew-131113041546-phpapp01/85/Modified-duration-new-6-320.jpg)

![CURRENT ACCOUNT DEFICIT

MODIFIED DURATION

Let us see the formula of the Current Account Balance (CAB)

CAB = X - M + NI + NCT

X = Exports of goods and services

M = Imports of goods and services

NI = Net income abroad [Salaries paid or received,

credit / debit of income from

FII & FDI etc. ]

NCT = Net current transfers

[Workers' Remittances

(unilateral), Donations, Aids &

Grants, Official, Assistance and Hope you have understood the

Pensions etc]

concept of Modified Duration.](https://image.slidesharecdn.com/modifieddurationnew-131113041546-phpapp01/85/Modified-duration-new-13-320.jpg)