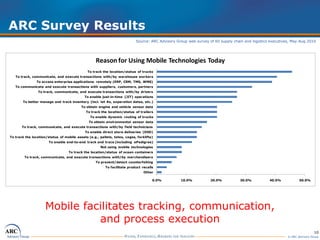

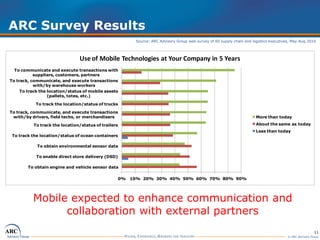

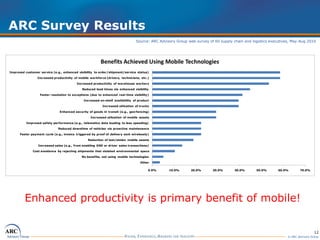

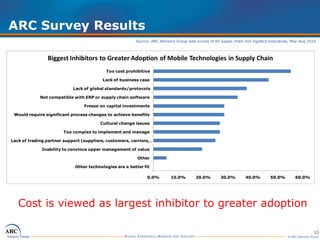

Mobile internet usage is rapidly growing, especially in Asia and emerging economies, impacting supply chains significantly. The combination of mobile technology and social media is driving process innovation, with supply chain software vendors making large investments in mobile solutions. Early adopters, such as consumer packaged goods companies and third-party logistics providers, are already reaping benefits from these mobile technologies.