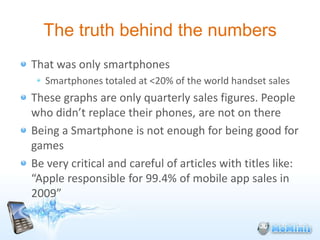

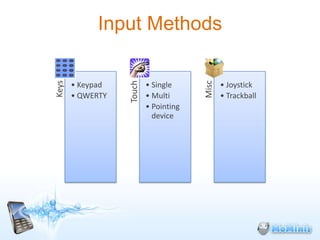

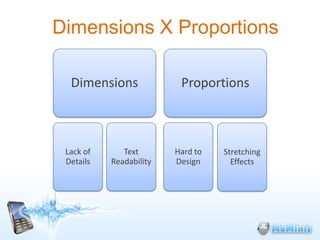

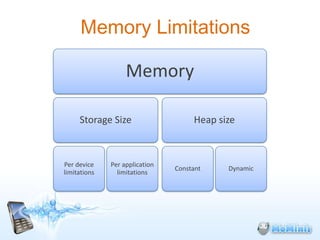

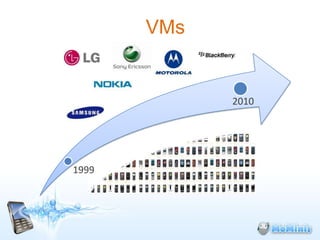

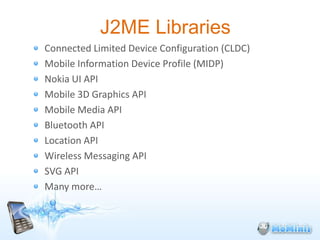

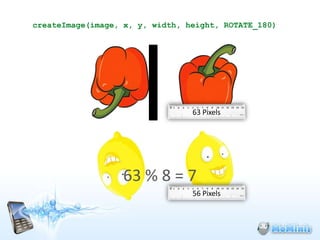

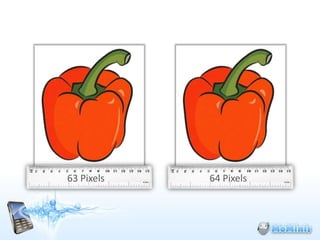

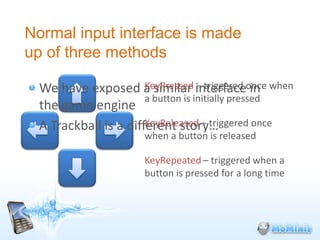

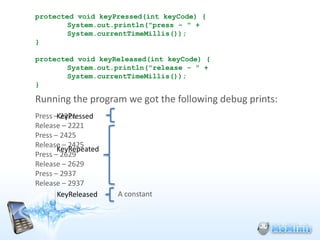

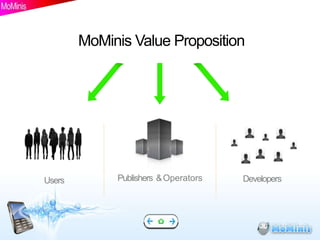

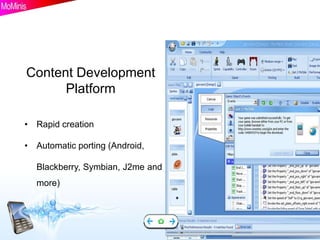

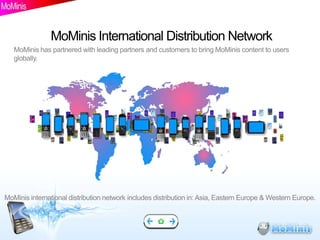

The document discusses the mobile gaming market, focusing on opportunities, challenges, and strategies for creating successful games. It highlights the importance of understanding target audiences, platform selection, and adapting to various device specifications while providing real-life examples of development issues. The content emphasizes a business-driven approach and scalable solutions in mobile game development, along with the role of mominis in facilitating content distribution.